AMT Top Ten Miscellaneous Interpretations on the 13th of Oct

10. Language: The French word histoirie includes both history and story via its English interpretation. The French usage conveys the acknowledgement that history is often subjective and a story written with an opinion which may or may not be the correct narrative.

9. Subway Series: New York baseball fans will be in an uproar this coming week as the Mets play the Los Angeles Dodgers, and the Yankees face the Cleveland Guardians. The potential of a crosstown World Series will have NYC holding its collective breath. New York fans shouldn’t celebrate too soon, because the Dodgers are dangerous and the Guardians will be competitive.

8. Free Press: CBS News in the U.S has been widely condemned this past week. Video released shows ’60 Minutes’ explicitly edited an interview with Kamala Harris. Also, a recorded and ‘leaked’ staff meeting from CBS management has come to light in which Tony Dokoupil, a news anchor, is reprimanded for asking critical questions to writer Ta-Nehisi Coates.

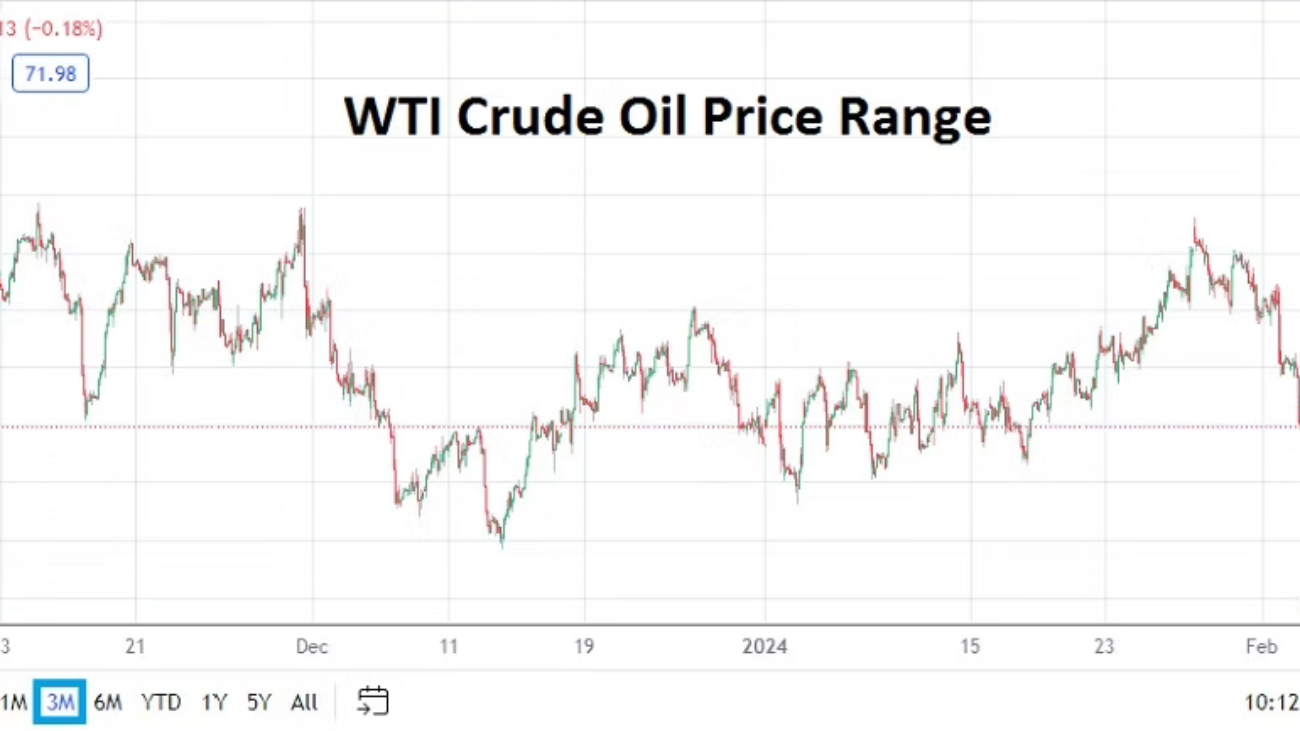

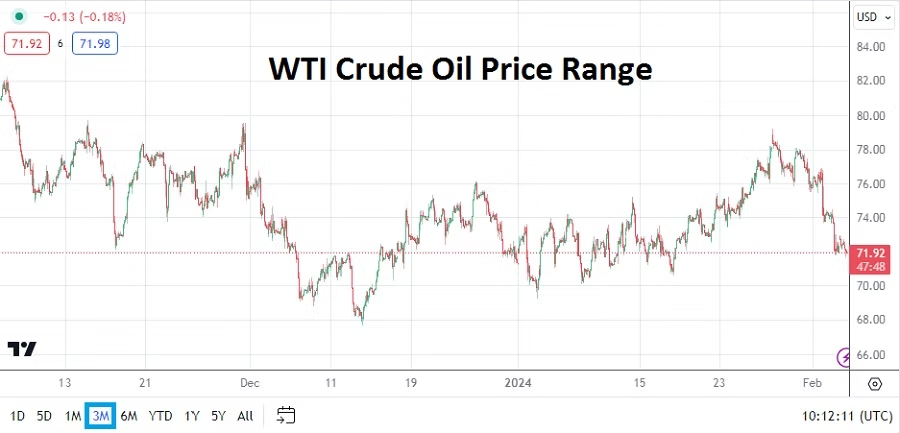

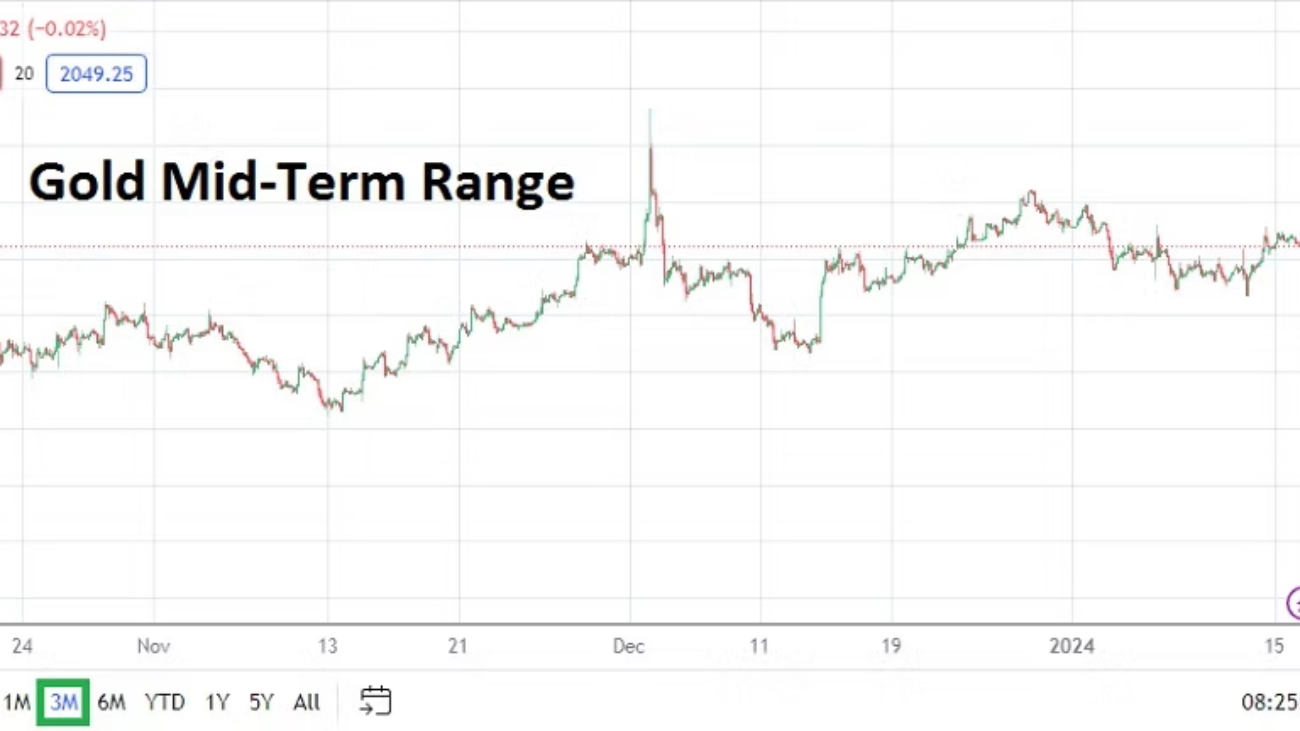

7. Barometers: Gold went into this weekend near 2,656.00, WTI Crude Oil closed around 75.45 on Friday, and U.S Treasury yields increased this week and are now challenging values last seen in the third week of August. Intriguingly, the major U.S equity indices continue to flirt with highs. Broad market results appear to be walking a tightrope as financial institutions seem to be waiting for November and U.S election outcomes. However, long-term investors who are diversified maybe cynical of this thought, and believe buy and hold remains the best policy.

6. Buy or Sell: Negativity surrounding Boeing via workers who are on strike, layoffs, a potential corporate bonds downgrade, production delays, and court decisions are still shadowing. In December of 2023, Boeing was near 265.00 USD per share value. Prices were near 158.00 this time last year, and as of this weekend Boeing is close to 151.00. The bad news surrounding Boeing has been a thorn in the side of investors. Boeing is a major corporation in the U.S and relied upon militarily and for global public aviation. What is the downside potential for Boeing the next year compared to upside capabilities long-term?

5. Crypto: The SEC has filed charges against Cumberland DRW LLC, claiming the crypto exchange has been acting as an unregistered dealer. https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26151 It appears the SEC is growing more aggressive via confrontations with U.S based cryptocurrency exchanges. The U.S election result will play a role in the future leadership and direction of the SEC, and could have an affect on cryptocurrency values. BTC/USD is near 62,700.00, ETH/USD around 2,465.00, BNB/USD about 575.00 at the time of this writing.

4. Tranquility: Stronger USD centric price action continues to create some downwards motion for other major currencies, but price velocity was not as violent last week compared to previous days since the end of September. Fragile sentiment in financial institutions is still stirring. The ECB rate decision this week will come Thursday and a 0.25 basis point cut is expected. Traders need to remember that a change to the European Central Bank’s Main Refinancing Rate has likely been priced into the EUR/USD. What needs to be heard now is ECB rhetoric and that is likely to remain guarded. Price velocity in Forex remains a danger for retail traders this coming week.

3. U.S Election: There are only three weeks left until the U.S vote. Day traders need to understand financial institutions will grow more cautious as the election approaches. Speculators may want to try and wager on the outcome of the election, but unless a definitive result is predictable beforehand, it will be hard to take advantage of political winds which are swirling. It will be nearly impossible for day traders to hold onto a position over the next few weeks unless they have deep pockets, use no leverage, and have the patience of a saint.

2. Make or Break: China will release important economic data this week. Trade Balance and Foreign Direct Investment numbers are tentatively scheduled to be released on Monday, along with New Loans reporting. This coming Friday New Homes Sales, GDP, and Retail Sales figures will be released. China is trying to stimulate the economy with billions of cash, but critics suggests this will not work. The Shanghai Composite Index is near the 3,217 mark, on the 30th of September the SSE was near 3,675. Before the China stimulus was released the Shanghai Composite was near 2,755. Bullish SSE momentum has run into headwinds since the beginning of October, China may be pressured to try and create more stimulus, but will it produce a lasting positive result? Traders caught up in the buying frenzy in late September are likely getting more nervous about declines. The USD/CNY is near 7.066. Chinese economic data should be monitored this week.

1. Interest Rates: The Federal Reserve via the CPI and PPI inflation reports still appears able to cut another 0.25 basis point from the Federal Funds Rate on the 7th of November. While the Consumer Price Index data showed a slight tick up in a few categories, Friday’s Producer Price Index met expectations via the core monthly report and the broad monthly outcome came in less than anticipated. The November interest rate decision is important regarding consistency per the Fed’s messaging the past two months, and mid-term behavioral sentiment outlook among financial institutions. U.S Retail Sales and Housing numbers will be published this week.