Why has the WTI Crude Oil Spot price remained relatively calm? The war between Israel and Iran has been going on per this latest violent phase since Friday the 13th. While tensions have been high between the two nations from the 7th of October 2023 in a very outward manner, and missiles were fired from Iran towards Israel on two separate dates in 2024 which then featured Israeli retaliation, the past handful of days is a new escalation.

Day traders of WTI Crude Oil need to understand that large players in the energy sector have a vast amount of experience and intel regarding production and supply worldwide when they make their buying and selling decisions. However, the biggest oil traders do not always share the same political viewpoints, except to say most large players in the energy sector practice the art of realpolitik. Day traders of WTI Crude Oil should try to get into the minds of the real movers of WTI Crude Oil via realpolitik considerations.

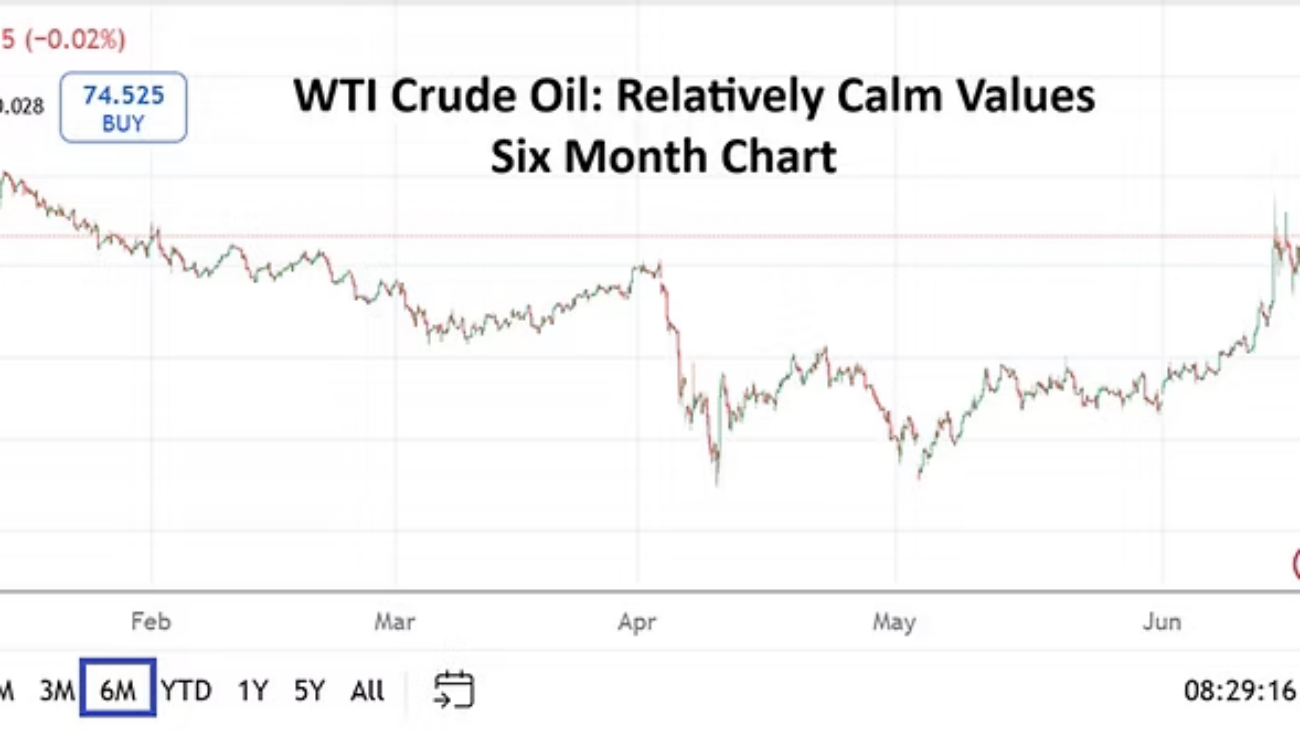

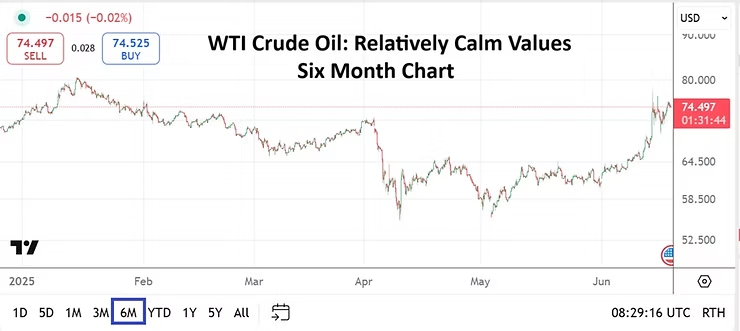

As of this writing the price for WTI Crude Oil is around 73.930 Spot, late yesterday it did move higher to within sight of the 75.750 USD mark – this when information that President Trump is considering a U.S military strike on Iran heightened. Traders need to understand Spot Crude Oil and Futures pricing can be different. The current value of WTI Spot is higher than the Futures pricing because of the short and near-term known risks.

However, volatility in WTI Crude Oil Spot has remained fairly muted, almost tame as Israel and Iran wage war. Other spot energy prices like Brent and Natural Gas are being affected directly too because of shifts in behavioral sentiment. But again, the prices within the energy sector have remained calm considering what is at stake for global economics. Here are points that may be affecting the WTI Crude Oil landscape and energy complex, which some large traders may be contemplating:

It is highly likely the U.S has told Israel not to harm Iranian Oil production or supply sites, including shipping.

The U.S does not want the price of WTI to jump rapidly because of the current war between Israel and Iran.

Inflation would be a scrouge for the global economy, not to mention President Trump’s ambitions.

Even though the U.S has its own energy supply, the price of WTI is affected by behavioral sentiment within the global Crude Oil complex.

Meaning conflicts in the Middle East and elsewhere always cause ripple affects, even if Crude Oil is flowing freely in the U.S via its own production.

The U.S doesn’t want China to be given a reason to consider becoming an open belligerent in the Middle East war.

China gets a lot of Crude Oil from Iran. The stated percentage is around 15% of its total supply, but it could be more if Iran sends oil to other locations and then reroutes supply to China afterwards.

The U.S not only wants to keep China calm about its energy supply, but also doesn’t want to give China an excuse to escalate political or military tensions elsewhere – read Taiwan.

As an aside there are a lot facts and rumors coming from China, highlighting that a powerplay is emerging between competing factions for leadership in China’s military, this may include the authority that Xi Jinping has too. China will be conducting Politburo meetings in the coming weeks that will get plenty of attention via Beijing analysts. If U.S intelligence knows an internal political fight is taking place in China, they will want to keep China calm regarding external considerations and not give China excuses to act. Concerns regarding the Middle East as a justification for more Chinese actions against Taiwan in some type of economic political/ military theatre is a threat.

By telling Israel not to attack Iranian oil infrastructure, this allows the U.S to placate China. Only if Iran were to attack U.S infrastructure – including military assets or interests in the Persian Gulf via attacks on Gulf States like the UAE, Bahrain or Saudi Arabia would the U.S consider retribution against Iranian Crude Oil.

While the U.S has an interest in global politics certainly, it also wants to maintain a stable global economic environment. President Trump knows this and so does his cabinet supposedly. The Federal Reserve meets later today and they will certainly speak about uncertainty regarding inflation. Whether or not they mention the Middle East war will be interesting.

Thus, it is likely the U.S will only allow an attack on Iranian Crude Oil production and supply if it has been directly threatened. And this is where it gets potentially more interesting for Crude Oil traders. It appears likely the U.S will get involved directly in Iran by hitting known Iranian nuclear facilities deep underground with heavy U.S ordinance. If the U.S does attack Iran via B2s using heavy bombs, how will Iran’s Revolutionary Guard Corps react?

Will the existing IRGC allow for the destruction of its nuclear ambitions and accept that it will have to prepare for a new political environment in which their power will likely be challenged by not reacting? Or will those in power of the IRGC double down on stupidity and attack U.S assets with some of the Iranian military weaponry that still remains? An attack on U.S ‘interests’ would risk aggravating the U.S more – giving the U.S reasons to attack Iranian economic infrastructure which is mostly Crude Oil, and likely close the door on the chances of the IRGC to survive after the war concludes.

Things often do not work out via political and military outlooks. The law of unintended consequences is always a danger. The end game is quickly approaching for Iran’s current leadership. The U.S and Israel also hopefully have taken this into account. Recent outcomes in Iraq and Afghanistan have not gone as planned for the U.S when seeking a serene endgame.

As an example, it might be better not to eliminate the current Ayatollah Khamenei, and allow the people of Iran an opportunity to remove him if they want. The Iranian Revolutionary Guard Corps and its various factions are probably eyeing what will come after a capitulation. There will be a fight for survival politically and a leadership vacuum.

The IRGC fiefdom gets most of its money from Crude Oil revenues. It is quite possible in a forward looking manner the IRGC may choose not to risk having the U.S ruin Iran’s one giant economic asset, thinking rightly or wrongly that they can continue to profit from Crude Oil the day after the war ends.