AMT Top Ten Miscellaneous Pre-Xmas Thoughts for 22nd of Dec.

10. Music: The Nutcracker by Pyotr Ilyich Tchaikovsky via Simon Rattle and the Berliner Philharmoniker.

9. Book: Zhou Enlai: The Last Perfect Revolutionary by Gao Wenqian.

8. Mobile Gaming: Revenues from ‘gaming on the go’ in 2023, via an Electronics Weekly article, is estimated to be 92.6 billion USD worldwide. Honor of Kings via Tencent leads the pack.

7. Data: U.S Final GDP quarterly numbers came in at 4.9%, missing its estimate of 5.2%. Final GDP Price Index quarterly results were 3.3%, below the anticipated mark of 3.6%. Canada will release its GDP numbers today for those paying attention.

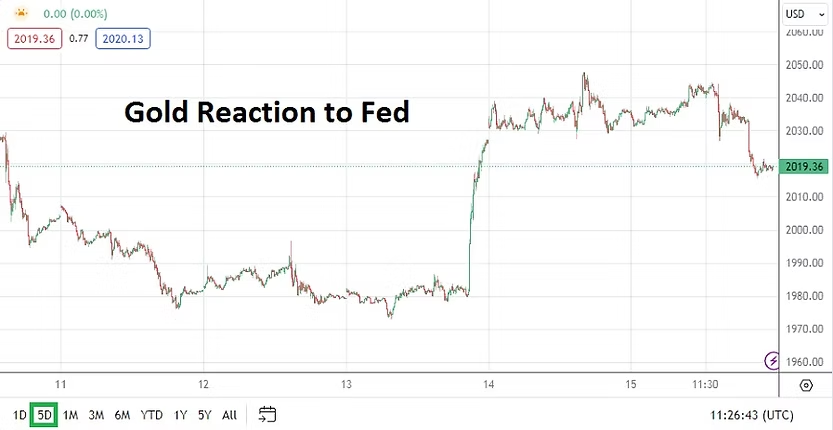

6. USD: The greenback continues to produce incremental declines. Yesterday’s ‘weaker’ U.S GDP numbers helped solidify a bearish USD outlook mid-term.

5. Trading Volumes: Speculators who insist on wagering today need to understand many financial institutions are closing early. ‘Thin’ holiday markets can be extremely quiet and then become volatile without warning.

4. Global Risk: As traders relax during their holiday break, they should monitor news about the Red Sea for potential problems caused by the Houthis rebels from Yemen.

3. China: Economic concerns are mounting for the nation. The Shanghai Composite is approaching lows last seen in October of 2022.

2. Holiday Markets: U.S equity indices continue to show solid risk appetite. S&P 500 is now approaching all-time highs seen in 2022. Dow Jones 30 is at a record level. Nasdaq Composite trend still bullish.

1. Thank you: We wish all readers who are celebrating Christmas a fantastic holiday.