Forex Debate and Coming Impetus this Week for Speculators

In many respects the broad markets feel as if they are waiting for big news and this may not be delivered as wanted. Yes, the debate between Biden and Trump this Thursday will get attention, but unless there is a major television moment the outcome is not likely going to give a final affirmation regarding the U.S election results in November. Some people may be counting on Biden to literally misstep, and for Trump to say something incredibly outlandish, but it is also possible the debate disappoints even as entertainment. Perhaps the Presidential debate will deliver sideways action like the broad markets have the past week, leaving us with a desire for more.

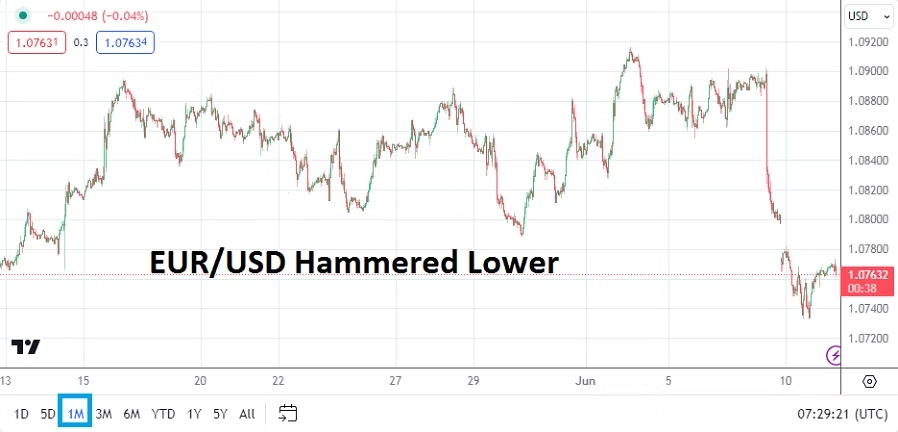

Financial institutions will look at U.S growth numbers this coming Thursday certainly, and also keep their eyes on the upcoming Sunday vote in France on the 30th which might prove rather remarkable. The EUR/USD is certainly back within its lower depths when a six month chart is inspected, and traders will react to France’s election this weekend, but it should be remembered the second and vital round of voting will not occur until the 7th of July. Until then, reactionary and precautionary results in the EUR/USD may produce headaches. The EUR does look oversold, but timeframes and the ability to hold a position may prove tough for short-term traders hoping for a wave of optimism to suddenly take hold and create a strong trend.

Not to be outdone the U.K is gaining plenty of attention because of its election on the 4th of July, but in this case it seems more like a coronation for the Labour Party and only a question about how devastating the carnage will be for the Tories. Financial institutions may have already factored in their perceived outlooks regarding the U.K vote into the GBP/USD. The currency pair will certainly react to the British election results, but financial institutions may have less to fear regarding sudden volatility of the British Pound, compared to the EUR/USD which could still have days ahead when it doesn’t trade in a USD correlated manner due to E.U political unknowns.

Monday, 24th of June, Germany Ifo Business Climate – the reading produced a drop to 88.6, missing the estimate of 89.4. Germany economic pressures remain negative and this may keep the idea alive that the ECB should be considering another interest rate cut. However, because the European Central Bank cut its Main Refinancing Rate recently and the U.S Fed continues to look rather neutral, it seems unlikely the ECB will decide to suddenly become the only proactive central bank around over the mid-term. Meaning, the ECB may stay conservative and want to wait on others to join the interest rate cut party, this before they create more unbalanced carry trade opportunities which could lower the value of the EUR/USD too much.

Tuesday, 25th of June, U.S CB Consumer Confidence – the reading will certainly be watched by investors, but will it create bedlam if there is surprise for equities or Forex? The likely answer is no. Behavioral sentiment has become flustered and shifted over the past handful of months, and this will create some caution no matter what today’s consumer reading says. Large financial institutions will probably stay geared to other upcoming data which will be considered more important.

Wednesday, 26th of June, U.S New Home Sales – a slight uptick in the amount of housing sales is expected. However, because of higher interest rates in the U.S via the cost of mortgages this number is likely to remain rather muted. For interested traders a look at the previous revisions of the New Home Sales data will prove interesting. The outcome of this reading should be treated with a bit of skepticism because it may be changed down the road. Unless there is a huge surprise the impact of this report may be rather calm, no matter what media narrative dictates.

Thursday, 27th of June, U.K Bank of England Governor – Andrew Bailey will speak about the Financial Stability Report. Bailey is certain to add some insights regarding the BoE’s neutral policy stance taken last week regarding interest rates, but more hints regarding potential cuts later this summer and possibly late this year again may be given. Economic data from the U.K remains troubling. The Bank of England may want to remain cautious because of inflation concerns, but financial institutions would like to see a more proactive dovish stance. Bailey might also talk about the potential affects from the U.K election, but he will have to be careful to make sure it doesn’t sound like he is taking a political side.

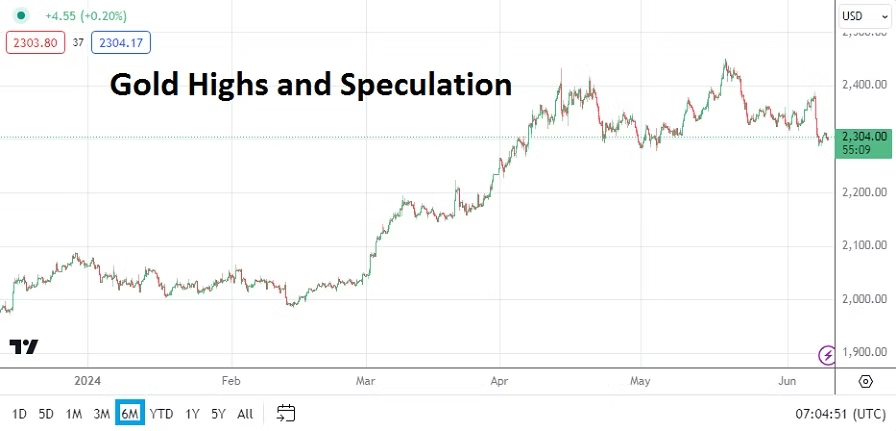

Thursday, 27th of June, U.S Gross Domestic Product and GDP Price Index – these two reports will impact the financial markets. The growth and inflation data will be examined by all financial institutions and generate trading reactions. The GDP growth number is expected to come at 1.4%, which is slightly higher than the previous report which posted a 1.3% result. Any number below 2.0% growth will be considered as lackluster by most financial analysts. Traders will then turn their attention to the inflation results which are supposed to match the 3.0% gain from the last Price Index report. If this number can somehow come in below expectations, this could propel some weakness in the USD. However, traders should be careful and remember U.S economic data the past handful of months has produced surprises which have created dangerous and choppy Forex conditions.

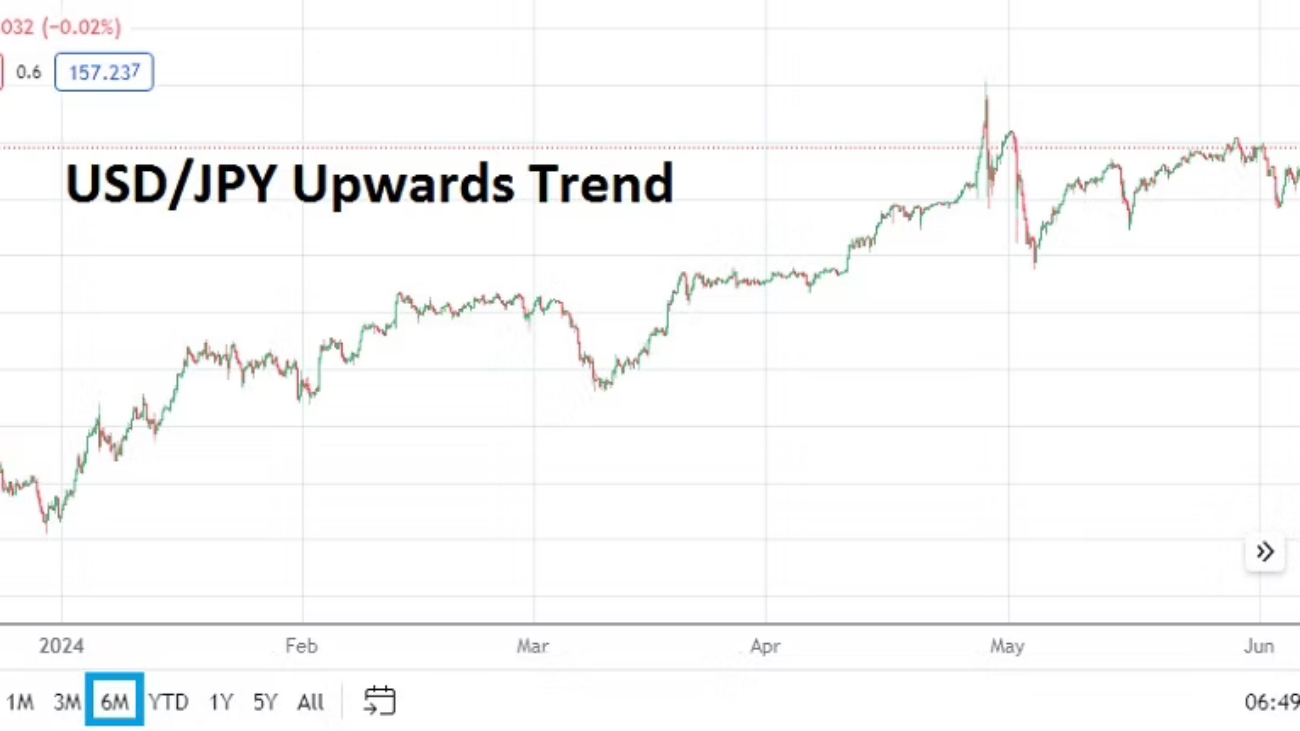

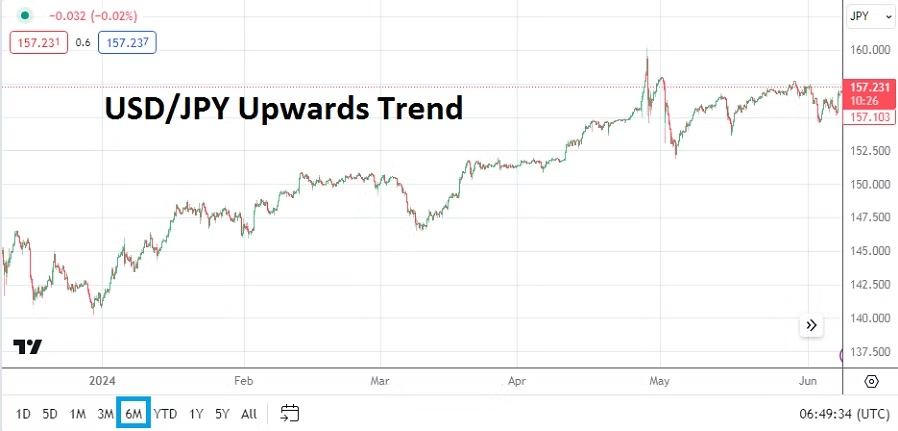

Friday, 28th of June, Japan Tokyo Core CPI – a gain of 2.0% is anticipated. The USD/JPY should be watched carefully. Early this Monday the BoJ likely tried an intervention in the Japanese Yen, but the USD/JPY only had a momentary swift selloff. As of this writing (Tuesday the 25th of June) the USD/JPY is trading near the 159.345 ratio which is very high when historical comparisons are considered. If the inflation number comes in with a 2.0% result or higher this could set off fireworks in the USD/JPY. Financial institutions clearly believe the BoJ should raise their interest rate by at least 0.25%, but the Japanese government appears keen on trying to keep the Japanese Yen weak to help GDP via exports from the nation. The Bank of Japan needs to be given attention. Speculators and the BoJ are battling against each other.

Friday, 28th of June, U.S Core PCE Price Index – the Personal Consumer Expenditures inflation report is forecasted to produce a gain of only 0.1% compared to the previous result of 0.2%. If the PCE Price Index does turn in the anticipated result, and the GDP Price Index from Thursday met expectations or came in lower, this could cause more speculative selling of the USD. However, if the inflation results come in stronger than expected Forex traders could see bullish USD buying which again challenges sellers abruptly.