Fed Today, Tmrw and Mid-Term with Changing of Guard

The Federal Reserve will cut its Federal Funds Rate by 25 basis points in a handful of hours, that is unless they want to cause a major selling attack on Wall Street and pandemonium in Forex and gold. The Fed which spoke about uncertainty in last month’s FOMC Statement and utterly refused to give guidance about today’s decision, has had the ignition regarding an interest rate cut delivered with nearly 100% certainty because inflation for the moment remains tame.

Fed Chairman Jerome Powell will leave the Fed in May of 2026. This isn’t a subjective opinion, he is leaving because he is not going to be reappointed by the White House. President Trump has made it clear he wants a lower interest rate and that he believes the Fed has failed to be proactive. Given Trump’s propensity for saying outlandish things, he is not wrong about Powell’s overtly cautious posture. The Fed could have cut the Federal Funds Rate in the early summer and refused to initiate.

Financial institutions have factored the 25 basis point interest rate cut into Forex already. Again, unless if for some reason they want to initiate a massive selloff in the equity indices and cause the 10 Year Treasuries yields to rise like a wildfire, the Fed needs to cut today. Day traders need to understand the first couple of reactions following the FOMC Statement tonight should not be wagered upon without deep pockets and steel stomachs.

There are three more FOMC meetings scheduled for the Fed after today’s decision while Fed Chairman Jerome Powell remains in office. The 28th of January, the 18th of March and 29th of April are the listed FOMC Statement announcement dates, this before the June meeting which Jerome Powell will not helm. While some analysts strongly believe the Fed will find it difficult to cut interest rates early in 2026, the potential for a shift in sentiment and open disagreement regarding the Federal Funds Rate could turn intriguing in late January. If inflation remains steady via the Core PCE Price Index it would not be a shock to see another interest rate cut next month.

Caution has prevailed in Forex the past couple of months. Major currencies like the EUR and GBP have lingered within known ranges. Yes, the JPY has incrementally lost value due to BoJ policy. President Trump cannot make the Fed decide what to do, but he can certainly keep appointing folks who agree with his policies and approach to enterprise. If Powell does not outright say an interest rate cut is impossible for next month’s FOMC decision, U.S economic data that will be generated over the next handful of weeks could deliver enough impetus. Let’s keep in mind ladies and gentlemen that holiday trading will come into full force after next week’s price action.

The Fed’s borrowing rate essentially stands at 4.00% for the moment. After today’s rate decision the Fed Fund Rate should be at 3.75%. And for the moment there is little justification to not make the borrowing rate 3.50% in late January. As economic data presents itself now via the PCE Price index and CPI and PPI statistics, there is reason to believe a more proactive Fed is on the horizon as the pressure is turned up on Jerome Powell.

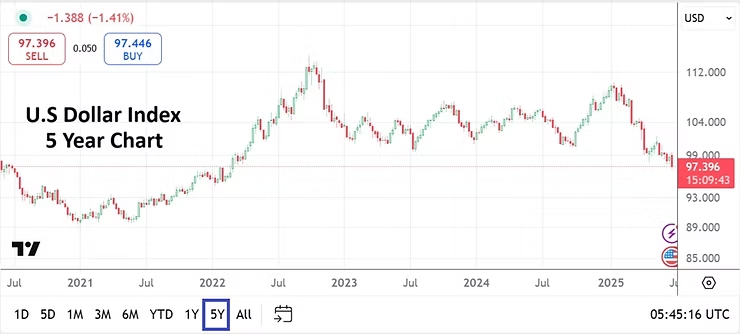

Perhaps nothing will happen in January, but if inflation remains tame not only will Jerome Powell be criticized by the White House, but he may also face a rather public debate from Fed members who do not agree with his cautious approach to interest rate policy. A weaker USD in Forex against many major currencies mid-term appears to be a real possibility. The ability of the EUR/USD to linger within a cautious middling range may be an indicator that financial institutions have built a mechanism which will allow them to become stronger buyers. Dangerous as it is to predict a timetable, the EUR/USD over 1.17000 would not be a surprise in the weeks to come – at least to me. Let’s see where behavioral sentiment takes us.