Trading Tips: Perspectives and Gaining Behavioral Sentiment

Data is everywhere. AI has helped increase the level of information accessible to day traders. However, the quality of the information and its insights remains questionable – suspect. Systems relying on technical, fundamentals, algos, and the magic word ‘quants’ are tools which can help a person make their decisions. Unfortunately they do not guarantee you are going to make money.

Profitable results in trading remain difficult to attain. Day traders – speculators – continue to look for a golden goose. Something or someone who can deliver profits on a steady basis remains hard to find. This article is to help you gain perspective, it is a trading tip. There are no secrets of the temple coming, but it may be time you stop looking for secrets which do not exist.

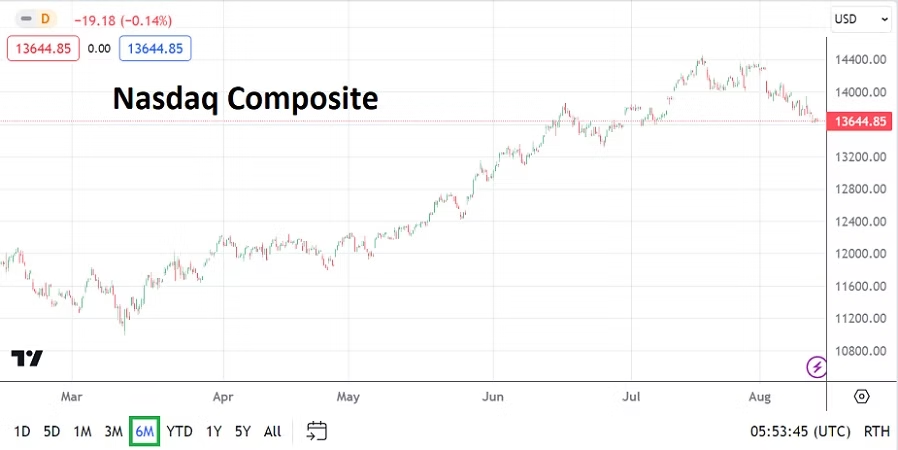

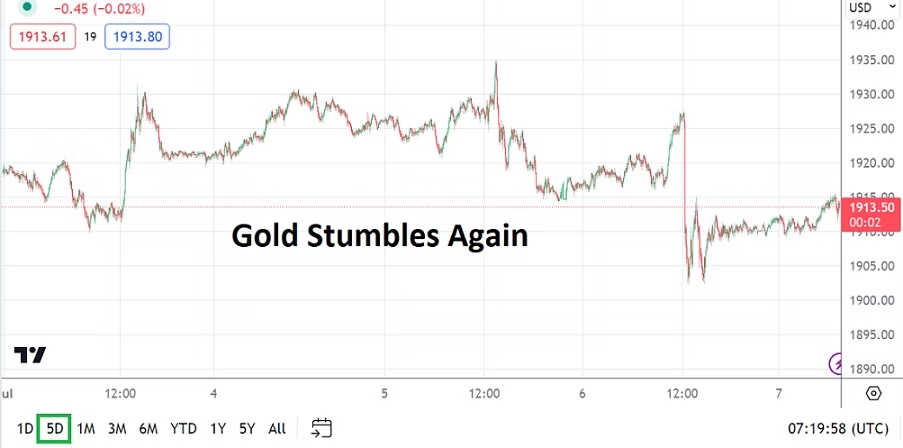

Trying to look forward and gaining genuine insights remains tough. Technical charts, fundamentals, opinions from experts all remain problematic to actually use in real time. The markets in a sense are alive, the environment is constantly changing. The moment information is shared it becomes old. Time and price action move fast. You can slow down the ‘game of trading’ by using different perspectives and practicing new ways to consider the dynamic values that are in flux that you are witnessing.

Behavioral sentiment – insights – regarding what the largest traders are going to do in the short, mid and long-term would be relevant. Understanding the asset you want to trade is important, understanding the inclination of the marketplace, price action – velocity – and timeframes of potential volatility is crucial. A key component would be to find a way to time a trade knowing what direction an asset is going to move.

This remains elusive for nearly all traders.

Again, this particular article is not going to solve this problem for you. It is to acknowledge the problem exists. We can have all the data in the world, past performances statistics, know what the markets are predicted to do, but the ‘game’ still needs to be played. Over 90% of day traders loss their money and eventually give up. Traders wagering on the markets need a way to put the odds of success in their favor. Folks may wonder why angrymetatraders.com writes about fantasy sports within its culture/ sports topics, it is because there is a correlation to sports and financial markets for speculators.

Day traders in many ways are not really participating in the marketplace, they are betting on the outcome of the results. The tiny trades of the majority of retail speculators are not affecting price action, sometimes the trades aren’t even being put into the real market – they are being traded virtually. Read about the topic B book trading within our articles if you have time.

Like sports gamblers who are not playing in the game, speculators are using their perceived knowledge of financial assets and past results to bet on future outcomes. A key ingredient to having successful trades that work in the financial markets is to have solid knowledge and a sense of what can develop as assets trade on a particular day. There are complexities within each sector, like every game being played in a variety of sports.

Gamblers not only bet on the outcome of the game, they also bet on the outcome of different components within the ‘contest’ – player stats, halftime scores, turnovers. Traders can do the same thing by speculating on an asset over different timeframes, and they can sometimes trade what are known as ‘options’ too, this to hedge on their positions or sometimes simply wager on their belief that a Forex pair or a share (stock) price is going to move in different ways during a certain period of time.

Understanding behavioral sentiment is important. The meshing of technical interpretation with fundamental data, and the way it affects perception and the tendencies of potential decisions to be made regarding outcomes is not easy. However, grasping the outlook of other financial market participants can improve a day traders results, if they put effort into perspectives and apply this to their risk taking tactics.