Trump Bounce Potentially Coming This Week in Equity Indices

Trump: U.S equity markets will be closed Monday for MLK Day. Upwards momentum developing this week as Trump White House takes power would not be surprising.

Retail traders need to know that U.S equity markets will be shuttered on the 20th of January because of the Martin Luther King Jr. holiday. Importantly tomorrow is also the United States Presidential Inauguration. Donald Trump will retake power of the Executive Branch of the U.S government at noon in Washington D.C as he is sworn in as the 47th President. U.S stock markets have produced choppy results the past few months but still remain in sight of highs. It would not be a shock to see optimistic momentum develop on Tuesday in the U.S stock markets near-term.

Yes, financial institutions have known Trump will be taking the White House for two and a half months and have had plenty of time to already react regarding their outlooks. However, from a behavioral sentiment standpoint it is easy to deduce that Trump’s coming inauguration speech tomorrow will deliver a confirmation of his economic policy intentions. Financial institutions near-term may produce optimistic upwards trajectory and they may have psychological targets which take into account late November and early December 2024 highs in the S&P 500.

The coming week will also be light on U.S economic data, except for the weekly Unemployment Claims on Thursday, Flash Manufacturing PMI and Existing Home Sales on Friday. Meaning the week will be driven largely on sentiment generated via President’s Trump’s actions in the coming days. Trump is expected to deliver a series of Executive Orders which will affect outlooks and likely be reflective of his campaign rhetoric spoken the past year.

Retail traders should not bet blindly on upside via CFDs for the S&P 500, Nasdaq and Dow 30. Near-term prices are not guaranteed to move higher, but there is reason to suspect buying might prove positive. An interesting barometer for price action will certainly be seen via future contracts early on Tuesday morning as financial institutions return to full volume and get set to return after a long holiday weekend. Risk taking tactics should include price targets that are realistic and not be leveraged wildly.

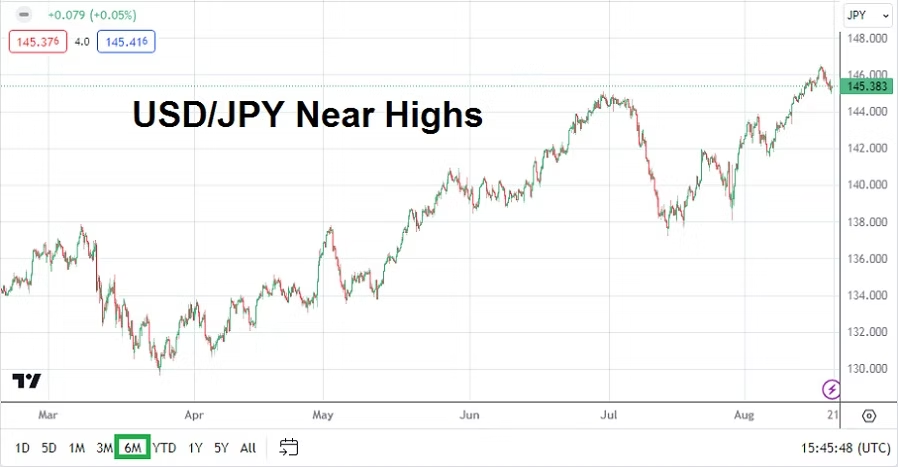

Forex conditions may prove volatile this week, and traders need to remain cautious about betting against the strength of the USD which has been ferocious the past three months. U.S Federal Reserve outlook remains murky and cautious, and nervousness regarding Trump’s intended foreign policy changes including trade negotiations still have to be fully demonstrated. USD centric risk bullishness likely still has ammunition which will be displayed in the coming days.