AMT Top Ten Miscellaneous Missiles for the 21st of June 2024

10. Say Hey Kid: Baseball legend Willie Mays passed away earlier this week. He was a beloved player on the New York and San Francisco Giants in the 1950s, 1960s, and early 1970s. He might have been the best five tool baseball player of all-time.

9. AI Apocalypse: Talk about selling Nvidia shares to cash out of the super hot Artificial Intelligence tech boom on Wall Street might be considered the safe thing to do in order to protect profits. However, betting on the existing ‘machine learning’ gold rush in the stock markets to possibly end soon, thus turning into a ‘dot com’ like bubble bursting in the spring of 2000 could be misguided. The ‘dot com’ exuberance essentially started in 1995 and ran for almost five full years. The Artificial Intelligence surge may still have a lot of room to run.

8. Simmering Crypto: Bitcoin, Ethereum, and Binance Coin all remain at lofty prices, but they have lost value since touching highs in the first week of June. Trading volume of cryptos – including BTC/USD – is still below its peak of 2021 and early 2022. While the introduction of ETF products for Bitcoin has gotten institutional money involved, many individual ex-traders remain cautious. Former illustrious speculative plays like Dogecoin and Shiba Inu have turned into niche wagering cesspools.

7. Hezbollah Poker: Hassan Nasrallah delivered a surprise statement earlier this week when he proclaimed if there is an escalation between Hezbollah and Israel, that Cyprus could be attacked by missiles. The U.K still maintains sovereign military bases at Akrotiri and Dhekelia on the island of Cyprus. Direct fire from Hezbollah on an E.U member nation would be a major intensification of the Middle East conflict. Nasrallah may believe the rather limited response by the West to the Houthis attacks in the Red and Arabian seas, makes his threats on Cyprus an objective guise to get the West to pressure Israel to hold their fire.

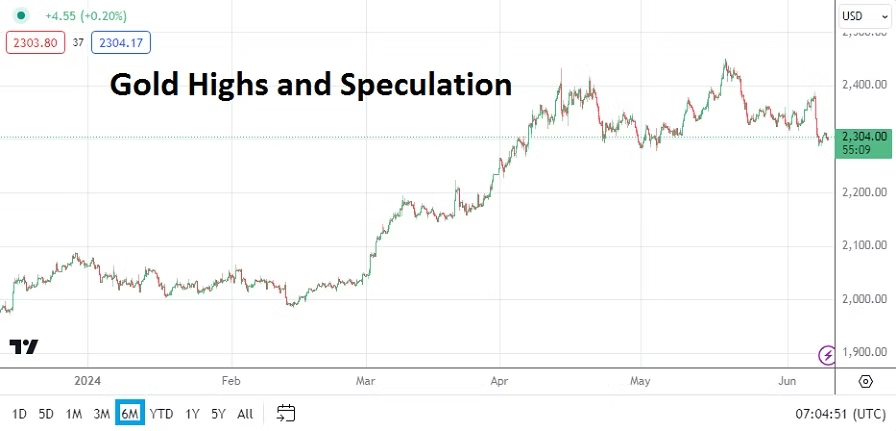

6. Commodity Watch: WTI Crude Oil price is over 81.00 USD as of this writing and Gold is near 2365.00 per ounce. The price of energy needs to be watched because of its potential impact of inflation. WTI prices have been rather tame the past two and half months, but have climbed the past week. The precious metal remains within sight of highs and has been lingering within an elevated range since the middle of April. Cocoa for those interested is back below 10,000.00 USD per metric ton.

5. Shifting Sentiment: The Mexican Peso and Brazilian Real have lost value as politics in Mexico and Brazil are causing nervousness among financial institutions. The governing political parties in both nations are trying to reach for new powers, and the selloff of the two currencies against the USD have been clear. Morena, the leftist political party governing Mexico, is seeking controversial judicial reform which is seen as an attempt to gain more political influence. Lula da Silva’s Workers’ Party is attempting to take the head of the Central Bank of Brazil, Roberto Campos Neto, to court to try and muzzle his fiscal viewpoints. The USD/MXN is near 18.31650 and the USD/BRL is around 5.4539 as of this writing. Rand traders who have seen a bearish USD/ZAR trend emerge the past week and a half because of renewed optimism in South Africa might find the spats in Mexico and Brazil intriguing.

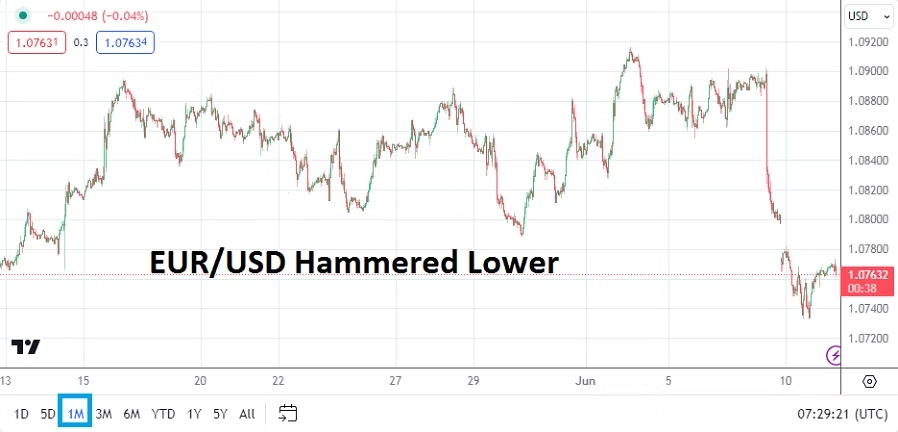

4. Euro Barometer: The first French election will be held on the 30th of June, the second on the 7th of July. The contest is shaping up as a election between the Left and Right. Political coalitions are being formed rapidly. The attempt to coalesce on the Left is an obvious sign that politicians feel threatened with the prospect of sweeping losses. Media noise is certain to boom and be exaggerated in the coming days as warnings about this election potentially affecting all of humankind litters the airwaves. Macron and other politicians may find tough days ahead as they apologize for policy failures and get punished via the election outcomes. The EUR/USD is close to 1.06931 for the moment.

3. China Woes: Economic data from the housing sector continues to show a downwards trajectory regarding home values in the nation, and it is having an impact on consumers as their net worth suffers and affects spending habits. Not only are property values still dropping at a rapid pace, but recent Factory output data has come in below expectations. China is tentatively scheduled to release Foreign Direct Investment numbers soon.

2. Summer Doldrums: Investor behavioral sentiment appears to be in a wait and see mode as as more impetus is awaited and large players grow cautious. The U.S will issue PMI manufacturing and services data today, but the results will have a limited effect. The U.S Juneteenth holiday which was celebrated on Wednesday and the return of traders yesterday did not rejuvenate optimism. The Nasdaq Composite and S&P 500 lost some ground. While the Dow 30 did gain slightly yesterday, the index has been treading water compared to the Nasdaq and S&P over the past month.

1. Geriatric Debate: Next Thursday the 27th of June, President Biden and former President Trump will debate. The televised event will be watched by American voters and the world. Not only will the debate deliver potential impetus to financial assets if there is a clear winner, but it may provide a large wagering environment for betters who gamble on which Presidential candidate will be the first to go off script. People in the U.S desire a discussion about the economy, foreign policy and immigration, this while hoping for a lack of mishaps, hyperbole and demagoguery which is unfortunately quite likely.