Reactions and Risks as Trading Clarity Remains Hard to Grasp

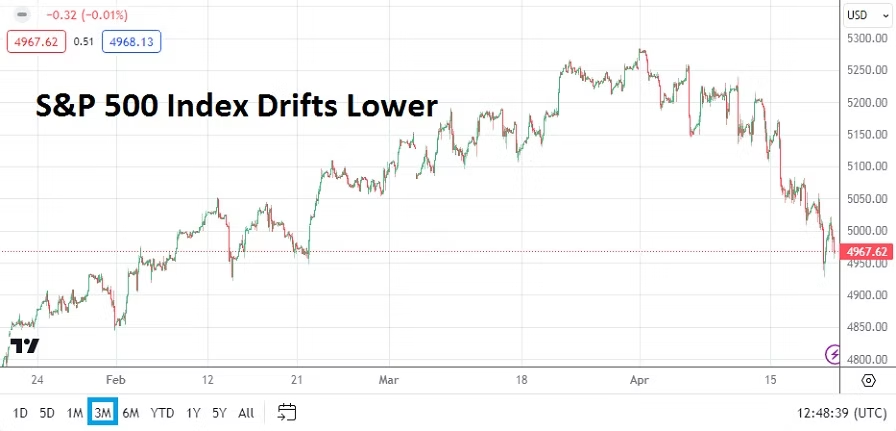

While many U.S government officials try to shrug off the downgrade of U.S Treasuries by Fitch Ratings last week, a warning shot has been fired regarding U.S spending and the nation’s growing deficit. Janet Yellen and others may believe the downgrade should not have happened, but the prospect that the U.S golden goose is going to stop eventually producing enough eggs is a realistic viewpoint from Fitch. Risk adverse trading on the news was seemingly sparked from the U.S Treasuries downgrade, while many prominent figures including Warren Buffet have claimed they are not worried. However, one thing that the downgrade did was certainly create more clouds for financial institutions which have already been suffering from a lack of clarity the past three weeks.

U.S economic policy remains troubling regarding its spending, and while the government believes its bonds will remain the best in the world for the foreseeable future, it would certainly help matters if responsible ‘adults’ would be allowed a voice regarding stimulus, expenditures and debt ceiling concerns. The U.S has been warned, but with a major presidential campaign approaching on the horizon, more promises to the U.S public will likely carry greater long-term costs.

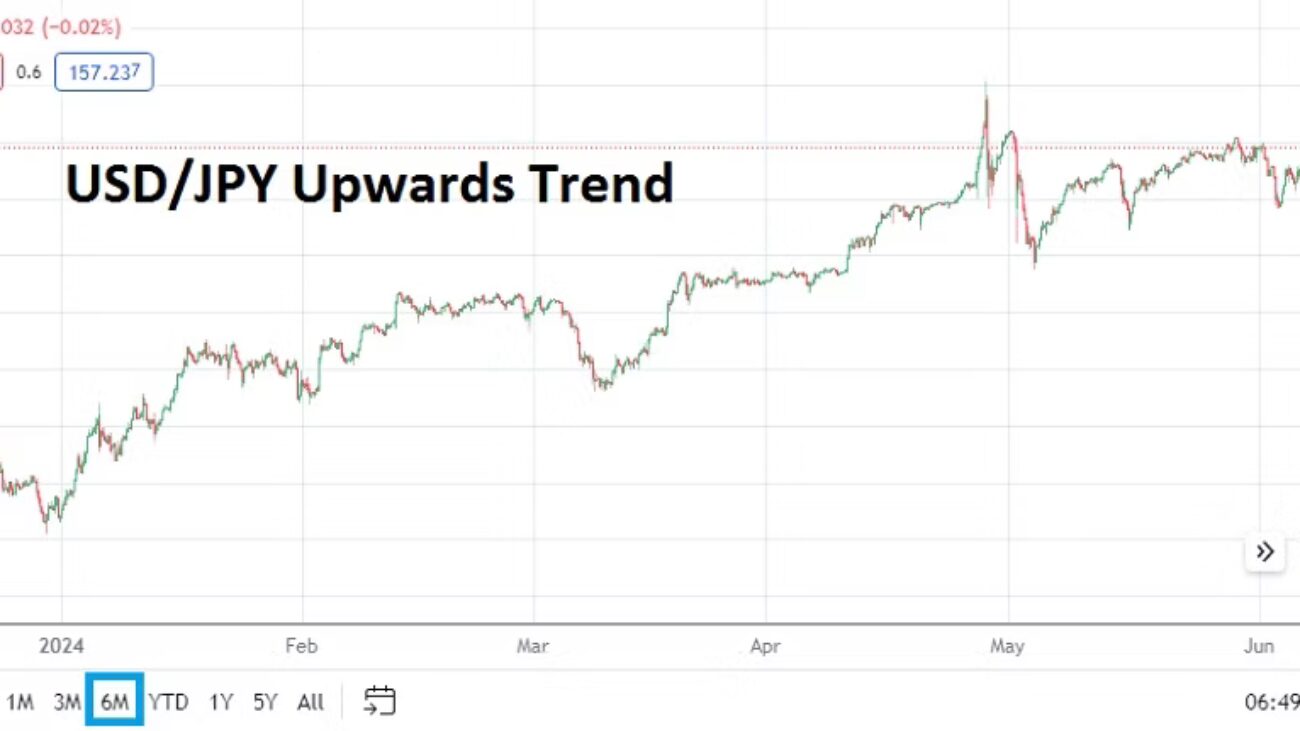

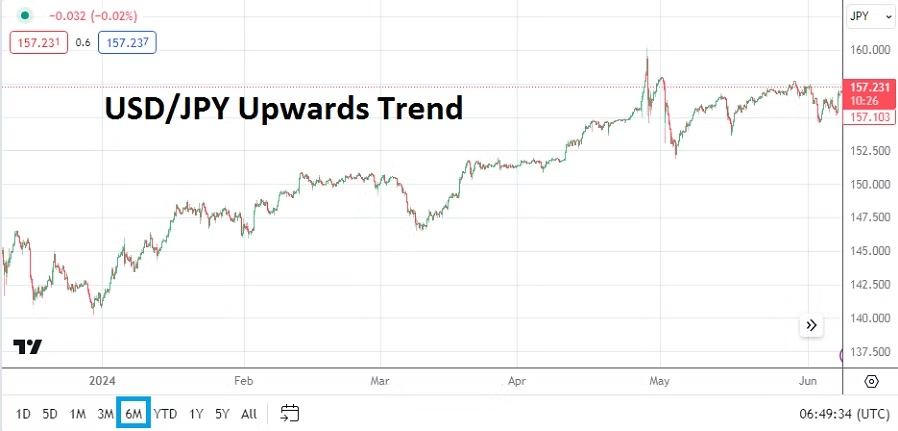

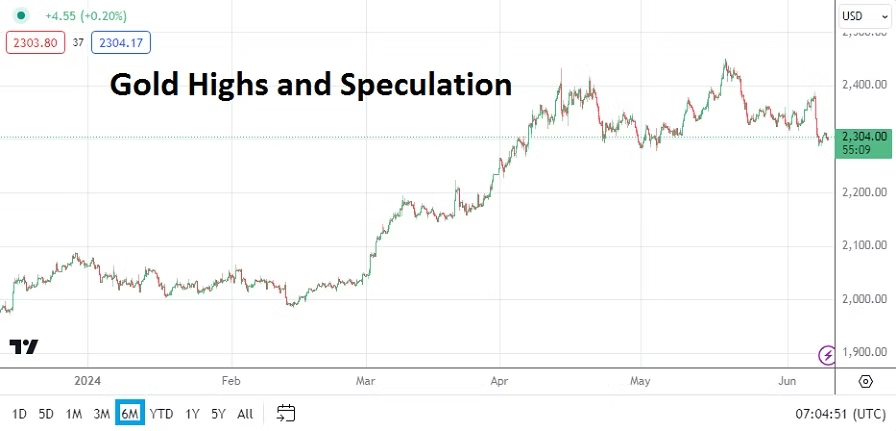

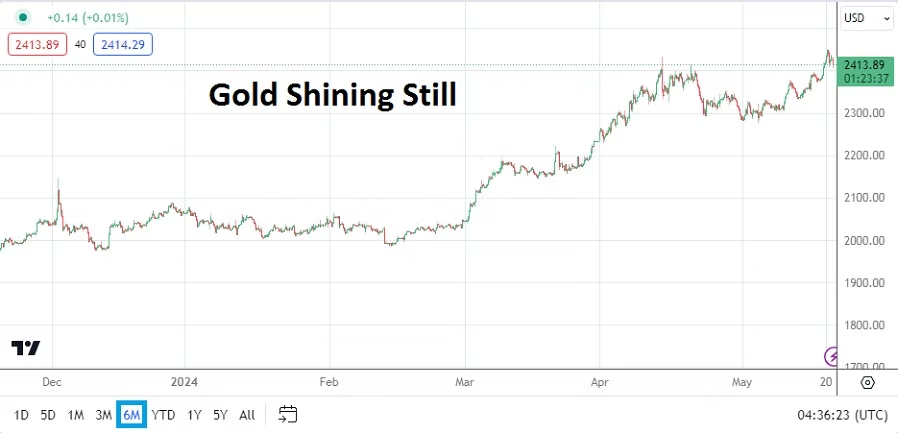

While the USD did get stronger across Forex and gold finished last week near lows, some major currencies finished Friday with slight reversals higher against the USD before going into the weekend, based on the weaker than anticipated Non-Farm Employment Change outcome. However, Average Hourly Earnings came in slightly higher. The rise in wages for employees wasn’t expected, but the gains via the inflation number may not have been considered significant enough to cause a panic.

Day traders trying to navigate through the news of the ratings downgrade and the mixed jobs numbers from the U.S may have gotten ripped apart from the volatility late last week. Forex brokers likely had a good week if the majority of their speculators were ‘B’ book – virtual – traders. Survivors of last week’s dynamic price action should be aware that financial institutions do not have the best of outlooks for global central banks. This week’s coming data may help a bit, but trading could also remain rather dangerous and churn volatility.

Global Outside Influence to Give Attention:

Although Niger may seem like a world far away for most day traders, they should keep an eye on the developments of the African nation. A military coup has gotten the attention of global powers and there are threats of military intervention rattling. France, the U.S and Nigeria and other ‘Western’ leaning nations have a stake in the Niger drama, on the other side is Russia and its Wagner affiliated mercenaries. The potential for a war to to start in this landlocked northern African nation appears to be growing. A conflict in Niger could include a wide range of competing sides and create loud rhetoric and hyperbole. It could also cause uncomfortable feelings at the BRICS summit scheduled to begin on the 22nd of August in Johannesburg, South Africa.

Monday, 7th of July, U.K Halifax Home Price Index – this data is expected to remain rather stable, but the past three results have been negative. Mortgages are getting expensive in the U.K and the pressure added from higher interest rates is not helping. The GBP/USD could react briefly to this outcome.

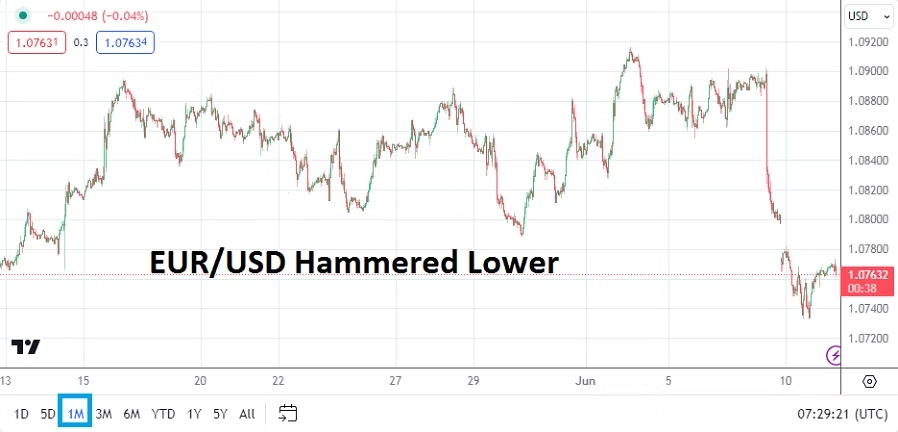

Monday, 7th of July, E.U Sentix Investor Confidence – the reading is anticipated to be worse than last month’s outcome regarding investor outlook. The past three months have been negative. The E.U is certainly facing recessionary pressure. Oddly enough, a poor outcome could spur on the belief the ECB may have to become less aggressive regarding their higher interest rates. The EUR/USD may see a flurry of reactions from this report.

Tuesday, 8th of July, China Trade Balance – the results will get plenty of attention because recent economic data from the nation has been troubling. Export demand is important for China’s economy.

Tuesday, 8th of July, Germany Final Consumer Price Index – the result is expected to match the forecast of a 0.3% gain. This inflation report will be watched by EUR/USD, but if expectations are met this could create rather consolidated trading until Thursday for the currency pair.

Wednesday, 9th of July, China CPI – the inflation data from the nation will be watched by global investors. Recent statistics from China have signaled concerns about ‘deflation’. An outcome of minus -0.5% is expected. Economic issues are shadowing China, this as it remains active in global affairs.

Last week Argentina announced China helped facilitate a ‘bridge loan’ for the South American nation so it could make a repayment to the IMF. Rising economic concerns in China could start to squeeze its ‘cash power’ as it tries to gain influence globally by pumping Yuan (CNY) into international finance. China has certainly been bold and is playing a ‘long game’, because its choice of Argentina as a nation to help can certainly not expect to produce short-term financial gains.

Thursday, 10th of July, U.S CPI – Consumer Price Index results from the States will cause potentially dynamic broad market movement. Inflation is expected to match last month’s rise of 0.2% via the broad and core numbers. However, traders should note that some analysts have voiced concerns rising energy prices the past month will hit the inflation numbers, if this occurs it could spark a volatile USD. Higher Crude Oil prices combined with a streak of U.S hot weather may create an intriguing outcome. Risk management should be used by day traders who are wagering in the markets as the CPI readings are released.

Friday, 11th of July, U.K GDP – the Gross Domestic Product numbers will be important immediately for the GBP/USD. Although last month’s outcome was slightly stronger than anticipated it was still negative with a minus -0.1% reading. The growth number this time around is expected to gain 0.2% per the monthly report.

Friday, 11th of July, U.S Producer Price Index – economic numbers from the States have been mixed recently. These inflation numbers are expected to show a slight rise, if the outcome meets expectations – the broad markets may remain calm. However, if inflation is stronger than expected, the result could set off fireworks if the outcome sets off fears about the U.S Fed maintaining it hawkish rhetoric.