Anonymous Kingdom: Bitcoin's Lack of Transparency is Supreme

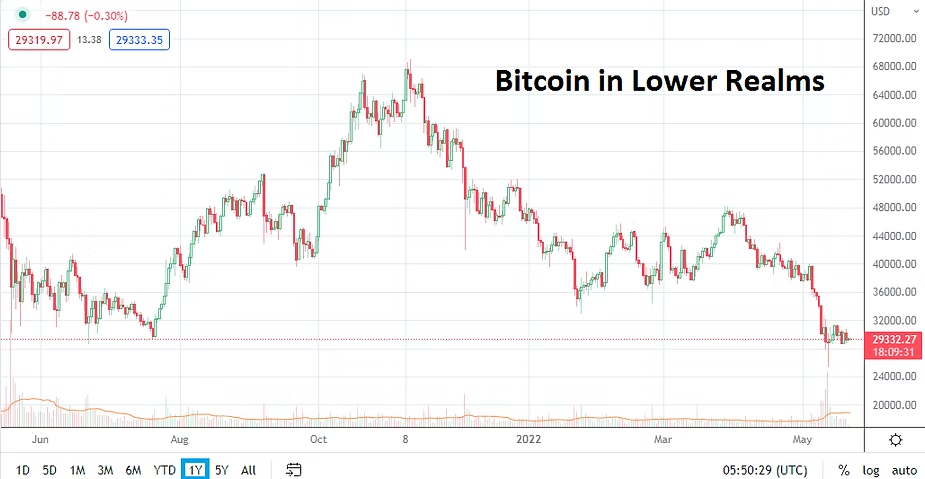

Bitcoin has fallen below the 40,000.00 USD price level today, and after penetrating the depth of 39,500.00 USD has shown additional velocity lower. Bitcoin is now testing support near the 38,850.00 ratio, a value it last tested on the 2nd of December.

Influencers will likely urge their fanbases to look at six-month charts to understand Bitcoin is still within the upper levels of its price range, this because a look at a three-month chart isn’t as cheerful. The speculative asset remains a dangerous place for day traders to participate who do not have legitimate insights regarding Bitcoin.

The question that some are likely starting to ask is what happened to the bullish rush in Bitcoin that was evangelized as a source of inspiration when the U.S Bitcoin ETFs materialized? FOMO (fear of missing out) again became an ‘advert’ for Bitcoin. True patience is needed when investing in financial assets, but day traders aren’t investing they are speculating and BTC/USD is likely costing them plenty of money.

It has been publicized that BlackRock’s spot Bitcoin ETF now holds over 1 billion USD in funds. However, while BlackRock and other ETFs have added to their assets under management of Bitcoin, what are short positions within the ETFs regarding size? This number is elusive, but the ability to sell ETF ‘share’ value within the new Bitcoin funds being offered is said to exist.

Bitcoin’s open interest numbers within the CME’s future contracts was nearly 26,669 positions on the 11th of January, yesterday’s reporting via the Chicago Mercantile Exchange was 22,250 open positions. While day traders may be speculating on the price of BTC/USD via their brokers’ trading platforms, they have to understand that their wagers are not affecting the real market price. The big players within the Bitcoin market do not operate on brokerage platforms which are merely offering CFD positions. The large traders are using cryptocurrency exchanges, futures and options via the CME, and now ETF positions.

Unless a trader is actively selling Bitcoin on a selected cryptocurrency exchange – and likely being asked to open a margin account – and thus opening the door to leverage and volatility, which it can be argued is designed to knock you out of the positions. You are going to find it difficult to actually sell ‘physical’ Bitcoin via short positions that are ‘manipulating’ the cash/spot market.

Bitcoin is a playground for sophisticated traders with plenty of cash to speculate and will continue to produce a world of extreme price volatility. On the 11th of January the price of Bitcoin jumped towards the 49,000.00 mark before declining. Bitcoin’s high early this morning was around the 40,150.00 ratio before stumbling the past handful of hours. Note, that open interest was at its highest on the 11th of January via CME futures trading information.

If you want to speculate (bet) on the value of Bitcoin as a day trader you should understand that you are participating in a marketplace that still doesn’t have the best of transparency. Yes, in most assets day traders are always competing against complex dynamics in which they have no control. However, speculating on BTC/USD is still being done almost blindfolded because of the lack of insights that is part of Bitcoin’s anonymous allure that many of its proponents love. We are still a distance away from transparency within the world of Bitcoin.

If traders can get access to volumes data – and the size of long and short positions being placed within the crypto exchanges they are using that helps. But because Bitcoin trading is still unregulated, and since there are many crypto exchanges operating you will only be getting small bits of information. The lack of information should worry day traders and serve as a caution sign.