The dangers of day trading in markets that are geared in favor of institutional houses with deep pockets and their ability to sustain volatility, versus smaller speculators should be taken into account before you trade. You are likely the smaller speculator, and you are engaging in a game that is not fair, it is a hunting ground and you are often the prey. It will be your proverbial head mounted on a wall as a keepsake by a salesperson who claimed to be your friend and care about your monetary outcome, when in fact what you have done is provide them with a solid commission and the ability to buy a nice dinner and pay their rent.

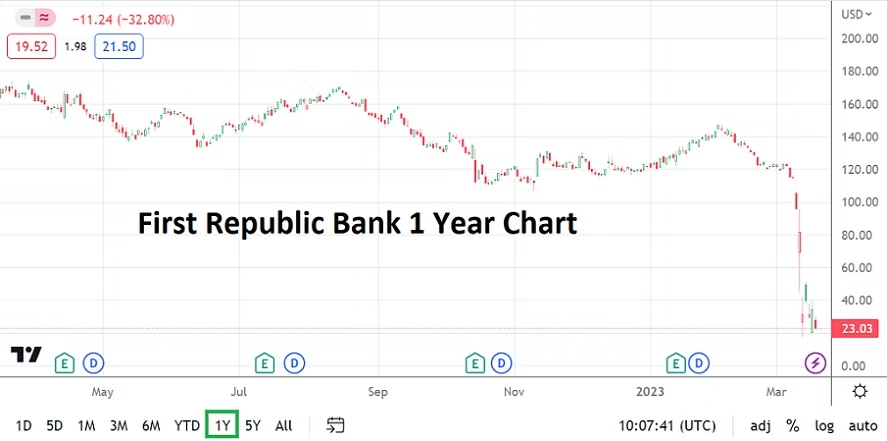

A lesson from the past week during this recent banking crisis and the trading panic that ensued, is these circumstances rarely make you money when it is you who are the frightened one and caught in the middle of the ‘troubles’ and having to make quick decisions. Brokerage houses may claim that they feel your pain, but actually they seek your discomfort, because brokerage houses working in the grey world of global regulatory confusion often make money when you lose. You must check on your broker’s licenses and understand how they are allowed to ‘trade’ your cash exactly. Brokers licenses are vastly different depending where their company is legally based and the jurisdictions they must comply.

Due diligence should not only be done by the broker regarding you as a client, you should undertake due diligence on your broker. The U.K, U.S, Cyprus, Malta, E.U, Germany, France, Australia and other locations have a long list of different rules which force brokers to act in different ways. Some jurisdictions are much less stringent and allow for a gambling environment, while others have secure rules that protect you. And then there are brokers situated in other regulatory landscapes that are faraway and without hardly any supervision. Just because your phone is telling you that you are getting a phone call from a ‘local’ number doesn’t mean that the phone call isn’t coming from a distance. Brokers can use software to make it look like they are calling from a location you feel comfortable dealing with, when in reality the call may be coming from a thousand miles away.

You are Frequently the Hunted because your Money is Valuable

Traders looking to profit in all financial markets must acknowledge they are frequently mere spectators, who are allowed to bet on a game being played by much larger participants that are capable of moving market values and causing violent conditions. You as the smaller trader are actually being hunted as a valuable commodity by brokerage houses working on the premise they know you will lose your money. You are their profit source.

You are not BlackRock, Goldman Sachs, J.P Morgan, your monetary losses are not going to cause a fear of risk exposure in the larger financial world. Your position of a mere 100,000.00 USD in the EUR/USD is less than a speck of dust in the financial world. You are likely a meaningless speculator to the brokerage house, only important because they see you as a money source for their profit. This is not meant to be kind, it is meant to keep you based in reality.

Small Traders must Acknowledge their place in the Universe

A more calm demeanor and acceptance of the chaos within the marketplace needs to be practiced by small traders. Allow others to be alarmed. Being tranquil within trades you are situated permits you to think and react objectively when the markets are going ‘mad’ and this is to your advantage. Using proper risk management and very conservative leverage is vital for you as a speculator. Attaining these capabilities are often difficult to learn, for some it is impossible. You as a trader will always be treated as an afterthought by the real cash market.

Emotions weigh heavy on the best of traders, trends created by the nervousness of the broad market as behavioral sentiment changes is commonplace. It may help you as a day trader to accept that your positions are likely meaningless to the institutional wagers being placed. Your trades do not move the needle, because your trades are not even part of the real marketplace in many instances. You are merely being allowed to bet on the game and this is a fact you should acknowledge. You do not have to impress anyone but yourself, using conservative leverage and solid risk management is crucial to stay alive in the markets. Do not get talked into large bets, use your commonsense.

Your wagers are certainly able to pursue the decisions of the larger players based on behavioral sentiment being exhibited which are affecting the markets, but you are merely betting on momentary tracks of momentum, again not being affected by you, but by the large institutional traders who are risking millions and billions of dollars. Your technical and fundamental decisions are following the more powerful mass, your viewpoints are not changing the way the real markets are moving.

Another piece of knowledge you must come to realize is that many brokerage houses are interested in you actually losing money, particular if you are trading on their CFDs, via indices and share prices within the virtual world of ‘B book’. Forex pairs, commodities and cryptocurrencies are treated by the brokers in the same manner, your wagers are merely ‘side bets’ based on the outcomes of the cash markets being made inside the broker’s casino. As the casino, brokers are taking your bets with the knowledge you are likely going to lose and they are quite content about this result.

‘B Book’ Trading is Not the Cash Market

The trades you are making believe it or not, are not going into the real cash market. Your money is simply being held by your broker who allows you to trade on the market price, and the value in your account changes per the winnings and losses generated by the market action on the computer terminal according to the real marketplace. Again, it must be stressed your wager is on a game that your trade is not in reality participating in. You are merely a spectator, think of it as betting on a horse race and watching from the stands or television. You are not running the race, you are not the jockey, you are merely cheering on an outcome and can win or lose money based on the result of the horse you have bet on. You have nothing to do with how the horse performs, nor the direction your financial asset takes.

Many brokers only want to make money off of you and literally watch as you lose all of your money. The money that you are trading is too insignificant to be entered into the real cash market, so it is entered into their casino instead. Let’s remember you are often not trading the large cash amounts your positions are quantified numerically, because you are trading with leverage. You are betting on the virtual result. Did gold go up or down? Did the EUR/USD go up or down? Who won the game? Your broker is the bookmaker. They are operating a casino allowing you to gamble.

Brokers are Not Your Friends, You are their Profit Source

Brokers who allow you to trade virtually do not want you to lose all of your money too fast, because they do not want to hear your complaints or face your lawsuits, they want to act as your friend, the key word being act. They try to make sure your losses occur in a slow manner, this so it is not so obvious that they do not care. Because you are participating in a theatre of the absurd with them – one in which they believe you will lose all of your money eventually, you are a mere actor in a play you do not know you are participating.

You are part of the center stage, but you are not participating as someone who affects the outcome of a wager on a financial asset, no, you are merely being watched by your salesperson who got you to deposit and the risk management team of the brokerage firm where your money is being gambled. You are the risk for them. You are trading on a ‘B book’, your money lost is often their gain.

It is much better to find a broker and platform that actually trades your money in a real system, one that is buying you the actual asset. But that is not easy and you will have to make inquiries by asking the brokerage company if they are trading your positions in a cash market or virtually. And to be a participant in the real game, you often have to be trading much more money than you have to risk. Remember one of the golden rules of speculating is to risk nothing more than you can lose. If you are investing long-term that is a different proposition, but the rule of not investing more than you can afford to lose is still very important and should always be given attention.

The ‘friendly’ voices you often hear on the other side of the phone are actually not well intentioned, you have often been seduced, this after being lured by one of their adverts promising excellent trading conditions. They want you to deposit your money, tell you they will guide and help you try to trade. Some may be brave enough to claim you are certain to make money, hang up the phone if you hear this bold lie.

Always be cautious, be suspicious. Ask the person you are speaking to, how much money they are going to get in commission per your deposit, getting a straight answer will be a surprise. The more cash you put in the more money they often make, while that seems obvious, what needs to be understood is that their percentage of commission actually grows – for the salesperson from let’s say 5 percent to 10 percent if you give the brokerage a huge amount of money. Ask yourself how their commission goes up when your money is supposed to be safe and secured and being traded in real cash assets. How is a commission of 5 or 10% being paid to a salesperson by a firm on your money deposited, and how is the brokerage going to make money? The only way to pay out such large percentages of commission is based on their knowledge, that most of your money will never be returned to you. They are counting on you losing your money to them – the brokerage house.

The salesperson will often assure you it is best to start conservatively, deposit a small amount to test their trading platforms. When you get comfortable and you have come to trust the brokerage firm, they will go in for the large ‘kill’ and try to get you to deposit large amounts of money. This will often come with the tacit reminder to you that you can only make big money if you are willing to put a large amount of cash into a trade. You have to risk to win is their subtle message. You do want to buy a larger house, have a faster car, take a vacation in some exotic location don’t you?

At the Racetrack your Horse is Not Going to Win most of the Time

Why do brokerages want you to give them a lot of your hard earned money and allow you to bet against their ‘house money’. Because they know you are not likely to make profits. In actuality you are entering a casino, they are just not telling you that. Again, think of it as being a spectator at a horse race. You are betting money at the track on a horse. The track that takes your bet is happy for you to wager, because like a casino they know most people are going to lose money while betting on the horses. They offer your enticements like better odds at the racetrack.

Brokerages offer you leverage to make more money. Have a thousand dollars in your account? They will allow you to bet 10,000.00 USD and in some cases 100,000.00 USD based on leverage of 10 or even 100 times the amount of money you have depending on their jurisdictions and licenses. Why? To increase the volatility within your trading position, because the bigger the trade with the house money using their leverage, the smaller a numerical value in a position on a financial asset has to change in order to cause a sea of volatility. Bedlam within your account and knocking you out of the ‘race’ quickly is the desire. The more leverage you use, the more dangerous the betting becomes for you. Brokers, like racetracks, entice you to make large bets on unreasonable outcomes by promising a bigger payout on the worst financial wager or slowest horse.

Why you Should be an ‘Angry’ Trader and Treat Brokers Suspiciously

85 to 90% of deposited cash and often higher in ‘B book’ trading brokerages are the expected net loss of speculators. Not only do brokers make money on your spreads, transactions, overnight fees (what may be referred to as carrying charges), handling fees for depositing and withdrawing your money, but most make money when you lose on your trades. How? Because they are not really trading your money, they are merely keeping a record of your stated position knowing that the trade is most likely to go against you. And when the trade goes against you, they pocket your losses.

Before you place your money with a trader, simply ask if them if they are trading your money on a ‘B book’ platform. However, note that your salesperson often will have no idea what you are speaking about because most of them are young or have chosen to remain ignorant about the way their company actually handles your money when you speculate. Those that do know what your questions mean, will answer you in an elaborate fashion ready with reasons why your money is not actually going to go into the real market. It is an odd day when a salesperson at a brokerage firm would actually admit you are being placed on a ‘B book’ because your speculative positions are simply too small.

Bonus Money is a Sign that all may not be Right with your Broker

Why do you think it is so easy for many of these companies to offer you a bonus to trade? Because the money really doesn’t exist. Brokers tell you they are giving you the money to help you trade and make more profit, but the money really doesn’t exist, again the bonus money is virtual – it is air. They are making it sound like they are doing you a huge favor, when in fact they are merely giving you more ammunition so you can destroy your own account, and also entice you to deposit more money later. They are allowing you to increase the size of your ‘account’ with their bonus money to give you the opportunity to use more leverage. You are being enticed into the dream, allowing you to think about that new house you want. They are helping you dream, but when you lose the money they will hold your hand and say that this is the nature of the marketplace and that the trade was a good learning lesson. Hints of doing better on your next trade will sometimes be heard.

How is it that when your account goes negative, that you are never asked to pay the negative amount? Because the money given to you via the bonus which was part of your account never really existed. The broker is merely touching a few numbers on their keyboard and balancing out your account to zero. You do not owe them any money. You can simply deposit again and start to trade and pursue your dreams once again. You are the fish and they provide the bait with bonuses and dreams of bigger houses to catch you on their hook.

‘B Book’ brokerage houses seldom put your money into the real market. Sometimes they might get scared and put your money into a ‘real cash account’ known as ‘A book’, but in actuality your broker is likely giving the trade to a bigger institutional broker who then puts the trade on their ‘B book’. In other words the bigger broker is acting like an insurance company for the smaller broker. Thing is, the large broker often thinks the smaller broker will actually lose money too on your bet when they take the smaller brokers ‘B book’ wagers.

Meaning if you actually make money on the ‘A Book’ and cash out of the trade, your broker collects the money from a larger broker most of the time – this if your broker essentially hedged by placing your trader elsewhere as protection. However folks this is not really your concern. What you should do when you make money is make sure you are able to withdrawal the money quickly and efficiently and not let the broker make excuses why it is taking so long. Suddenly, you may be asked to give new identification to get your money. If this happens, please feel free to get impatient. You will be shocked at how easy it was to deposit your funds compared to getting them back sometimes.

Ask this question too, how is your money sent back to you? If you have deposited money by a credit card, if you are actually lucky enough to make more money than you have deposited, you will in most cases not be allowed to be paid via your credit card. The money will have to be wired to you via banks. That is fine, but make sure your broker actually has the capability to do this. Sometimes they do not know how to do this effectively, because they were not expecting you to win money. Your salesperson may say that the money is sent back by credit card for all your winnings, but this is often wrong so it is best to check on this beforehand.

Most brokers are counting on the volatility of reversals, leverage that is too high or stop losses to knock you out of a trade eventually. You lose and your broker wins. It may sound like conspiracy thinking, but be honest with yourself and read the small print of your user agreements which you may be tempted to glance over quickly, or better yet ask directly if your trades will be put in a ‘B book’ or into a cash market. Now one other thing you should be aware of, your salesperson representing their broker often does not know your money is not being traded in the cash market, because they are not privy to the risk team’s decisions who are watching your trades and trying to determine if you pose a danger to them.

Authentic Salespeople, Retention and Risk Teams

Your salesperson is most likely kept as ignorant as possible about the way your money works if their company operates a ‘B book’. Because it makes the salesperson much more authentic when they believe you are being treated fairly and the brokerage has your best interest in mind. The risk team is watching to see if you know what you are doing or if it is OK to let you bet and simply relax in the thought they know you are going to lose your money. The risk team at brokerages often asks the salesperson what the level of experience of a trader is regarding the markets – and your salesperson will ask you. While these might seem like a simple and innocent question, what the brokerage is doing is sizing up the amount of risk you to pose to their ‘casino’. When you open your account take the time to notice if you have suddenly been given to a more experienced salesperson to handle your account. Often this salesperson is known as a retention agent, this person has been ‘trained’ to keep you ‘happy’ and engaged, enticing you into large trades and to get you to deposit more money.

Think of it like a casino where players walk up to tables to play blackjack, the dealers give you your cards, pit bosses watch from behind making sure the dealers are working well and keeping an eye on you too. Casinos and brokers are watching you at all times. Yes, good ‘B book’ brokers are actually happy sometimes when you win, because you will tell your friends you made good ‘investments’ and withdrew your money without a hitch, thus alluring others into the casino – brokerage. But like a casino the brokerage knows most players lose, so the infrequent winning day for a speculator is good because others will step into the arena – where the odds are against them. This is a losers game.

Not all brokers are bad, some actually have solid interests in you doing well. You must do your homework and know who you are working with by asking questions and investigating what you are being told. Being suspicious and alert will help you stay alive and not become the hunted.