China's Economic Future: Speculation & Transparency Question

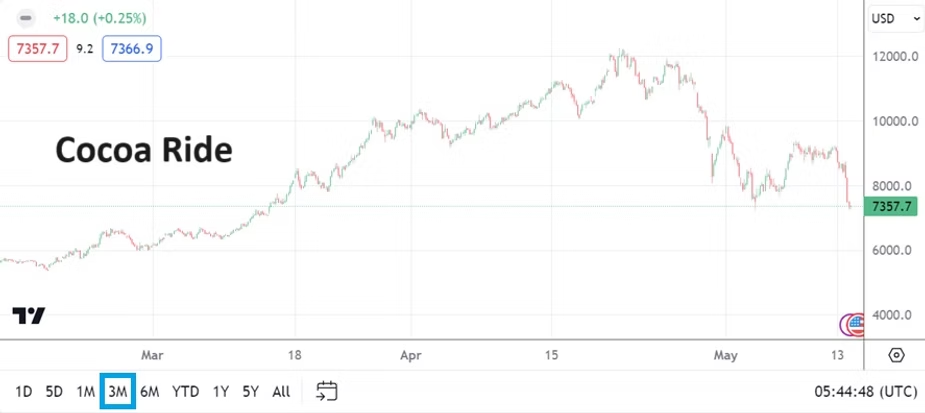

China’s economy has been underperforming for a handful of years. Growth has not only stagnated but has experienced a downturn, deflation has been experienced. Strong leadership from Xi Jinping has led to a firm approach regarding the management of China’s political and economic affairs. Until this year, Xi’s grip on power had grown significantly since he took office as the President and General Secretary of the Chinese Communist Party in 2012, but his control appears to be waning. Yet even as lackluster Chinese economic data has persisted, the Shanghai Composite Index (SSE 000001) has mirrored many global equity indices and done remarkably well since April of this year.

The SSE is near 3,826 currently. In early April the SSE was around 3,080, and in the middle of September 2024 the Shanghai Composite Index was close to 2,700, which was clearly within sight of long-term lows. The current heights of the SSE have not been seen since August of 2015. Yes, the Shanghai Composite Index was over 5,000 in April of 2015 and also in 2007. The point being that highs being traversed have not been seen in a long time. But is the positive speculation in the SSE a sign that economic conditions and political considerations in China are positive? Where is the transparency?

China’s ability to create significant growth over the past four decades has transformed the nation into a global powerhouse economically and militarily. Yet, the past few years have begun to show cracks in the single handed approach to centralized decision making regarding the economy, government data presented has become suspicious. Rampant speculative forces in the SSE have been seen before. Is now the time to buy more Chinese equities or is it time to become cautious? Reliable statistics remain a troublesome aspect for investors.

China’s real estate market collapsed under the weight of too much building and speculative buying of apartments. Yes, inflated property and sudden deflation has been seen in capitalist countries in the past and will be witnessed again in the future. But the bubble in Chinese real estate and its crash also points out problems regarding a lack of transparency. While the Chinese government has tried to fix the fiscal problems caused by the real estate implosion, it has also created significant fractures within its banking system, which are confronting the Chinese government and public, and sometimes feels like a coverup trying to hide bad news. When will there be a recovery in the China real estate sector, is the worst of the crisis fixed?

Chinese political questions and some evidentiary circumstances point to intriguing considerations. There is evidence in China that a change of leadership is progressing. In the past couple of months small hints have been allowed to be published via China’s state media, the Xinhua News Agency. Rule changes have been made regarding decision making processes in the Chinese Communist Party, this was published by Xinhua in late June and republished by the South China Morning Post of Hong Kong in early July. While paraphrasing, both news entities expressed that rule changes meant Xi Jinping would officially have to delegate more decision making.

Speculation is growing beyond a mere whisper that the Chinese military has become a wildcard and a source of power that is potentially ready to help remove Xi Jinping. The military apparently is not supporting Xi and wants a more collective approach to decision making via the Chinese government. Yes admittedly, this information can be described as being from news services and podcasts that do not favor the Chinese government, but they seem to be singing in unison. It appears that China’s People’s Liberation Army have decided it is time for a change and is ready to play a role in the selection of new Chinese leadership.

The 80th Anniversary Victory Day Parade in Beijing will be held on the 3rd of September, what role will Xi Jinping play in the show of military force? Will it become apparent that Xi is merely a figurehead until an official decision is made on how the Chinese Communist Party will be led? Importantly, the 15th Five Year Planning Conclave for the Chinese Communist Party will be held in October and this is where a leadership change could take place including the official removal of Xi Jinping.

There appears to be – yes, via the dissident information heard, two factions within the Chinese Communist Party vying for power – hardliners and reformers. The army still hasn’t made it clear if they are backing the hardliners or the reformers. What is evident however via many publications, is that China’s PLA has decided along with other important leadership circles in China’s Communist Party that Xi had too much control and they want a more collective leadership.

Regarding the Chinese economy which has undergone a period of stagnation and lackluster results the past handful of years under Xi’s strong centralized approach, something big is about to happen which will have ramifications for the next five years. Who will lead China? The hardliners who are true believers in ideological communism or reformers who want China to move towards more of a market economy? This is a huge question. This type of political infighting has been seen in China during the past four decades and played a role in key leadership changes. It is not a conspiracy plot which is being sounded, it is the possibility of a transfer of power which happens cyclically in many nations when changes are warranted.

China’s Shanghai Index has done well recently. Perhaps this is a correlation reflecting optimism being sparked globally in equities in recent months. Or is it also possible that some folks in the know are betting on the reformists to take control of the Chinese government? Tariff concerns have seemingly been brushed to the side in China and something bigger is certainly at play. President Donald Trump is not the story here. Investors participating in China need to pay attention to the political changes that seem to be brewing. While speculation has certainly brought the Shanghai Composite Index to long-term highs, transparency from China is a concern economically and politically and there will be an impact if changes to leadership occur.