Is the USD Bullish Surge Coming to an End?

The long and brutal bullish trend the USD has exhibited against many other currencies could be coming to an end, as behavioral sentiment begins to suspect the U.S Federal Reserve will have to consider halting its interest rates hikes sooner rather than later.

PMI and Consumer Confidence statistics from the United States on Monday and Tuesday has heightened the perception that the U.S is within a recessionary cycle which the U.S Federal Reserve will have to act upon – by not acting. The Fed is likely to raise interest rates in November per their hawkish rhetoric, but the notion that the U.S central bank will then sit back consider the statistical landscape is growing. In other words a halt of hawkish policy appears to be a legitimate prospect after November.

GBP/USD 1 Year Chart

If recessionary data continues to be exhibited in the U.S, the USD fundamentally could lessen its grip in Forex and allow other currencies begin to gain ground. The GBP/USD has been hit extremely hard – yes, this has had just as much to do with the political environment in the U.K which has resembled a three ring circus. The idea of tranquility within the U.K politically could help the GBP/USD move higher, the prospect of a less hawkish U.S Federal Reserve should help the British Pound also.

The EUR and JPY also may have the ability to gain within the EUR/USD and and USD/JPY as financial institutions begin to change their outlooks. Yes, the walls could crumble unexpectedly and another round of chaos could ensue which could cause a shockwave in Forex. However, if the U.S enters a recession which has to be officially recognized by the government and thus the Federal Reserve, the USD will be affected.

EUR/USD 1 Year Chart

This is not written to suggest a weaker USD will bring upon a great fix for the ailing global economic outlook mid-term. But it is certain that a weaker USD which trends in a bearish manner may be rather interesting to retail traders looking to gain an edge via Forex speculation. Equity indices may continue to struggle if corporations report weaker than expected earnings, but the downward trajectory in many stocks also means that PE ratios are becoming more realistic and a potential buying opportunity for long term investors. Warren Buffett can be your imaginary friend.

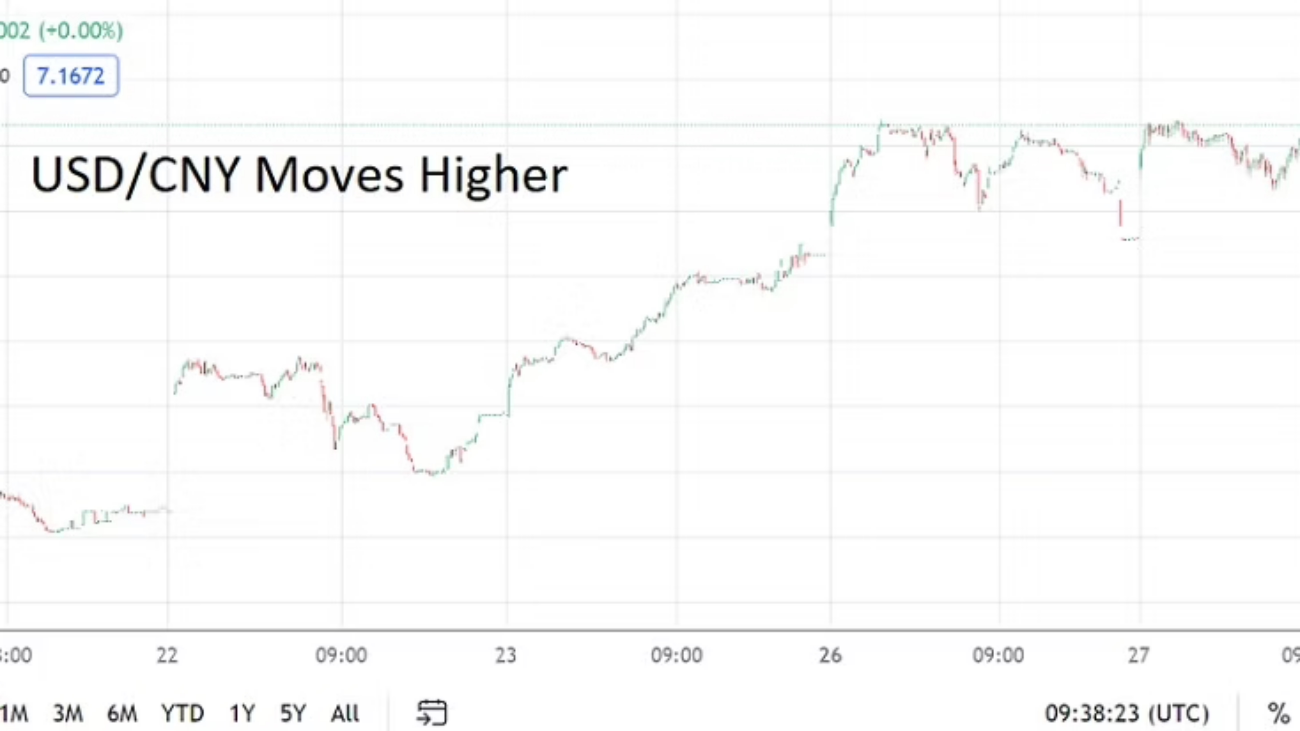

It has been a dynamic year of results in Forex as the USD has created stark trends with the USD/JPY, USD/ZAR, EUR/USD, GBP/USD and the USD/INR. Results in Forex and their volatility have created trading opportunities for speculators that have been likely better than wagering on cryptocurrencies; Bitcoin and Ethereum continue to stagnate and wait for the next great upheaval.

The past year has seen major equity indices suffer stark losses. Traders who have a constant bullish perspective because being positive is part of the human psychology have likely suffered if they have tried to be day traders via CFD’s of equity indices on the buy side constantly. Choppy conditions in the stock markets may continue for a while. Certainly in the long term many indices will rebound upwards, but buying individual stocks with leverage in anticipation that widespread bullish momentum is going to be a constant remains a nervous bet.

Forex via a USD pairing is beginning to look opportunistic for speculators. Picking the exact time a true solid reversal is going to become a constant is difficult and dangerous. There are no guarantees that we have seen the lows for the GBP, the EUR and JPY along with others currencies versus the USD, but if the U.S is truly going to have to admit recessionary pressures are taking hold, this may have an impact on inflation as demand decreases which the Fed would react to.

Things can wrong, more war breaking out, viruses bursting forth can be transmitted, political upheavals are a possibility in various locales, but from a risk reward perspective perhaps we are drawing to a close regarding the dominance the USD has shown the past year.