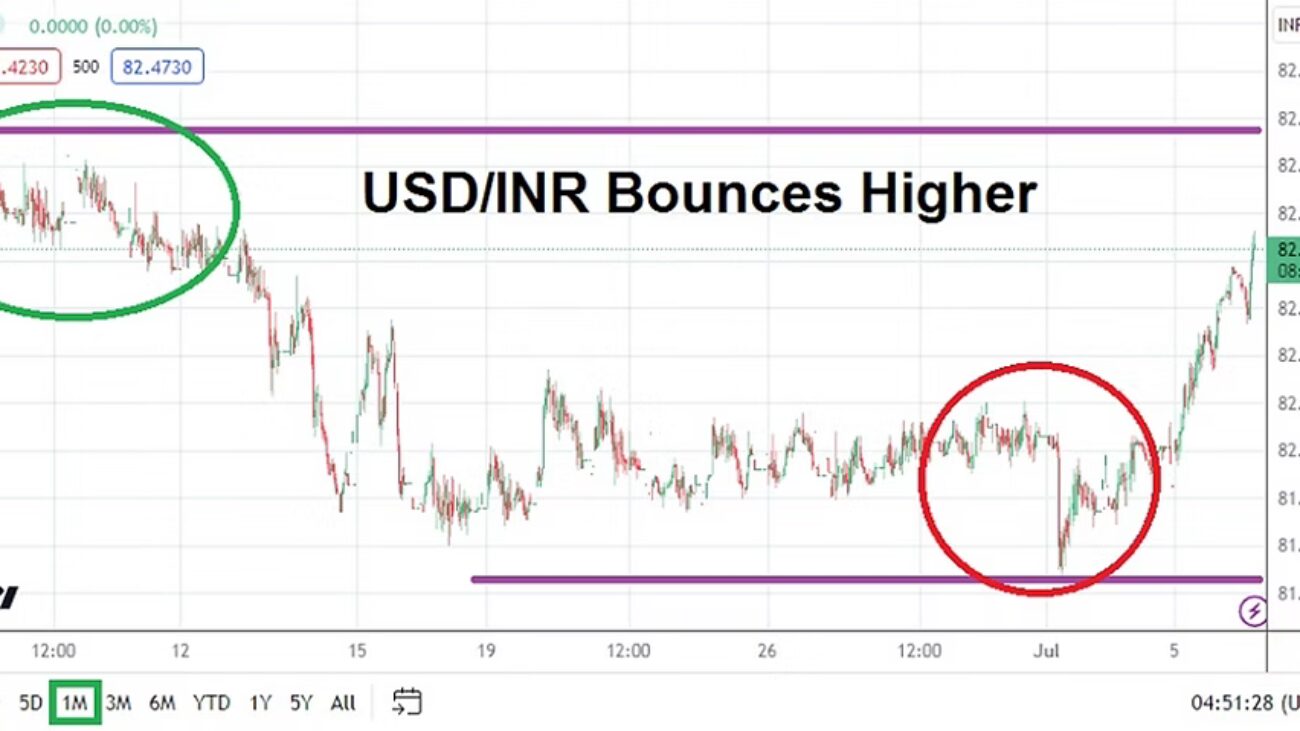

USD/INR: Consolidation Might Come to an Abrupt Conclusion

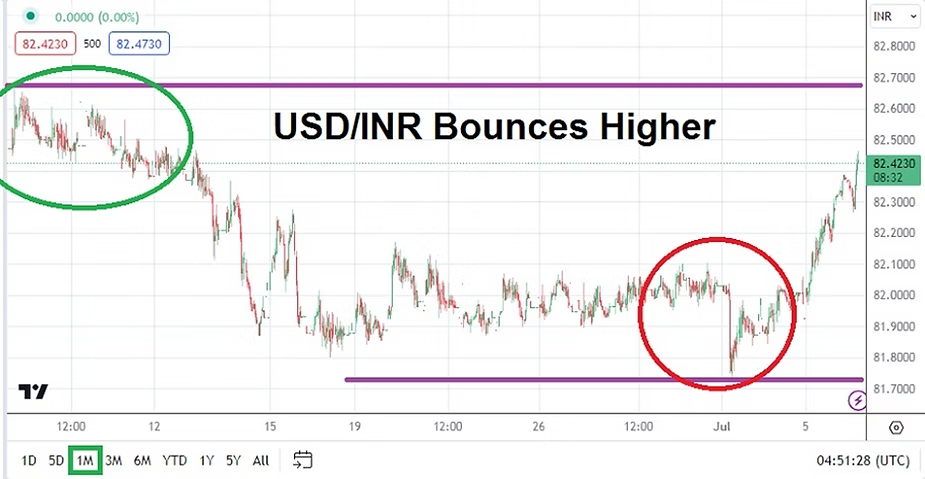

The USD/INR is trading near the 81.9750 ratio as of this writing and its price action since the 13th of July has produced a tight price range. On the 12th of July the USD/INR was trading around the 82.3000 region, this after being able to incrementally decline when a high of nearly 82.7900 was reached on the 6th of July.

Prior to the apex value of July, the USD/INR had traded in a rather consolidated mode from the middle of June until the first few days of July, essentially within a price realm the currency pair now lingers. Speculators must constantly fight the slightest of reversals if they are using too much leverage, but the USD/INR over the mid-term has produced interesting behavioral sentiment and this can be seen on technical charts.

While day traders may believe the current price ratios will hold and the potential interest rate hike from the U.S Federal Reserve has been digested into the USD/INR for this coming Wednesday, they might want to reconsider their thinking. No, the world is not coming to an end, Forex has dealt with U.S central bank decisions before and experienced traders understand the sudden potential of the USD/INR changing direction. The rather tight price range of the USD/INR could vanish in the coming days if the Federal Reserve begins to change their tone within the FOMC Statements.

U.S Federal Reserve is Likely to Raise the Federal Funds Rate but Perhaps Shouldn’t

The USD/INR may not get hit too hard when the U.S Federal Reserve delivers the anticipated 0.25% addition to the Federal Funds Rate. However, the FOMC Statement which talks about the Fed’s outlook might cause a change to what have been calm seas recently in the USD/INR. Recent U.S economic data has been rather troubling, but inflation does actually seem to be creeping lower. The Fed has been pretty adamant in their recent ‘whispering’ about raising interest rates in July, and the potential of raising again later this year.

Time for the U.S Federal Reserve to Start Sounding Dovish

Yet, recent data suggests the Fed should likely not even raise rates on the 26th of July and continue its pause. But having expressed plenty of verbiage on the subject, the Fed may not want to surprise financial institutions and may have to raise, even if they do not really have to this week. And here is where it gets interesting – the FOMC Statement may have to express this notion of becoming more dovish. Think of this potential hike to the Federal Funds Rate this week as the last dose of medicine for a patient who already feels better, the doctor (the Fed) is insisting that to make sure the ‘sick’ is cured another teaspoon consisting of an interest rate hike is necessary.

If the FOMC Statement sounds more dovish than expected the USD/INR might start to see selling ignite and a downturn generate. There are no guarantees and certainly the Fed’s actions this coming Wednesday are not known. Yet, if the Fed hints that it will not raise interest rates over the mid-term and wants to see if inflation continues to lower that it may consider the potential of no more hikes, the USD will start to get weaker across the board. In other words, this last dose of medicine from the Fed may give them the feeling to tell the patient (U.S economy) that they no longer need to visit the doctor’s office for a while.

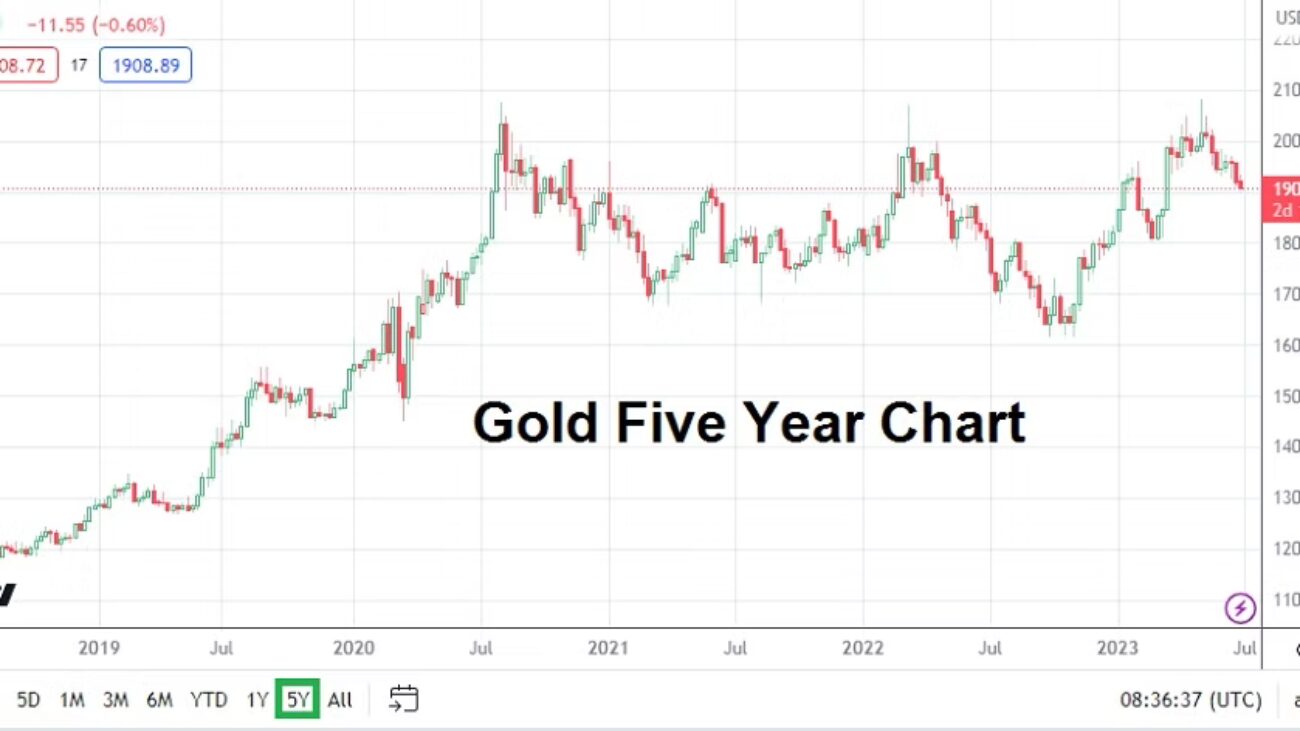

Other central banks are watching too. Inflation in Europe and elsewhere remains high. The complications of weaker domestic currencies against the USD have hit many economies including India where inflation has been rather strong. If the Fed can now start to become less aggressive, the effect will be quick and start helping the USD/INR trade lower if healthy economic mechanics allow this to happen.

Support levels for the USD/INR near 81.8000 to 81.7500 should be watched, if these levels begin to see challenges and sustained prices remain nearby, the USD/INR may be signaling that another downturn is about to happen. If the U.S Fed delivers a cautious, but more optimistic FOMC Statement this coming Wednesday, the USD/INR may deliver a new cycle of selling.