Opportunity? Market Ambition as Day Trading Volatility Looms

The U.S government shutdown looks like it will take place at 12:01 am EST on Wednesday, this if Washington D.C politicians fail to agree to a funding gap. There have been significant shutdowns in the past, thus financial institutions though not in love with concept are adept at continuing to trade during the events. President Trump’s first term in office produced a long shutdown from the 22nd of Dec. 2018 until the 25th of January 2019. President Obama’s White House had a 16 day affair in 2013. And President Clinton’s administration dealt with a shutdown lasting 21 days.

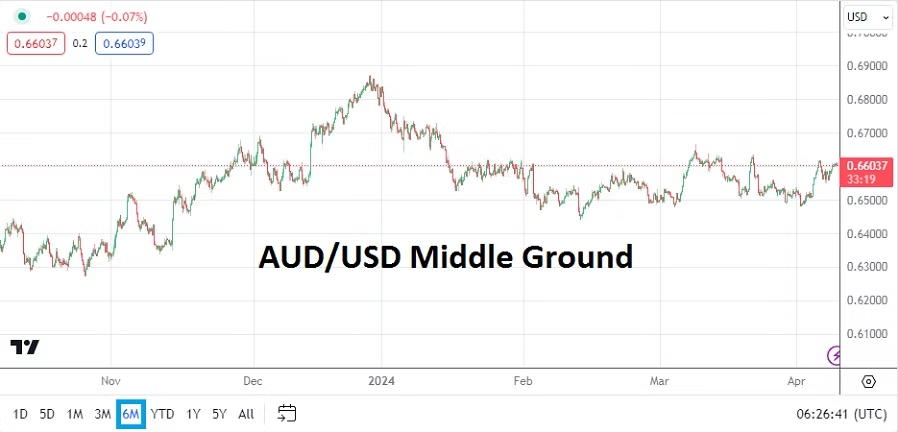

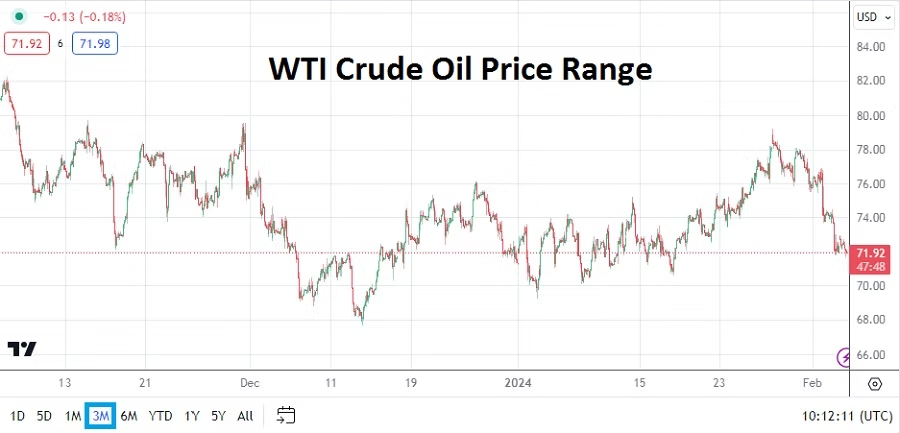

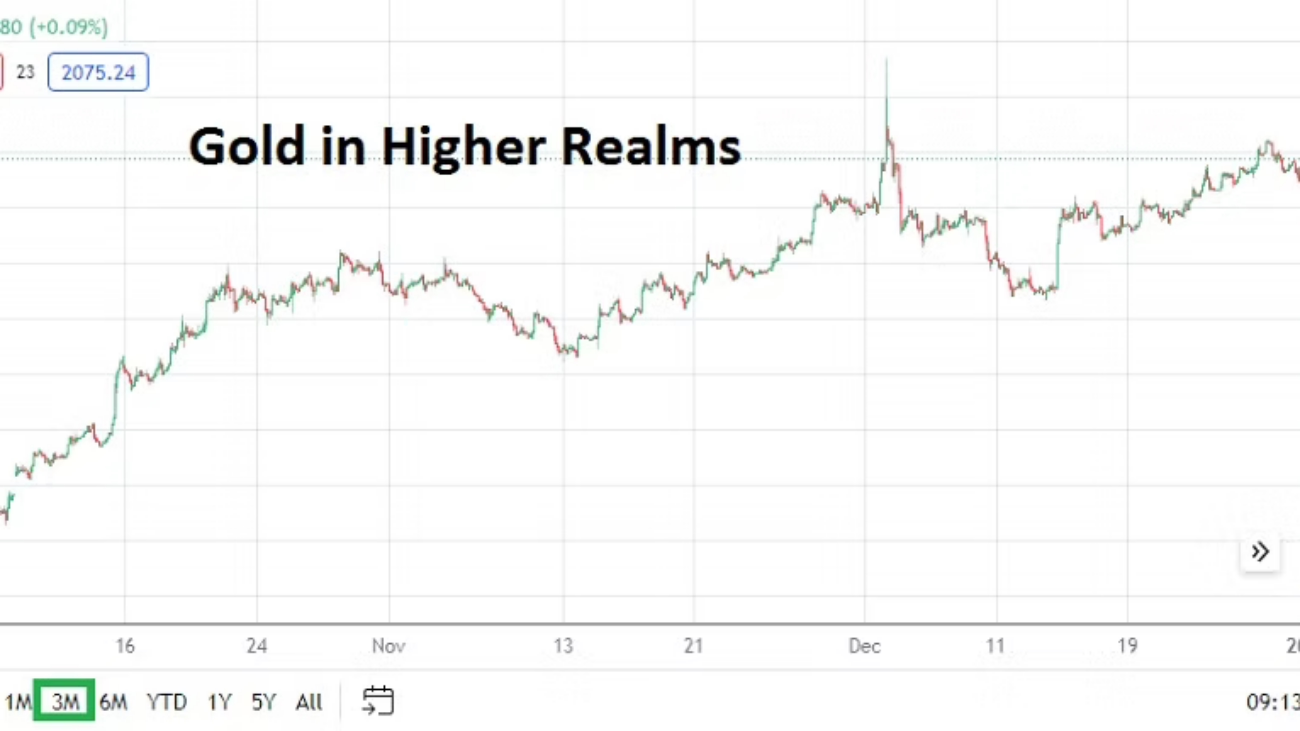

While the financial markets will certainly survive and long-term investors will likely remain rather sedate during this developing saga, day traders need to brace for volatility. Opportunities may develop if Forex, U.S equities and gold see reactions per perceived safe haven endeavors by some investors. However, wagering in markets when shifting tides are happening due to sentiment torrents could prove difficult for speculators. Timing the market and its gyrations caused by potential mood changes poses threats for small traders.

And that is why it will be important to actually remain patient in the coming days. The Democrats appear ready to try and score a political win against President Trump. But what would a win look like? The public is seldom fooled by the government shutdowns. While government offices shutter and economic data publication dates will be postponed, the rest of the world will move forward.

Day traders should not be tricked into panic. Nor should they react too fast based on fears that are not legitimate. The U.S major indices may languish during a government shutdown, but it is also conceivable that they may perform rather well. The Nasdaq 100, S&P 500 and Dow Jones 30 are all within sight of their highest realms. The USD may find some buying action, but just like trades that have already been digested into the market when the Federal Reserve’s FOMC decisions are anticipated and acted upon, speculators should be prepared for counter-intuitive moves. In other words do not be surprised if sudden reversals in Forex via the USD develop.

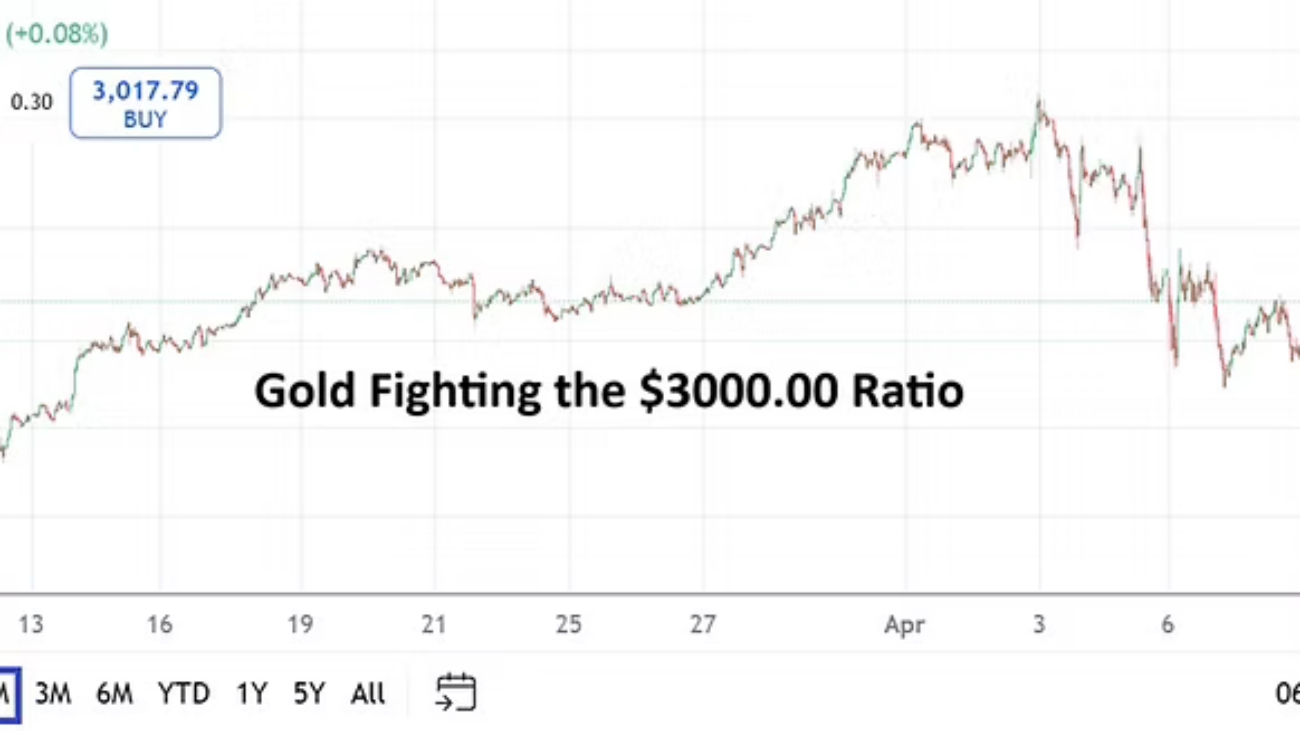

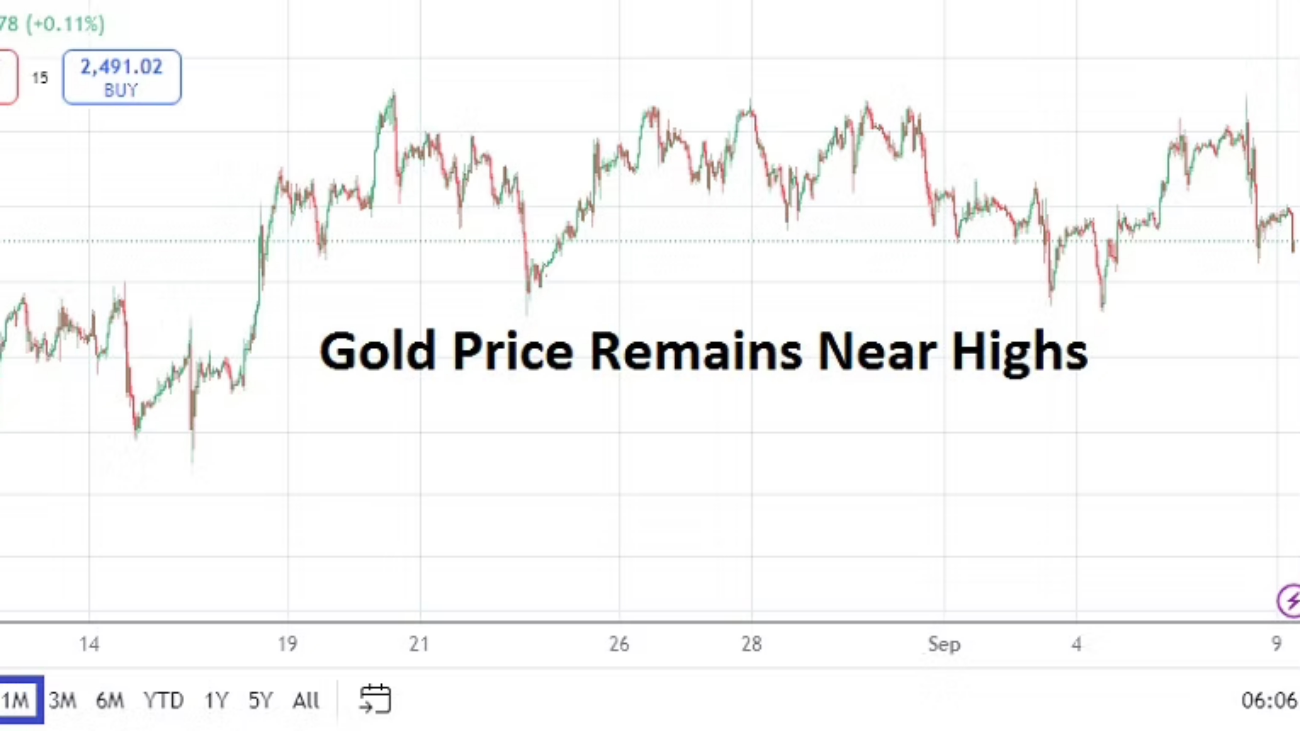

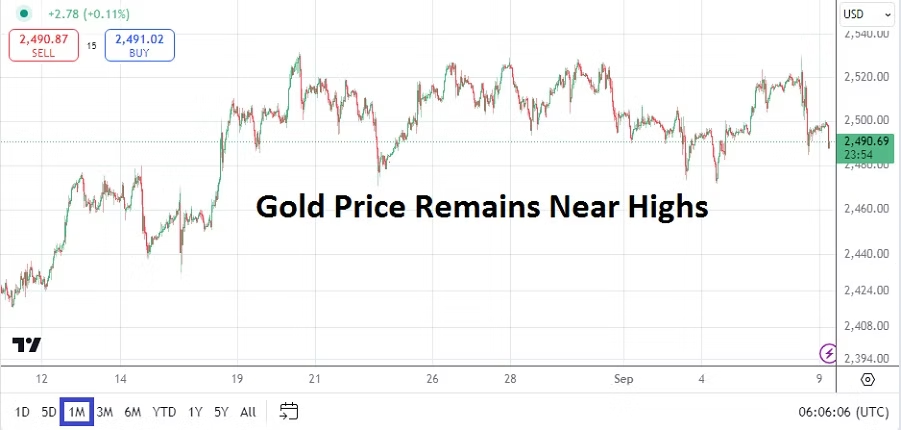

Traders looking for discounts to emerge will need to be careful, but if the equity markets were to suffer a strong downturn on heightened nervousness, having a longer-term approach to speculative positions could become worthwhile. Gold which is traversing within record values may prove to be a significant near-term barometer as a safe haven gauge in the coming days. But then again gold has been within a sincere bullish trend over the long-term, so buying if produced near-term needs to be looked at suspiciously. In other words, the bullish trend in gold while getting perhaps an additional dose of fuel to ignite higher because of the potential U.S government shutdown should also be treated carefully and not traded with blind ambition.

The potential of a U.S government shutdown is a big event, but it is intransigence that financial institutions and big investors do not want to see. As long as some aspects of communication are being shared transparently with the public regarding negotiations in Washington D.C, many markets are likely to remain rather unbothered. How long will the U.S government shutdown last this time? It might all depend on how long the Democrats believe they can get the most out of the shutdown if it adds to their political image.