Trump: Will He or Won't He Day and Uncertainty for Investors

Liberation/Tariff Day will blow onto the global financial shores this morning. President Trump and his team are certain to take a victory lap as they announce their decisions regarding actions being imposed on commodities and products. Nations who are on the other end of the drama will be braced for the rhetoric and policies. Investors, trade ministers, financial institutions will have to sift through the pronouncements and consider their outlooks amidst uncertainty.

Trading today will be rough for smaller speculators. Choppy conditions should be expected as behavioral sentiment twists according to shifting winds and interpretations. President Trump is likely to announce aggressive penalties, but he may also try to soothe those who have worried about being punished. As an example, Trump has said recently that India has acted upon many of the White House’s wishes. Mexico, Canada, the European Union and China are likely to be mentioned as the U.S President speaks later today. Will a public scolding take place again?

Equities have faltered the past month, Forex has been volatile and commodity prices have also reflected fragile sentiment as outlooks became grey. The tariff policies announced today will affect all aspects of the financial world. Day traders thinking about wagering on the outcome should be patient and wait for the reactions which unfold from Asia, Europe, Africa, and the Americas. Wall Street will certainly be a barometer, along with the EUR/USD, USD/MXN, USD/JPY, GBP/USD, USD/SGD and gold.

While President Trump declares this is a great and magnificent day for the U.S, it will be of keen interest if an olive branch is offered to trading partners. After talking tough the past few months, financial institutions would like to hear words of optimism from the White House. If belligerence is heard and punitive actions are enacted, which are considered unproductive by investors and financial institutions the broad markets will show their disdain promptly.

President Trump’s skills as a negotiator will be judged today. The White House must play towards its constituency and show they are putting America First, but will the President also display he is cognizant that international trade provides benefits? Trump will point to his claim that he is merely putting tariffs on those who have treated the U.S unjustly and use levies against U.S goods.

It will be an important day for the Trump Presidency, because in many respects the global audience watching will decide whether or not the U.S sees itself as part of the global fabric or seeks a position which is isolationist. Brazil will look on the tariff theater intently, its position as a trading center may find increased demand from a host of nations.

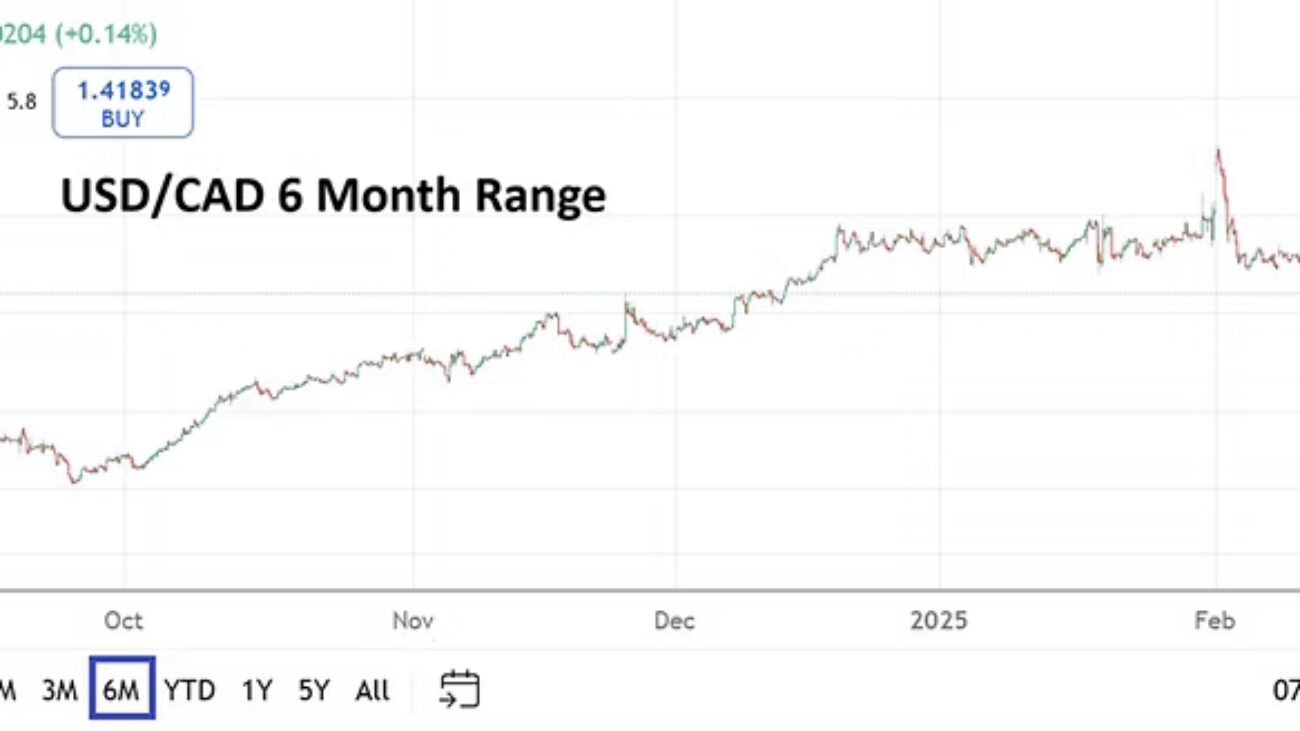

Predicting the results: On the 3rd of February a fast and dangerous Forex market developed which witnessed USD centric strength exhibited with spikes in many currency pairs. In early March reactionary trading was displayed in equity indices, Forex and bonds too. Today will see wide spreads emerge in Forex with near-term resistance and support levels proving vulnerable.

Equities which sold off in March via the Nasdaq 100, S&P 500, Dow 30 and the Russell index are certainly hoping for a dose of cheer. The question is if Trump will deliver a positive message. The likelihood is that today’s events will not be the last of the tariff tirades and some proposed actions remain under deliberation. Today is unlikely to produce final results and the broad markets are probably going to be choppy as outlooks stay mitigated and absent of clear resolutions.

Day traders should think safety first today. Gold remains within record territory. If unpredictability rules near-term and the reactions of investors and financial institutions create fast conditions, the precious metal and bonds will find takers. Uncertainty breeds cravings for risk adverse assets.