We Have Seen This Show Before Friends

Another day, week, month and year – another financial crisis causing havoc. We have seen this show before, and experienced traders should make sure friends who are ‘newbies’ are prepared for what is going to happen next. And what is next is: unknown.

People who believe they can profit from the current mess in the markets need to have deep pockets to sustain choppy conditions and a time parameter that allows for volatile prices until the results targeted are achieved. Day traders need to have very narrow goals, because if they do not cash out of the market quickly, then they should expect to get burned by the price velocity which will ensue.

Sharks Eating the Minnows as Crony Capitalism Flourishes

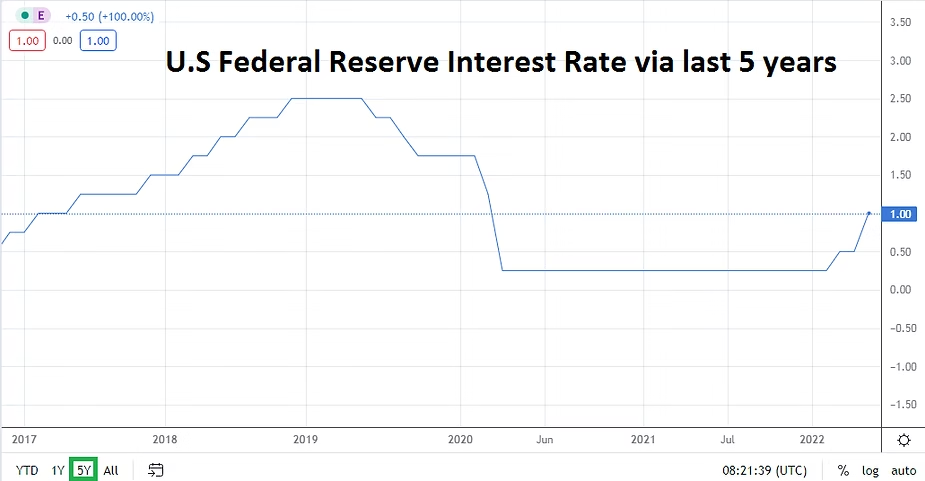

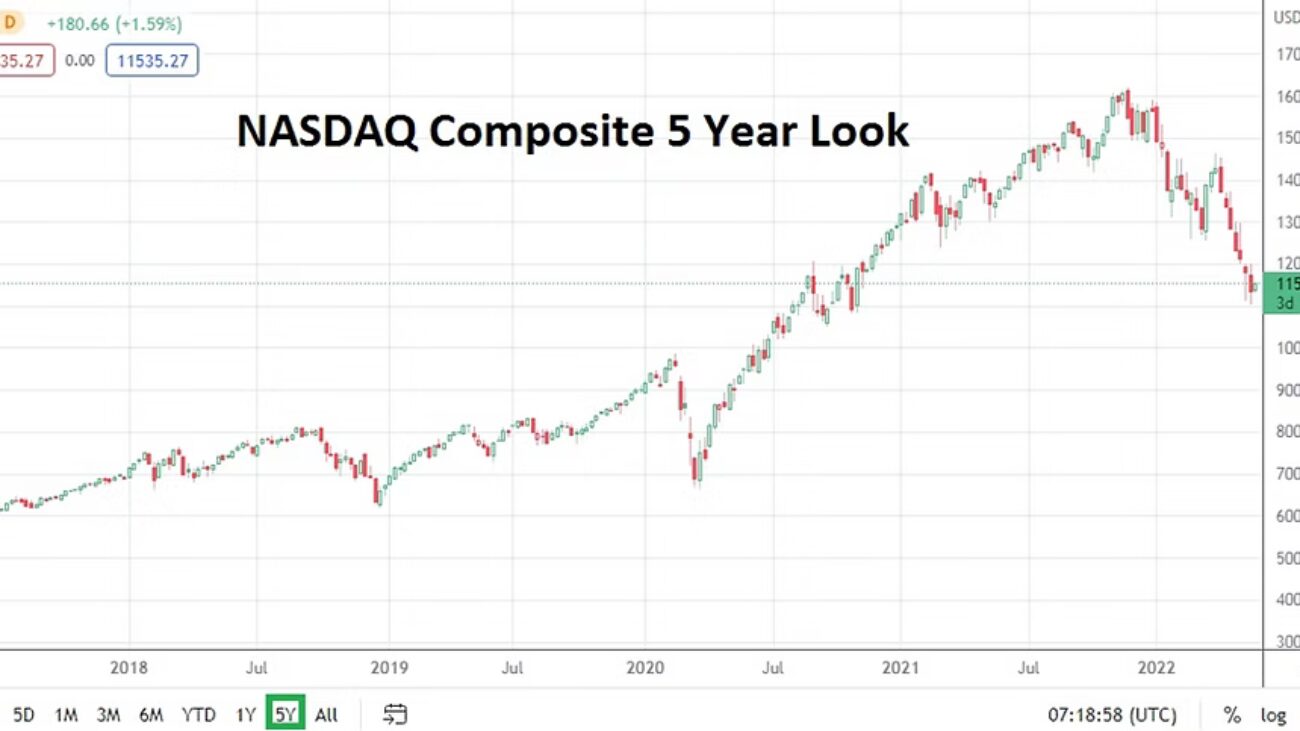

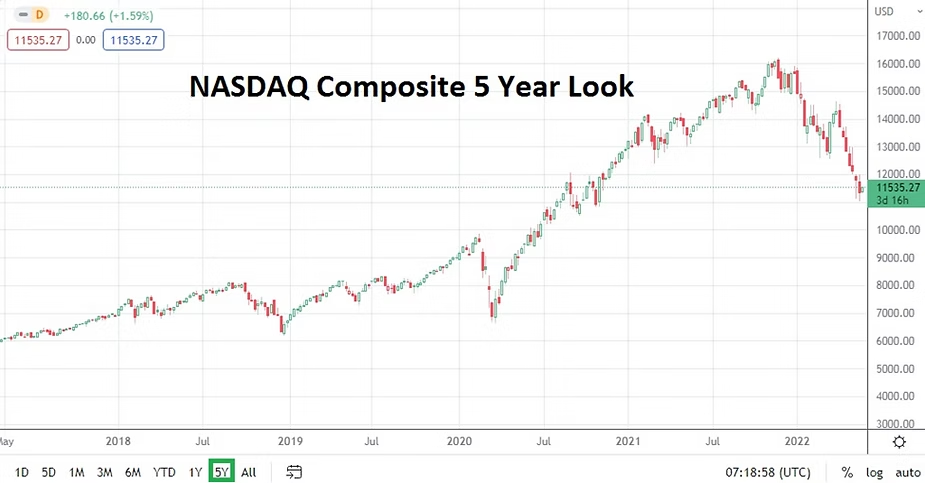

The demise of Silicon Valley Bank and Signature Bank are unpleasant surprises, but not shocking, and not to sound too matter of fact or contradictory, but the handwriting has been on the wall. The aggressive stance by the Federal Reserve finally caused enough nervousness in the stock markets to make certain equities shake and the banking sector has proven vulnerable. It is easy for many corporations to make money when it is cheap, but when ‘and not so suddenly’ borrowing costs, inflation and bonds chaos combine and deliver mayhem then profitable outcomes become more difficult, and for some – impossible. Corporate investors do not look kindly on mid-term and long-term projections which hint of negative growth implications. Investors tend to punish these equities.

Gold One Month Chart

What comes over the next week and month will likely anger many people. Capitalism is good, it is even great. However, a dark and evil shadow lurks when crony capitalism starts to have an upper hand. The insolvency of Silicon Valley Bank raises the prospect for crony capitalism to be witnessed by all. Suddenly the U.S Treasury, Federal Reserve and government have emerged to save the skin of depositors within a bank which up until last week was heralding its ability to be a ‘lone wolf’; merrily disregarding sound investment principles and saying they knew better. It is only my opinion, but it stinks of contradiction that both the U.S Federal Reserve and Silicon Valley Bank have made vast mistakes and now are being allowed to cover their tracks and protect members of their ‘club’. Both Fed and Silicon Valley Bank officers need to be held accountable, but do not count on this result producing more than scapegoats.

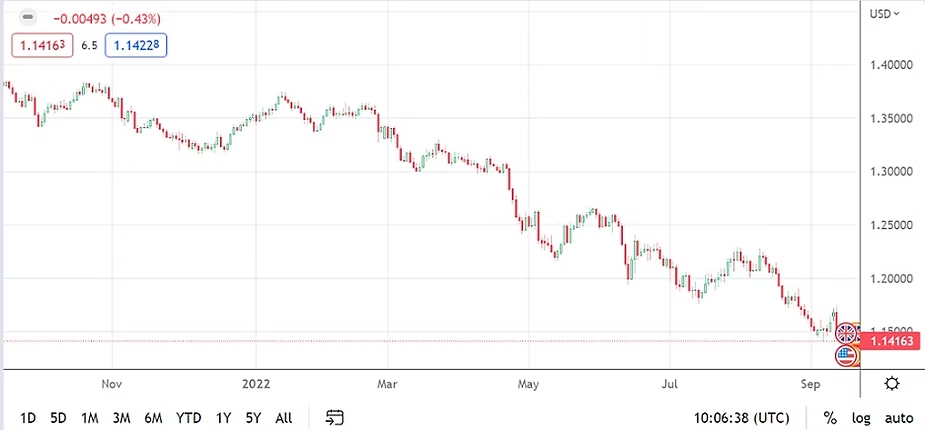

Rising interest rates which are causing ‘import inflation’ has been a worry expressed by some economists and they can still be heard, but obviously not given enough attention. The Fed has marched to its own drummer and disregarded ‘the street’ for its own ideals and statistics viewed from its ‘ivory tower’ where it could not be held accountable.

Inflation is stubborn, yes, but it is a result of chaos via global commerce from the effects of difficult supply and logistics problems caused by coronavirus. Inflation became problematic two years ago and it was essentially disregarded for about nine months, until the Fed and others admitted rising prices was a concern. Hopes of transitory inflation have faded into oblivion. But I digress…..

Nervous Financial Institutions Battling as Federal Reserve Wavers

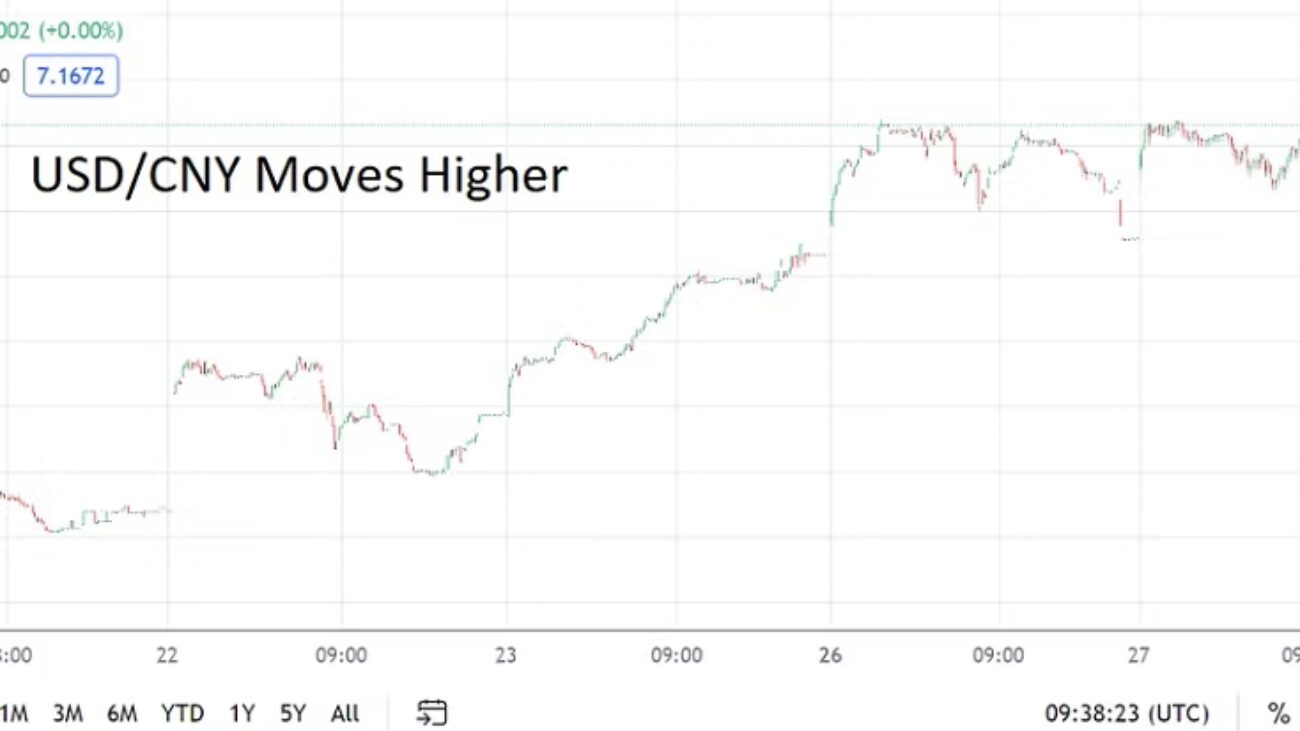

A sin bin of mistakes has collected and is now being exposed. Many financial houses were surprised when the Fed came out on the 1st of February and sounded so aggressive talking about inflation while increasing the Federal Funds rate again. Then jobs numbers came out on the 3rd of February, along with Average Hourly Earnings and showed the U.S economy was stronger than expected. The USD began to find strength again, and inflation data then added an extra punch by coming in strong again in February via the CPI results.

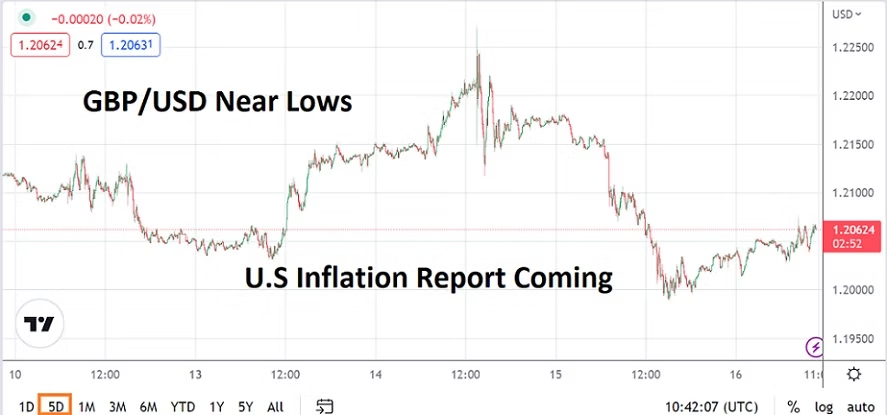

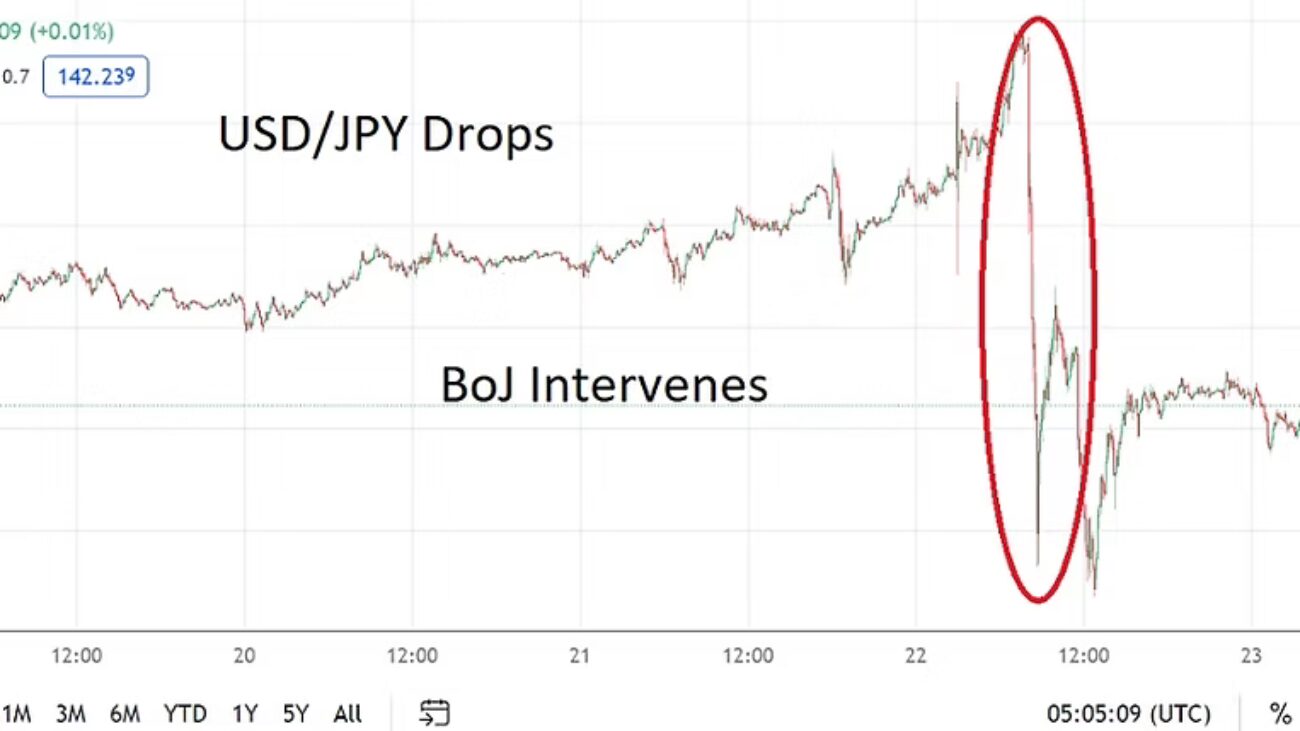

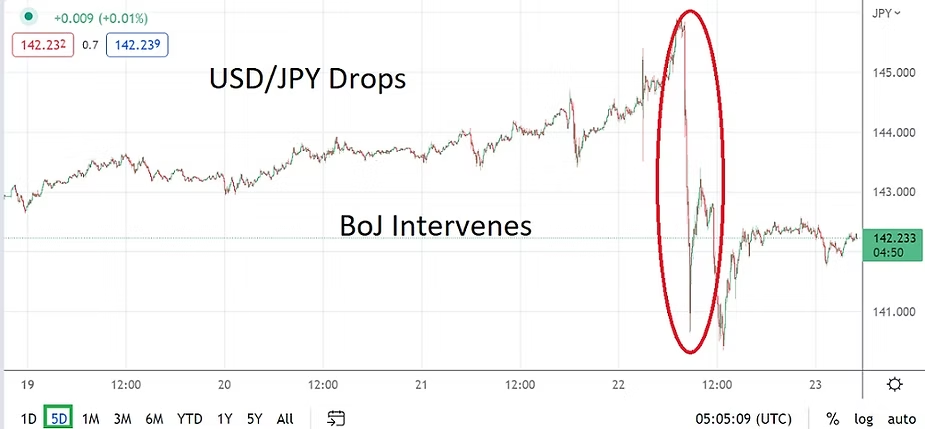

Btw, Consumer Price Index will be published today too from the U.S, and this will cause a reverberation for those attempting to day trade among waters filled with nervous financial houses who have their programmed algos ready to take advantage of hectic markets. Volatility the next handful of trading days is set to be wild. The Fed is not likely to raise interest rates by half a basis point on the 22nd of March, but if CPI numbers are stronger than anticipated today, this could cause a tremor and fear. Even if the Fed pauses for the moment, the prospects of raising interest rates again in the near future unless the banking sector shows it cannot sustain another round of Federal Fund increases is troublesome. Nothing like a complete lack of clarity for short-term traders to cause bedlam and a complex gauntlet of inflation statistics to make the Federal Reserve squirm.

Traders have to understand that if they are going to attempt to wager on the markets in the near-term that they are taking a huge risk. The use of leverage could provide solid profits on a winning bets via Forex, commodities or CFD wagers, but it could also wipe a trader completely out if they are caught by a violent wave. And the U.S Federal Reserve is not here to protect small traders, they frankly do not consider your results very much and likely believe you should not be wagering.

What the U.S government and its institutions like the Fed, Treasury and FDIC want to do is guard against systemic risks for the larger speculators – corporate traders, banks, hedge funds, V.C’s, etc. to make sure they do not go belly up and cause a global financial sink hole and long-term ruptures. The financial crisis of 2007 and 2008, the coronavirus pandemic starting in 2020 and the ongoing Ukrainian war have tested the markets and were likely enough for most of us to voice troubles. Now the prospects of a far-reaching banking crisis and illiquidity adding fuel to the fire are quite a combination of risk events usable as costly teaching moments. Do we seriously need another teaching moment however?

We are the little people and nobody sees us. We may yell, we may bellow our angst towards the system, but the system treats us as an afterthought. Day traders should keep this in mind as they bet in the coming days, because more gyrations are likely as a metaphoric ‘country club for institutional risk takers’ is given sanctuary. This as we minnows look up, shaking our heads in disbelief while our trading accounts flounder.