Friday's Forex Violence and Coming Attractions for Traders

While the past month has continued to produce positive trends upwards for traders speculating on equities via U.S indices with record breaking values, Forex has been rather brutal for many day traders if they have remained stubborn.

Short-term trading conditions in Forex again proved violent this past Friday, as the Non-Farm Employment Change and Average Hourly Earnings reports came in stronger than anticipated and set off fireworks in the major currency pairs.

Fed Chairman Jerome Powell offered a clue to speculators paying attention last Wednesday, during the Fed’s Press Conference in which he spoke about the tight labor market. It seems likely the Federal Reserve knew the jobs data was going to be rather robust and hinted.

The Federal Reserve did continue to speak about interest rate cuts, but they certainly have not given an exact timetable when more dovish policy will begin. This has left many speculators, corporations and financial institutions nervous and the results via choppy trading conditions the past handful of weeks are proof.

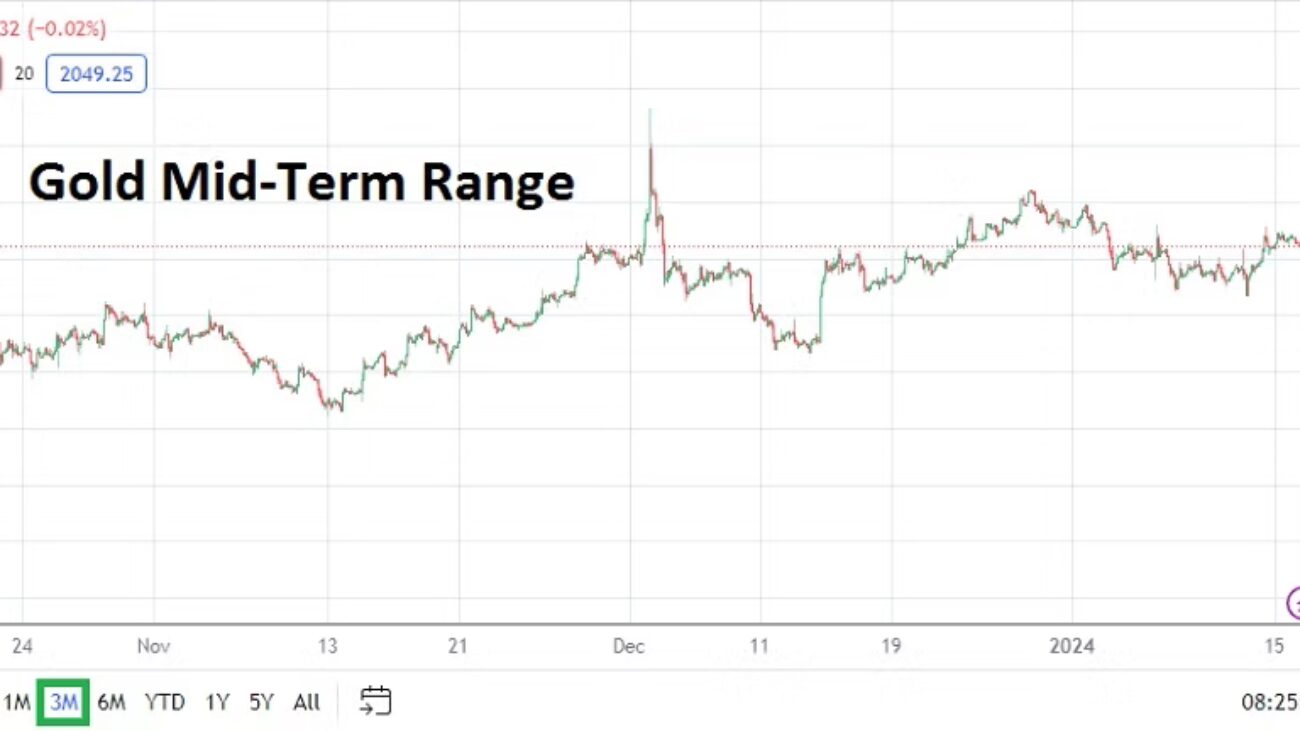

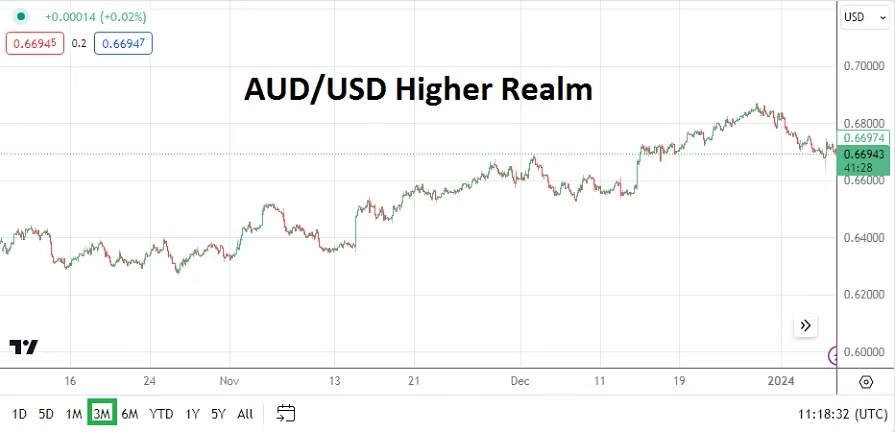

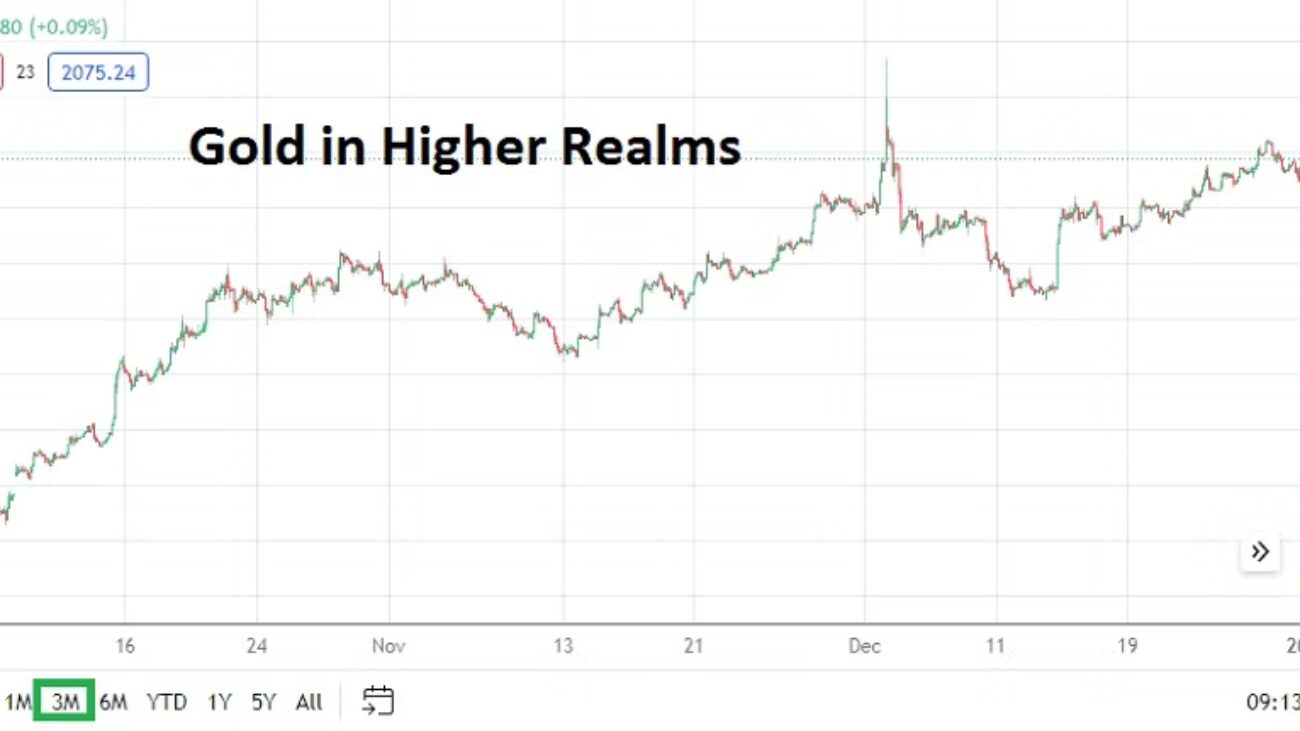

USD strength the past month has caused headaches for many Forex speculators, but it needs to be said that many major currency pairs are lingering near values post-December 13th 2023, this was when the Federal Reserve made it ‘official’ that a more dovish monetary policy would develop in 2024.

Early wagers by financial institutions in December indicated they believed a March Federal Funds Rate cut would be seen, but after last Wednesday’s Fed’s FOMC Statement and Friday’s jobs numbers it seems more likely for the moment a May interest rate cut could be a legitimate target.

Risks do Abound and Speculators Should Remain Cautious Near-Term

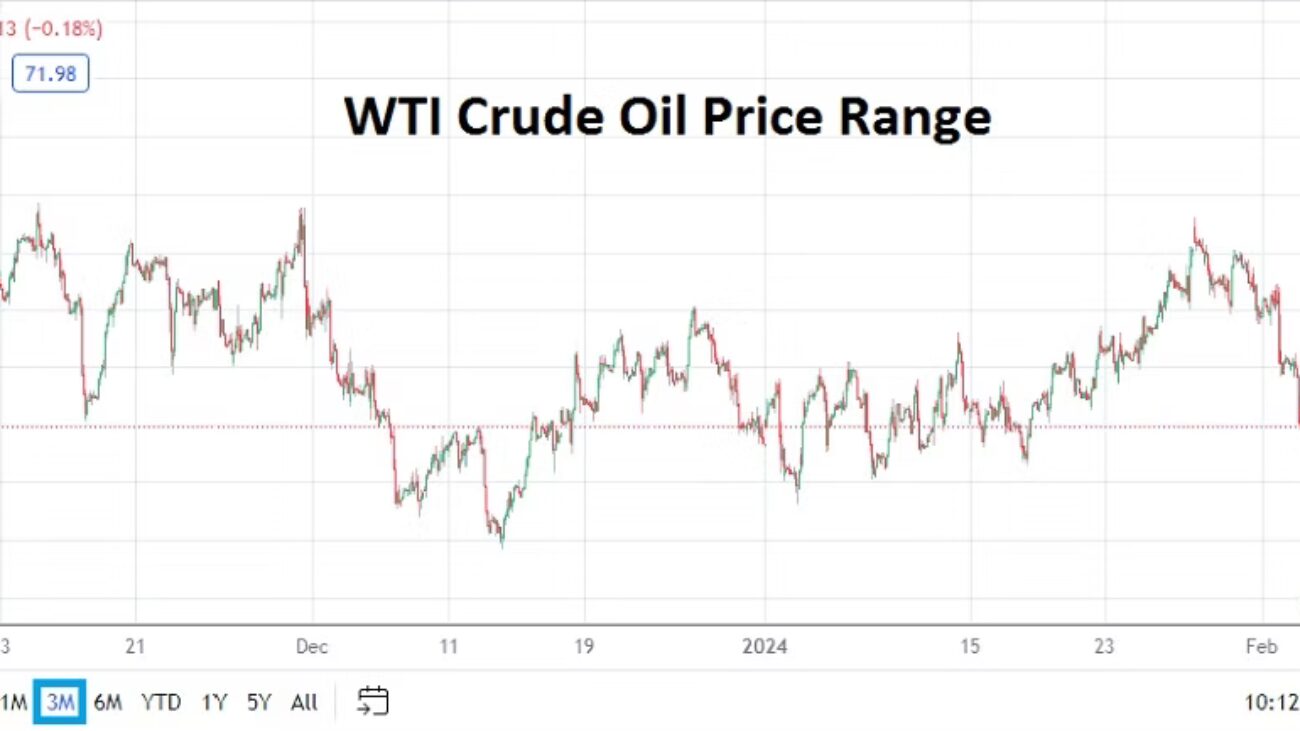

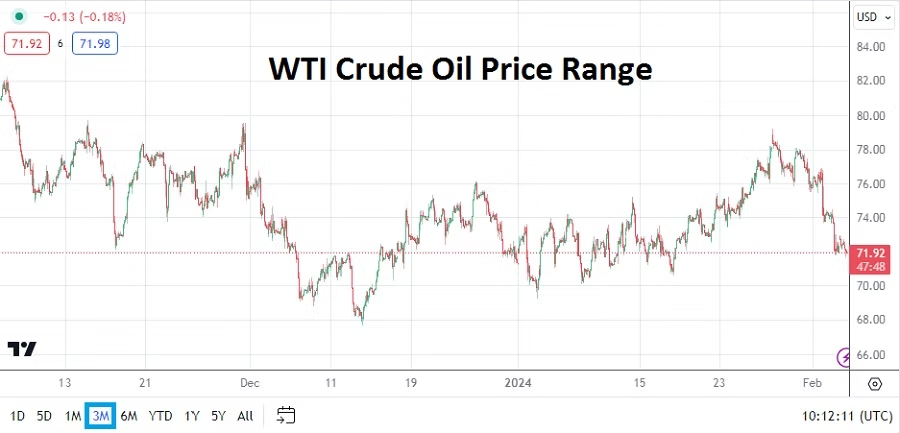

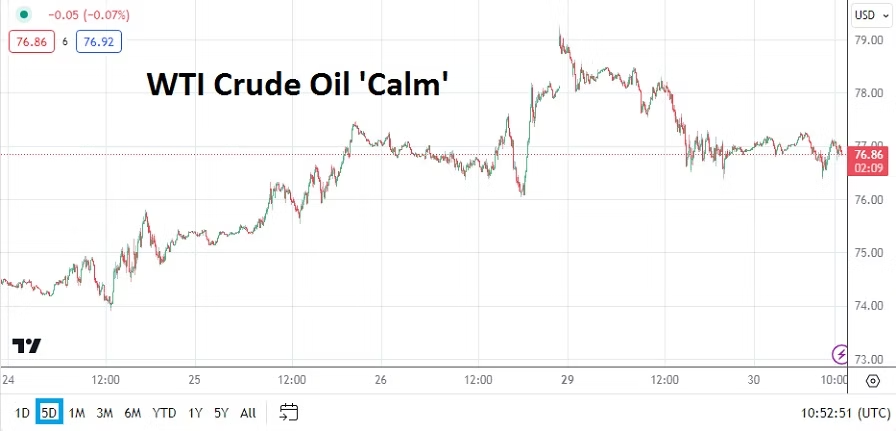

Inflation concerns via knock-on affects from logistical complications via Red Sea chaos which disrupts the Suez Canal shipping is a legitimate threat and needs to be monitored. However, the price of WTI Crude Oil traded in a remarkably stable manner last week as noise was heard from the Middle East. In early price action this morning the commodity has been polite and remains within sight of 72.00 USD per barrel. The lack of a nervous reaction in Crude Oil thus far could keep global investors calm.

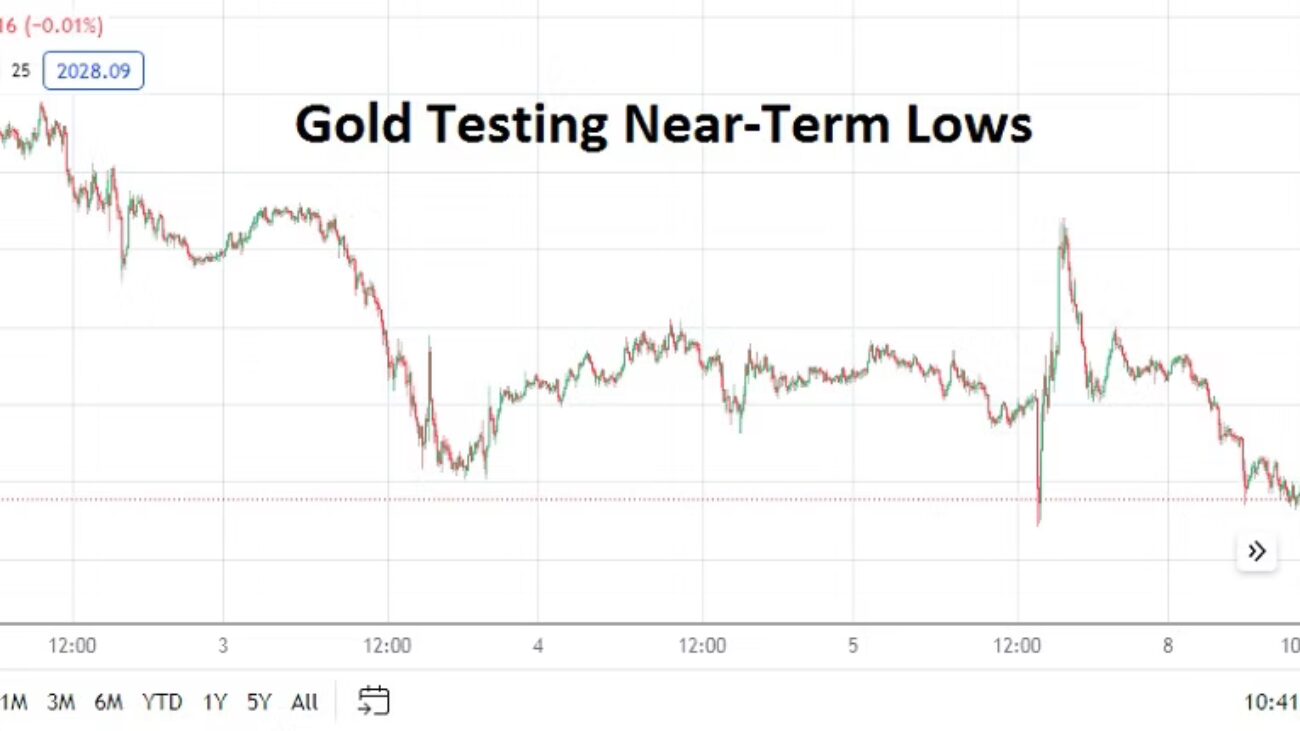

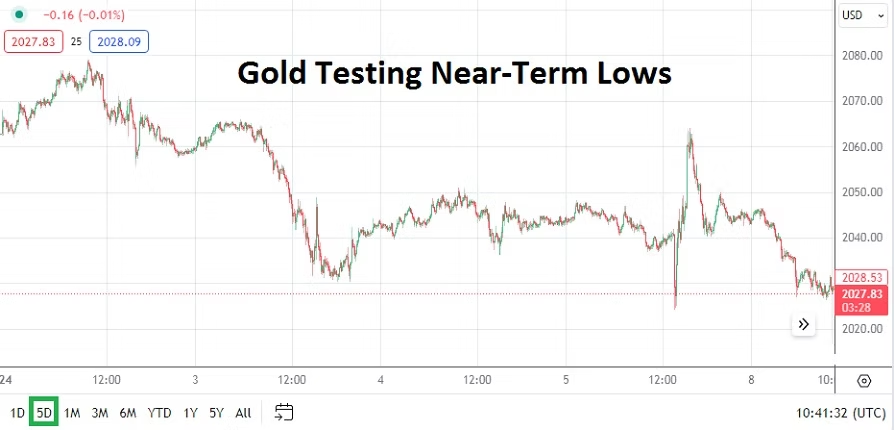

This week will be limited regarding important economic data. However, there will be plenty of rhetoric offered by U.S Federal Reserve members in the coming days via conferences and interviews. Forex traders have needed to combat an array of reversals as price equilibrium has created rather tenacious price realms and this may continue near-term.

There are time periods when traders should be willing to accept that methods regarding short-term trading tactics need to be adjusted. January has shown that financial institutions were of the mindset the USD had gotten too strong. And although it appears financial institutions continue to lean towards a weaker USD outlook in the mid-term (as proven by lower moves in the USD leading up to the jobs report on Friday), the surprisingly good jobs data certainly caused the USD to bounce upwards.

Technical considerations of the USD at this moment are important, fundamental data is still coming in rather mixed, this as financial houses wait on central banks to start reacting with interest rate cuts due to lackluster economic data. It is important to note that some analysts have started to murmur the ECB and BoE may have to move first regarding interest rate cuts – if they have the courage to take this action sooner rather than later. The U.S economy has remained rather strong regarding consumer sentiment and this is causing angst among Fed observers. The U.S jobs numbers on Friday highlighted this nervousness.

Monday, 5th of February, U.S Services PMI via ISM – an outcome of 52.0 is the expected reading, which would be higher than the previous result of 50.6. If the Services number meets its estimate and doesn’t exceed the expectation, this would calm nervous financial institutions which may believe the U.S economy may be too strong for the Federal Reserve’s liking, and cause some hawkisk sentiment regarding monetary policy to linger. A weaker number from the Services PMI could help the USD selloff slightly, a stronger outcome could result in more USD buying short-term.

Tuesday, 6th of February, Australia Cash Rate and Monetary Policy Statement via RBA – no major changes are expected from the Reserve Bank of Australia. Global central banks have taken a wait and see approach as they likely remain nervous regarding the potential of inflation to remain stubborn in the mid-term. The RBA is probably going to follow the ECB, BoE and Fed’s stances from last week and remain conservative.

Wednesday, 7th of February, Germany Industrial Production – though this report is not viewed as a major economic event for traders the results should be watched. The EUR/USD has been hit by rather volatile conditions as financial institutions try to anticipate central bank moves. If the German data comes in weaker than expected (a minus -0.4% result is anticipated) this could make the EUR/USD slightly more bearish.

Thursday, 8th of February, China CPI and PPI – economic data from China has not improved and foreign investors are not showing an appetite for risk. Deflation remains a concern in China, and although the official government rhetoric promised sunnier days ahead, fundamentals in real estate, manufacturing and consumer driven data offers troubled prospects. The Consumer Price Index from China is anticipated to be worse than the previous month’s outcome. The downturn in the SSE (Shanghai Composite Index) is now challenging the 2,700.00 vicinity.

Friday, 9th of February, Canada Employment Change – Canadian economic data has been lackluster and analysts have been quite critical of government policy. Having said this the USD/CAD is largely going to stay in a USD centric mode going into the weekend.