AMT Top Ten Miscellaneous Picks for the 26th of April 2024

10. Salk Institute: Work known as the Harnessing Plants Initiative is focused on optimizing the ability of plants to help combat climate change, sometimes via root systems in order to help reduce carbon dioxide. Problematically when plants die they do release carbon dioxide too. One key to the HPI project maybe altering the affects of Suberin. The Salk Institute received 50 million USD last year from the Hess Corporation to fight climate change.

9. Anticipation: Chicago is celebrating today after landing quarterback Caleb Williams and wide receiver Rome Odunze as hoped. However, as the August 2024 Democratic National Convention approaches, trepidation for the potential of nasty demonstrations is building.

8. Quantum Investing: Oak Ridge National Laboratory has announced a successful test using the H1-1 computer via Quantinuum to study the spread of disease via quantum mathematical models. Honeywell International Inc. owns a large stake in Quantinuum which is a stand alone company valued at approximately 5 billion USD.

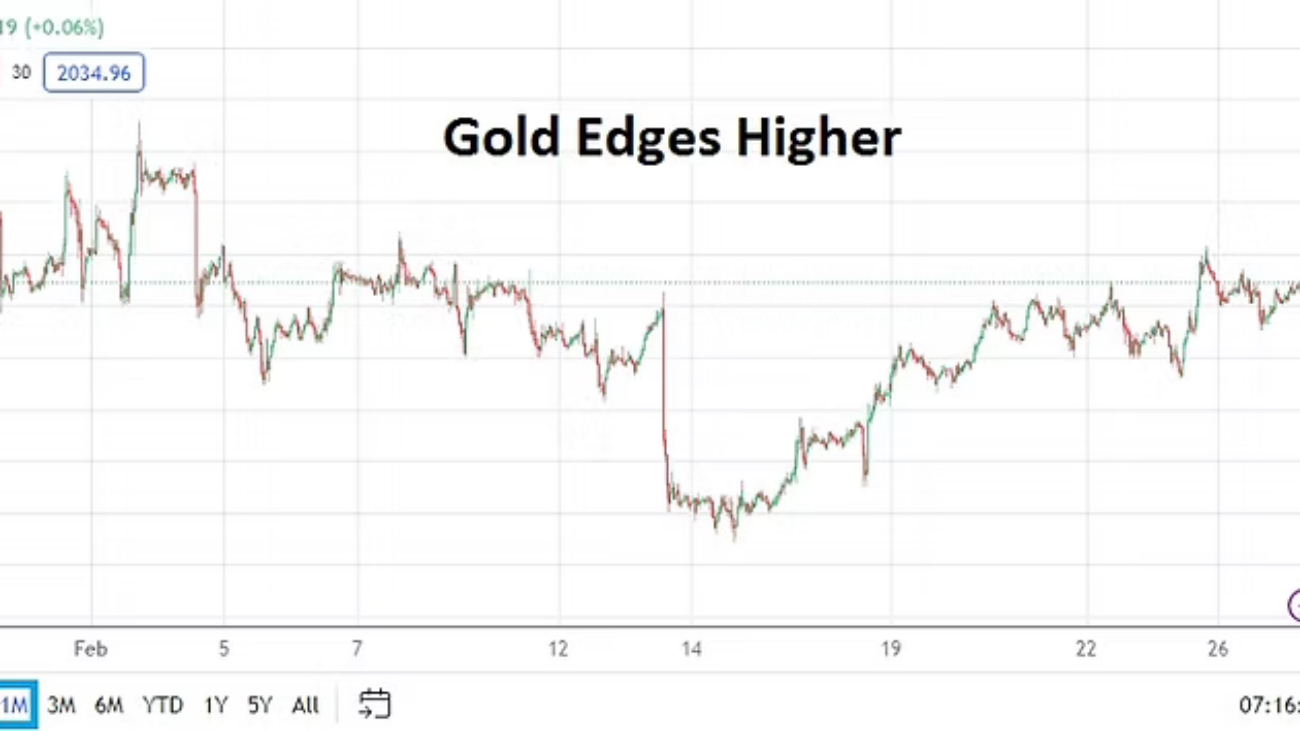

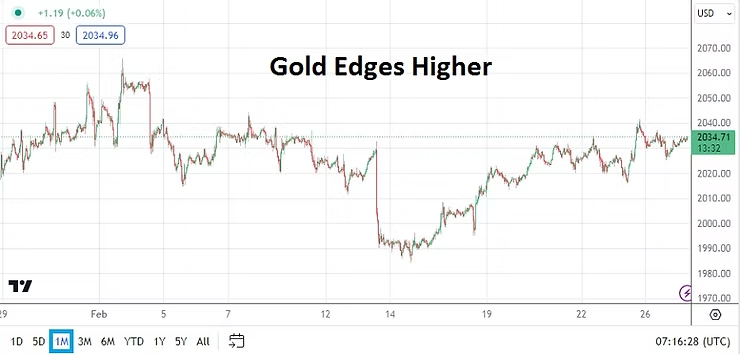

7. Speculative: Gold is near 2348.00, the price is below values seen last week, but remains high via some perspectives as the USD creates havoc.

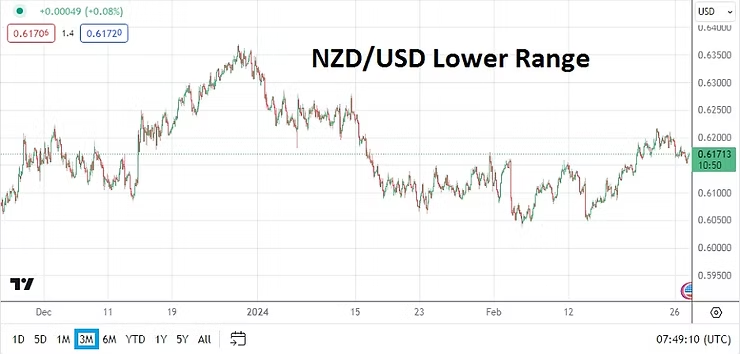

6. Forex: Whipsaw volatility has been seen in foreign exchange as financial institutions fight to get a proper gauge on their mid-term outlooks. Equilibrium will continue to be fought over today.

5. Fixed Income: U.S Treasury yields are battling within higher ground as investors look for guaranteed returns as behavioral sentiment remains fragile. And there is a likelihood the next four days of trading will continue to produce a whirlwind.

4. Equities: Major U.S indices continue to grapple with headwinds caused by a murky economic outlook. Retail traders speculating via CFD’s should remain careful. Patience is a key for the S&P 500, Nasdaq Composite, and Dow 30. Trying to ‘time’ the indices for short-term wagers is dangerous because technical trends are vulnerable.

3. Data: U.S Core Personal Consumption Expenditures Price Index statistics will be released today, inflation via the GDP Price Index came in higher than expected yesterday. Forex will react to the PCE results which is anticipated to have a gain of 0.3%. Financial institutions do not need another scare today. The Revised University of Michigan Inflation Expectations reading should also be given attention which will be published afterwards.

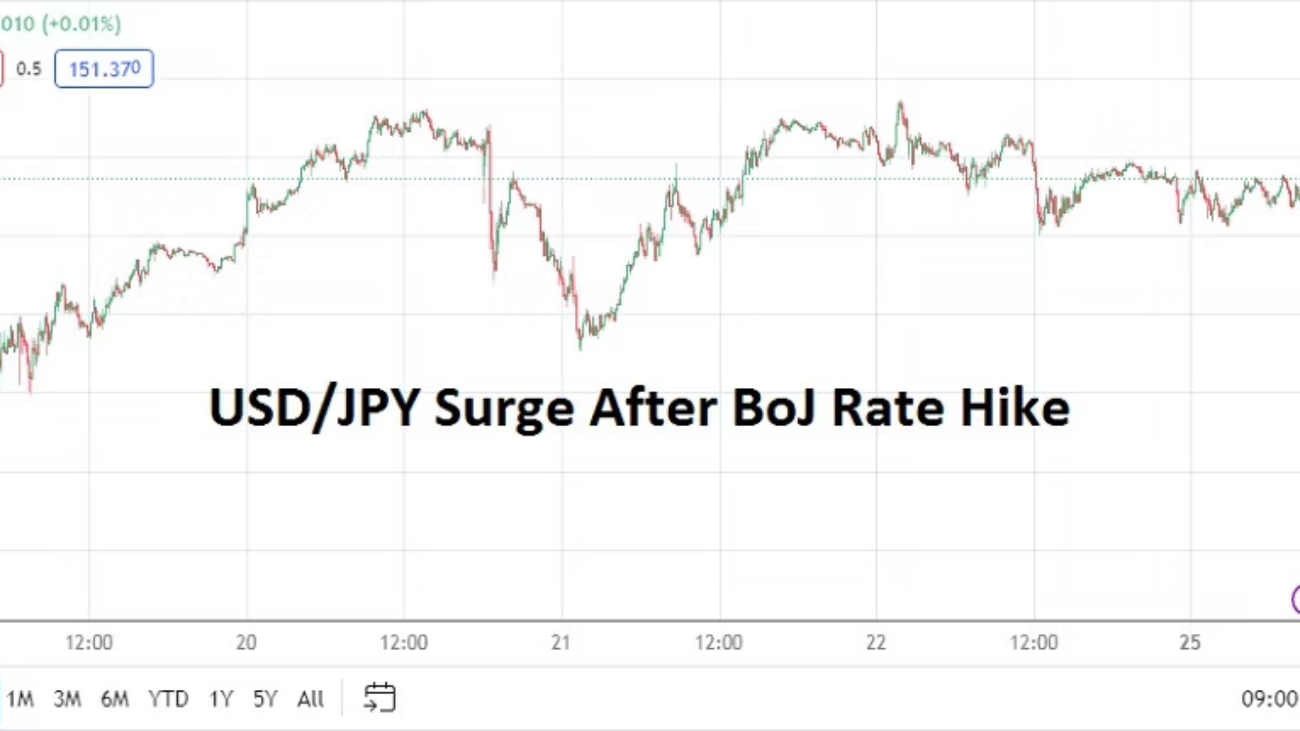

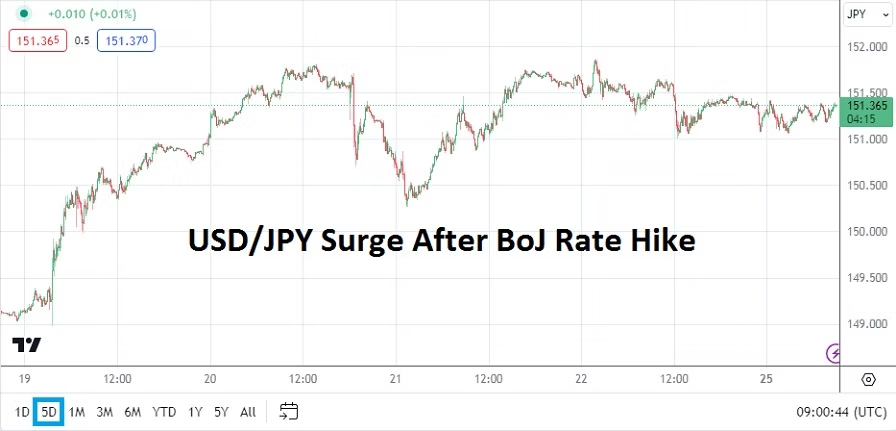

2. BoJ: The Bank of Japan is clearly playing a game of truth or dare with Forex. Having held interest rates at merely 0.10% earlier today, the USD/JPY climbed comfortably above 156.000 and is presently near the 156.540. The BoJ will remain in the news as the USD/JPY trades around a 34 year high. As financial institutions clamor for a higher interest rate, the BoJ apparently is more concerned with creating dynamic export demand and growing Japan’s economy, believing it can keep inflation under control. Speculators need to be on alert for an intervention from the Bank of Japan, but cannot count on one either.

1. Analysis Paralysis: The Federal Reserve was served an intriguing dose of results via the lower than expected growth numbers from the Gross Domestic Product yesterday, while digesting a higher GDP Price Index. Jerome Powell has stressed caution and patience. However, yesterday’s stubborn inflation numbers with waning growth creates the prospect for stagflation. This is an important political year because of the upcoming U.S elections in November. Next Wednesday the Fed’s FOMC Meeting pronouncements will be made. There will not be a change to the Federal Funds Rate on the 1st of May. It is the FOMC Statement’s vocabulary which will get attention. Today’s inflation reports will play a role in next week’s Fed meeting. Day traders may want to tune out political noise from pundits today which will certainly be sounded. The inflation numbers globally are tricky, and have created overthinking by investors and central banks which remain mostly reactive.