Market Volatility Shelf Life Doesn't Have an Expiration Date

Updated: Apr 11

An associate in the financial world just wrote to me that “all bets are off”. Perhaps that is a solid way to think about the present speculative and investment situation. The tumultuous wave of hysteria in equity indices, Forex, commodities and U.S Treasuries are evident to everyone. President Trump’s tariff policies released last week lacked precision via perspectives for many investment institutions who suddenly had their mirage of calm destroyed. The realization that President Trump was undertaking what he had promised caught many by surprise who thought he was bluffing. Trump’s ‘Art of the Deal’ tactics are now being confronted by middlegame chess strategies from opponents.

While the broad markets have boiled and folks look for calm to return, the prospect that current volatility has the potential to carry a long shelf life with no expiration date has to be considered. Yes, the financial world will become serene again. The return of semi-tranquil trading has been seen in the Nasdaq, S&P 500 and Dow 30 the past couple of days – only because the losses and gains depending on the index have been moderate compared to last Thursday’s and Friday’s results.

Yet the shadow of more violent trading remains crystal clear. China and the U.S are now exchanging loud threats which include higher tariffs and retaliatory measures. The USD/CNY is under scrutiny as devaluation by China appears an evident threat. And U.S Treasuries are being watched as some contemplate that China is undertaking a selloff of U.S bonds. Higher U.S yields on long-term Treasuries will create pressure via the amount of debt the U.S will be obligated to pay.

Vice President J.D Vance’s peasant comments about China were not helpful on Tuesday. Why must a hornets nest must be stirred up? China has now been hit with a 104% tariff from the U.S, this while China has vowed to ‘fight till the end’ in its media. Asian markets are selling off cautiously this morning as tensions reignite. Forex pairs such as the USD/SGD, USD/ZAR and USD/BRL should be watched as a barometer not only by currency traders, but by those who want metrics regarding how global economic sentiment and credibility of policies are being contemplated. Risk adverse trading in emerging markets will cause harm and has the earmarks of looking like a stiff penalty for nations trying to develop and raise their standards of living.

While the start of this week has been smoother in relative terms compared to last week, the lack of a comprehensive end game is still missing. There is merit to treat current circumstances with cautious respect. The mid-term outlook remains highly questionable as President Trump and his negotiation gambits are tested publicly.

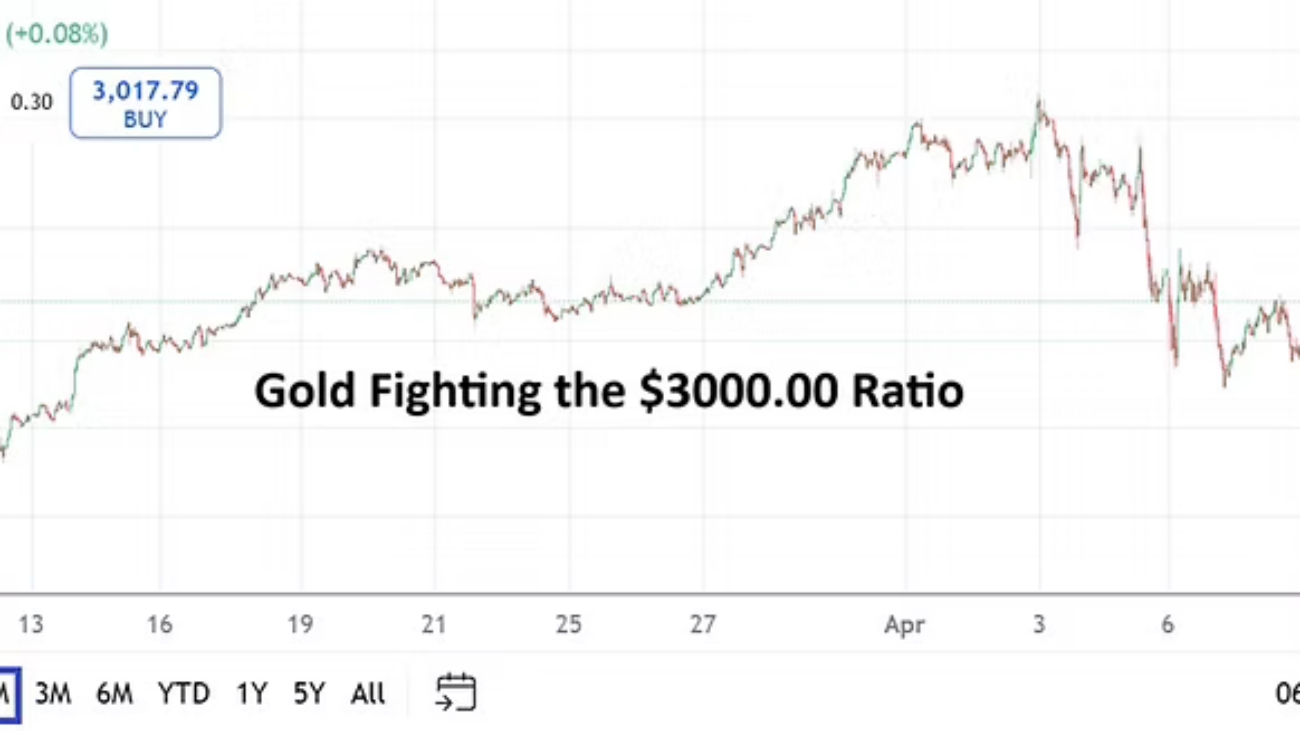

Gold has stumbled back to the 3000.00 USD level, WTI Crude Oil is down and these two commodities are intriguing as a looking glass into the hearts of large players. Are people selling gold short-term because they believe inflation will lessen because of a recession which some are forecasting, or is it merely a speculative move? Gold certainly carries an important risk adverse power and its lower move showed be looked upon skeptically.

Is WTI Crude Oil selling off because there is a belief there will be less demand due to fear tariff policies will influence a stumbling global economy? This viewpoint is plausible, the price of the commodity falling below 60.00 USD is a warning that large players are not comfortable with their outlooks and view downside risks as legitimate. The energy selloff in the past couple of hours is a negative barometer for what potentially is in store the remainder of the day in the broad markets.

The lack of finesse exhibited during these tariff negotiations is not palatable, the taste in the mouths of financial institutions has them worried. And outlooks via talking heads and analysts must be treated carefully by traders, this as they try to digest the onslaught of information and complex economic scenarios. Importantly, day traders should avoid getting caught up in the deleveraging talks surrounding the notion that large financial institutions will now pull money out of their U.S based investments in companies via stocks and Treasuries. Traders need to consider the bias of the people they are listening to and reading, and consider the scope and might of the U.S economy mid and long-term. There will be value found after the massive selloffs.

As a side note Warren Buffett has let it be known for a while he is sitting on a large amount of cash via Berkshire Hathaway. And folks should note that the annual meeting for Berkshire Hathaway is on Saturday the 3rd of May, which means people should get ready for insights from Buffett and his legions of admirers in the coming weeks. Certainly, Buffett’s comments and potential actions will be watched carefully.

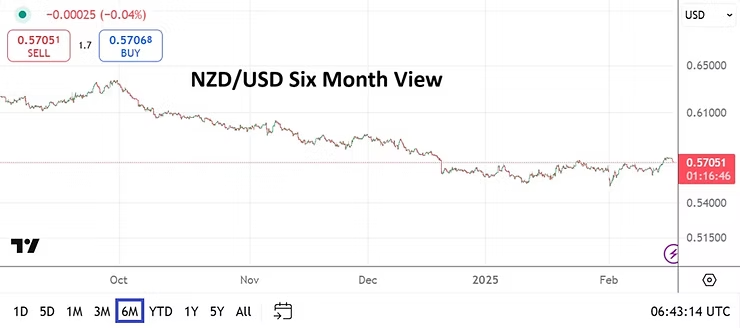

The U.S Federal Reserve has taken a wait and see approach to the Trump tariff implications. Calls for an immediate cut of the Federal Funds Rate have not caused Fed Chairman Jerome Powell to shift his cautious stance yet. The coming days could bring a different attitude from the Fed if equity markets and U.S Treasuries perform badly. In the meantime some central banks have said they might become more proactive – the Reserve Bank of New Zealand cut its interest rate by 25 basis points this morning to 3.50% and said it will continue to cut their Official Cash Rate if tariff policies create more negativity.

The consideration by financial institutions regarding the beginning of a paradigm shift of the global economy is justified. However, the ramifications of the Trump tariff policies have a long way to go before these present days will be able to be pointed to as the moment the world decided that it no longer wants to participate in the U.S marketplace. That notion seems farfetched. The USD remains the world’s reserve currency, its corporations remain extraordinarily large and valuable, and U.S Treasuries as they absorb current volatility and see yields moving higher in the 30 Year bonds cannot be viewed as an economic apocalypse – yet. Yes, the warning signs are meaningful and the Trump White House will need to respond diligently.

Again, the past week of trading has seen vast disarray, but we have been here before. It is important to recognize that current circumstances however do remain dangerous, this because we are still in the midst of the crisis. At some point, egos will have to be put to the side. The Trump White House will have to negotiate with China. China may be vulnerable, but so is the U.S. Why be belligerent and show no respect to each other? The remainder of this week’s trading will produce more whipsaw results. Selling looks to be in vogue once again this morning. Behavioral sentiment and understanding its power need to be contemplated as folks await sunnier days.