Anticipated Federal Reserve Shop Talk to be Delivered Today

For what it’s worth, here is my prediction regarding what the Federal Reserve will do today. The Federal Funds Rate will remain unchanged in my opinion. The FOMC Statement may show that the vote actually was debated and not unanimous. The statement is likely to warn that inflation remains stubborn and potentially problematic, meaning the Federal Reserve continues to believe it may have to raise the Federal Funds Rate over the mid-term and again before the end of 2023.

The Forex market has seen the USD get weaker against many major currencies since late May. While financial institutions have seemingly positioned for no increase from the Federal Reserve today, this move has also likely been priced into Forex. Day traders need to understand institutional traders will not be betting on what took place the last three weeks, but are trying to anticipate what will happen into early July and beyond regarding their Forex positions.

GBP/USD One Month Chart as of the 14th June 2023

Many financial institutions may still be betting the Fed will remain more dovish than the U.S central bank wants to admit, but this is a dangerous perception and could prove costly. Financial institutions are concerned about the Fed because they know the central bank has painted itself into a corner it may not be able to maneuver freely within. The battle to conquer inflation while trying to fuel economic growth is not an easy one. Mixed sentiment abounds regarding the U.S economy depending on who is asked.

Talk of a soft landing and a small recession continues to be heard, this while some analysts warn about a hard drop and darker days ahead. Folks, it is all about timelines and their interpretations, experts warning about brighter or darker days ahead have a tendency to be vague regarding exact moments in time. Everyone has an opinion, and people often have more than one.

In my opinion – my one opinion, the Fed is likely to say that it is not going to raise rates today, but may have to do so in the mid-term. If these were normal times and economic conditions were not suffering from huge spending running amok in Washington and the corporate banking sector wasn’t fragile, the Fed may actually have raised the Federal Funds Rate today to continue to battle inflation deliberately. However, a pause for the moment seems like the logical choice, this while ‘hoping’ inflation continues to diminish. And hope is a key word here. Everyone seems to be hoping. The question financial houses and traders need to decide after the FOMC Statement takes place today is how seriously do they consider the Fed’s remarks.

If they believe the Fed will have to continue to remain neutral regarding its mid and long-term interest rate policy, the USD may soften and incremental selling might be demonstrated. Human instinct tends to be optimistic, which means financial institutions and maybe even the Fed wants to believe inflation will ebb lower. If this happens the USD would weaken further. However, the Fed may have to sound more aggressive than people want, but that would damper the mood of financial institutions – so look for optimistic interpretations to abound with rose colored glasses, even if they are wrong in the long-term.

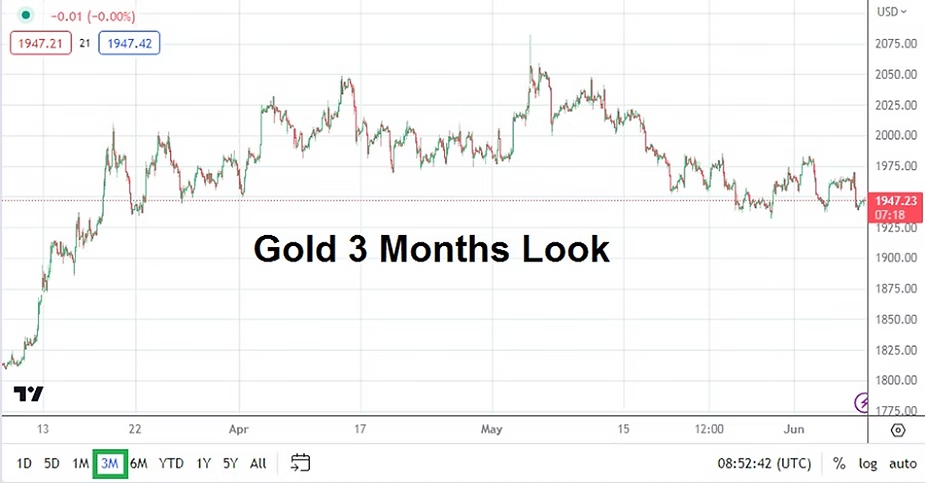

Gold One Month Chart as of the 14th June 2023

For evidence of outside barometers, traders may want to look at Gold which has essentially traded between 1940.00 and 1975.00 with a few outliers since the last week in May. The price of Gold has seemingly situated within a consolidated framework the past few weeks. The precious metal may produce a strong move if the Fed shows more dovish behavior today, particularly if financial institutions show more optimism via behavioral sentiment in Forex – meaning if a weaker USD trend continues momentarily Gold could traverse higher.

My prediction and $1.00 USD may get you on a bus. As always caution will be needed if you are trading immediately before and after the U.S Federal Reserve’s rate decision. I advise using a seat belt today consisting of entry price, stop loss and take profit orders via solid risk management, but then again these cautious attitudes should always be practiced by day traders.