Behavioral Sentiment Fatigue and Long-Term Opportunities

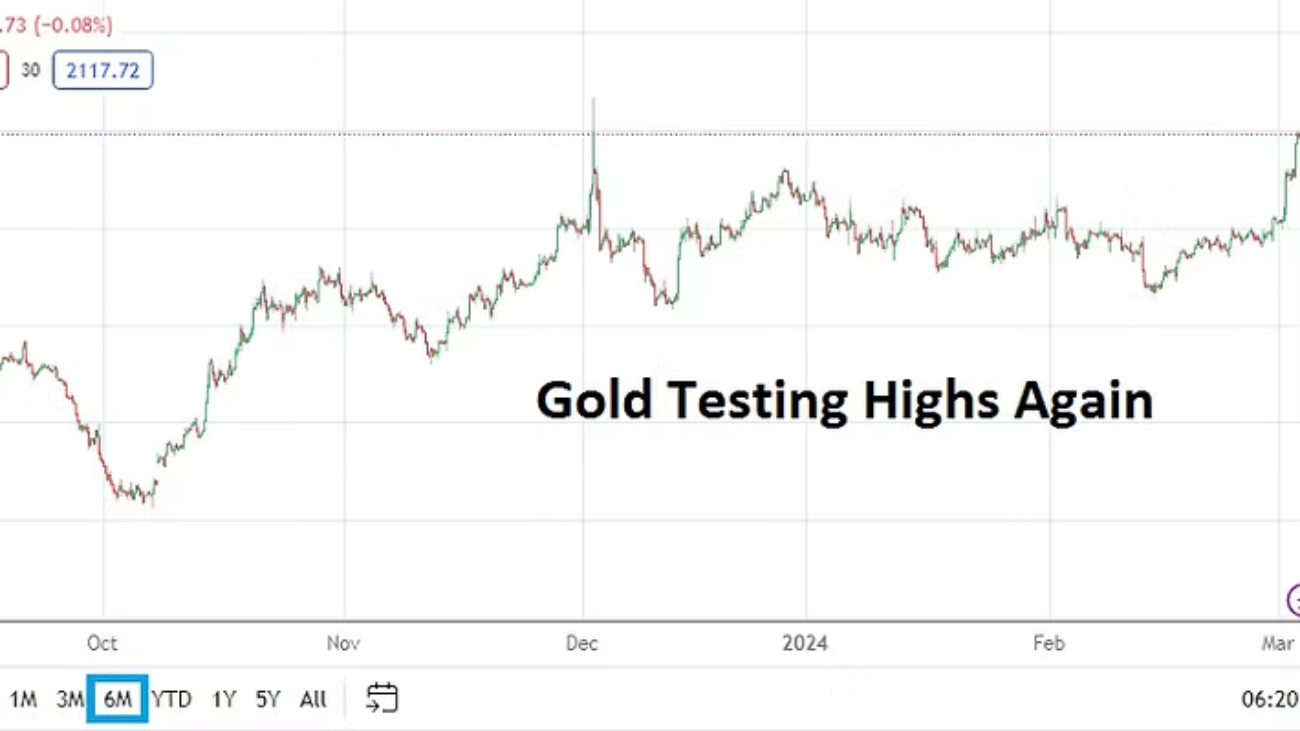

As I write Gold remains below $5,000.00. Silver is slightly above $75.00. The Nasdaq 100 and S&P 500 remain cautious. And my favorite exclusion choice – MicroStrategy is struggling below $129.00. The markets in general appear to be waiting for a dose of impetus, be it positive or negative. Some investors who are brave may believe assets have reached an accumulation phase as support levels get tested in equity markets. They hopefully also understand that the equity indices can go lower and they may suffer for a while as prices decline. And because of this notion, perhaps the larger investors remain ultra-cautious and are trying to time when they will re-enter the marketplace as a forceful buyer. In the meantime bonds will be bought as signals are awaited on for long-term positions in the major indices.

However, there is also a large contingent of traders who are not looking for long-term investment, instead they are hoping to take advantage of short-term price movement – positive and negative – depending on their philosophies. These folks may be part of hedge funds, or simply large players who believe they have the benefit of experience and know-how.

And then there are folks like me who watch the market and offer analysis on current conditions. I am of the opinion the broad markets are nervous and that behavioral sentiment remains troubled. While I know that experienced large players and financial institutions are accustomed to noise, there seems to be sense that an attitude of fatigue is being felt. People are tired of dealing with the constant amplitude of policy threats and risks. However, this insight regarding tired minds and markets may serve a purpose, it is possible long-term players will see current conditions as an opportunity to buy and hold.

If short-term players such as hedge funds and large speculators are too busy being nervous and assets are straddling prices in equities that are seen as potentially oversold by others, real value can be accumulated and waited upon to produce more growth. This is still a gamble, there are no guarantees. The markets go up and they go down. Cycles occur and new traders are often perplexed when their insights do not come to fruition. Patience is needed. And it is also good to have others in your ear who serve as contrarian advocates offering different opinions that you may not find agreement.

Perhaps you know someone who has an interest in the financial markets and is the same good friend. There is even a chance that you have worked with this person professionally, and have shared ideas on business management, organization and scaling trades and investing. And there is a chance that even though you like this person and find them completely engaging, that you disagree with everything they say.

Trust me when I say my friend (colleague) knows I am talking about them, and suffice it to say that I know he will completely disagree with my further comments, but also quietly embrace the words and believe he is serving his function as a voice of reason. He will not call himself a devil’s advocate, but as someone who serves to create focus. He is the person that says charge ahead, aim for an outcome and tell people what you think. He wants values to look for and timeframes to take action.

However, as a risk manager I frequently find myself being cautious, I try not to make outlandish predictions and try to remain conservative in my approach. I tend to think long-term, while he the trader frequently acts on short-term intuition with a focus on the future per his perspectives. But timing the market and exactly what is going to happen in the next five minutes, one hour, day and sometimes even a week remains a difficult and often an expensive game, I am constantly vigilant of this possible plight.

When I wrote that Silver appeared to be in a speculative mode and feared the highs, and told folks to be prepared for the metal returning to earth it was appreciated by my associate, but it also came with the question of when. When is Silver going to fall, he would ask. And I typically answered that patience was needed. And now that Silver has fallen he says, ‘you warned us that Silver would fall, but didn’t say when’, and he is correct. I cannot give an exact answer because I am not a master of the universe.

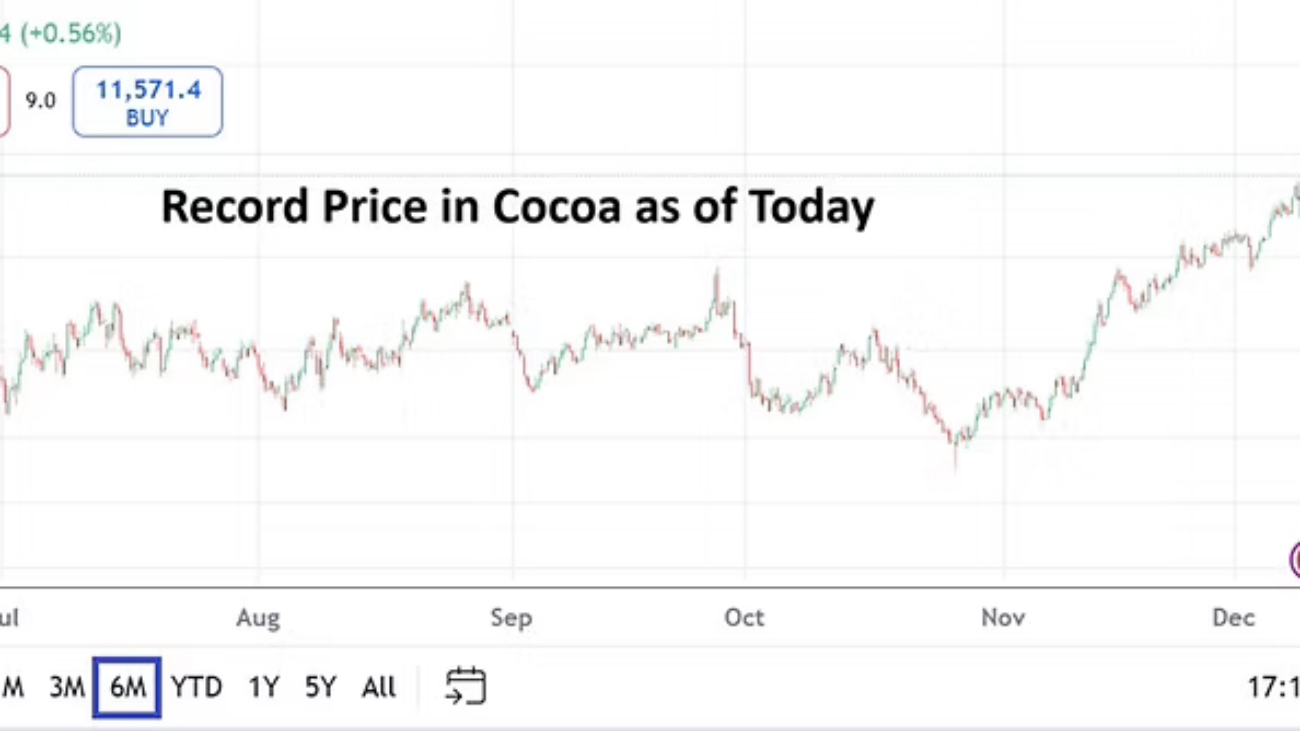

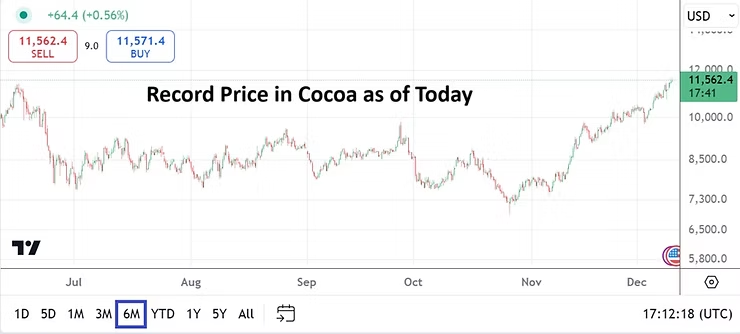

Day traders need to know that their CFD positions do not move the cash market. And even participants in the cash market are actually mostly wagering in the futures markets via exchanges and hoping for prices to move in their chosen direction only. Most people choosing to trade in the futures markets do not want to take deliverables of a commodity. Speculators in the futures markets may dream about taking Gold and Silver deliverables, but they know logically they cannot. The same goes for traders in futures with agricultural products and soft commodities.

To buy or not to buy is not the question. To participate or not to participate is the question. You do not have to trade every day, even if you are a short-term speculator. You can watch the markets. Sometimes the best trades you will ever make are the ones you do not pursue.