The USD stumbled last week as inflation numbers via the Consumer Price Index and Producer Price Index both came in slightly below expectations. Yes, inflation is still dangerous in the U.S, but an erosion of momentum has certainly been hoped for by financial institutions, and they clearly took advantage of the CPI and PPI reports and helped a selloff of the USD build momentum.

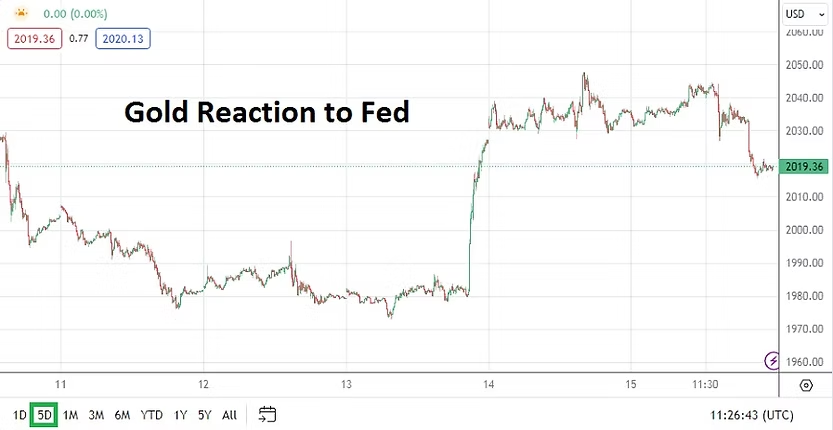

The Federal Reserve is now highly anticipated to begin lowering the noise of its aggressive rhetoric, and actually start to sound more neutral when December’s FOMC Statement is delivered. Yes, this is speculative and things can change, but financial institutions like speculators position their assets based on outlooks.

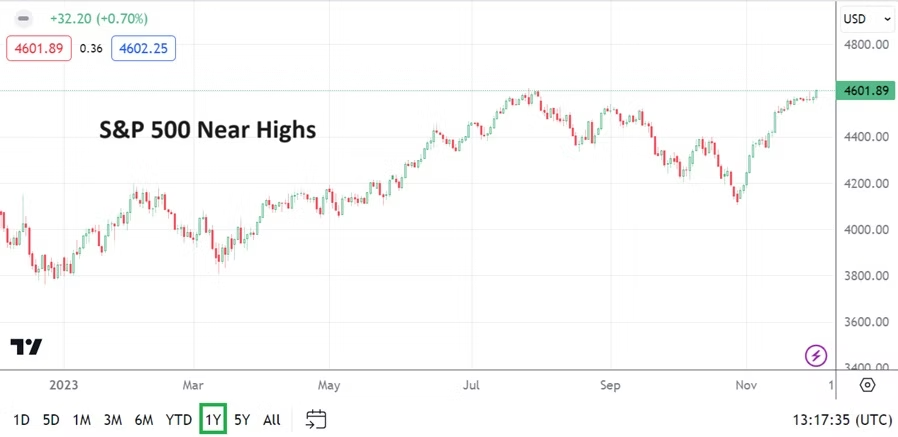

Equity markets in the U.S also showed that there is growing risk appetite which wants to be part of the moves higher in the major indices. The NASDAQ 100, the Dow Industrials 30 and S&P 500 have all sustained upwards movement and are at three month highs with additional upwards targets clearly in sight. However, before day traders try to hop onto the higher trajectory they should remember the speculative timeframes of institutional investors are different than their own. Fear of missing out could feed into buying momentum, but caution is needed.

The U.S will celebrate its Thanksgiving holiday this Thursday. Volumes across the broad markets will begin to drop significantly on late Wednesday, and full trading will not return until Monday or Tuesday of next week until the U.S turkey meals have been digested. Meaning that while risk appetite has certainly begun to creep in the broad markets again, forecasts this week should be treated carefully. Day traders should watch momentum today and tomorrow, if the USD remains weak going into Wednesday, this could signal further weakness in the USD is anticipated. Yet, the dangers of near-terrm reversals exists and speculators should not get over confident.

U.S Treasury yields remain near their five day lows. The price of gold is range trading below its highs made late last week, this as the USD has shown weakness and risk adverse global concerns have also become more calm. Trading results later this week should be viewed suspiciously, price velocity when unbalanced positions are executed often leads to spikes during the Thanksgiving holiday, like the Christmas holiday which will follow in a little more than a month.

Monday, 20th of November, Germany PPI – the inflation data has already been published and the Producer Price Index came in at minus -0.1%, which was below the estimate. Global economic data the remaider of today will be rather light, and behavioral sentiment being generated from U.S markets should be watched.

Tuesday, 21st of November, U.S FOMC Meeting Minutes – this report which will be published late on Tuesday for many global traders, may provide evidence to previous thoughts regarding the outlook for the U.S economy regarding inflations impact on monetary policy. Meaning that if there are signs that FOMC members were already talking about the notion that inflation was eroding last month and was expected to continue to decline further – this could feed into weaker USD outlooks mid-term.

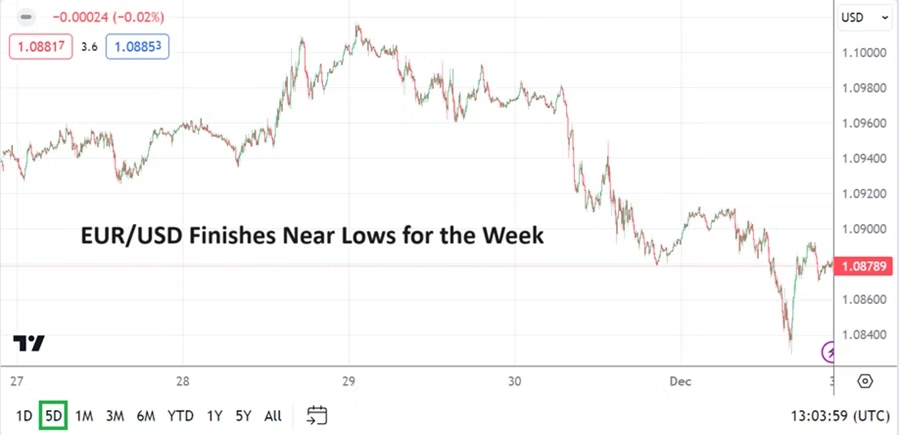

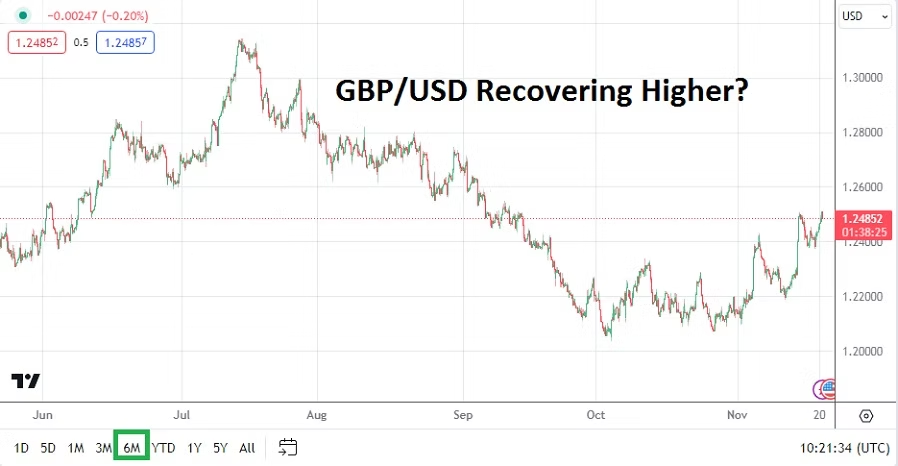

Wednesday, 22nd of November, E.U ECB Financial Stability Review – this report will have limited impact because Forex will remain USD centric. The EUR, like the GBP and JPY, is showing signs of a recovery based on the notion of having been oversold. Traders should be cautious about the EUR/USD later this weeek because of the U.S holiday and expect volatility.

Wednesday, 22nd of November, U.S Core Durable Goods Orders, and Revised Consumer Sentiment via University of Michigan – both these reports may fall on a U.S marketplace that is preparing to escape for the long holiday weekend. Last week’s weaker than anticipated Retail Sales numbers will combine nicely with the Consumer Sentiment reading, but again its affect may be muted. If the Core Durable Goods Orders number meets expectations or comes in with a slightly less than expected statistic, this could help continue to create weaker USD outlooks.

Thursday, 23rd of November, U.K and E.U Flash Manufacturing and Services PMI – the reports from Great Britain and the European Union are expected to show stable results, but also that purchasing managers remain unimpressed by the prospect of future demand over the mid-term in Europe.

Friday, 24th of November, Germany Business Climate via ‘ifo’ – this report is expected to be better than last month’s outcome. If the result is stronger than expected this could help the EUR/USD going into the weekend.

Friday, 24th of November, U.S Flash Manufacturing and Services PMI – both reports are expected to be slightly weaker than the last month’s numbers. U.S trading will be limited before going into the weekend. Yes, many markets will be open but volumes will be sparse. This could set the table for a reaction early next week if financial institutions believe they can take advantage of Forex, equity and commodity markets that became unbalanced during the Thanksgiving holiday celebrations.