India Insider: The 8.2% Growth Mirage Needs a Reality Check

India is celebrating the 8.2% real GDP growth result for Q2 FY26, as if it has entered a new economic orbit. Politicians are claiming victory and media is packaging optimism. The narrative is simple: India cannot be stopped. But once we move beyond the headline, the number loses credibility. It rests on a broken deflator, a statistical gap that no one can trace, and data architecture that doesn’t consider half the economy. This is not a story of unstoppable growth. This is a story of statistical convenience.

The Production–Expenditure Divide

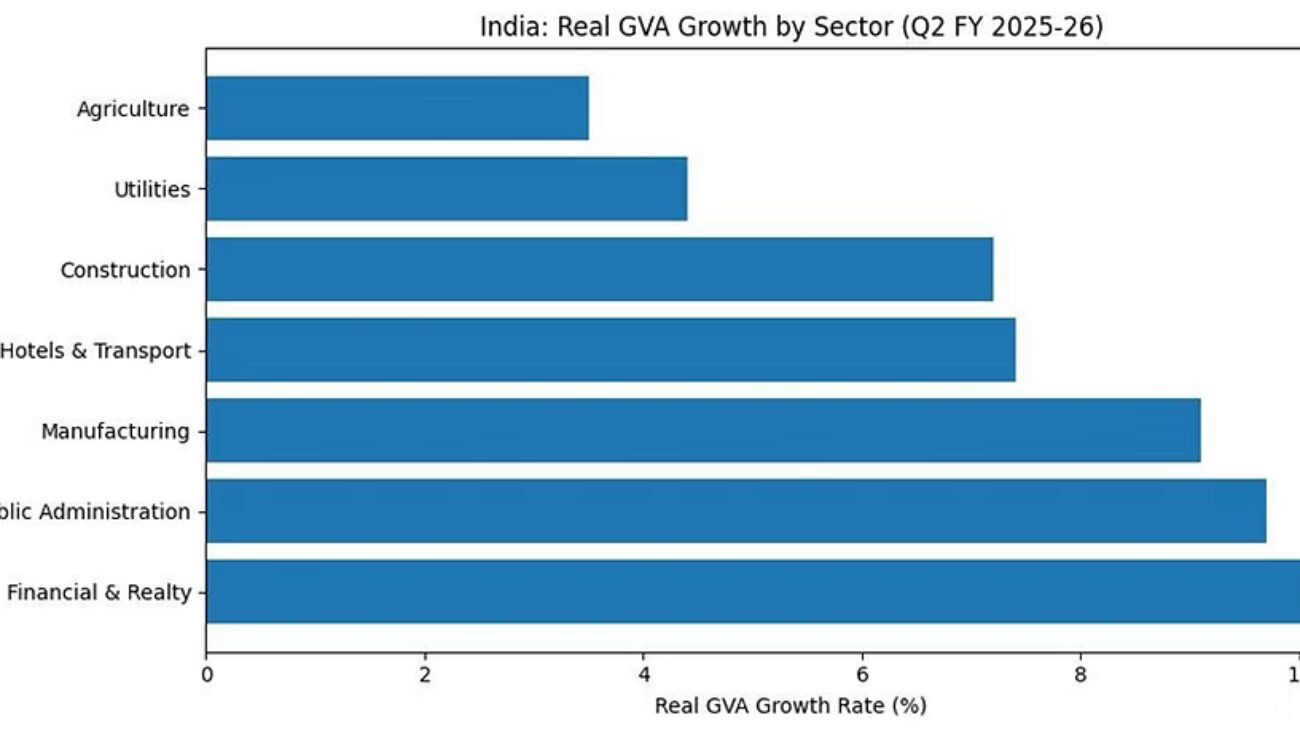

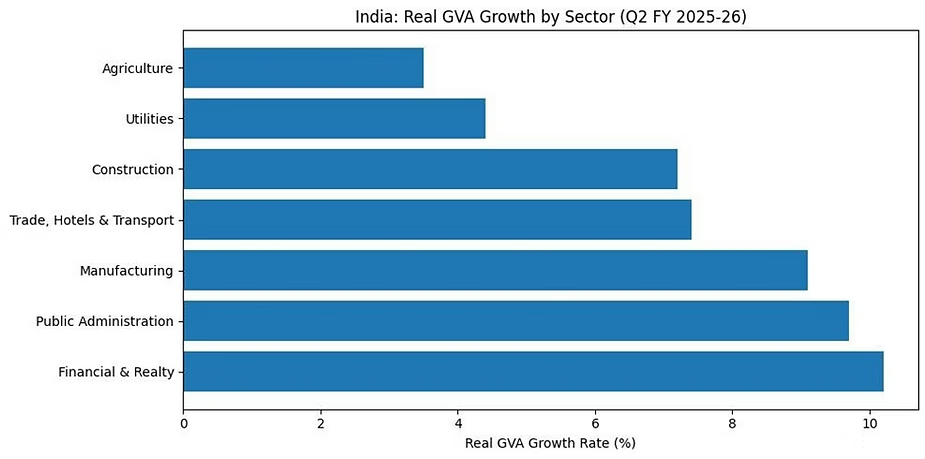

On the production side, the numbers look heroic. Manufacturing allegedly grew 9.1%, and financial and professional services posted more than 10% growth. Corporate India looks like it is flying. But when the same activity is measured from the expenditure side – who actually spends this income – the story weakens.

Private consumption at 7.9% is respectable, not outstanding. The real shock is government consumption, which contracted by 2.7%. A shrinking government should normally mute growth, not accelerate it. Yet the GDP shoots up. How does that make sense? It doesn’t unless the number is being propped up somewhere else – and this is the case.

₹1.63 Lakh Crore of ‘Unknown Growth’

GDP includes a category called ‘discrepancy’. It exists because the two methods – production and expenditure – never perfectly align. The discrepancy stands at ₹1.63 lakh crore ($18.2 Billion USD) which equates into roughly 3.3% of real GDP. That means a chunk of this 8.2% growth has no identifiable spender: No households. No firms. No government.

It is income without absorption. A statistical plug. When a number this large is called ‘discrepancy’, the headline becomes unreliable – suspicious. You cannot claim world beating growth when your own data admits it cannot explain where that growth came from.

The Deflator Illusion

The next distortion is the nominal vs real GDP gap. Nominal GDP is growing at 8.7% and real GDP at 8.2%. A gap of 0.5 percentage points implies inflation has almost vanished. Every Indian knows this is not true. Costs did not collapse. Food inflation has not disappeared.

The explanation is mechanical: India still uses the Wholesale Price Index (WPI) to deflate nominal output. Global commodity prices fell, WPI softened sharply, and that flattening pushed up the real number. In other words, GDP grew because the denominator fell, not because production surged.

This creates a fiscal problem. The Union Budget assumed 10.1% nominal growth. At 8.7%, tax buoyancy will weaken, deficit targets become more difficult, and next year’s fiscal capability shrinks. Real GDP does not pay the bills, Nominal GDP does.

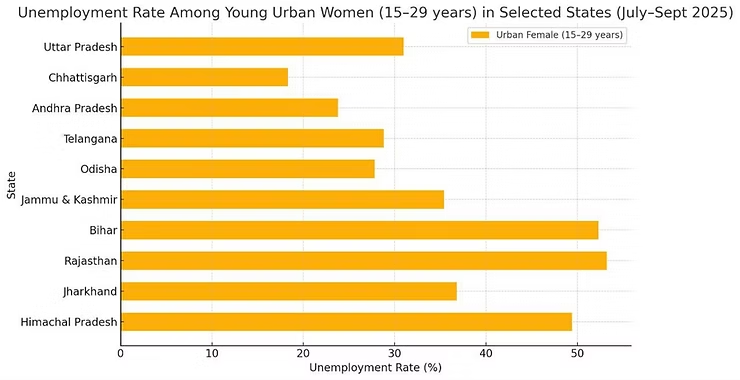

The Informal Blind Spot

India still cannot measure its informal economy accurately. Nearly half of GDP and employment sits outside the formal system, yet the NSO uses formal sector proxies such as corporate balance sheets, GST data, and financial flows to estimate the rest of the economy. If a small business collapses and a corporate giant expands, the data shows a net gain, erasing distress at the bottom which means real economic circumstances are not portrayed accurately for Indian citizens.

Agriculture grew at 3.5%, but it still supports 46% of India’s workforce. That means growth is concentrated in capital intensive and balance-sheet heavy sectors, not into areas that put cash into rural hands. A booming Nifty Index via the stock market does not translate into household prosperity.

An Economy Measured with Old Tools

India continues to measure GDP using a 2011–12 base year, an era before UPI (Unified Payments Interface), before fintech credit, before e-commerce, before gig workforces, before the pandemic rewired supply chains and consumption patterns. India is living in a digital economy, but measuring activity with analog instruments.

A shift to a 2022–23 base year, plus replacing WPI with a Producer Price Index, may finally align the numbers realistically. But until then, headlines are running ahead of bona-fide measurements.

India’s 8.2% print is impressive, but growth estimates that don’t reflect grounded realities produce illusionary optics rather than useful insights. For India to strengthen fiscal and economic credibility, measurements must capture households, labor markets, and productivity, not solely corporate outputs. Policy cannot be shaped by statistical ambiguity, it requires transparency and trusted data.