Curious economic data was published at the end of last week, this as the broad markets turned in a rather convulsive five days of results via financial assets. U.S jobs numbers came in slightly higher than expected for the Non-Farm Employment Change figures and the Average Hourly Earnings. Following the employment data, the Preliminary University of Michigan’s Consumer Sentiment reading came in much stronger than anticipated, and its inflation data found that people are less fearful of inflation looking forward in the States.

On Saturday, China released its CPI and PPI statistics and they continued to show a downwards path. China has taken on a rather sticky deflationary track and this signals that consumers and producers in the nation remain burdened by harsh economic considerations.

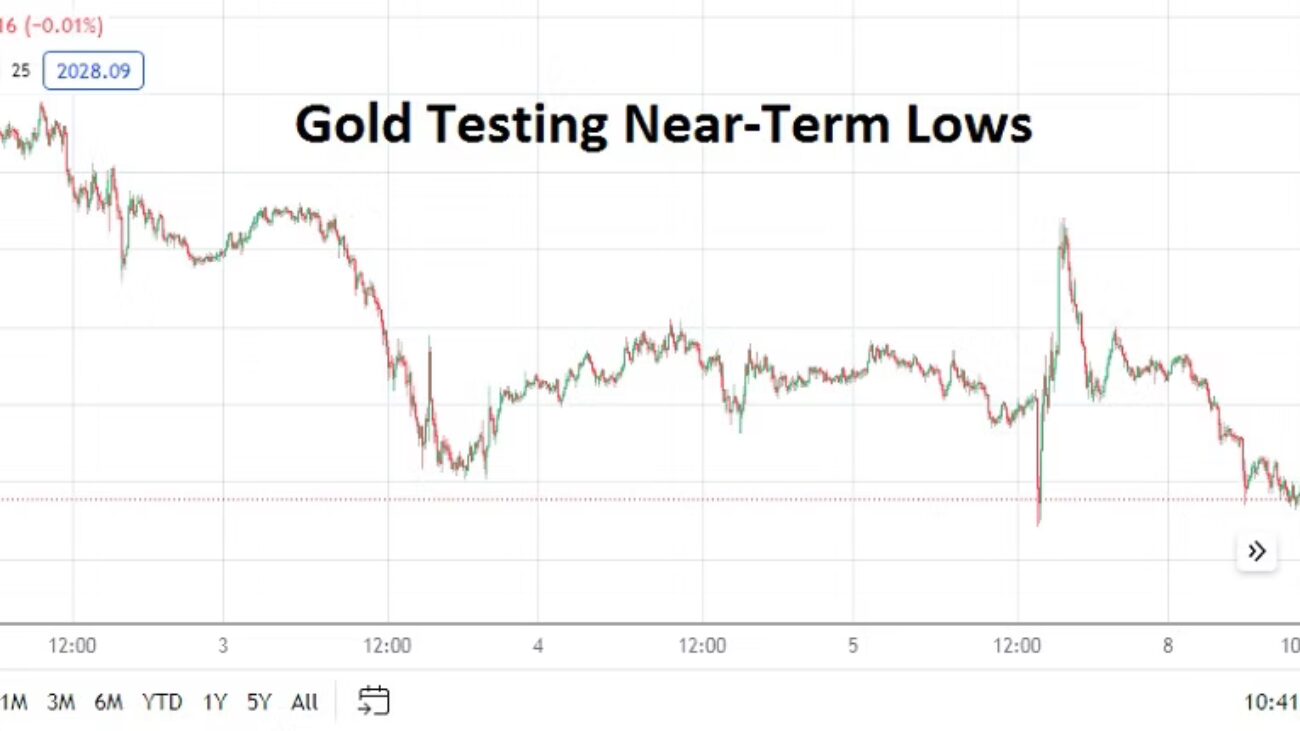

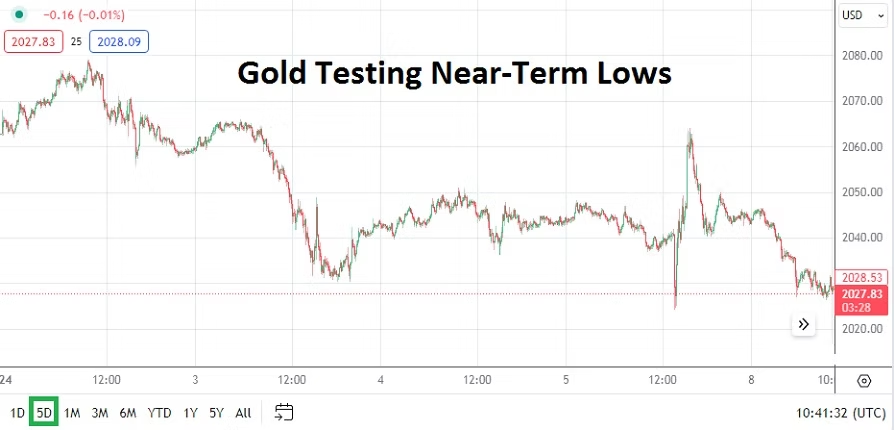

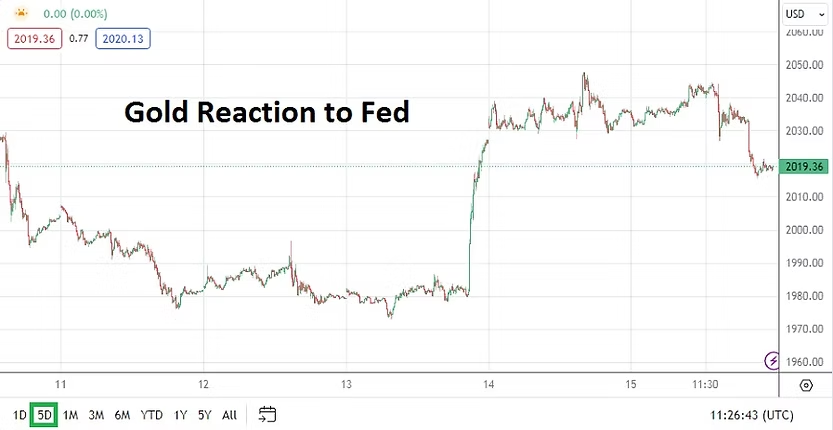

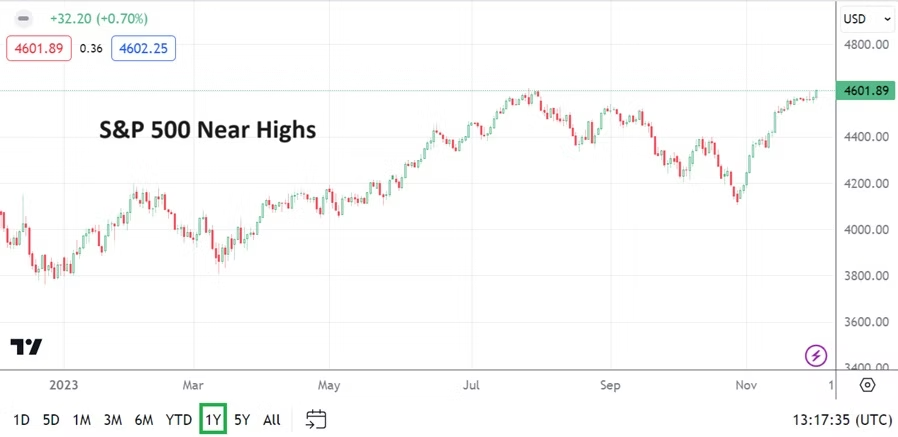

U.S equity indices were rather jerky, but finished last week’s trading higher than they started. U.S Treasury yields finished the week higher, except for the 30 Year Bond which came in with a result slightly below its starting point for the five day period. Gold has seen its price come down from highs and this may be interpreted as a reaction to the stronger USD. The precious metal may be in for volatile days ahead.

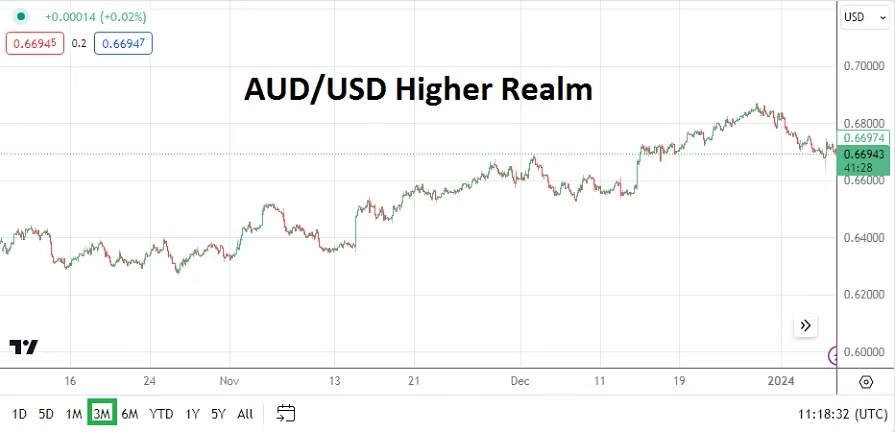

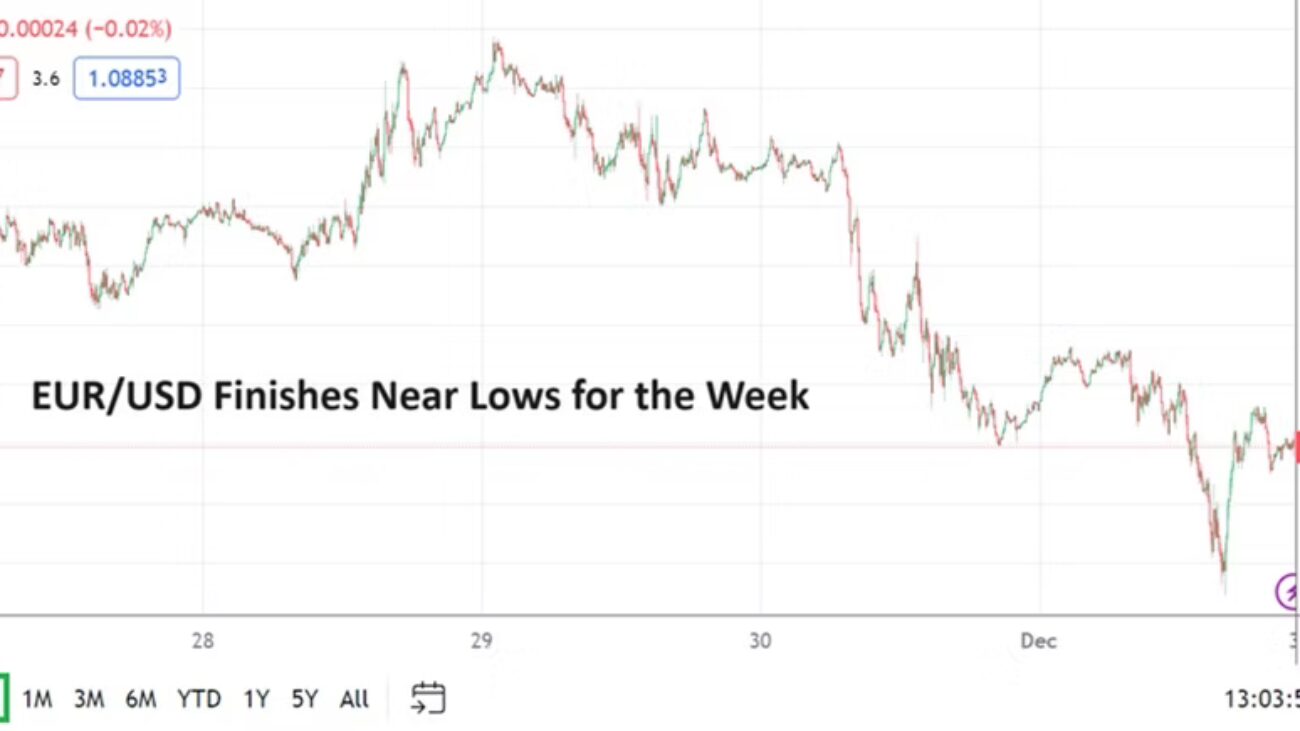

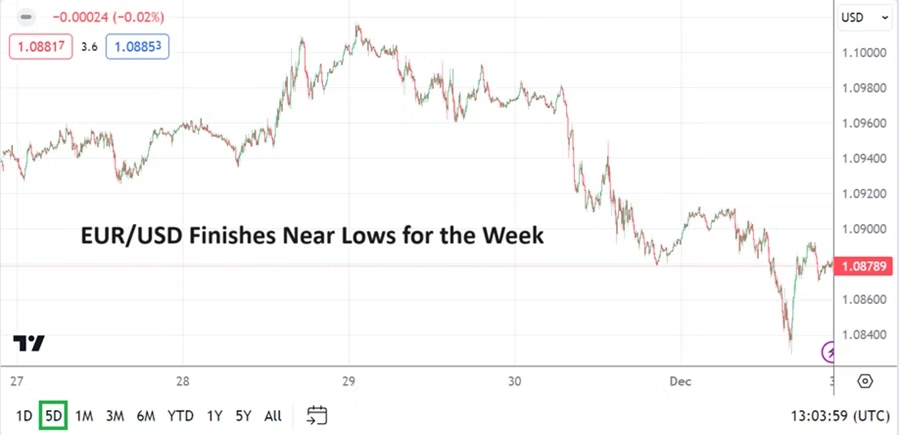

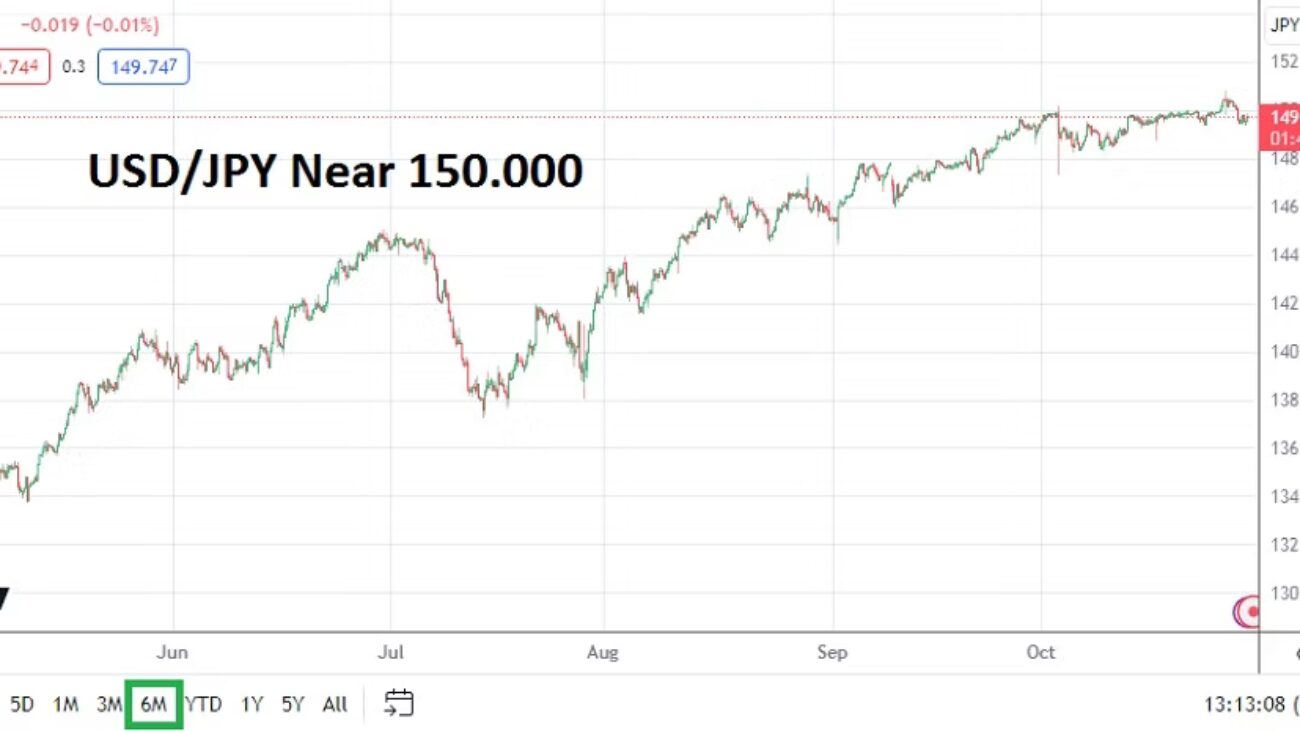

The risk appetite flame has apparently been turned lower, but is still simmering and this is due to financial instiutions waiting to see if the U.S Federal Reserve delivers a neutral monetary policy rhetoric this coming Wednesday. The USD which had been getting weaker across the board for a handful of weeks, suddenly seemed to hit ‘support’ and reversed higher as questions regarding ‘fair market value’ may have been considered. Larger players in Forex are likely waiting for their outlooks to be confirmed via the Federal Reserve or dampened considerably. The higher Average Hourly Earnings data on last Friday was a reminder inflation data continues to be stubborn, even if many analysts believe the Fed’s higher interest rates will begin to have an impact in 2024 and slow the U.S economy.

Monday, 11th of December, U.S Ten Year Bond Auction – the results of the auction will be studied by financial institutions, particularly as investors debate the necessity for interest rates to be kept high, against those who are arguing for the need to cut the Federal Funds rate by late spring 2024.

Tuesday, 12th of December, U.S Core Consumer Price Index – the inflation numbers will be critical for behavioral sentiment and certainly affect the attitude of financial houses and their trading positions before the Fed steps into the limelight on Wednesday. The Core CPI numbers are expected to be slightly higher compared to last month’s outcome. Perhaps last Friday’s higher U.S earnings data will pave the way for a calm reaction if the CPI is strong. Forex markets will respond to this report and day traders should be braced for price ranges and spreads to get wider.

Wednesday, 13th of December, U.S Producer Price Index – the PPI numbers will be released early in the States, five and a half hours before the Fed’s Federal Funds Rate publication. Traders need to be ready for volatility before the Producer Price Index figures are reported. The inflation numbers are expected to be higher than the previous month’s outcome.

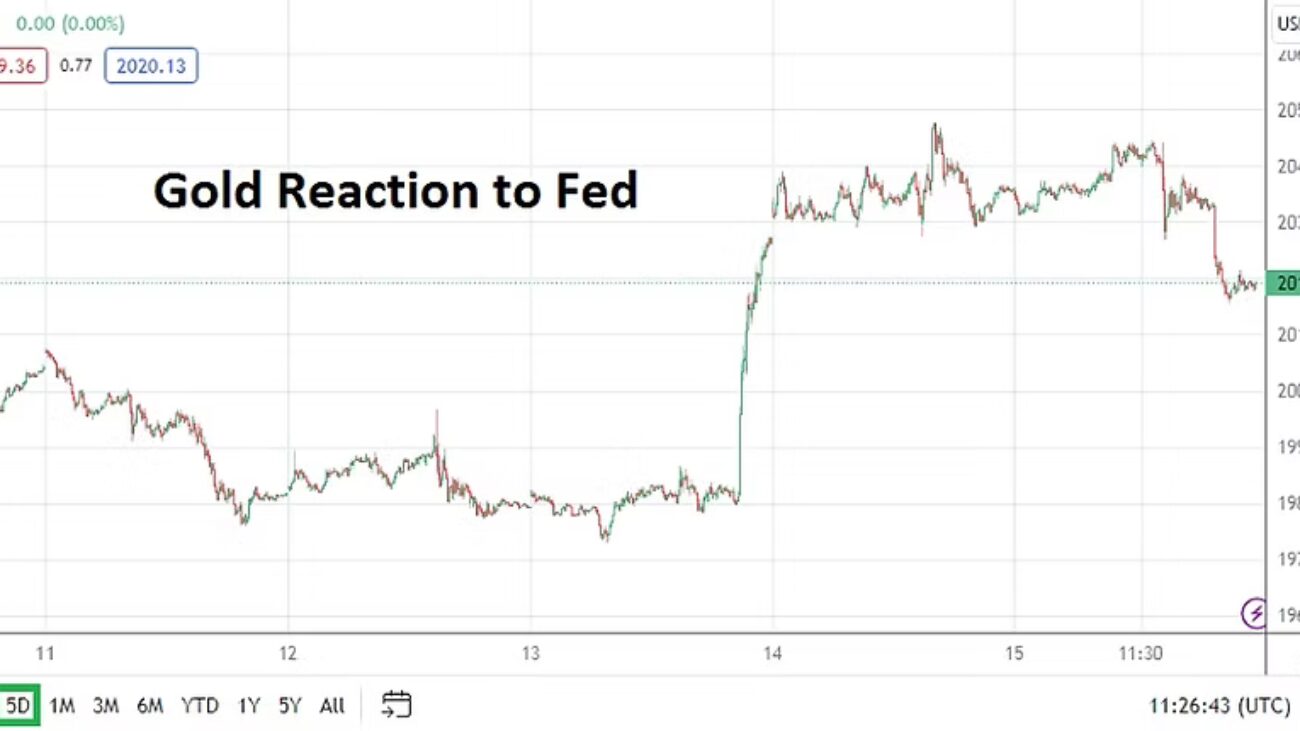

Wednesday, 13th of December, U.S Federal Reserve – the last interaction of the year for the U.S central bank and financial institutions will be an important affair. The Fed’s Federal Fund Rate, FOMC Statement and Press Conference will get full attention. The Fed is expected to hold interest rates in place, the question is what ‘vocabulary’ the central bank will use as it lays the groundwork for its 2024 outlook. While talk of a more neutral Fed, one that isn’t as aggressive has been envisioned, financial institutions want to see a ‘softer’ tone become the reality.

Depending on how the U.S Federal Reserve talks about inflation and its monetary policy insights for the next few months to come via this FOMC Statement, the USD will take center-stage and Forex conditions may become rather violent as Wednesday concludes. Day traders are advised to be very careful if they plan on trying to surf the waves caused by the Fed’s storms which will certainly be stirred.

Thursday, 14th of December, E.U European Central Bank – the ECB will release its Main Refinancing Rate, Monetary Policy Statement and conduct its Press Conference. The last ECB event proved to be rather mundane. While some talking heads may try to make this coming event into must see television, many financial institutions likely expect the European Central Bank to say, “the E.U economies remain lackluster, there are glimmers of growth in some spheres, but recessionary problems are still evident”, this while also mentioning inflation is observed to still be too strong, but showing signs of erosion. In other words, the EUR/USD is likely to remain USD centric according to existing behavioral sentiment that has been triggered earlier.

Friday, 15th of December, China, Industrial Production – the report is anticipated to show a better outcome than last month’s figure. China skeptics will examine these reports carfully, as well investors with ‘skin in the game’ in the nation.

Friday, 15th of December, E.U, U.K and U.S Manufacturing and Services PMI – these reports will be watched from the European Union nations, the United Kingdom and U.S, but the results will be filtered into existing sentiment which has been generated on Wednesday and Thursday from the Fed and ECB. Behavioral sentiment in Forex will likely look at the PMI results with vague interest levels. Traders should note that as the weekend approaches, there will be only one full week of trading left before the holiday season gets underway and financial markets begin to experience thin volumes.