U.S National Security: USD Reserve Currency Importance

Opinion: The following article is commentary and its views are solely those of the author. This article was first published the 23rd of December via The Angry Demagogue.

We would like to start going through the U.S administration’s National Security Strategy released last month. There is a lot in there – much of it the same as in past administrations and much of it different. The tone of course is full Trump and while the introductory parts try to make it into a revolutionary document it does in fact build upon much of what has been American foreign policy for decades. One thing it most certainly gets right is that American foreign policy since the end of the Cold War has not found its compass. From a unitary world to one dependent upon global organizations, from a sharing of goals with western Europe to a pivot to Asia, from the war on terror and the middle east to Russia-Ukraine, the United States has struggled to find its way in the post-Cold War world.

We however will concentrate today on one aspect of the strategy, the third bullet in part III – “What Are America’s Available Means to Get What We Want?”. The third bullet point speaks of America having “The world’s leading financial system and capital markets, including the Dollar’s global reserve currency status” – a point that no one with any knowledge of global capital markets can not accept. The end of the bullet point – the Dollar’s global reserve currency status – is the most important because it underscores America’s leadership and essentially allows the United States of America to finance its military and its welfare state. The U.S Dollar as the “reserve currency” means that nearly all the world’s goods are quoted and therefore sold in Dollars.

Why is that important to the United States? Because the U.S government depends on its ability to issue Treasury bonds and bills at will – something no other government can do. It can do this because for another country to buy oil or copper or titanium or corn or soybeans from a country that is not their own– they need access to Dollars. Saudi Arabia and the other gulf states quote the price of oil in U.S Dollars and demand payment in U.S Dollars. The Saudis can deposit those Dollars in American banks or in what is called Eurodollar deposits in foreign banks (there are some 13 trillion Dollars in Eurodollar accounts globally). The Eurodollar accounts are essentially promises by the bank to give U.S Dollars to the holder when he makes a withdrawal. This strengthens the U.S capital markets and allows investors to have better and more investment choices. It is not only America’s often superior companies that bring profits to 401k’s and pension funds but the liquidity and vastness of America’s capital markets that can list domestic and foreign corporations. The reserve currency leading to the advanced capital markets allows the world – and America – to do this.

The U.S Treasury market is so liquid because every country needs Dollars in order to trade. They need to have enough dollar reserves since no one actually wants their own currency. In Israel, for example, local gas companies cannot buy oil with Israeli Shekels, since what will Azerbaijan, for example, do with them? There are only so many products that Israel can sell them. They need Dollars so that they are free to buy other commodities or other products.

The U.S Dollar as a reserve currency also is a break on inflation since the price of oil and other commodities is always in U.S Dollars. A weak or strong U.S Dollar influences the inflation rate in non-USD countries. A weak Israeli Shekel, South African Rand or Chinese Yuan does not influence the price of gasoline in the United States.

In short – as the Trump Administration understands well, the dollar as a reserve currency is a luxury the U.S cannot give up. The lack of the USD as a reserve currency could cause the Dollar to collapse and along with it the price of U.S Treasuries. As UST prices drop, their yields will rise and the cost of financing the U.S government will make interest payments on debt to rise well beyond its already absurd figure of over 4% of GDP – while debt itself is 120% of GDP. The U.S government currently pays over $1 trillion in debt service (interest payments on its bonds and bills). By contrast, the U.S defense budget for 2024 was $836 billion (about 3.3% of GDP).

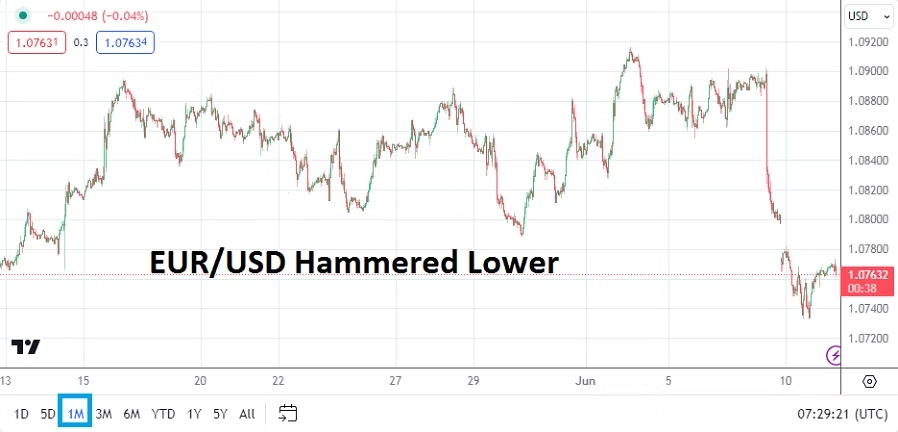

We need to ask ourselves what can challenge the USD as the reserve currency and what could happen that would encourage the world to change? While the E.U had dreams of making the Euro an alternative reserve currency, the lack of growth in the E.U’s economy and population have put that dream to rest. The only other country that could theoretically replace the United States as the global economic go to country could be China. While in the long run, China’s lack of openness would probably mean that the Yuan would not last long as the reserve currency, that does not mean that they couldn’t jolt the global economy just enough to force it to use the Yuan to buy oil and other commodities.

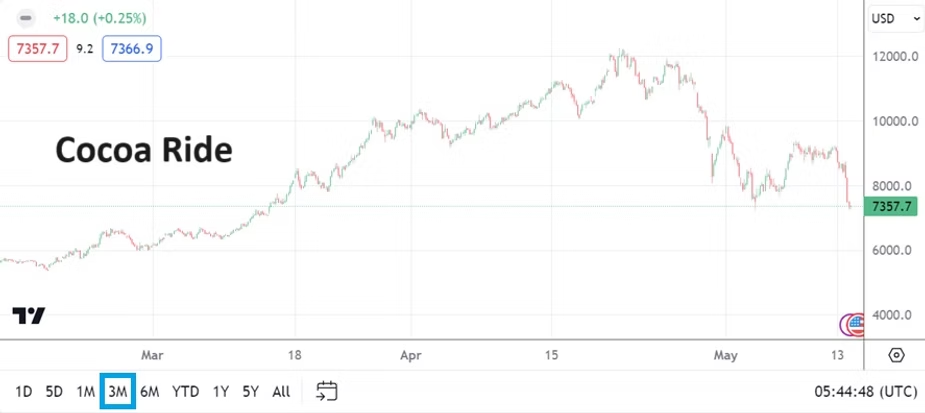

China is already cornering the market on rare earth minerals and it making inroads in Africa where it mines all sorts of commodities from gold to copper to platinum and so many others (Africa has about 30% of global mineral reserves). That in itself is not enough to rock the global markets and cause a change in how the world does business.

Oil though, is that one thing that could allow China to challenge the USD as the reserve currency, even if it just presents the Yuan as an alternative.

How could that happen?

A Chinese takeover of Taiwan, by whatever means it uses would give the Chinese Communist Party control not only of the South China Sea but also allow its noisier and inferior (to America’s) submarine fleet to enter the Pacific and patrol it freely. The Chinese Navy, with a base on the “other” side of Taiwan would give it control of the north-south sea lanes that Japan and South Korea are dependent upon. Essentially, Chinese control of Taiwan would put Japan, South Korea, Vietnam and the Philippines at the mercy of the Chinese Navy. China could blockade these countries but that would be an act of war and then involve the navies of those countries and possibly the United States. It would affect the global economy negatively but it would not cause a change in world’s reserve currency. But, what if China works out a deal with Saudi Arabia to quote and sell their oil in Yuan (or the Chinese Petro-Yuan it wants to create) and then tells these countries, especially industrial powerhouses and energy poor Japan and South Korea that it will allow the passage of oil as long as they purchase the oil in Yuan?

Russia is already trying to get India to pay it for its oil in Yuan, to some success. Adding economies the size of Japan and South Korea would mean that any country that wants to buy oil could buy it in Yuan instead of Dollars. Once in Yuan, these countries would need to use the Yuan to buy Chinese products, deposit cash there and buy Chinese treasury bills. If China were to combine that with demands that all chips made in Taiwan also be sold in Yuan, the U.S Dollar would suddenly and forcefully no longer be the only reserve currency in the world.

Obviously, the way to stop this from happening is by stating outright that the United States will not tolerate a Chinese takeover of Taiwan. It is true, that the Strategy claims that the US “will also maintain our longstanding declaratory policy on Taiwan, meaning that the United States does not support any unilateral change to the status quo in the Taiwan Strait” but in practice the administration has criticized Japan’s tough talk on China instead of leaving it be. A strong silence on Prime Minister Takaichi’s remarks on China would have served the purpose of keeping the status quo more than telling her to tone down her rhetoric. There is a strong “no intervention ever” strain in the country and the President must make the case that that is not an option if the United States wants to maintain its leadership position, way of life and general prosperity.

In short, the threat to the Dollar as the reserve currency heads right through Taiwan. For those who think that the investment the U.S makes in keeping the Dollar where it is, is too expensive, just think of going on vacation and having the change to Yuan before you leave the country, wondering how much to change because of currency fluctuation and how much fun it is to return with hundreds of dollars in banknotes that you can’t use. Imagine your credit card bill on such travels and wondering how you went 15% over budget but didn’t get anything extra for it. Now imagine the national economy working that way.

Disclaimer: the views expressed in this opinion article are solely those of the author, and not necessarily the opinions reflected by angrymetatraders.com or its associated parties.

You can follow Ira Slomowitz via The Angry Demagogue on Substack https://iraslomowitz.substack.com/

Related article of interest by Ben Ezra https://www.angrymetatraders.com/post/india-insider-why-russian-oil-should-be-treated-skeptically