Forex: Dangerous Triggers Abound for Inexperienced Speculators

While the U.S jobs reports via the Non-Farm Employment Change and Average Hourly Earnings will grab attention today, and the Advance GDP this Wednesday and inflation numbers yesterday were important. Institutional trading focus in many respects will be elsewhere, behavioral sentiment and the potential reactions that lurk after the results from the U.S election are known are the biggest risk threat.

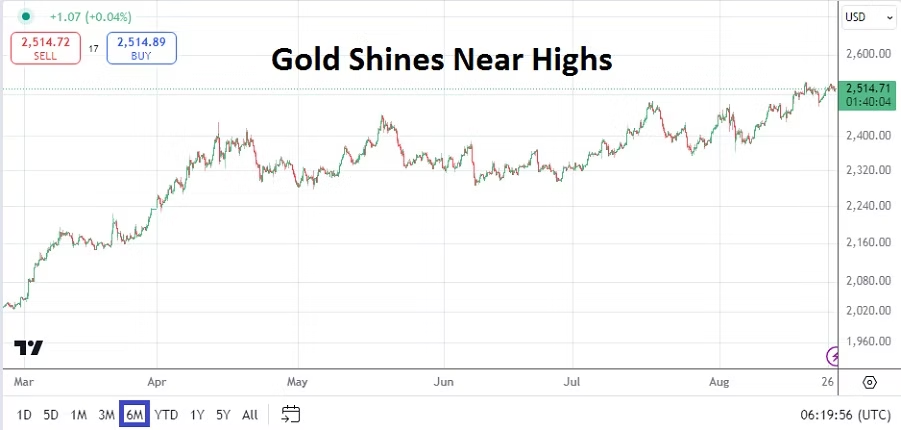

Yesterday’s weaker than expected Employment Cost Index will help the U.S Federal Reserve to clip another 0.25% off of the Federal Funds Rate on the 7th of November. However, the winner of the U.S Presidency will be a talking point in the coming FOMC meeting, and also the halls of the U.S Treasury, influencing potential policies. Weaker than expected jobs numbers would fuel dovish perspectives from financial institutions today, but because of the coming U.S election on Tuesday results will fall on ears possibly tuned into other frequencies. And let’s remember last month’s job numbers were stronger than expected, and revisions downward in the back months remains a problem causing mixed sentiment.

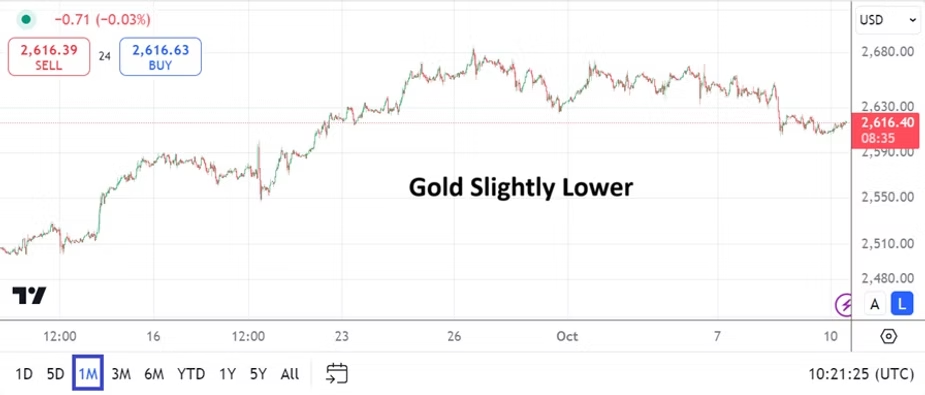

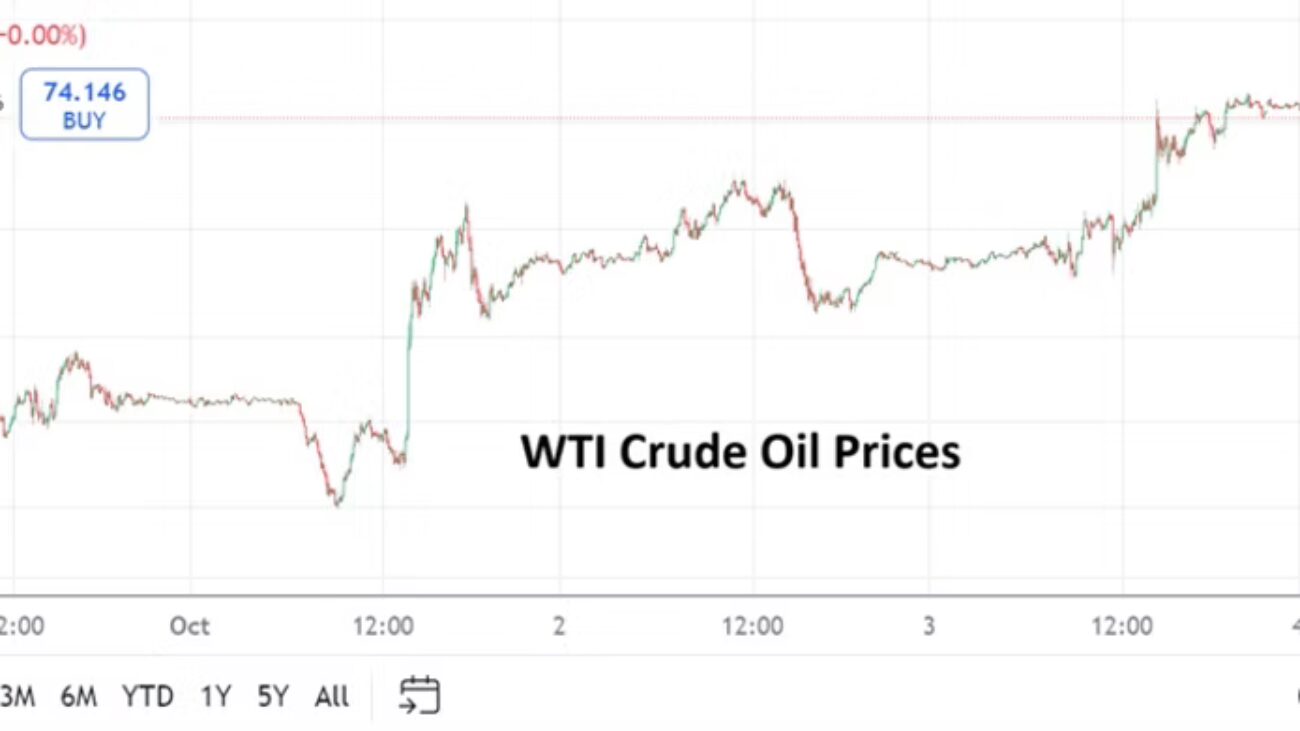

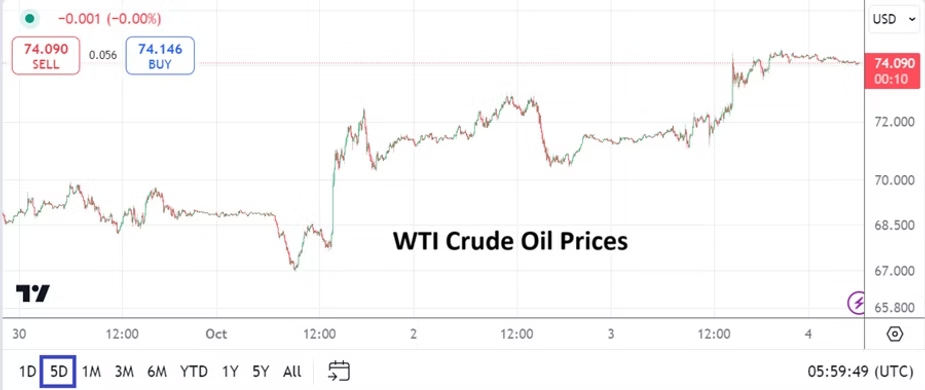

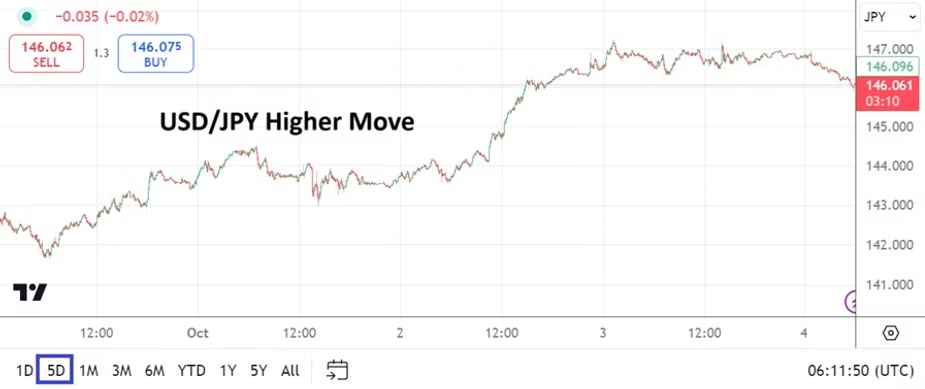

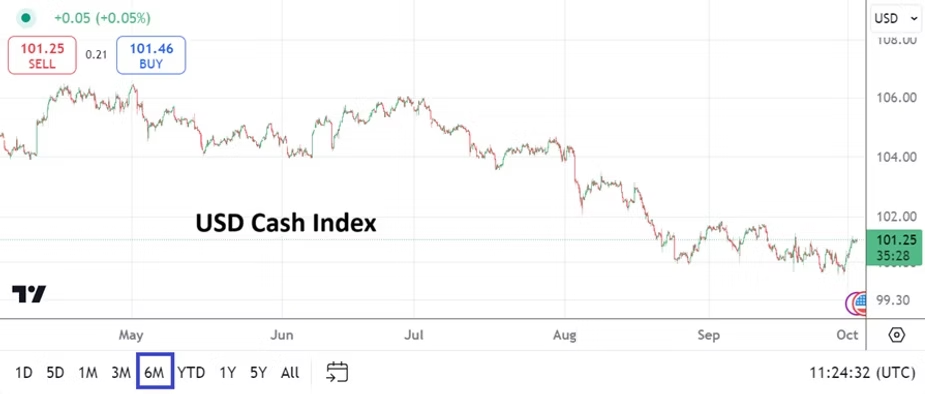

Major currencies versus the USD continue to thread within cautious weaker values. USD centric strength has been persistent since the last week of September. If this had been a normal week of trading, the USD would have likely gotten weaker after the Advance GDP results came in slightly less than anticipated. Fuel might have been added to USD selling on yesterday’s lower than expected labor costs too, but this did not happen in many cases. This needs to be a consideration for day traders who are trying to interpret U.S economic data as the U.S election looms. Simply put, behavioral sentiment in the near-term is being more influenced by the race for the White House.

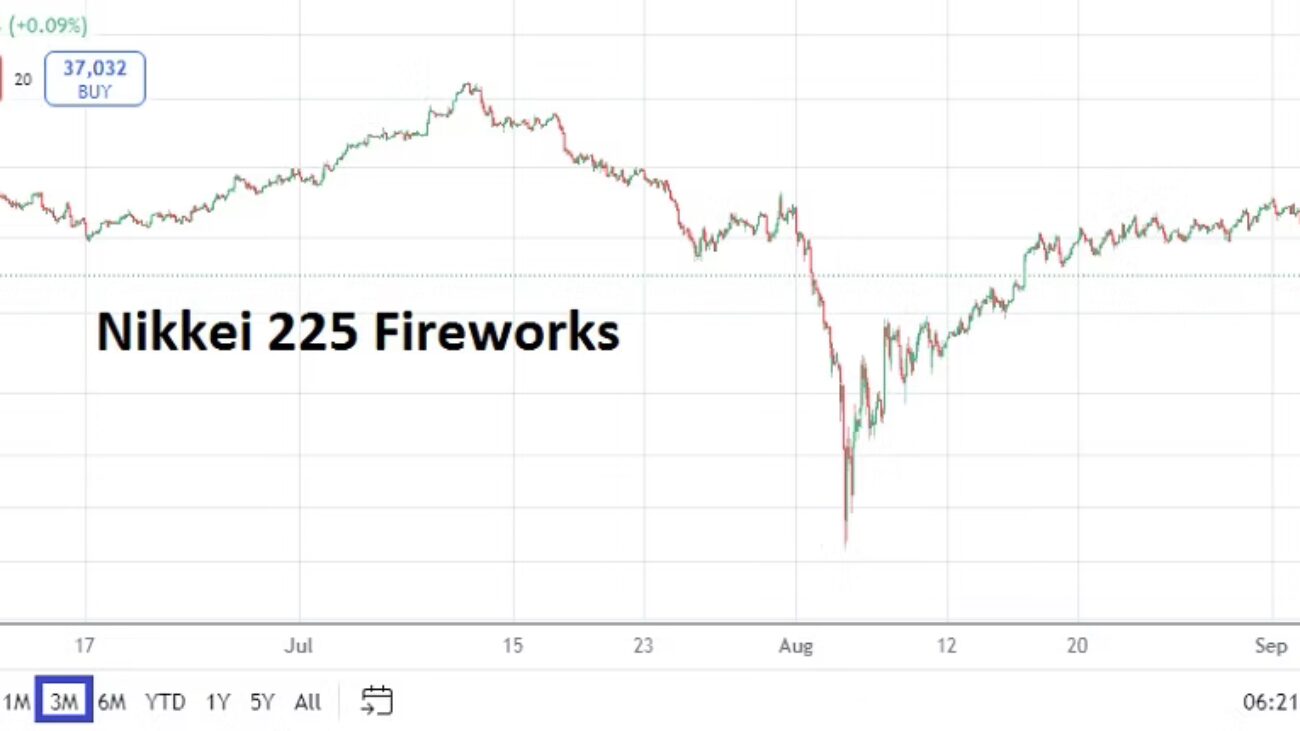

If a trader wants to bet on who they think the winner of the U.S vote will be they need to be careful too, not only because they could be wrong, but if their ‘winner’ takes the presidency, reactions may be more tumultuous than planned. Speculators need to understand that financial institutions too have likely been positioning their cash forward transactions based on who they think is going to win the U.S vote. Meaning wicked reversals and take profit orders could be triggered when the U.S election outcome is known. Forex trading volumes next week should be immense.

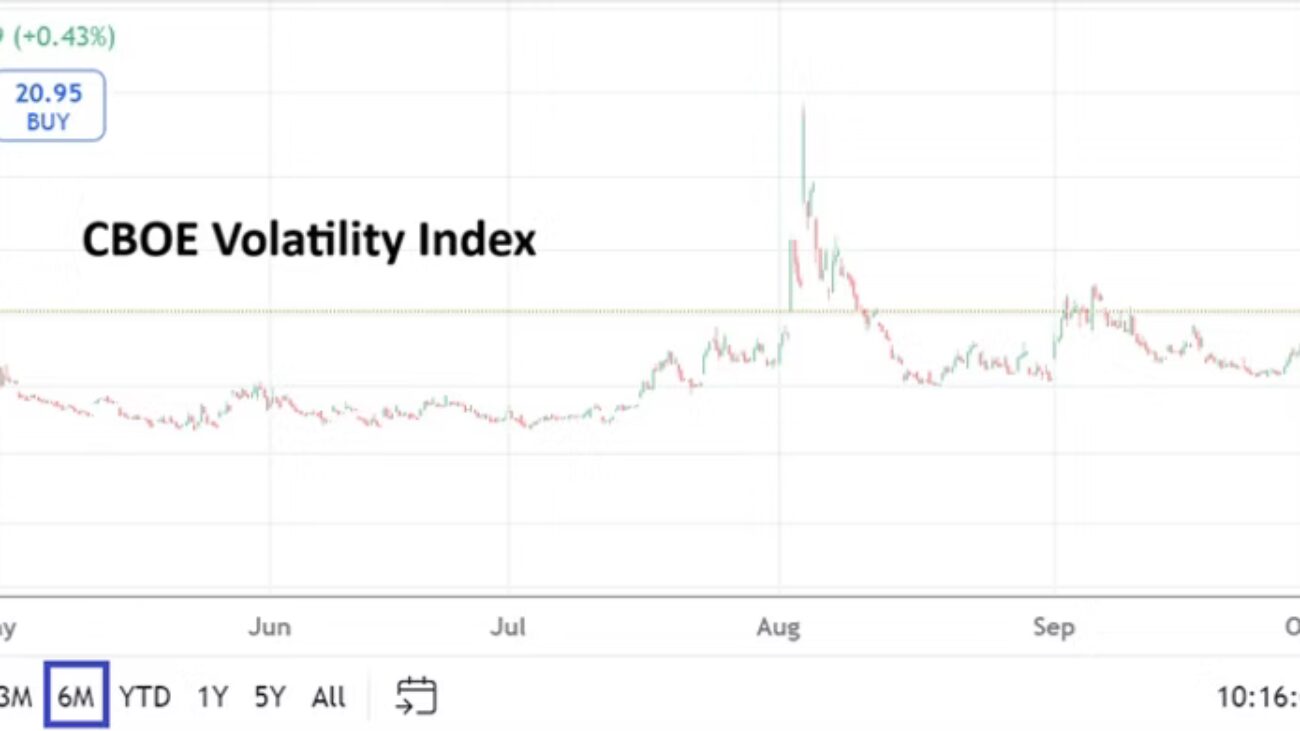

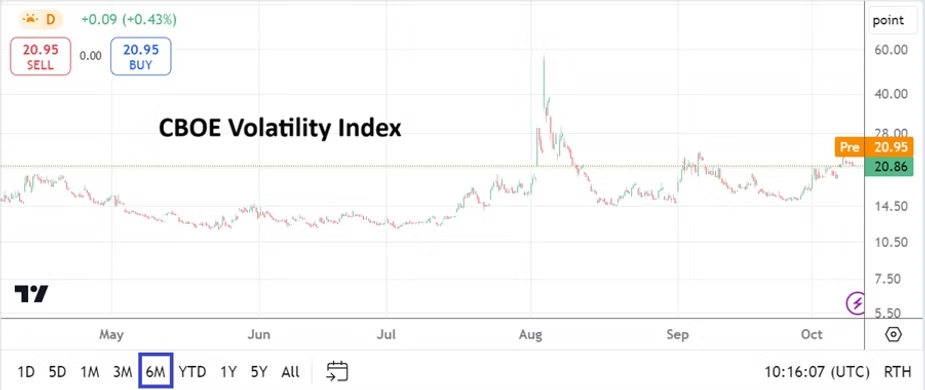

It is a dangerous time for inexperienced traders to participate in Forex. Brokers will certainly sell this alluring show and point out that there is a lot of opportunity to make money in the coming days, but the opposite is true too. Because if you can make a lot of money from volatility, you can also lose a lot of money. Folks without deep pockets who are using leverage will be vulnerable to price velocity.

Retail traders need to understand the risks that confront them are dangerous because their Forex positions cannot be held over a long-term because of too much carrying costs, too much volatility and frequently too much leverage. Large financial institutions who are the shakers in Forex play by a completely different set of rules. It may help a day trader immensely to understand they can really only feast on profits when they have been able to ride the technical momentum caused by the influence of financial institutions.

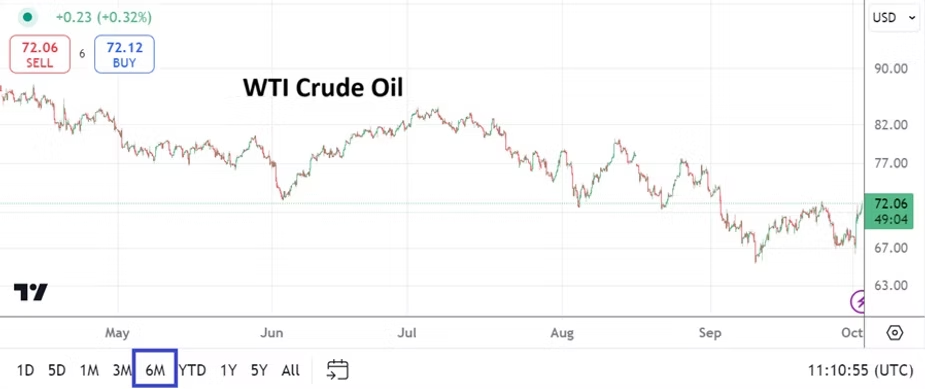

The cyclical nature of Forex has been on full display the past three months. Trading within the USD/SGD the past three months is a solid example of a major currency teamed against the USD and sustaining a strong bearish cycle on the expectation the U.S Fed would become dovish, and then the reversal higher since late September as financial institutions started to become risk adverse. While some analysts may argue this point, the coming results in the weeks ahead will tell us a lot as large players react to clarity via a new U.S President and the Federal Reserve’s monetary policy outlook. Traders large and small over the next five days in Forex will be treated to quite a carnival like experience.