Nervous about the Markets, You're not Alone

U.K political chaos turning into clarity or further madness? Mid-term elections coming in the U.S about to deliver change? More turmoil in Brazil? What could go wrong?

So you are nervous about the global markets. You are thinking about the possibility of putting cash under your mattress. Perhaps closing your equity positions and just being a spectator for the next year, well, you are not alone. It doesn’t mean you are right however, and you may want to proceed with caution before your let paranoia guide your decisions.

Past month of results from S&P 500

Global markets have faced perils before and will again in the future. Long term perspective is needed. The U.K, U.S and Brazil are all within intriguing political circumstance. The U.K is about to have its third Prime Minister after the ‘sacking’ of Liz Truss. The U.S is about to have a mid-term election and it appears the Republicans may seize control of the House of Representatives and Senate. Meanwhile in Brazil, the race for President appears to be getting closer and President Bolsonaro may actually pull off a photo finish against his challenger.

U.S indices have suddenly started to show brief moments of strong buying again. However many financial analysts remain skeptical. Fear of inflation, recession, quarterly earnings, debt and rumblings regarding stagnation are legitimate reasons for financial institutions to worry about this Halloween season. Jokes aside, the short term will likely remain rather challenging.

The U.S Federal Reserve has served as a solid place to show officials remain locked within their offices without a vision regarding the real world, but that is too easy to merely claim. Numbers need to be looked at and quantified to cast official blame on bad monetary policy. It does appear the Fed will raise interest rates again in November. Will they rest after this coming hike and actually wait for corporate evidence and economic data afterwards to help guide their decisions late in 2022 and early in 2023? We shall see.

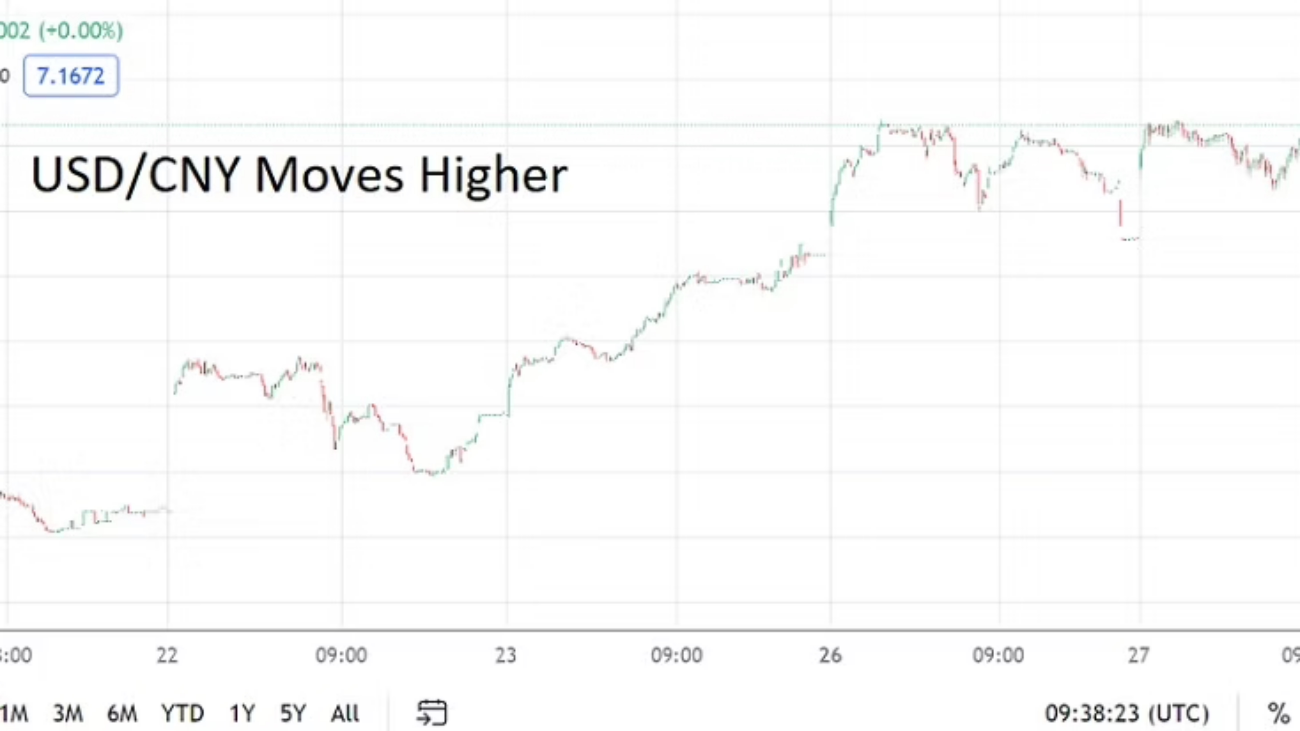

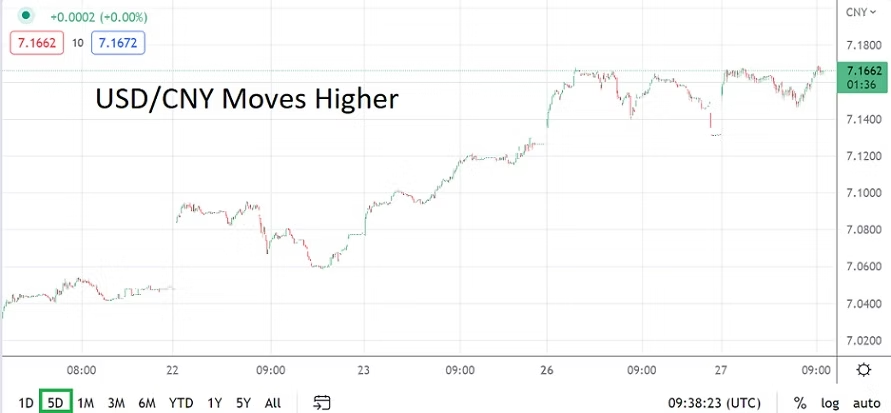

The USD remains very strong and is hurting other economies as nations deal with the rising costs of food and energy, particularly when imports are involved. Things are not going to get tranquil in the short term, more hurdles need to be jumped. Remaining calm as an investor and trader is needed. Being reactionary will likely not lead to good results.