A More Aggressive Sounding ECB Could be Wishful Thinking

Will an interest rate cut by the ECB spark near-term buying in EUR/USD today? Financial institutions want news they have anticipated, day traders need to understand this dynamic.

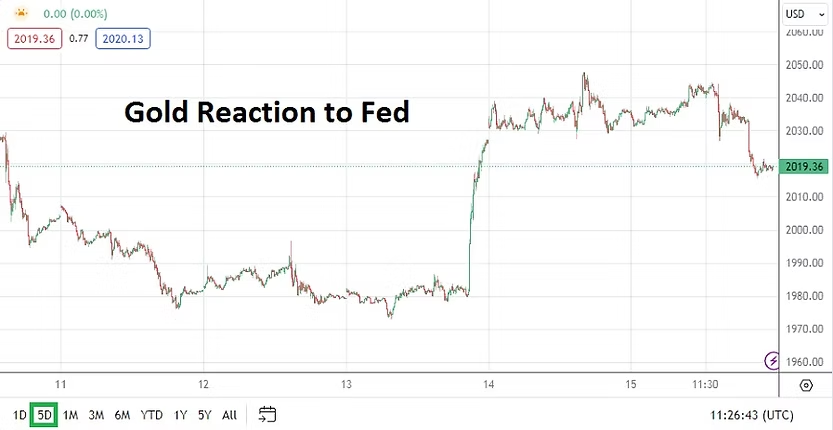

The Federal Reserve stood in place yesterday almost acting as if it is afraid of its own shadow. No one was surprised the Fed did not cut the Federal Funds Rate. The Fed insisted inflation remains slightly elevated, it also said it thinks most of the worst employment data has been seen. What it did not say was that it remains in a quandary regarding the potential affects of President Trump’s policy on the U.S economy. The Fed wants to stay away from this debate. They also likely understand Donald Trump will bring up the subject himself. Trump wants the Fed to cut U.S interest rates more.

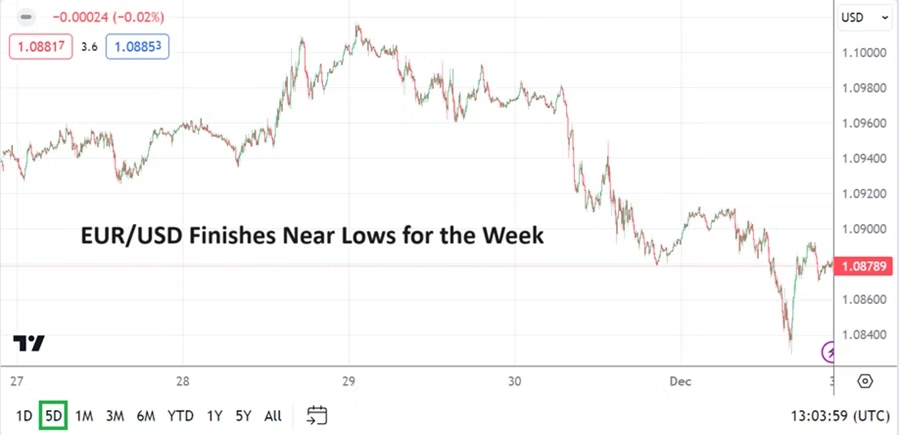

On the other side of the coin today stands the European Central Bank, which is anticipated to cut their Main Refinancing Rate by another 0.25, this to the 2.90% level. Financial institutions have certainly factored an interest rate cut from the ECB into the EUR/USD already. If there is no cut, this would cause an immediate reaction and likely a bad one against the EUR.

However, if the ECB acts as expected and cuts their rate this might actually spur on some near-term positive thoughts about the EUR and create some buying momentum. But for the move to be sustained and stronger, as outlandish as it might seem, what financial institutions will want to hear is that the ECB understands the E.U faces ongoing tough economic conditions and will remain dovish.

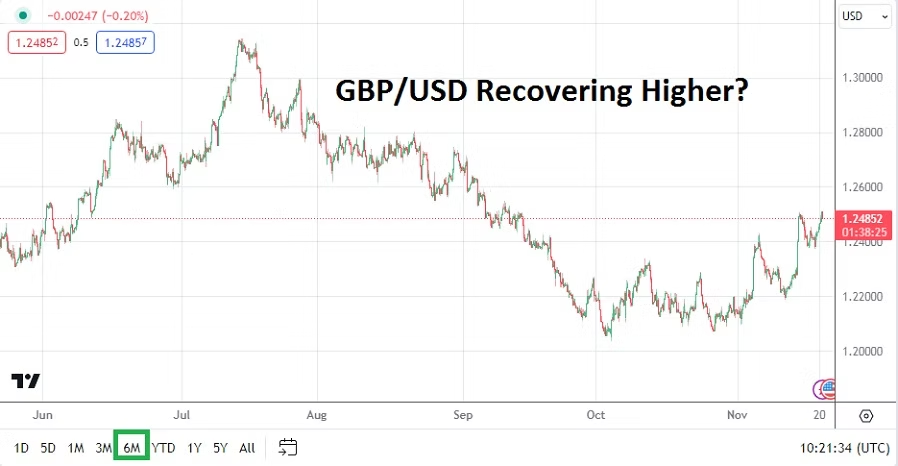

The problem with an overly aggressive attitude by the ECB today is that this is not anticipated. Yes, the rate cut of 0.25 is being counted upon, but the ECB and Fed are not exactly bastions of pro-active policy change. The ability of the EUR/USD climbing above the 1.05000 ratio last Friday and into Monday of this week was a signal financial institutions believe the EUR/USD is oversold, but they want to see more concrete steps taken. Doubts about what the ECB will say today has likely led to the 1.04000 level again being tested.

It may seem counterintuitive to believe that interest rate cuts from the ECB and a overly cautious Fed will help the EUR/USD achieve a bullish footing, but behavioral sentiment regarding mid-term outlook is crucial. Carry trade folks may say that if the ECB were to promise another cut today after their actions taken now, that this would create too large a difference between the ECB and Fed borrowing rates. This may be correct, but pro-active policy is something financial institutions would like to see. Day traders should be very careful today.

The EUR/USD hovering near 1.04000 is a signal that financial institutions will certainly react, there will be volatility in the coming hours. A rate cut from the ECB today will be the first ray of hope regarding a stronger EUR. However, unless the European Central Bank sounds like they will remain vigilant and are considering another potential cut sooner rather than later, the EUR/USD could quickly start to become choppy again.

The EUR/USD is essentially occupying a price range right now that it traded one month ago. Sentiment remains jittery. And President Trump will be watching and his comments which could come at anytime regarding the Fed, interest rates, potential tariffs and sanctions will create vulnerabilities for Forex and financial institutions in the days ahead.