Risks: Powell and Inflation Data will Generate Market Reactions

Traders returning to their desks after a long holiday weekend can see the USD has become weaker the past couple of sessions as behavioral sentiment has shown signs of shifting again. Yet the trends experienced in Forex have not been clear cut, this as questions and concerns regarding what governments and central banks are thinking remains problematic. Investors who take a long-term approach to the markets will likely have an easier time in the coming days because their comfort levels are set to different metrics compared to large traders and the retail crowd. Noise doesn’t effect investors as much as traders.

Politics clearly remain on the minds of many as President Joe Biden has his ability to effectively lead the U.S questioned with growing doubts. However, it is unlikely that there will be a change in the immediate future from the Democrats as they decide on a path regarding their nominee for the November Presidential election. Financial institutions would certainly react to a decision to eliminate Biden as a candidate, but the President remains steadfast that he will move forward. It is very conceivable that Biden may be forced to vacate against his wishes, but until then the broad markets will not react too much to worries about the White House. For the moment U.S politics remain hyperbole.

France held its Parliamentary second round elections on Sunday, and while the votes have been counted, the results in many ways are not yet clear. Coalitions are being rumored and EUR/USD traders may react to the developments and within French bonds, but the murky political conditions within Paris remain hard to predict regarding outcome as a whirlwind of deal making takes place in an assortment of offices.

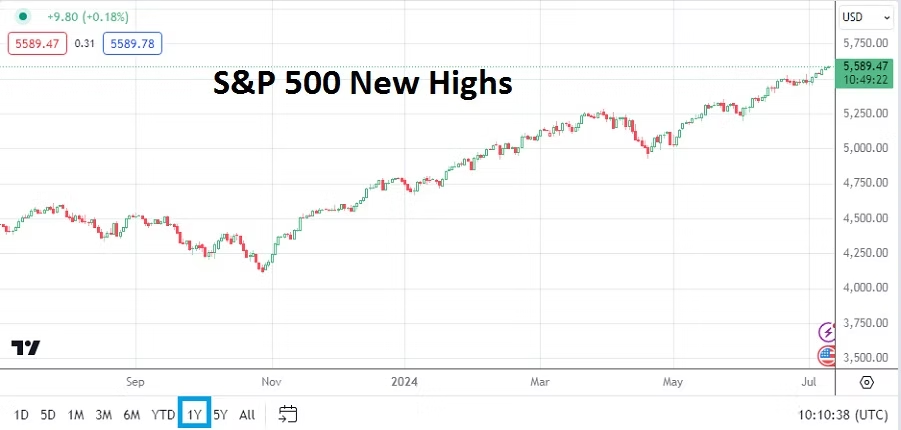

The lack of total volume last week in Forex and equity indices did not stop trends from being seen and technical perceptions being formed. U.S stocks remain highly valued and U.S Treasury yields have produced a downwards slope.

Today will prove interesting as Jerome Powell and Janet Yellen speak in Washington D.C, later this week inflation data will certainly cause a stir. While Biden remains a concern, France tries to form a working government, and the Bank of Japan is being viewed with deep suspicion, day traders have reasons to monitor news, but they should also remember financial institutions have been positioning for potential sentiment shifts and may not react with volatility if their outlooks are confirmed.

This week of trading is laden with risk events, some of which are listed below, but speculators need to understand behavioral sentiment is showing signs of optimism within many financial assets, and the prevailing mood of financial institutions appears to be leaning towards risk appetite.

Monday, 8th of July, Japan Average Cash Earnings – real wages continued to fall via data reported yesterday. The USD/JPY is traversing dangerous heights and speculators are likely still testing their bullish perspectives even as the 161.000 sees values tested above. Traders should stay cautious and not bet wildly on more upside, but lower valued speculative viewpoints are also problematic for the time being. Simply put, beware of the BoJ as it looms in the shadows.

Tuesday, 9th of July, U.S Federal Reserve Chairman Powell – the central bank chief will testify before the Senate. U.S economic data has weakened via Gross Domestic Product, and Manufacturing and Services readings. However, inflation remains troublesome and Powell will have to speak about these issues in conjunction via his Monetary Policy Report. He will certainly try to sound cautious. If Powell hints at a potential rate cut in September this would spark USD selling. At the same time the Fed Chairman is talking, Treasury Secretary Yellen will be speaking to the House Financial Services Committee. Traders can be assured that Powell and Yellen will mirror each other. And Powell will speak to the House on Wednesday.

Wednesday, 10th of July, China CPI and PPI – the Consumer Price Index is expected to have a gain of 0.4%, while the Producer Price Index is anticipating a result of minus -0.8%. Deflation in China is a concern. Economic statistics continue to produce lackluster results, while this a partially due to the collapse of the real estate bubble in China, it also has to do with less demand for products from abroad as Europe and America suffer from economic declines too. The USD/CNY has produced a bullish trend since the start of 2024 and is traversing near 7.2714 as of this writing. Traders should look at the inflation reports and examine them for revisions downward in previous months.

Thursday, 11th of July, U.K Gross Domestic Product – the newly elected Labour government will get their first taste of big economic data challenges as they now guide Britain. A lackluster gain of 0.2% is expected. While this may move the GBP/USD a bit based on the result, the currency pair will likely react more to the U.S inflation data later in the day. The July bounce higher in the GBP/USD has been healthy and value above the 1.28000 has provided bullish traders with some optimism.

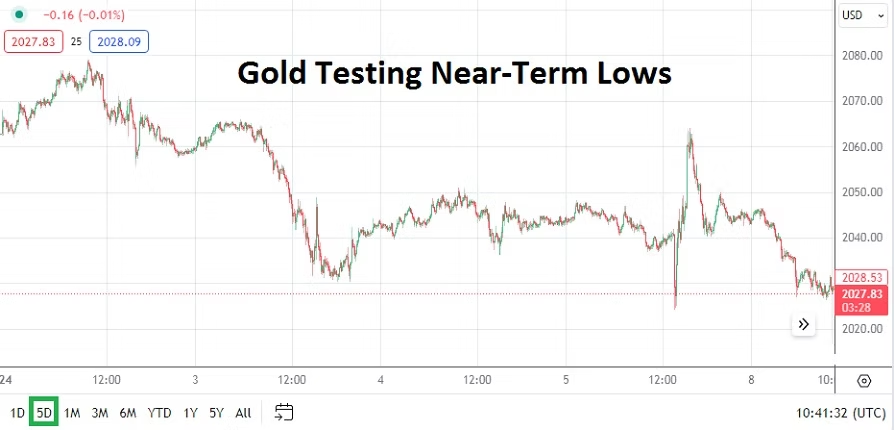

Thursday, 11th of July, U.S Consumer Price Index – the core CPI report is projected to match last month’s number of 0.2%. If this result can be attained and the CPI annual data comes in with the anticipated 3.1% mark compared to last month’s figure of 3.3%, this could create dynamic bearish activity for the USD. However, traders should remain cautious and note that even though recent U.S economic data has tumbled, inflation reports have been stubborn. Betting on the outcome of these reports before they are published is akin to gambling for day traders.

Friday, 12th of July, U.S PPI and Preliminary University of Michigan Consumer Sentiment – the Producer Price Index reports are expecting slightly higher ratios. The Consumer Sentiment report should be looked at too, because the readings have been coming in weaker the past handful of months. If consumer behavioral sentiment is weaker the USD could sustain a negative stance.