Impact: Powell's White Flag, Inflation Data, and the BoJ

Federal Reserve Chairman Jerome Powell’s waving of the ‘white flag’ last Tuesday, when he admitted that inflation was producing stronger than anticipated data had been essentially wagered on since the second week of March by financial institutions. Powell’s speech acknowledging the Fed will find it difficult to cut the Federal Funds Rate in the mid-term (and probably at best not until late this summer) simply verified Forex positions which had already been taken by large players who could afford to make mid-term wagers.

The USD Index has returned to early November 2023 values, and appears able to challenge late September and October prices if inflation data this week causes more volatility, which should put traders of major currencies like the GBP, EUR, JPY and others on full alert. After the USD spiked higher from the 10th to the 12th of April, Forex speculators have seen dynamic action incrementally flirting with stronger USD results the past week and a half.

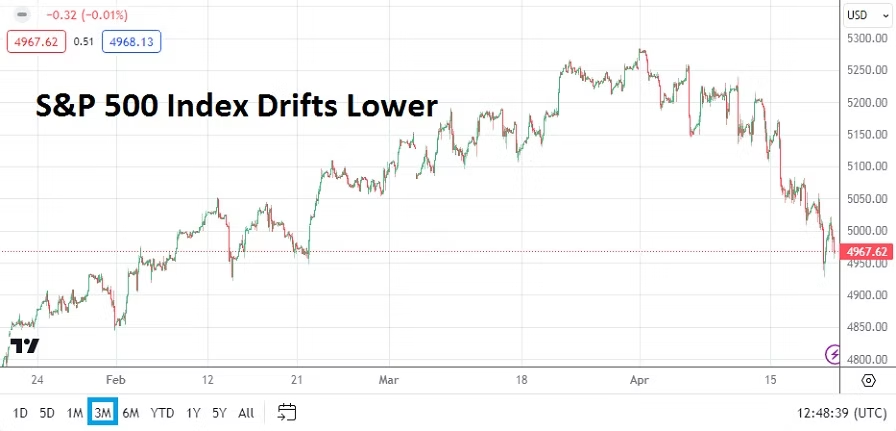

Nervous trading continues to be seen in U.S equity indices. The Dow 30 and the Nasdaq 100 are fighting near ratios they touched in the last week of January. And the S&P 500 is traversing ground from the first week of February.

Content

Gold remains speculatively high as its hovers near 2,400.00 USD per ounce. The price of the precious metal has not given back its gains made since the start of March and this is intriguing because of the ‘known’ USD inverse correlation, which had proven to work well with the precious metal over the past couple of years but has been stopped in its tracks for the moment. Technically Gold may look overbought, but geopolitical concerns and the prospect that some central banks may be strong buyers could be fueling the rather incremental gains. Retail traders of Gold need to be careful because price action is likely to produce more surprises.

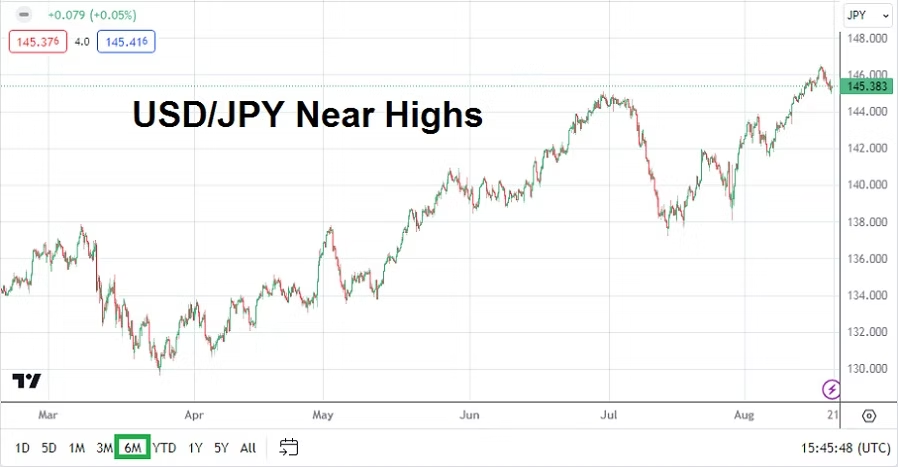

Forex has been turbulent the past handful of months as shifting behavioral sentiment has created choppy conditions. This coming week contains large fundamental risk events via data releases traders should monitor. USD/JPY speculators will also have to contend with the Bank of Japan.

Monday, 22nd of April, China Loan Prime Rates – borrowing costs are anticipated to remain at the current benchmarks. China produced slightly better Gross Domestic Product results last week, but Industrial Production numbers were weaker. Consumers in China remain burdened by decreasing home values and concerns about the economy.

Tuesday, 23rd of April, European Union and U.K Manufacturing and Services PMI – E.U results via the PMI readings are expected to show slight improvements. However the readings from the United Kingdom are anticipated to come in flat. The EUR/USD and GBP/USD will be affected by the results, but the currency pairs will likely remain focused on U.S data later in the day.

Tuesday, 23rd of April, U.S Purchasing Managers Index – the Manufacturing and Services sectors are expected to produce slightly better readings than the previous month. These results will be interesting taking into consideration the Empire State Manufacturing Index numbers last week were bad. The PMI statistics will provide some impetus to the broad Forex market.

Wednesday, 24th of April, Australia Consumer Price Index – inflation data is anticipated to be higher than the previous month’s results. While stronger inflation is not something that will make consumers happy in Australia, stubborn price results may keep the AUD/USD slightly steadier. The currency pair is traversing values last seen in the second week of November 2023 as of this writing.

Thursday, 25th of April, U.S Advance Gross Domestic Product and Price Index – these numbers are certain to have an impact on all financial assets. A decline in growth is anticipated in the U.S compared to the previous month’s result, but the Price Index is expected to show an increase. Jerome Powell having come out last week and said inflation is causing uncertainty within the Federal Reserve, may have a bit of inside knowledge regarding this GDP inflation number and ‘tipped his hand’. If this inflation gauge is higher than anticipated it could pour fuel onto the already volatile USD. All Forex traders need to pay attention to these results and be prepared with solid risk management.

Friday, 26th of April, Bank of Japan – in what has already proven to be a couple of weeks filled with drama for the USD/JPY, the BoJ will step into the limelight. During their last central bank meeting the Bank of Japan increased the Policy Rate to 0.10%. It was the first time the BoJ hiked interest rates in 17 years. The USD/JPY is trading at values last seen in June of 1990. The Nikkei 225 has come off of recent record heights, but the famed Japanese stock index is also trading within territory seen in January of 1990. Business activity via the Core Machine Orders and the Tertiary Industry data last week were stronger than anticipated.

The Bank of Japan may want to maintain a weaker USD/JPY equilibrium to continue fostering domestic growth. However, many financial analysts have been calling on the BoJ to become more hawkish regarding monetary policy. The interest rate decision is certain to cause immediate volatility before and after the Policy Rate is made public. USD/JPY traders need to be prepared for fireworks. A slight raise of the interest rate seems to be needed, but after the March hike the BoJ may prove conservative again. The 34 year lows now being seen in the Japanese Yen are astonishing.

Friday, 26th of April, U.S Core PCE Price Index, and Inflation Expectations – the data from the government, and the reading from the University of Michigan will close the curtain on a big week of economic statistics for all traders. The USD will react to these outcomes. It should be noted the previous Inflation Expectations data from the University of Michigan caused a storm in Forex when it came with 3.1% gain.