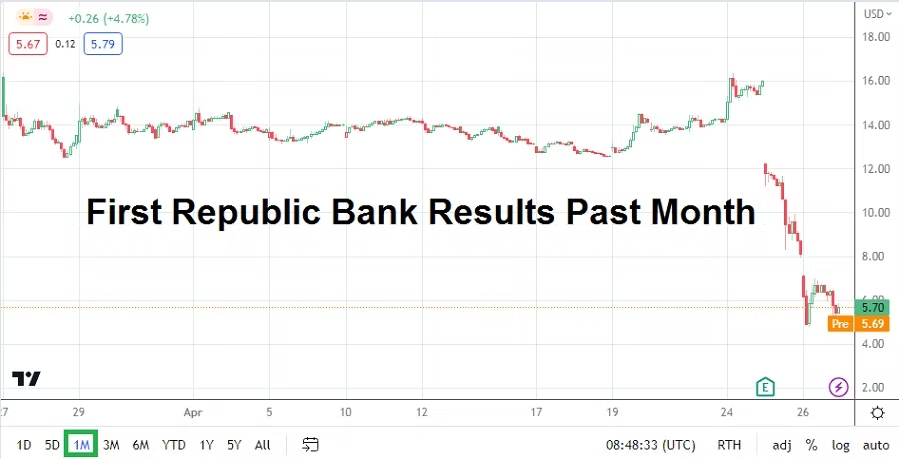

A Fed Funds Rate hike is going to happen on the 3rd of May unless there is a financial catastrophe that suddenly emerges that is nearly cataclysmic. While First Republic Bank wobbling is certainly a problem (Mark Zuckerberg is supposedly a rather large client of the bank), if this entity fails completely it may not cause massive bedlam. The stock has dropped violently, so a collapse should not be a surprise. No, it will not be welcome, but it should not be an unexpected calamity.

The question is how much the U.S government will protect depositors? The large clients who are not insured above the standard 250k USD ratio will want the same benefits that clients of Silicon Valley Bank received in March. Should they be rewarded the same way? The American public may not like the idea of another bailout for the deep pocketed, but there may not be much they can do about it, except to vote the politicians out, but who do you exactly punish?

What a collapse of First Republic Bank will do is hurt the corporate bond sector in banking again, because it is likely holders of these bonds will be put at the back of the line once again if the U.S government decides to protect big depositors of millions of dollars like Zuckerberg, before it protects bond holders.

U.S Data in Focus and the Allure of a Black Dress with Growth

But I digress, yesterday’s Core Durable Goods Orders statistics came in better than expected. Today Advance GDP will come from the U.S and if this number produces an increase instead of a downturn, the U.S Federal Reserve will have more ammunition to remain aggressive regarding interest rate hike rhetoric. An increase of 0.25% has been calculated into Forex for next week. The USD has done rather well recently, but what is of intrigue is the perception the USD is doing well after the financial markets have seemingly priced in a rate hike on the 3rd of May. Meaning, typically the USD would have started to ebb a bit lower after financial houses put their interest rate outlook into their Forex positions. Yesterday’s better than expected Core Durable Goods Orders leaves the door open for another hike on June the 14th to be precise.

While Core Durable Goods Orders isn’t a sexy statistic, GDP numbers frequently are, and if the growth numbers show up with a stunning black dress on with alluring ‘expansion’ it could send large speculators into a tizzy and make them believe the Fed could increase by another quarter of a point in June. The Fed during its FOMC Statement next week will certainly try to help financial institutions anticipate outlook. The Fed doesn’t need to hold the hand of investors, but it often treats them like children.

Financial houses had largely believed the Fed would hike in May and might raise in June. The notion that a June increase is certain would then put the focus back on the long-term again, and Forex could then break free of its rather consolidated incremental USD strength seen the past couple of weeks. Inflation remains a drum beat that is steady. And while today’s GDP numbers will be important. Tomorrow PCE inflation statistics will be the final nail in the coffin. If growth is stronger than expected today, and inflation numbers remain stubborn tomorrow, the Fed would certainly consider another June increase valid.

On the bright side for day traders is that the cautious choppy air which has circulated the past couple of weeks in Forex is almost done. While steady trends may not reappear for a while, at least near-term outlook will have more clarity by this time next week.

Big Institutions Have Long Term Outlooks and Treat Trading Conditions Differently

Long term outlook is another game as day traders should know and one they cannot easily participate. Long term investors have the money to specialize in assets which are not expecting profits today, but instead have a larger time frame for making money. Deep pockets, patience and the need for less leverage help financial institutions trade in a more stable manner, frequently putting the ‘odds’ in their favor.

The price of Crude Oil is actually behaving politely in recent trading, and its ability to find a mid 70.00’s USD price range is interesting and may help inflation move lower if it can be sustained. If supply of goods can adequately stabilize and global logistics costs come down, inflation could decrease. These factors are part of the long term perspective of financial institutions. Day traders may want to consider this because it could affect behavioral sentiment moving forward.

Higher interest rates from the Fed are causing other currencies to loss value and this has caused increased costs for international manufacturing companies located outside the U.S which frequently have to buy commodities in USD from their converted domestic currencies, this causes inflation. This is a factor not spoken about enough and traders need to consider this within their perspectives too.

The Fed and Perhaps a Conspiracy Theory

If the Fed actually starts to decrease its interest rates, it would help other currencies stabilize. And yes, if the Fed stops increasing interest rates it may actually help weaken global inflation. The Fed has caused import inflation to occur into the U.S. Are they aware of that? It is a good question. The likelihood is a yes, and it has been disregarded, but why? Perhaps there is another reason; does the U.S Fed and U.S government want to cause inflation globally to strike politically at some competitors? This is a different topic………kind of. Conspiracy theory.

While insight regarding the dialogues between the Federal Reserve and U.S government is certainly above my pay grade, one has to wonder about considerations regarding inflation and a stronger USD and its potential effect on China. The Fed increases may be a way of trying to inflict harm economically and in a subtle manner, but this cannot be proven. Perhaps the Fed is unaware of the global conflict being waged.

On another note, Gold remains near 2000.00 an ounce – almost steadily, displaying a certain amount of cautious behavior.