Forex: The Art of Not Making Sense and Accepting Price Values

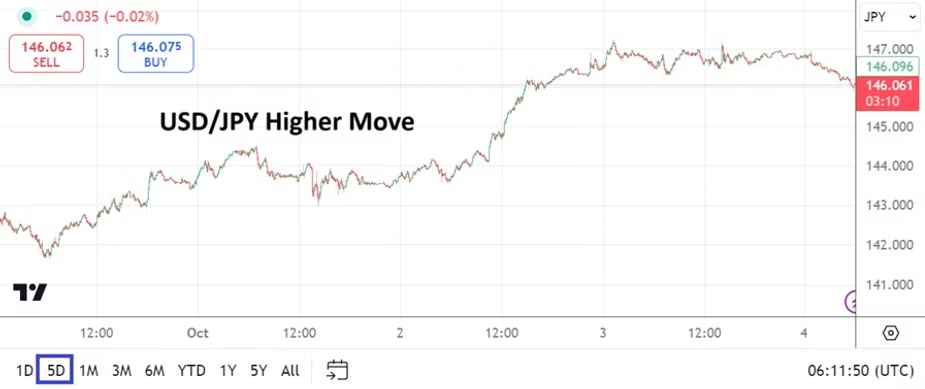

Retail traders are likely learning the hard way that attempting to trade in Forex for the moment is more than dangerous, it is expensive. The U.S Consumer Price Index numbers yesterday met expectations, which essentially allows the Federal Reserve to remain in a cautious dovish stance. However, after an initial show of USD weakness upon the data in many FX pairs, USD centric strength quickly returned.

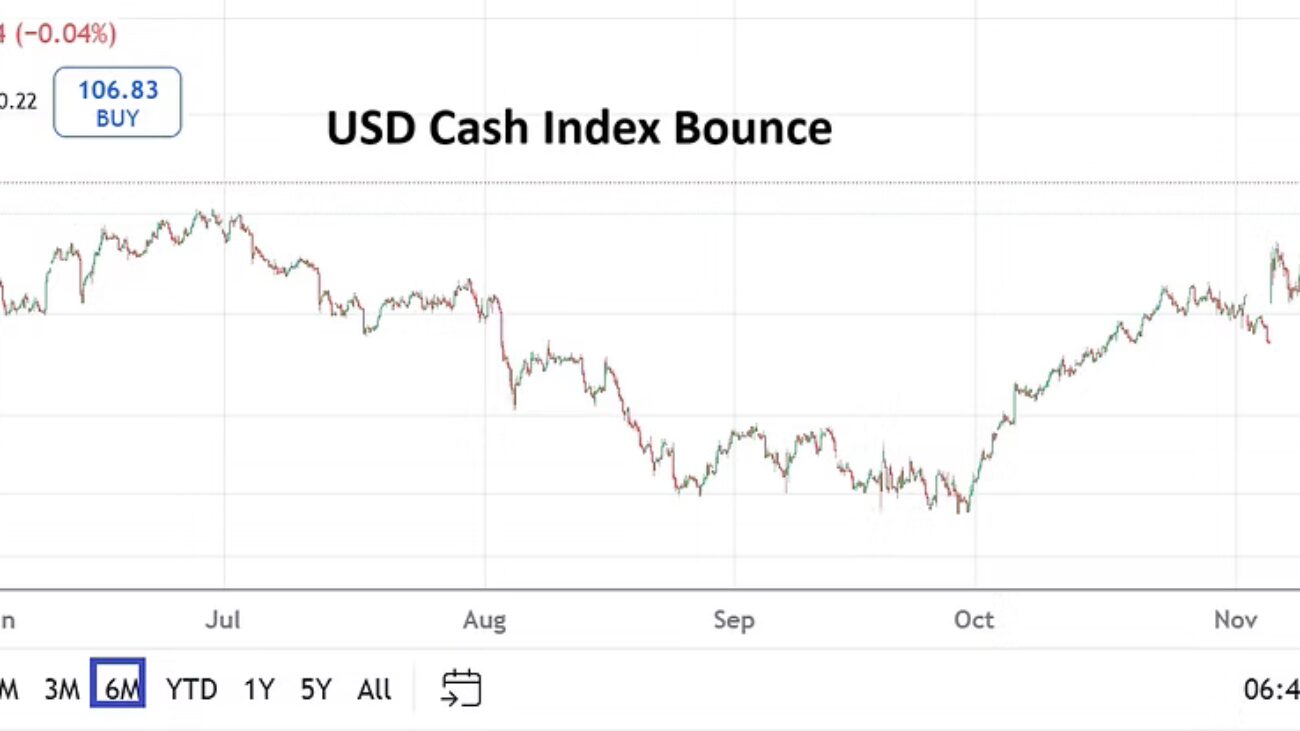

Short and near-term trading for speculators who do not have deep pockets and are suffering from whipsaw movements are creating the need to take a step back. As many major currencies have suffered losses against the USD since late September, the tendency is to likely think a reversal is going to develop sooner rather than later. However, until financial institutions become comfortable with the notion President-elect Trump’s policies aren’t going to harm economic prospects in a variety of nations regarding tougher trade agreements, risk adverse trading is going to remain a key in Forex.

Yes, at some point the USD will start to give back some value, but timing the moment this is going to start and become sustained for day traders is simply betting. Financial institutions are feeling anxious about their commercial forward positions in Forex too, which will continue to create volatility for all trying to predict where the USD will be mid-term. Federal Reserve policy may actually be able to deliver a 0.50 basis point total cut over the next few months, but this notion has had almost no impact on USD strength short-term. Perhaps financial institutions do not feel the Fed will be that dovish through February, but if inflation remains tame the Federal Funds Rate still has room to decrease.

Today’s Producer Price Index inflation reports will be watched, but like yesterday the results are unlikely to be a key which will suddenly ignite strong reversals in Forex. In the meantime traders need to practice solid risk taking tactics and patience. Retail Sales figures will come from the U.S on Friday, but again day traders should expect financial institutions to remain risk adverse until there is an event which changes their cautious mindsets.

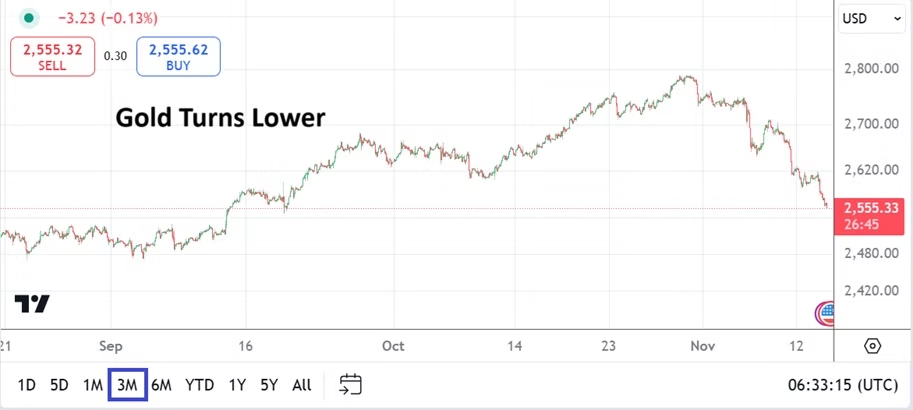

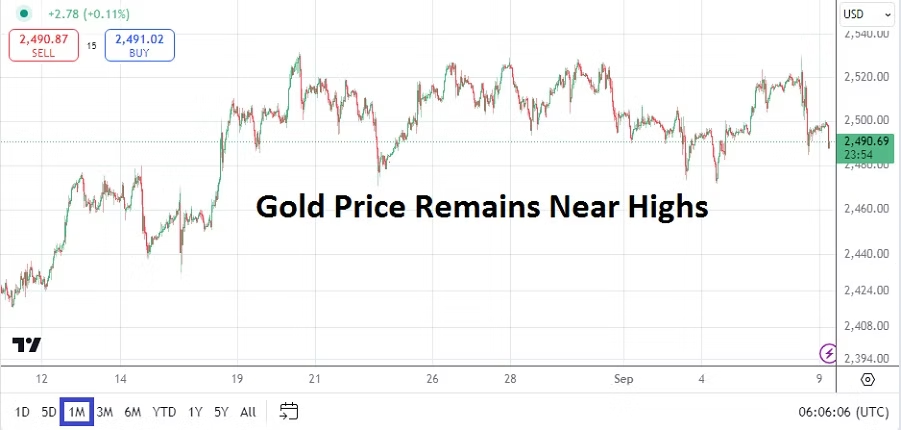

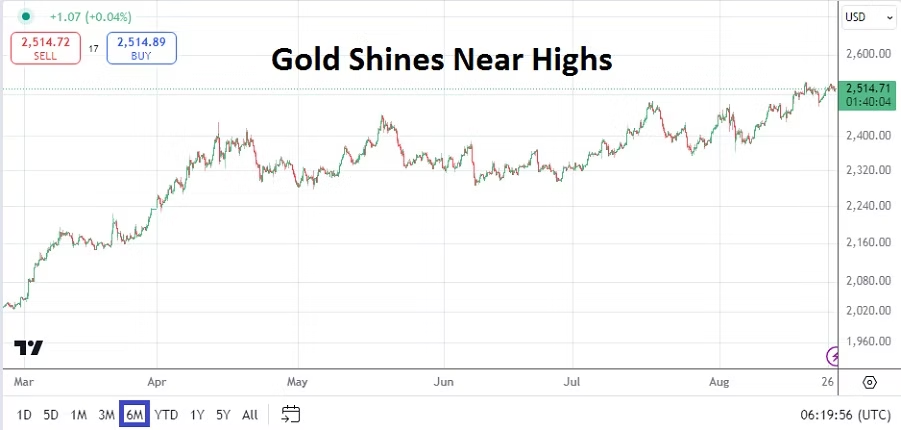

Gold is noteworthy because it has struggled since early November. There is the possibility the precious metal has turned lower because investors feel more sure about their long-term bets in the U.S equity markets for a moment, but that is likely wrong. It could also be argued speculators are cashing out winnings they have made the past handful of months. The point being that explanations for price movements are tenuous. False narratives abound. Fundamentals like behavioral sentiment are shifting because new economic policies from the U.S are going to develop and market participants want greater clarity.

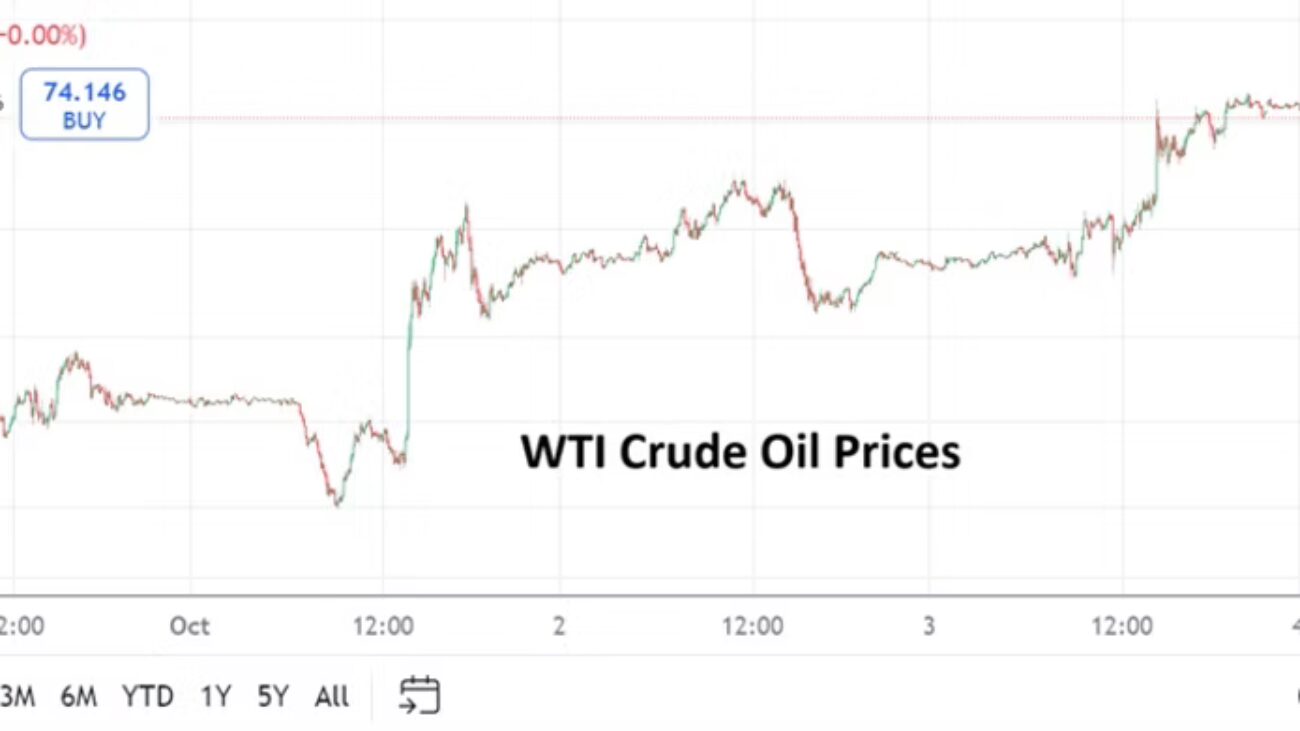

Like the major currencies suffering significant declines versus the USD, the value of gold can be argued, but the market is telling us what participants are willing to pay for assets whether we agree or not. Let there be no doubt that the highs being produced in U.S Treasury yields which are near early summer values, the USD Cash Index reversing towards technical levels seen in early July, gold recently losing value, and U.S equity indices being near all-time highs makes it particularly difficult for predictions regarding what is next. Except to say the Trump victory in many ways has sparked a buy American parade for the moment. If you want to bet against the trends you are free to do so, but behavioral sentiment is proving once again the king of the hill.

While the broad markets may not feel like they are making much sense to some, as traders we need to be able to put our bias to the side and accept the markets as they are, not what we think they should be. There is a significant difference between near-term and long-term targets. Day traders need to understand they are wagering in markets that will remain dangerous for a while. Nothing is guaranteed, but the idea that U.S equities may continue to rally into the New Year is being wagered upon by larger players and they might be proven correct.