India Insider: Affluence Among the Few, Aspirations for Many

A recent report by Franklin Templeton highlighted that India’s per capita income will penetrate the $5,000.00 USD level by 2031, pushing the country into what some analysts consider an affluence trigger zone. Their article celebrates the consumer boom showing the rising sales of premium detergents, growing green tea consumption, and a surge in discretionary spending, as if prosperity has finally crossed over into a mainstream phenomena.

But a closer look reveals something else and a worthwhile critique of Franklin Templeton’s optimistic portrayal.

Who Actually Spends this Money ?

The Franklin Templeton report confidently attributes the wealth effect to rising equities, real estate and gold. Yet, with only 13 crore (130 million) demat accounts in a country of 143 crore people, how can equities be driving broad affluence? Even within those attributed accounts, activity is heavily concentrated in the top decile of income earners like urban professionals in finance, IT and export linked sectors; and over 70% of mutual fund assets under management come from the top ten cities.

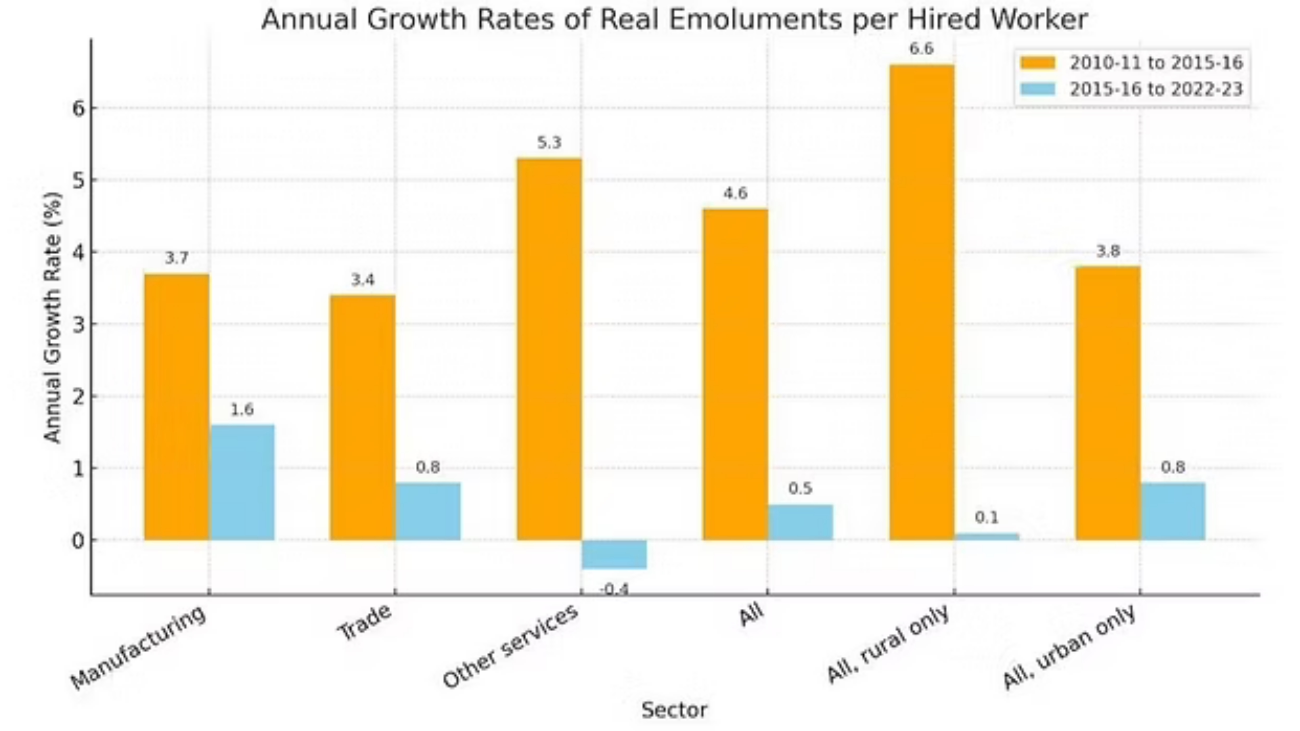

The so called upper middle class that fuels premium consumption largely works in these sectors. For the rest of India – especially the 42% still dependent on agriculture – wages have barely kept pace with inflation. Several national surveys and analyses show real wage stagnation since 2015-2016. Data from the Labor Bureau and the National Sample Survey (NSSO) indicates that real wages for rural laborers had near zero growth between 2015-2016 and 2022-2023. In contrast, the period before 2015-16 showed much faster wage growth.

The Concentration of Savings and Spending Power

The report itself concedes that the top 20% of households hold around 85% of India’s total savings. That’s roughly 26 crore people (260 million) driving most of the premium consumption, while the remaining 104 crore (1.04 billion) share only 15% of savings – a stark reminder that aggregate growth often hides skewed realities. And this is why rural households and lower-income urban families, meanwhile, are facing tighter budgets and are actually cutting back on discretionary spending.

Gold as a Survival Cushion

The report romanticizes gold as a symbol of wealth, but in rural India, the precious metal plays a very different role. Gold is not an indicator of luxury and status, but a financial safety net. In villages around Tiruvannamalai City of Tamil Nadu State. Where I have surveyed about 50 families, average holdings are often below 40 grams. When harvests fail or cash flows tighten, this gold is pledged or sold to fund essentials like health expenses, education or seeds for the next planting season.

Yes, some towns in India have higher gold holdings and savings, sharply due to offshore remittances especially in States like Kerala and Gujarat. This remittance led prosperity fuels local real estate and pushes up rents, but it’s a localized story, not a national one. Most rural communities still depend on seasonal income and informal borrowing.

The Uneven Reality Behind Growth

Premium brands are growing faster, but this signals income polarization, not inclusive growth. The per capita income maybe rising, but it’s an average skewed by the top 10-20% who hold multiple assets. For most, consumption is fueled by rising debt. Until wage growth broadens and rural incomes strengthen, India’s consumption boom will remain the affluence of a few – not the prosperity of the many.