Retail Traders Caught Out by Shifting Sentiment as Data Hits

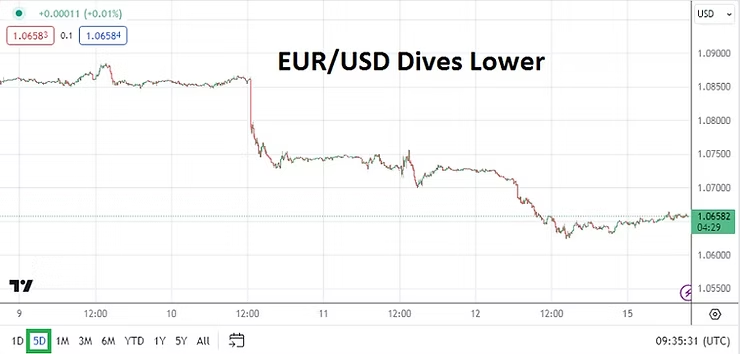

Forex speculators who relied heavily on technical data solely last week were likely punched in the gut by the rather surprising numbers from the Consumer Price Index results in the U.S last Wednesday, particularly if they were on the wrong side of trading trajectories. U.S inflation has shifted sentiment within many large investors with a rather seismic move regarding mid-term outlooks. Financial institutions which have been counting on cuts to the Federal Funds Rate have had to take a step backwards.

The dynamic momentum in Forex hit major currency pairs in the middle of last week and washed away support and resistance levels within a blink of the eye. Behavioral sentiment turned U.S Treasuries yields upwards and the major equity indices also experienced nervousness. Volatility also continued in Gold as new record values were produced, and then were followed by a rather strong reversal lower which likely hurt over-leveraged day traders.

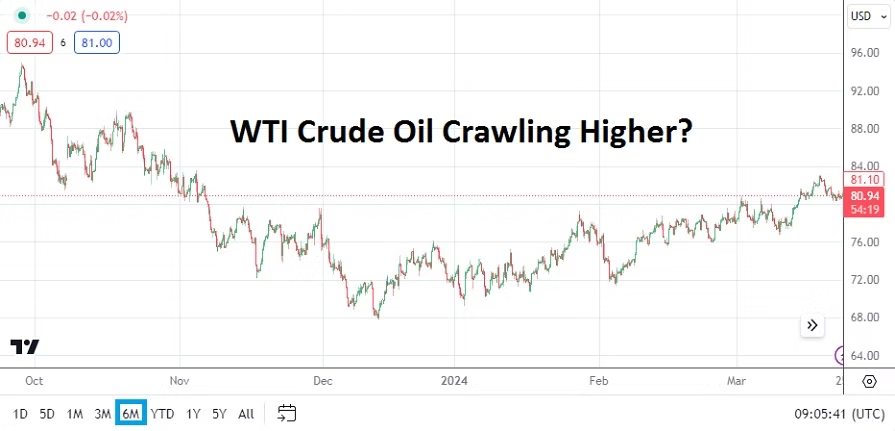

Not only were U.S inflation numbers important last week, but geopolitical noise became heightened. Perhaps the climb in Gold before the weekend was helped by the anticipated conflict between Iran and Israel which did play out. The price of the precious metal and WTI Crude Oil have been more tranquil early today, which may be a signal for the moment that large market players are calm.

Monday, 15th of April, U.S Core Retail Sales – after last week’s larger than expected increase in the CPI results, the spending report today will get attention from financial institutions. Last Friday’s Preliminary Price Expectations reading from the University of Michigan did not allow investors to rest when it came in with a 3.1% elevated mark. If today’s Retail statistics are above expectations, this could make Forex roil again.

Tuesday, 16th of April, China Industrial Production and Gross Domestic Product – these economic reports will be watched closely by international investors. While there have been murmurs that China’s economy is improving, and media reports that the Biden administration is trying to engage diplomatically, the industrial and GDP results are expected to be weaker than the previous month’s outcomes. China will also release Retail Sales figures.

Tuesday, 16th of April, U.K Claimant Count Change – last Friday’s GDP report from Britain did not produce any significant surprises. The U.K economy continues to struggle, but like most spheres inflation remains a problem. The GBP/USD sunk violently last week, while many speculators may believe it is currently oversold they may want to remain cautious.

Because of the U.S Federal Reserve’s own perilous fight against inflation, there are some who believe the Bank of England may need to cut interest rates before the U.S central bank. However, given the lack of proactive characteristics from the BoE and ECB which have been on full display as they dance in step with the Federal Reserve, this makes a BoE cut before the Fed a skeptical notion for the time being. The GBP/USD will stay largely USD centric even in the wake of this U.K employment report.

Tuesday, 16th of April, U.S FOMC Members – a parade of Federal Reserve voting policymakers will speak at various events, this includes Fed Chairman Jerome Powell. There will likely be little in the way of surprises from the Fed members as they likely all stick to ‘party’ lines and emphasize a cautious outlook.

Wednesday, 17th of April, U.K Consumer Price Index – the inflation report could prove to be catalyst for the GBP/USD. If the CPI number does come in weaker than expected it could spur on behavioral sentiment shifts regarding the potential for changes to BoE policy. Because the GBP/USD was so volatile the past week, day traders should be prepared for rather combustible price action from the currency pair which may look counter-intuitive. Smaller speculators should remember that ‘smart money’ from larger players may be positioned for the results of the U.K CPI data already.

Thursday, 18th of April, U.S Weekly Unemployment Claims – although not the most significant of reports usually, financial institutions are ‘waiting’ on a change of statistical direction via labor market evidence. If jobs numbers start to come in weaker than anticipated – meaning there are higher jobless claims – then the USD could react with some selling.

Friday, 19th of April, U.K Retail Sales – having endured a rather wild trading cycle, Great Britain will deliver one more important economic report to end this week. The GBP/USD will react to the consumer spending results.