WTI Crude Oil Trading in a Storm (War)

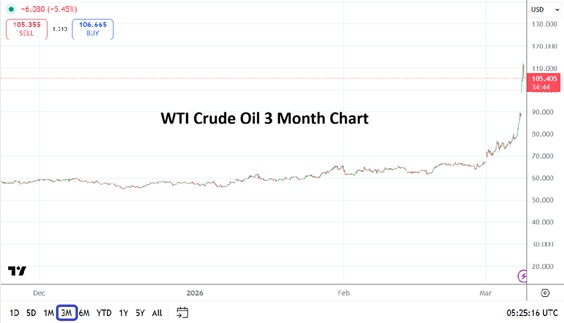

Writing from within the storm, it would be easy to feel a strong sense of nervousness as the newest Middle East War rages. However, this is unlikely the beginning of World War 3. Traders looking at WTI Crude Oil this morning have seen the commodity launch over $110.00. But the price has seen a slight dip and is now hovering above $105.00 in albeit fast conditions.

WTI Crude Oil Three Month Chart on 9th March 2026

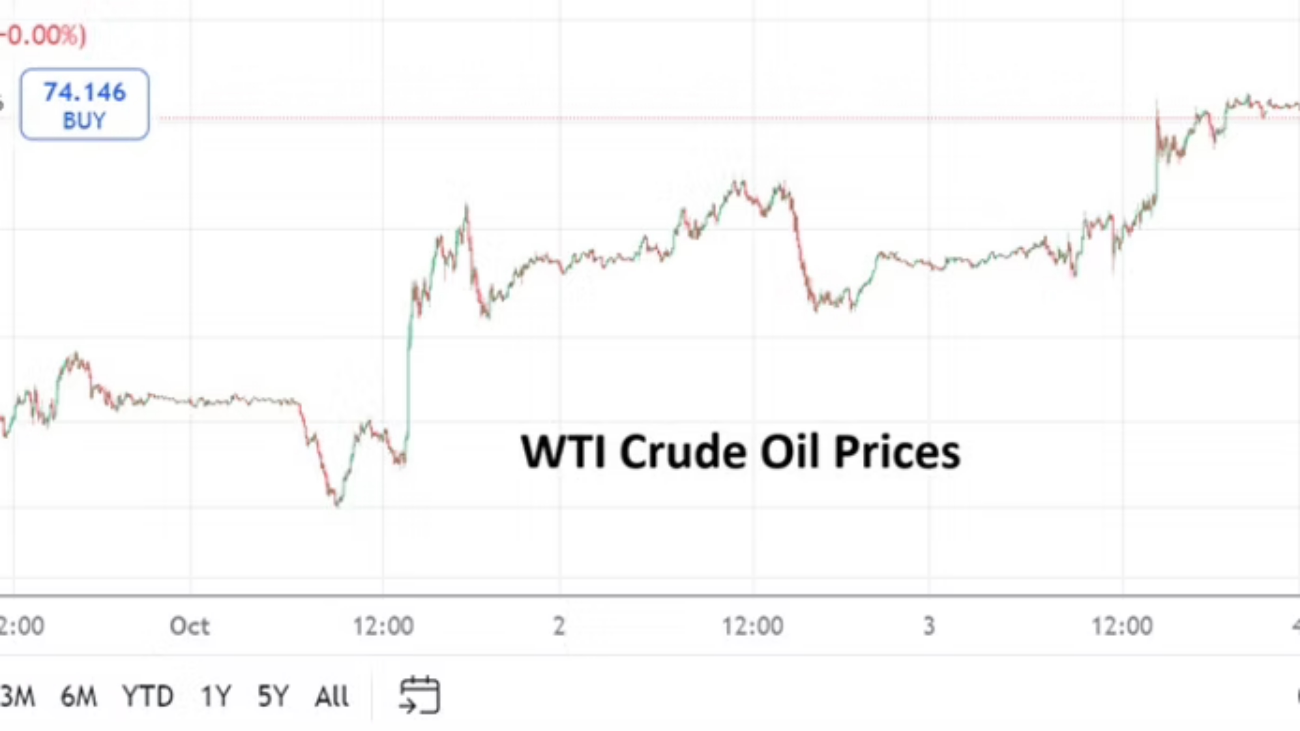

Behavioral sentiment is nervous, there is no disregarding that notion and taking it seriously. Iran has been firing missiles and drones at neighbors and Saudi Arabia has been effected via some of their oil production. The Strait of Hormuz is certainly seeing an escalation in tension and is threatening to become a sea battle.

However, while the price of WTI Crude Oil rocks higher and day traders either make or lose money fast, speculators wager on short and near-term notions, there is likely a group of folks taking another approach and watching cash prices compared to options.

Yes, the intra-day price of WTI Crude Oil and all other energy sources will remain volatile near-term, but those with a mid and long-term outlook may be betting on optimism and the belief an end game will produce calmer prices.

WTI Crude Oil is up close to 40% percent when a mid-term perspective is used. Will the commodity remain above 100.00 USD six months from now? Will WTI Crude Oil be above $100.00 three months from now or even one?

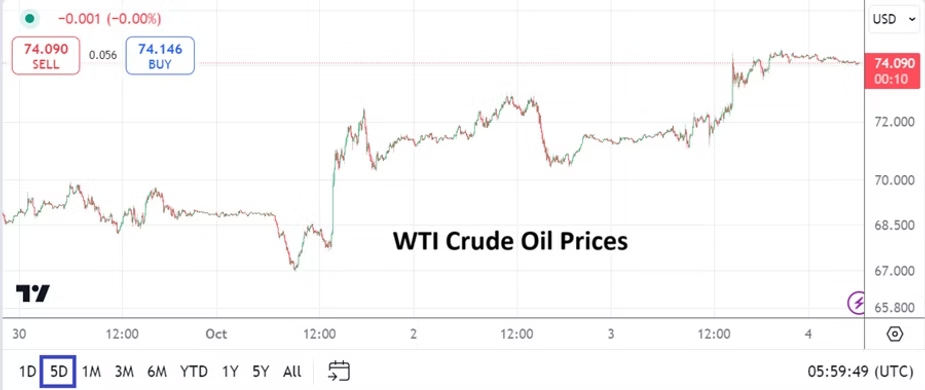

This thinking may deliver some type of price resistance in WTI Crude Oil. Certainly, there is a chance of greater escalation. But even though it was widely reported that oil facilities in Iran were bombed this weekend by Israel, the terminals hit were on the outskirts of Teheran, not on the island of Kharg. As dangerous as the war has become and the potential of worse damage occurring, those who are striking Iran do not want to damage Kharg terminals – at least not yet.

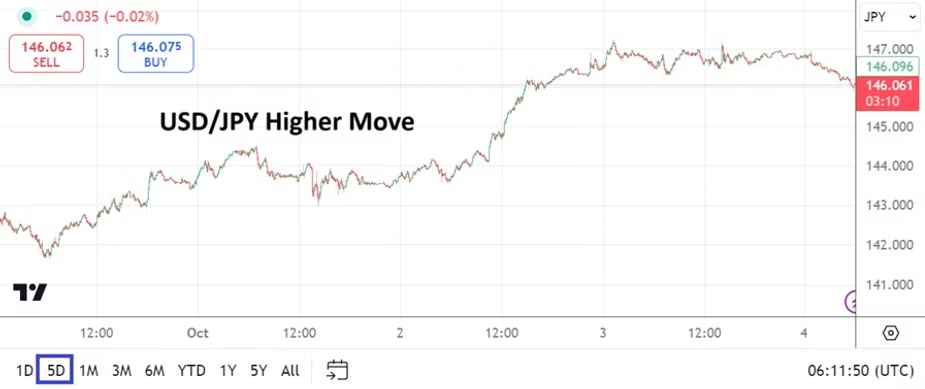

As for endgame, Russian oil is being allowed to be sold more easily, sanctions have been relaxed. Thus, it can be said there are international efforts to fight against price spikes. There are concerns about higher oil prices causing bedlam via inflation for the global economy rightfully. However, at some juncture things will eventually calm down. And that is what day traders need to keep in mind as WTI Crude Oil has raced higher, the notion that tactically the Iranian war will reach a de-escalation period is reasonable.

Yes, there is a threat that Iran plays the an ‘Armageddon’ card and tries to destroy all vital energy resources in the Middle East, but we have likely passed that stage. Iran in many respects, respectfully, has been declawed. Iran can threaten, but can it really bite at this point? The island of Kharg is a key barometer, its facilities remain mostly kept out of the destruction zone, WTI Crude Oil may not spike too much higher.

As for highs, this morning’s jump occurred on fear, however the price has started to calm. We could certainly still see higher values in WTI Crude Oil this week or next, but thoughts about the potential of an end game resolving the current dangers, whatever that may be and no matter how long it will take – may prove to be an important ointment. Time shall tell.