Forex: Tomorrow is Known, October and Beyond are Uncertain

The U.S Federal Reserve will cut its Federal Funds Rate by 25 basis points tomorrow. The big question all financial institutions would like some clarity about is whether the U.S Central Bank will strongly suggest that another cut of 25 basis points will need to take place in late October during the next FOMC meeting.

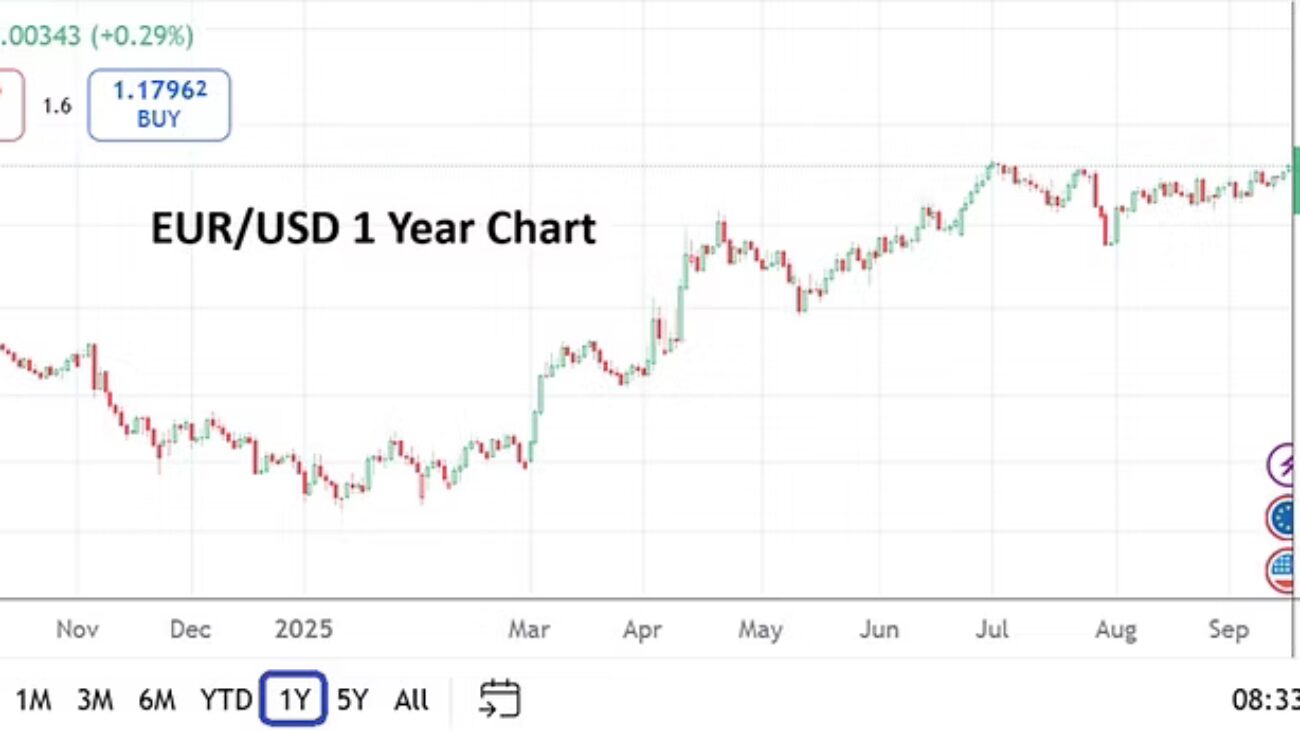

Forex has certainly seen the USD weaken because a definitive interest rate cut has already been factored into mid-term outlooks. Those who are betting on a 50 basis point cut tomorrow are spitting into the wind and most likely wrong. The Fed under Jerome Powell has proven time and again that it is cautious. The word uncertainly is likely to be heard on Wednesday, even as the Fed Chairman admits conditions warrant cutting interest rates further.

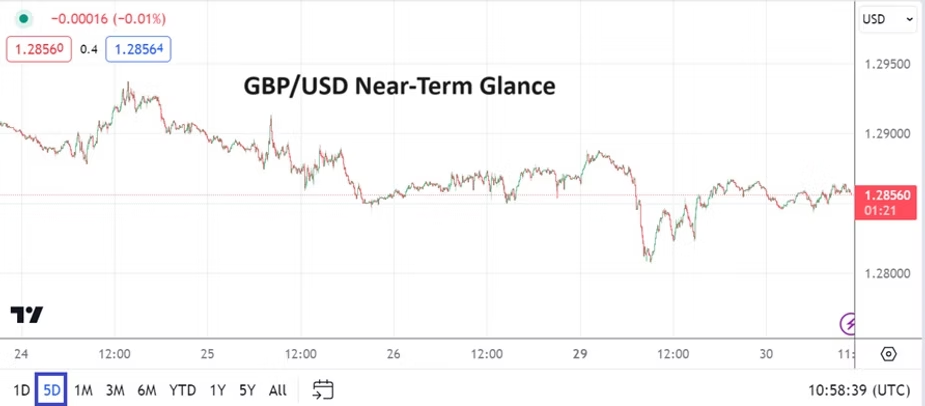

And this is where it will get tricky for day traders betting on conditions beyond tomorrow. Since the quarter of a point cut has been factored into Forex already, and the EUR/USD, GBP/USD and even the USD/JPY are bouncing up against technical inflection ratios for the time being, powerful reactions and dangers will ignite based on the perceptions generated about late October outlook. It is likely some large financial institutions have already priced a rate cut of 25 basis points into the USD already for their October outlooks, meaning some big houses have accounted for a 50 basis point cut mid-term.

It is probable some larger firms have remained conservative, and have not leaned into overly confident cash forward contracts for their corporate clients. This because they want to be certain the Fed is definitely setting the table for another interest rate cut in October.

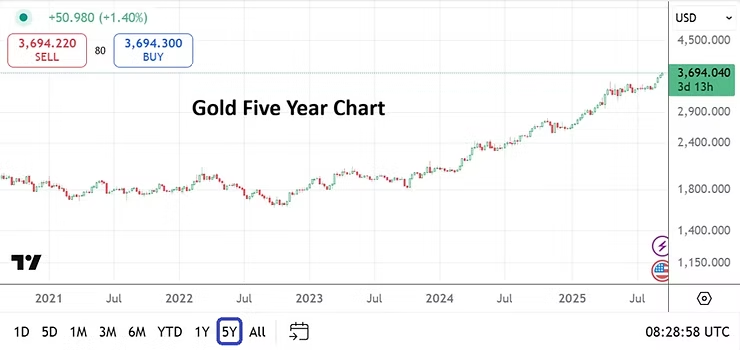

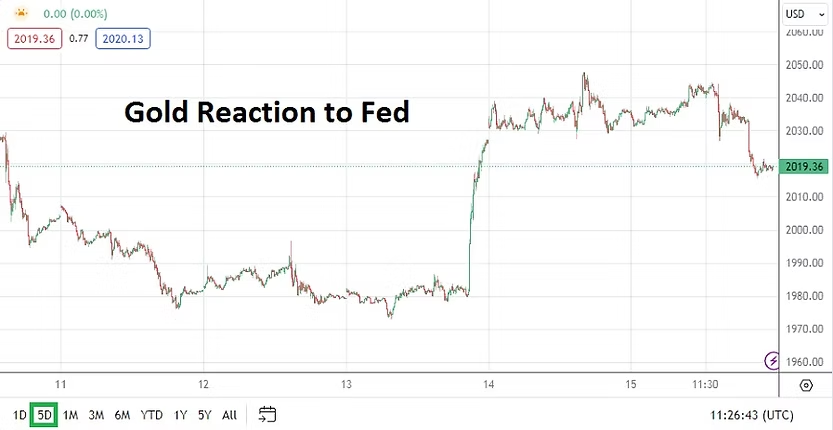

Nothing is guaranteed and Fed Chairman Powell is likely to state this obvious point tomorrow. However, he may have to admit the jobs market looks weak. And he may have to also acknowledge, that although he and other FOMC members remain concerned about the threat of inflation, that for the moment it remains somewhat tame. This is where a secret ingredient in Forex trading tomorrow may fuel volatility. Inflation fears telltale signal is being seen in the current price of Gold which is within record territory and sight of $3,700.00 as of this writing, this even as the 10-Year U.S Treasury yields have decreased.

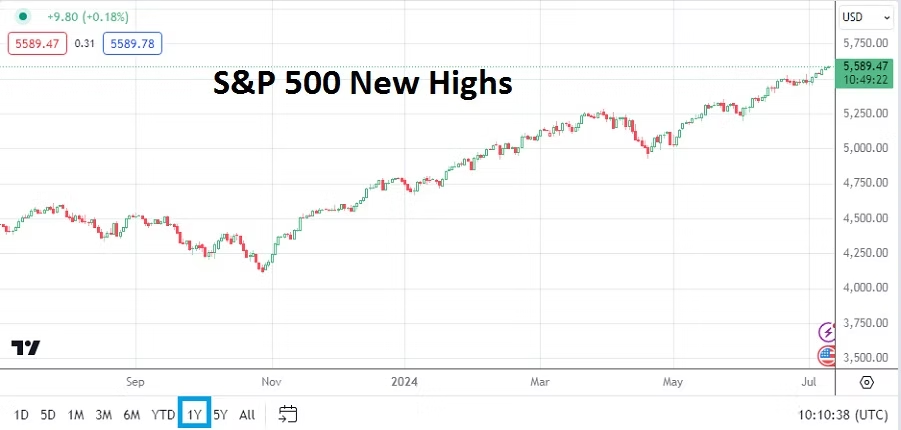

Again the Fed has at its disposal high tech quantified data via its distinct Fed Districts to know the economic landscape and react at a quicker pace. It chooses not to do this efficiently, this was a feature of the Fed’s inability to accept that inflation was a danger almost four years ago and its snail like reaction which caused economic harm. Now the Fed finds itself in a position in which it should be admitting that it should have been cutting interest rates six months ago, while also knowing logically storm clouds are on the horizon regarding murky economic outlooks due to the threat of inflation actually increasing in the mid-term. Justification for a nimble Federal Reserve remains a pragmatic desire.

Here’s the thing, the Federal Reserve is going to cut the Funds Rate by 25 basis points tomorrow and say they are considering another cut in October. The Fed will probably also say after another cut in October, that they anticipate taking a way and see approach into the end of this calendar year.

Regarding the potential reactions of the EUR/USD, GBP/USD and USD/JPY tomorrow and into Thursday, volatility needs to be expected. The consolidation we have seen develop the past few days near important levels that seemingly are holding back large value moves will vanish for day traders. Small retail speculators in Forex need to understand what they view as massive moves are often considered simple small mathematical gyrations by financial institutions which are not only participating in the cash forward business via FX rates, but also taking part in hedging via futures trading through the likes of the Chicago Mercantile Exchange and other venues.

It needs to be noted the Bank of England will release its Official Bank Rate on Thursday along with its Monetary Policy Summary. And the Bank of Japan will issue its Policy Rate and Monetary Policy Statement on Friday. The BoE is not expected to change its borrowing rates on Thursday, and the Bank of Japan is expected to stand in place too. It should be pointed out that the Bank of Japan does have room to increase its borrowing costs, but the government of Japan appears to be married to maintaining a weaker Japanese Yen, much to the chagrin of some economists.

If the Fed admits they need to likely cut interest rates again in October this might spur on some USD weakness and create volatile conditions tomorrow and Thursday. However, if the Fed offers the phrase that they will take a wait and see approach after October, until further economic data can be accessed in November and December, then the USD may start to show signs of firming. The Fed’s interest rate is 4.50% today, by the end of Wednesday it should be at 4.25% with signs that by the end of October it will be 4.00%. Looking for more than those clues is speculative, financial institutions want answers like everyone else.