AMT's Dubious Dozen Forex March 2024 Sentiment Outlook

The Dubious Dozen is comprised of nations who are wealthy or should be, and face criticism because of domestic and sometimes international policies. As the reader you are free to differ from the AMT opinions, which are admittedly subjective. The ratings and outlooks are not delivered as trading advice, but as a viewpoint to inform. The work presented is a living document. The nations and currencies listed, and data and critiques shall change monthly according to points deemed important.

AMT’s Dubious Dozen Monthly Forex Sentiment Outlook has a scaled ratings table, listing nations and currencies that are judged to have concerns regarding outlooks due to behavioral sentiment factors within financial institutions and among citizens, based on economics, transparency, and risk concerns about government fiscal policy, and ‘leanings’ toward autocracy. Metrics like inflation, gross domestic product, direct foreign investment information, debts and budgets, and foreign currency holdings which are gathered from various public sources will sometimes be presented.

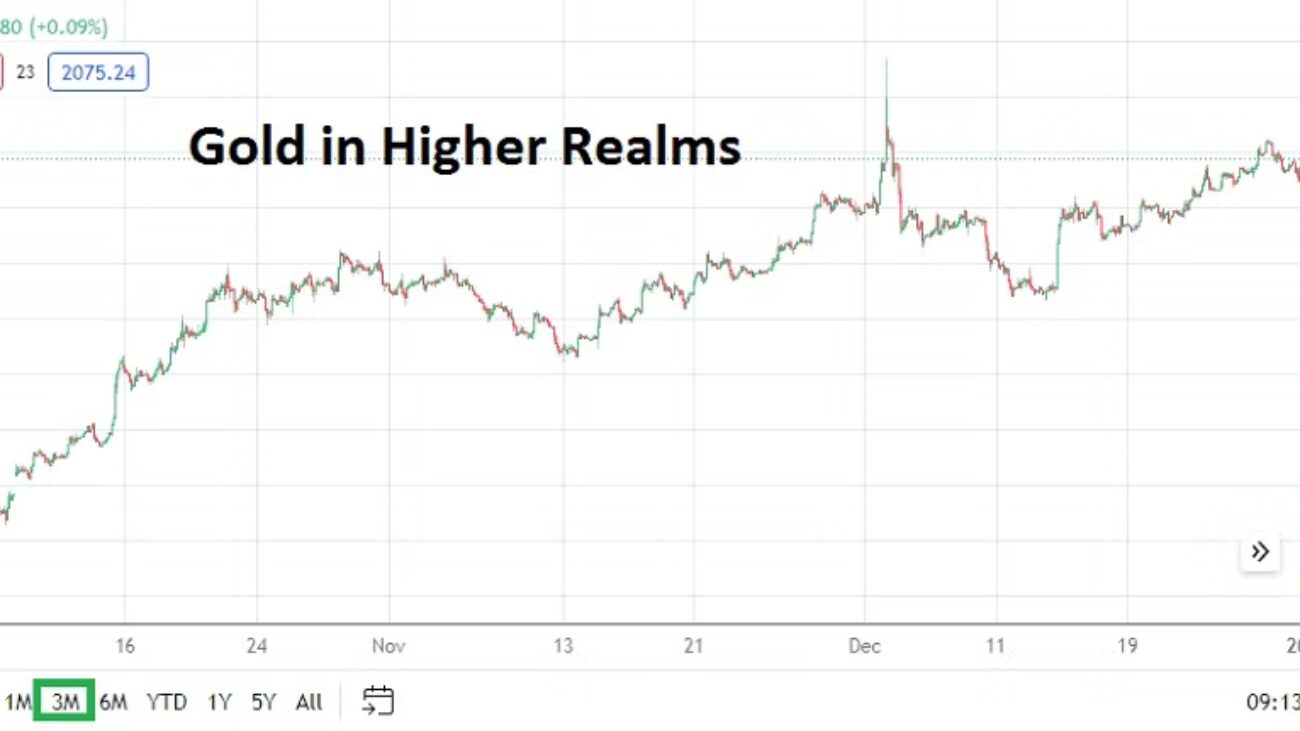

AMT also tries to judge the trust level the citizens of the nations have in their domestic currencies via exchange rates, black market FX factors, and alternative assets held to guard against potential risks – like digital assets, cryptocurrencies, and gold.

A lack of credibility in a ‘fiat’ currency is dangerous and often leads to black markets for Forex in search of safe-haven currencies like the USD. The lack of a credible domestic currency also leads to price inflation because people selling goods fear the value of the domestic currency is losing value rapidly. Rampant inflation also leads to a desire to sidestep taxation on occasion.

Problematic inflation and inability to collect taxes may open the door for certain countries to contemplate and potentially initiate Central Bank Digital Currencies in order to control domestic economic activity. It is not a coincidence that China, Iran, among others are considering implementation of CBDC’s. The potential of CBDC’s by governments could allow for draconian laws for citizens of certain nations. The ability for a government to check on how all money is used via a centralized blockchain could lead to a more authoritarian landscape.

Quick Insights of the Dubious Dozen Nations Listed:

Argentine Peso (ARS): The election of President Javier Milei has started to ignite changes within fiscal policy and has created hope among international observers of a less corrupt Argentina. However, many obstacles still must be overcome by the newly elected leader and the government, and many economic issues will take patience from the public to improve. Patience has not been a classic virtue in Argentina, unless one considers the ability to accept massive corruption and go on with everyday life as a supreme power.

Brazilian Real (BRL): Concerns regarding potential fiscal policy changes hover over the existing government which leans towards a socialistic bent and has shown a tendency to align itself with some of the most autocratic governments. Some businesses and investors are anxious about the potential of government mismanagement to develop under President Lula da Silva. The listing of Brazil will create catcalls from some, but the fear in some circles is what might happen if fiscal policy which is led by a socialistic government becomes too populist. For the moment the BRL appears to be under control, which is a good thing. However, the Brazilian Real should be kept in sight for any signs of nervousness.

Chinese Yuan (CNY): The domestic economy remains troubling and fragile. Deflation abounds. Manufacturing, electrical usage, real estate, export numbers should be monitored by observers. Government policy, and transparency reliability due to political control by the Communist Party is problematic. Concerns are causing a backlash among many foreign investors who are looking elsewhere for long-term business endeavors, when they have the ability to divest. Stats: IMF expected GDP for China in 2024 is 4.6% for 2024. China is suffering from current monthly deflation around minus – 0.80%.

Egyptian Pound (EGP): Corruption is problematic within national institutions, bureaucracy issues plague businesses due to interference. Central bank independence is in question as the government faces a litany of fiscal problems. Worries persist about a devaluation for the EGP in order to try and get inflation under control which is currently near 26.5%. The Egyptian Pound is viewed as highly vulnerable.

Iranian Rial (IRR): The nation remains mired under international sanctions. The government practices a heavy hand regarding domestic policies which carry the threat of prison and worse because of the ability to oppress the general population. The Iranian Revolutionary Guard which has several branches of ‘service’ helps the ruling government dominate and benefits monetarily, which makes the Iranian leadership and its ability to rule comparable to a mafia. The current inflation rate in Iran is estimated to be around 32.5%. Unemployment in Iran is estimated to be above 10% and 60% of the total economy is believed to be centralized by the government.

Nigerian Naira (NGN): Corruption remains a troubling part of Nigeria. Although it is a massive exporter of commodities including ‘energy’, and has a dynamic demographic, government policy is highly questionable. Nigeria’s GDP is estimated to be around 3.46% as of December 2023. A problem for Nigeria is its shadow/informal market economy, which is estimated to be nearly 58.2%. Corruption and an inability to legitimately collect taxes hurts the government’s finances and its citizens. The Nigerian Naira is weak and is losing credibility.

Pakistani Rupee (PKR): Economic concerns regarding export and import disparities are a major factor in the lack of foreign currency reserves. A new government has been elected in Pakistan which has been able to form a ruling coalition. Issues regarding corruption remain troubling. Pakistan has also formed a stronger relationship with China, particularly as they search for strong economic partnerships, but this may leave them vulnerable politically. The IMF is a large factor in the current valuation of the PKR. The currency has been stable for a handful of months but needs monitoring.

Russian Ruble (RUB): Although the war with the Ukraine battles on, Russia has found a way to continue to create growth within its economy even in the midst of sanctions. The nation has found other ways to trade and acquire products from abroad via ‘new’ trading channels largely coming from Central and Eastern Asian routes. Russia’s government is seen as highly one dimensional and rules with an iron fist. Russia’s economy appears to have grown at a remarkable rate of 3.6% during 2023. Core Consumer Prices were about 7.15% higher as of January 2024 per annum. Vladimir Putin has played a rather impressive game of economic poker with the ‘West’ in light of the Ukrainian war, much to the chagrin of his critics.

South African Rand (ZAR): The African National Congress has been in power nearly 30 years. Concerns about mismanagement and corruption abound which are believed to influence questionable fiscal policy. The South African economic outlook is weak due to problems regarding reliable electrical supply, logistical problems at ports, and bureaucratic interference led by government policy which leans towards central controls. A large amount of immigrants from other African nations are still coming to South Africa as a cheap labor source, but professionally trained people are still unfortunately leaving South Africa via emigration in large numbers. The South African Rand has been within the grips a long-term trend of losing value, and while not entirely vulnerable its credibility is becoming shakier.

Turkish Lira (TRY): A thriving business and manufacturing base exists in the nation. However, inflation due to fiscal policy in Turkey remains an impediment for corporations which are forced to deal with a currency that many within the nation are worried about because of its incrementally weaker outlook which has been noteworthy for a handful of years. There are concerns about current government leadership regarding transparency and a tendency to interfere in Turkish Central Bank decisions. Financial institutions and their corporate clients have a difficult path as they try to mitigate the constant threat of high inflation in Turkey due to questionable fiscal policy.

Venezuelan Boliver Soberano (VES): The failed socialistic nightmare continues to cause squalor in Venezuela. If you want to see the potential of where the VES is headed look to Zimbabwe and the years that a combination of despotic rule under the guise of socialism has delivered. Venezuela should be a rich and successful country due to its natural resources, but it is led by a band of thieves. The black market rate of exchange if it can be found in cities like Caracas is much higher than the ‘official’ listed rate of the government. The VES has little to no credibility.

Zimbabwean Dollar (ZWD/ZWL): The nation is still trying to fix the problems caused by government mismanagement under the authoritarian leadership of Robert Mugabe which led to hyper-inflation and the destruction of the economy. Zimbabwe has a long way to go and issues to overcome to achieve the reintroduction of a domestic currency which does not suffer from a lack of faith from its citizens, which have led to a wide abandonment of the Zimbabwean Dollar and demonetization.

A national currency that is tradable internationally does not exist, the government is aiming for another attempt at monetization in 2025 if economic stability is created. The Botswana Pula (BWP), USD, and ZAR are among other currencies that are used and accepted by the population to transact business. The government tries to monitor all FX exchanges after years of misrule, but this does not stop a vigorous black market. There is an accepted perception the current leadership is trying to fix the massive problems which have created havoc in the nation for a few decades, but the road back to normality is still perilous.