Apolitical Doesn’t Mean Blind to the Trump Forex Reality

Has everyone stopped panicking in global Forex? It appears financial institutions are showing signs of stability and perhaps even optimism, this as USD centric strength appears to actually have begun giving back the outlandish gains made on Monday when spikes higher were seen across Forex.

The nervous buying of the USD early on Monday morning erupted after President Trump’s ultimatums were not taken seriously by financial institutions late last week. Outwardly it appears that the targets consisting of Mexico and Canada going into the past weekend also wanted to make believe all would be fine. The only nation to say that it would negotiate with Trump prior to Friday was China. And now Mexico and Canada have largely fallen into line.

Speculators may want to be apolitical. They may want to believe Forex has nothing to do with politics. And some traders may not like President Trump and what he represents. However, Forex participants need to make sure they put their biases to the side and understand that economic rhetoric and actions from the U.S do effect the Forex reality.

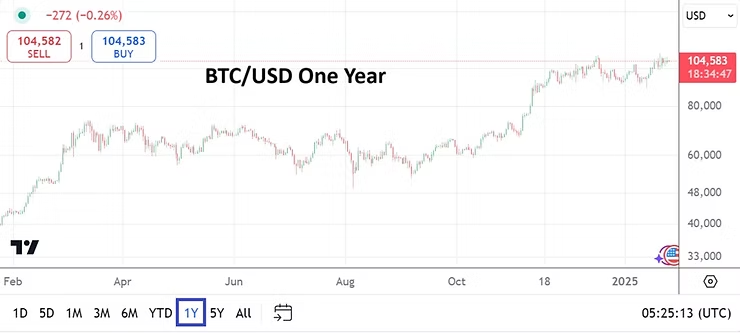

We have seen a vast example of this the past couple of weeks, in fact the past few months. Financial institutions have braced for and wagered on their outlooks since early November when the results of the U.S election became known. A strong USD centric element has been demonstrated as they prepared for President Trump to take executive power in the U.S again.

This past week has seen vivid Forex results and demonstrated why it is important to pay attention to international news flow, even when some may want to disregard what they are hearing. The price action in Forex particularly the USD/CAD and USD/MXN this week highlight the significance of not turning a blind eye. The highs seen on Monday followed by the reversals lower have brought support into view. Near-term and mid-term considerations will be fought over by financial institutions and retail traders may find technical opportunities to take advantage of nervous behavioral sentiment.

China which has dealt with President Trump before, appears to have handled the tariff bluster and negotiations better than Mexico and Canada. China has also been laying the groundwork to deal with the new White House administration based on having dealt with President Trump before. The USD/CNY has remained stable and China has set the table to deal with developing economic discussions in a calm manner.

It is not a question of liking or disliking Trump, it is a matter of understanding the reality and being ready to trade the circumstances that are seen across Forex. Bias when trading Forex can lead to bad decisions, it is not about betting on who you like, it is about wagering correctly on the results you believe will happen and managing your risks.