Trading Thud Ending Last Week and Early August Insights

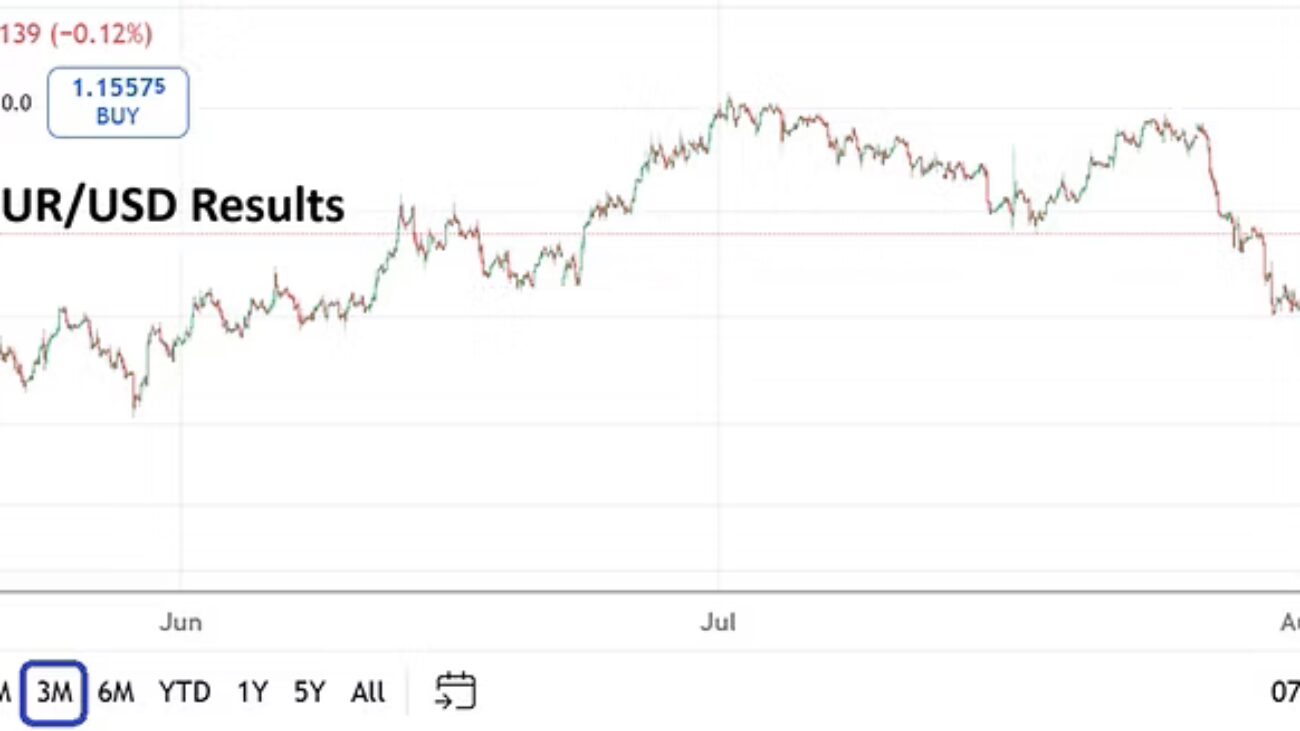

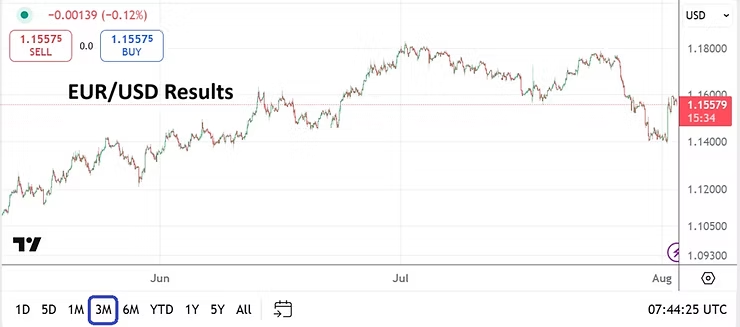

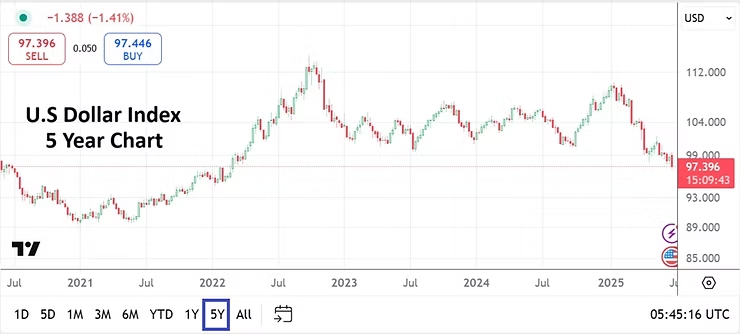

The EUR/USD is near 1.15650 early this morning. The USD/JPY around 147.850. Forex has provided fast reversals and most major currency pairs are within well established known realms, but caution prevails. Friday’s U.S jobs numbers before going into weekend provided additional mud to filter through for those seeking clear outlooks. Were the employment numbers rigged by the Bureau of Labor Statistics?

Questionable economic statistics have become an open sore spot for some analysts in the U.S, this has been a problem since the financial crisis of 2007/08 and ensuing years when politically expedient numbers were rumored to be in use so the Federal Reserve and U.S Treasury could work in a more comfortable manner. Let’s just say there are actual reasons why and how economic statistics could be used to hurt and help policies. For some evidence take a look at the art of revisions that has been practiced with key economic data the past handful of years. Financial institutions now need to consider the possibility that numbers cannot be trusted, interpret reports, try to decipher reality and consider impact.

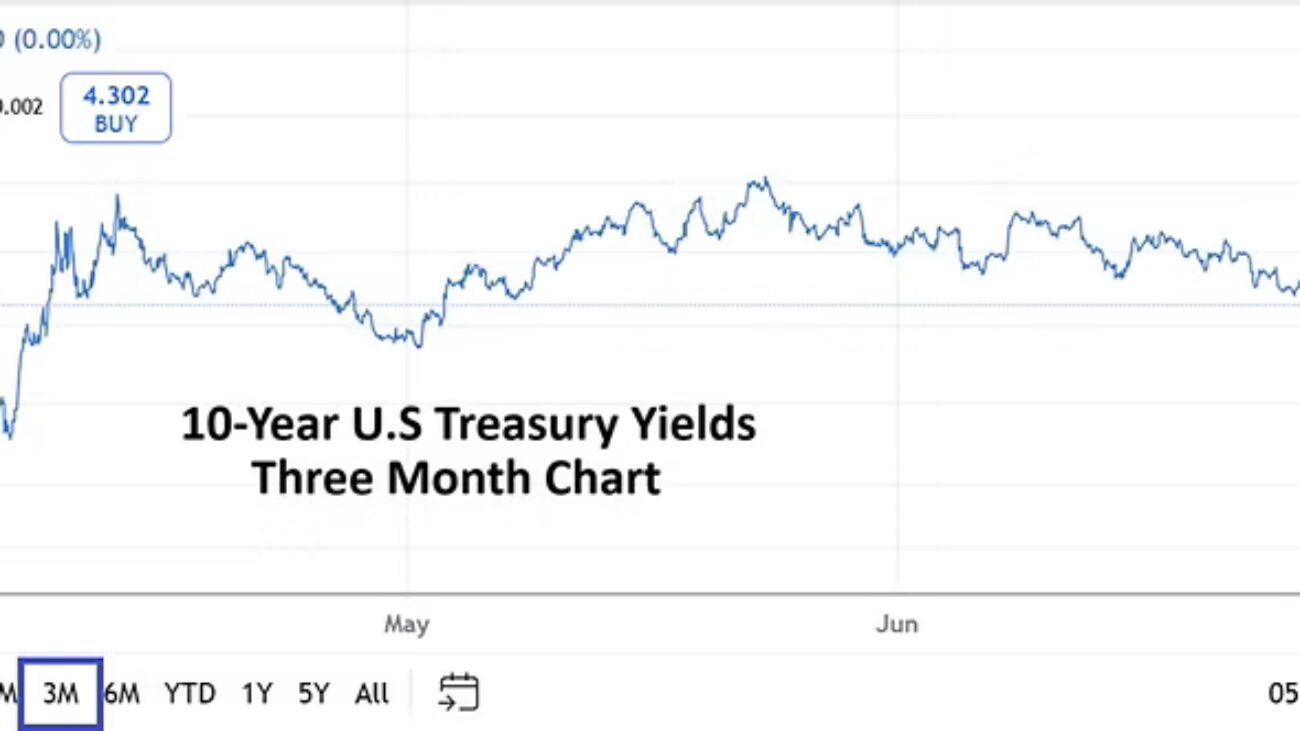

Effect on the Federal Reserve is a big question. Fed Chairman Jerome Powell continues to preach uncertainty and say a wait and see approach is needed because of implications regarding tariffs. However, conspiracy theories are also somewhat blown out of the water regarding the recent jobs numbers, because the lackluster results will actually put pressure on the Fed to cut rates in September in order to help spur on a better jobs market. So in other words, financial institutions, big investors and day traders are back to square one.

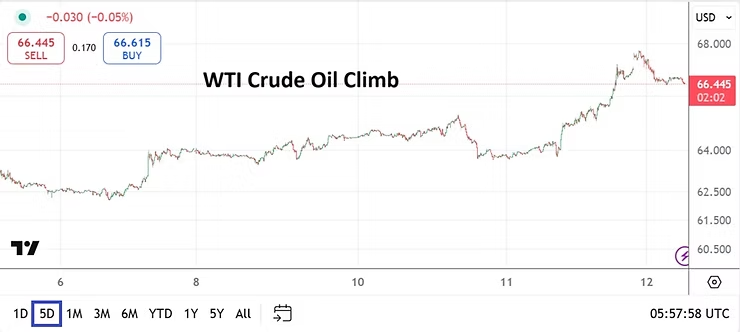

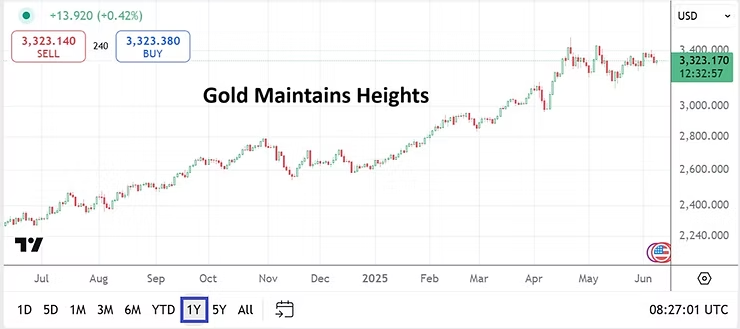

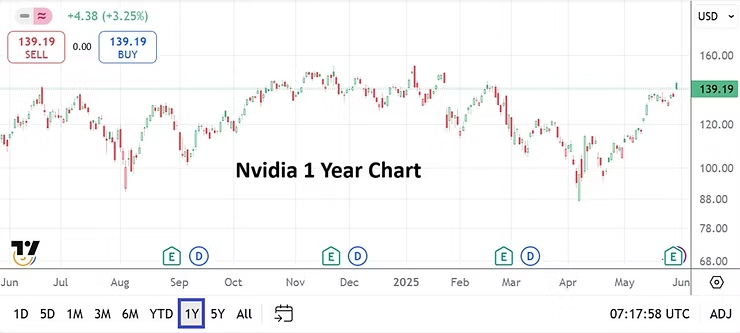

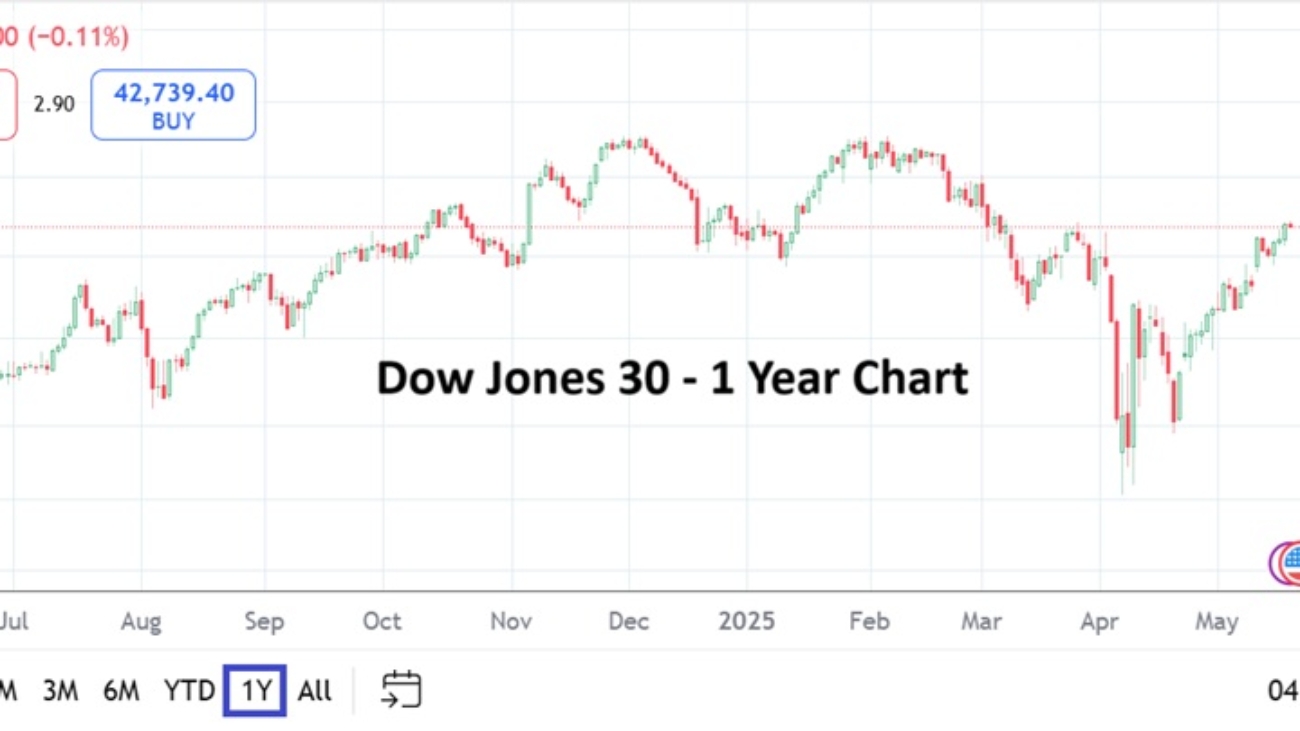

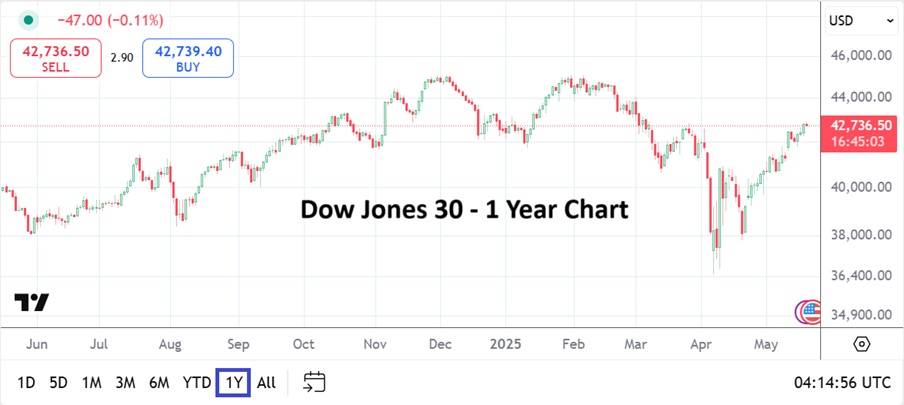

The ISM Services Purchasing Managers Index stats will be published tomorrow for the U.S, but this report is likely to be a mere ingredient that affects the marketplace. Behavioral sentiment will remain the cornerstone in Forex, equity indices, Treasuries and commodities. August is typically a rather calm month of trading taking into consideration that holidays are being taken by many market participants, but as the S&P 500, Nasdaq 100 and the Dow 30 remain elevated and capable of achieving new record highs, the USD creates chaos regarding outlook influenced by a Federal Reserve that is now in a difficult spot, and tariff implications are contemplated it would be wise to keep an eye on all near-term outcomes.

Technical trading and computer generated algos will factor into conditions as psychological levels are challenged and perceptions are debated. Has the global marketplace grown comfortable to the tactics used by President Trump? While it is easy to say yes, there are still plenty of reasons to remain concerned, this because White House policy seemingly has the ability to shift without notice.

Which has helped produce what may be the golden rule that develops under the current circumstances. Stay alert, stay optimistic but practice caution. Financial institutions have always practiced the art of realpolitik behind closed doors to chase profits, but they must remain vigilant to fast reactions caused from the potential sudden fear of shifting doctrine. President Trump’s rather swirling mix of laissez faire enterprise, and his stark ability to express anger at those who stand in his way or disagree with him do make for a new trading reality. Cautious optimism is likely to rule the world of investment and speculation going forward.