No Chance of a Nimble U.S Fed as Entitled Investors Served

On Wednesday of this week Consumer Price Index numbers will be published, followed by Producer Price Index data on Thursday. Inflation statistics from the U.S for several months have been coming in rather tame and sometimes below forecasted results. Fed Chairman Powell and his team of FOMC members continue to plead uncertainty as the main reason for a lack of Federal Fund Rate cuts because of tariff concerns. The next meeting by the Fed finishes on Wednesday the 18th of June.

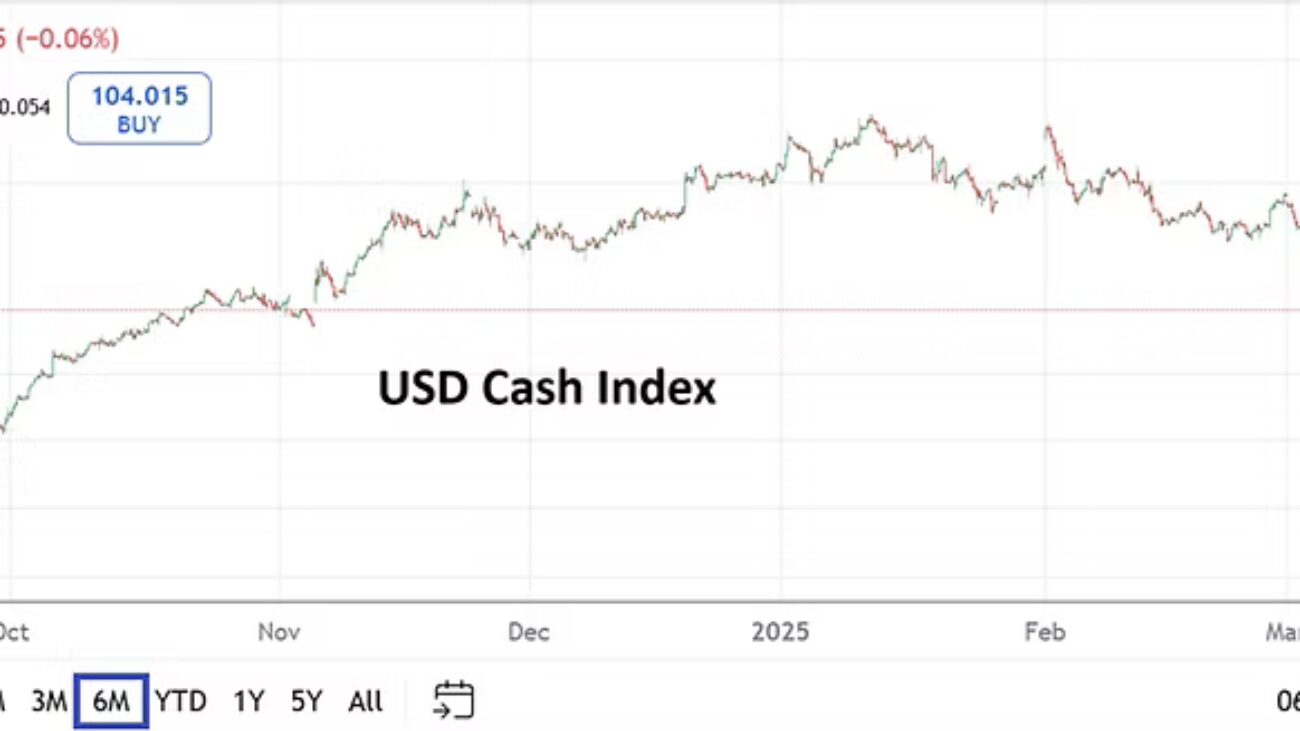

Even if the inflation numbers come in as anticipated in the next few days, the Federal Reserve is unlikely to cut interest rates next week. President Trump and some in his cabinet have spoken about the need for rate cuts. Not only would it help consumers via mortgage rates, borrowing costs to buy autos and other high ticket items, but it would help the U.S government pay less on interest rate expenditures generated by inflamed Treasury yields.

The Fed continues to stay passive about its outlook, but if inflation data via the CPI and PPI are near forecasts this week, why would the U.S central bank continue to take such a stubborn stance? Interest rate decisions are not supposed to be political. The Fed has pointed to the potential of sudden inflation occurring due to tariff implications. This is a genuine concern. However, why can’t the Federal Reserve be more nimble? Inflation has not shown signs of immediate upwards pressure.

Perhaps it is because the Fed serves large U.S and foreign financial institutions, and has gotten into the habit of telling important folks not only what it anticipates, but handing out its interest rate plans on a silver platter so large players can position themselves beforehand like entitled elites. The Fed is very unlikely to cut interest rates the middle of next week, but it is probable they will open the door to a 25 basis point cut in July. However, July’s meeting is scheduled for the end of that month, in essence this is the middle of the summer, which is a long time to wait for action.

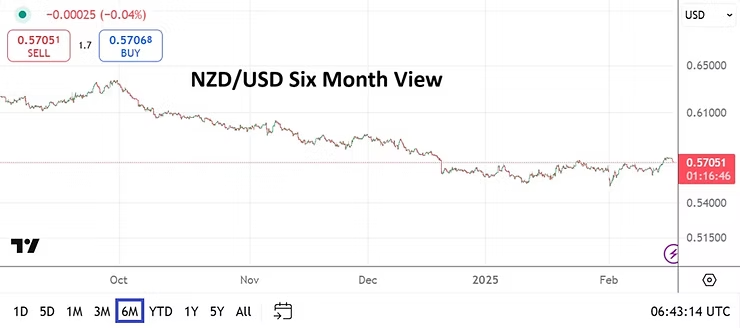

Day traders hoping to ride the trends that flow through the marketplace as they pursue speculative wagers remain in a difficult spot. Intraday volatility remains dangerous. Mid-term outlooks are certainly taking hold in Forex and equity indices, but sudden reversals for those using too much leverage continues to cause harm. Short-term speculators need to remain patient and vigilant, it is important to remember day traders are seen as second class citizens in the big scheme of the financial world, and this is not going to change for the moment.

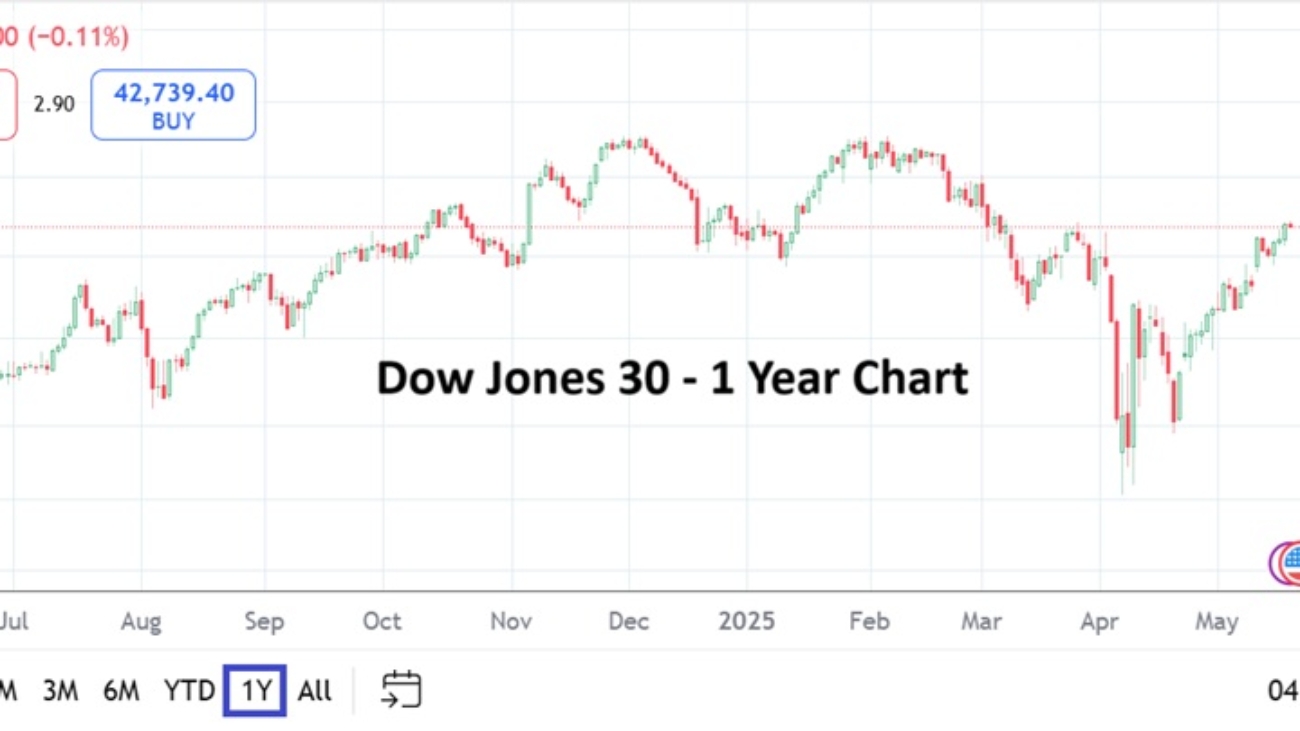

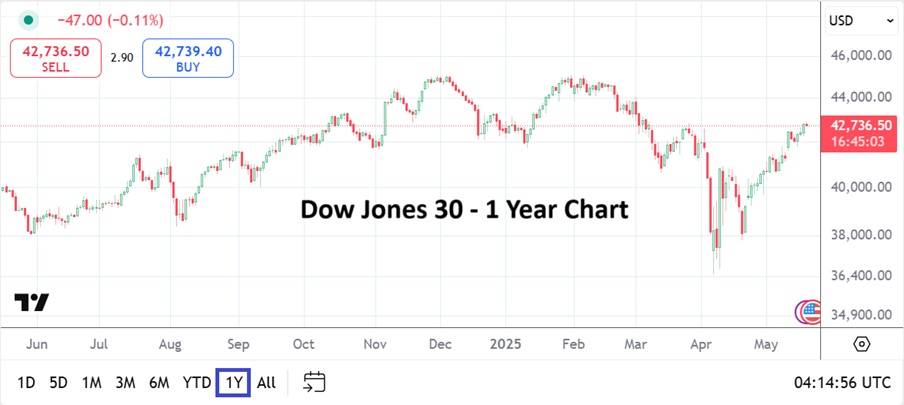

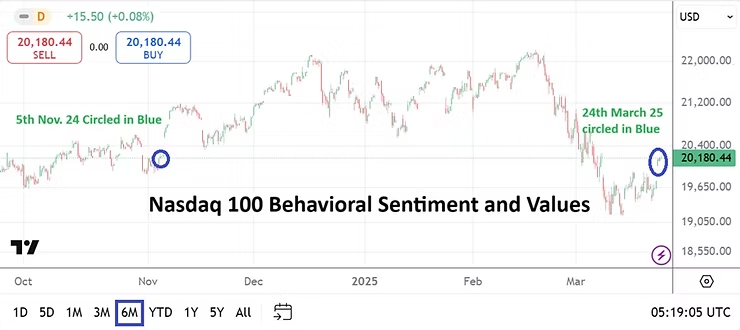

A lack of clarity has spooked large players in the financial markets the past handful of months, but it does appear many institutions are becoming more comfortable. Though not at all-time highs, the major stock indices are within sight of important values. Behavioral sentiment seems to be leaning into a more positive outlook. Large investors appear to have concluded that while President Trump talks a tough game and often presents a strong stance, that ultimately he allows for tactical maneuvering to achieve deals. Trump is not big on being polite and this occasionally inflames markets. Bullish sentiment is growing on the hope President Trump’s characteristics are understood.

The Fed and the White House are likely to continue locking horns for the next few weeks. Perhaps if Jerome Powell tries to placate Donald Trump with a solid hint of an interest rate cut in July this will smooth things over. However, waiting for an interest rate cut in late July seems like a road too far, particularly when inflation levels the past couple of months avail the U.S economy to proactive actions from a Federal Reserve now.

Let’s remember, there is no law that says the Fed cannot cut or raise interest rates only during the conclusion of FOMC meetings. The U.S central bank has the ability to make changes to the Federal Funds Rate whenever it deems needed. Yet, the Fed refuses to be nimble in an age when technology allows data to be attained faster, this is a detriment.

The inability of the Fed to show it can be agile is another reason why investors are nervous about U.S policy regarding fiscal matters. The U.S government’s bureaucracy is too slow and bloated. The U.S is still a golden place to invest, but it is becoming problematic and this is leading to changes which effect long-term financial decisions.