Forex and Equities Storm: Crucial Data will Impact Markets

Today will start out with a rather important consumer report from the U.S and day traders should stay alert. It is easy to point to every day and week as being a crucial circumstance for speculators, because that is what gets their juices moving and gets them to wager in the markets.

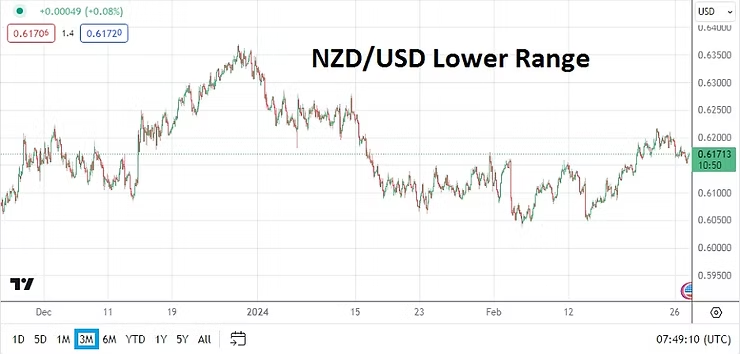

However, given the rather choppy conditions in Forex seen since the last week of December and pointing to the results of the Consumer Price Index on the 13th of February and the storms created in FX, traders hopefully have enough muscle memory to remember how they felt in the midst of the whipsaw conditions which were experienced only two weeks ago.

Central bank outlooks are fragile among analysts and financial institutions. Simply put this week’s data could prove to be more important than the CPI numbers. Consumer sentiment, GDP, and inflation statistics are all on the U.S roll call this week.

Other geographies will make news too and impact global markets. Last week’s impressive results from Nvidia created another massive wave of positive momentum in equity indices. The Nasdaq 100, S&P 500 and the Dow Jones 30 all have hit record values. Japan’s Nikkei 225 has surpassed record heights.

Yet, other barometers do highlight caution abounds too, U.S Treasuries yields have edged upwards and are touching values which show there is nervousness regarding monetary policy from the U.S Federal Reserve. This week’s data will deliver more insights for investors, and Treasuries are certainly going to react to the economic reports.

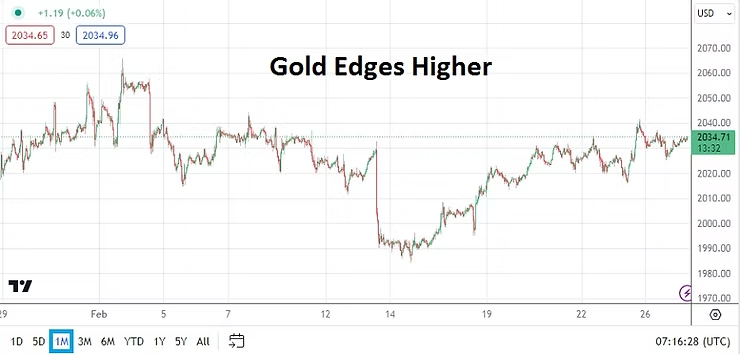

Gold has edged higher in the past week and is around the 2034.00 USD mark as of this writing. The slight climb above the 2020.00 ratio which has worked like a magnet recently, indicates some traders may be leaning optimistically towards a weaker USD mid and long-term. These folks may be proven correct, but day traders should note that the 2030.00 ratio in gold is below highs seen in December, January and early February – which indicates nervousness. If day traders do not believe gold acts as an inverse barometer for the USD, simply look at the results of trading when the stronger than expected CPI numbers were released on the 13th of February. Gold fell to a low near 1985.00 on the 14th, this was not a coincidence.

Again, while it is easy to sound alarms and jump up and down and proclaim every week important for day traders, the acknowledgement that this week’s economic data is significant should not be treated as hyperbole. You have been warned.

Monday, 26th of February, U.S New Home Sales – yesterday’s results showed another decline in the housing market, and the previous month’s number was revised downwards. The outcome may point to concerns about U.S mortgage rates which remain stubbornly high for those considering purchases.

Tuesday, 27th of February, U.S Durable Goods Orders – a rather large drop of minus -4.9% is expected. The Core data however is expected to produce a rise of 0.2%. These numbers will be a good precursor for the important consumer sentiment which will follow one and a half hours later.

Tuesday, 27th of February, U.S Consumer Confidence via the Conference Board – the results of the important readings have shown intriguing gains since late fall in 2023. While improvement in sentiment has been recorded, revisions lower have also been seen in the previous three reports. The outcome of today’s report should be treated carefully. If another higher reading is produced this may create some positive momentum in the USD momentarily.

Wednesday, 28th of February, Reserve Bank of New Zealand Official Cash Rate and Monetary Policy Statement – while many Forex traders will be sleeping when the RBNZ makes its important pronouncement, New Zealand inflation data has remained strong and a conservative government is in charge politically that is pro-business. The question is if the Reserve Bank of New Zealand will go against the grain of other global central banks and actually increase their interest rate while others seem to be adamant about trying to become less aggressive. While many analysts believe the RBNZ will sit on its hands and act according to the whims of others, if an interest rate hike is announced global Forex traders should take note because it would be a signal that central bankers are uneasy regarding their rhetoric and not in agreement.

Wednesday, 28th of February, U.S Preliminary Gross Domestic Product – a gain of 3.3% is the expectation from many analysts. The previous reading was stronger than anticipated. If growth numbers in the U.S come in higher than estimated the USD will react with strength. The Federal Reserve would like to see the outcome meet the expectation or come in below, this so the U.S central bank can consider reducing the Federal Funds Rate late this spring or in early summer. However, if a significantly strong growth number is demonstrated this would cause turmoil in Forex.

Thursday, 29th of February, Germany Preliminary Consumer Price Index – a slight gain is expected in the inflation number. The EUR/USD has been struggling as stagflation concerns shadow the European Union. A higher inflation result will not be welcomed by the ECB, which would prefer to cut interest rates sooner rather than later. The German number should be watched and it will cause an impact if there is a surprise. The EUR/USD has been turbulent and is likely to produce more choppy conditions depending on the parade of data results this week.

Thursday, 29th of February, U.S Core Personal Consumption Expenditures Price Index – traders who have felt the previous economic reports already have caused intense reactions this week should brace for this inflation report. A result of 0.4% is expected. The Federal Reserve admits this is one of the most important publications that it monitors. This means financial institutions react to this report too. If inflation were to come in higher than expected, like the CPI results from two weeks ago, this would essentially kill off expectations of a May interest rate cut from the Fed. The USD will react to this report and so will U.S Treasury yields, which means equity indices will also be affected. A weaker inflation report is being wished for by many market participants, but will this be the result?

Friday, 1st of March, China Manufacturing PMI – not to beat a dead horse, but China’s economic data has been poor and this report will be viewed as important. Another negative outcome is expected. Transparency regarding economic numbers from China is a worry for investors. Conditions in China are being watched and it is important for traders to eliminate bias regarding their perspectives. China may be struggling, but its importance as an economic power is still very much in evidence. Foreign direct investment into China is diminishing, but plenty of investors still have ‘skin in the game’ and will be affected by the manufacturing reports.

Friday, 1st of March, U.S Manufacturing PMI via ISM – a slightly improved manufacturing reading is expected. However, because of the U.S data releases from the previous days, the results may be looked at only momentarily and not cause much of a reaction from market participants. Traders may be looking forward to the weekend after this week’s economic publications in order to rest.