India Insider: Speculation, IPO Mania, and Capital Erosion

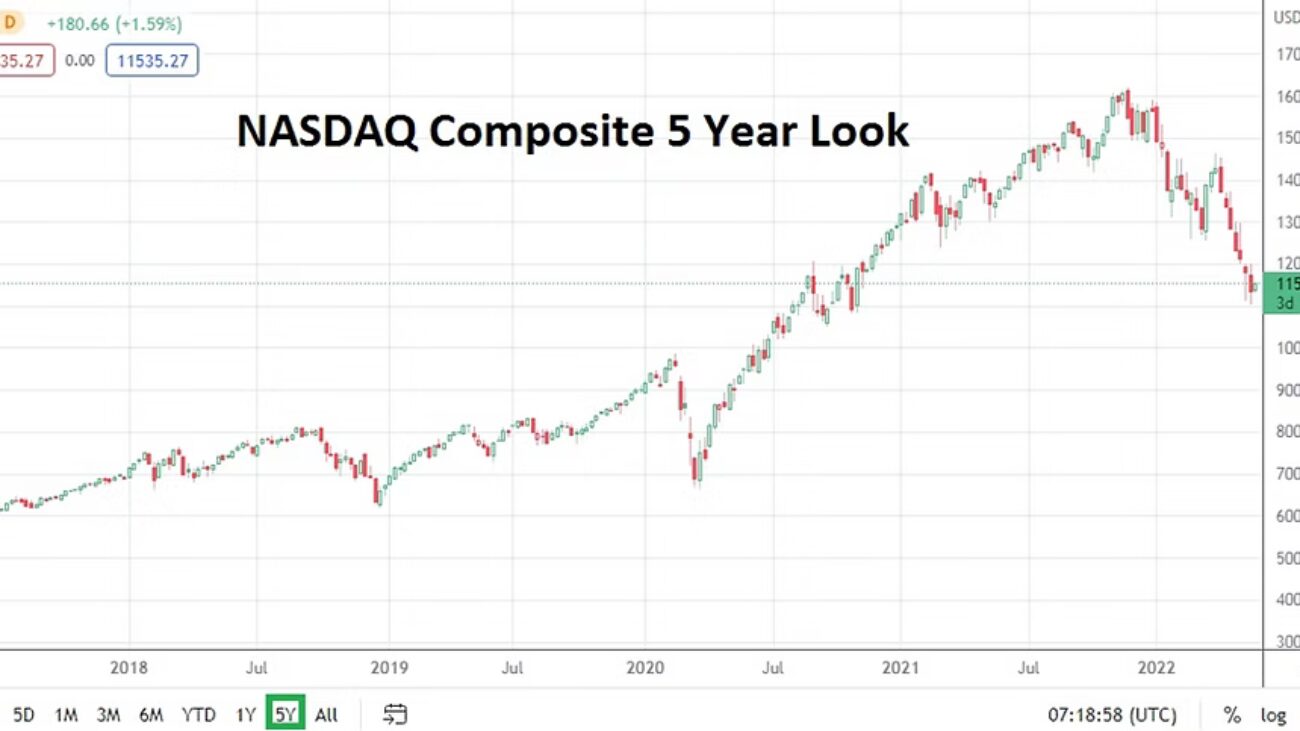

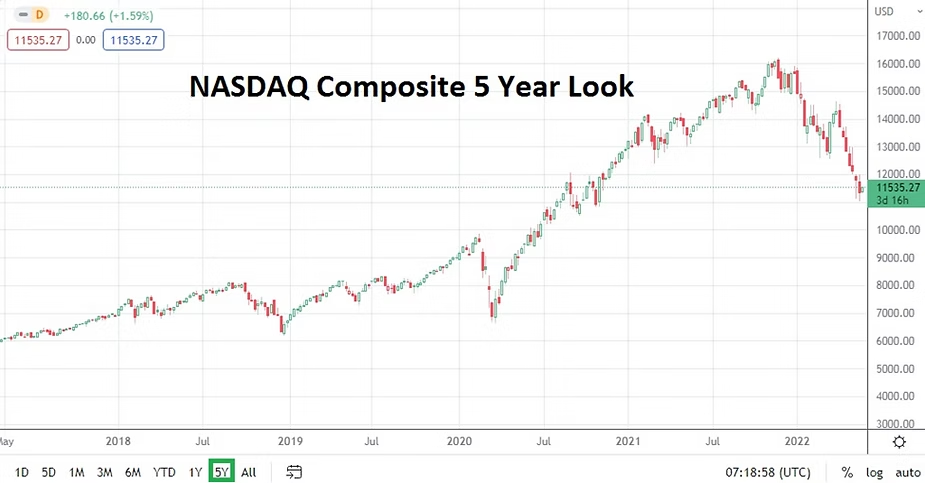

A speculative frenzy is reflected nowadays via India social media around quarterly results and IPOs. Animated talk about investment potential in India can be compared in some respects to the Dot-com bubble in the U.S which grew in stature into the late 1990’s and peaked in March of 2020 before imploding. Retail speculators in India rush into untested technology stocks hoping for quick profits, often without understanding the businesses. Avoiding a Dot-com like crash is important.

Hedge funds and institutions with their superior supply of capital often speculate across stocks, bonds, Forex and commodities as part of their strategies. However, retail investors should only purchase individual corporate stocks like pieces of businesses which they want to own when they have the ability. Market fluctuations lower can be used to buy quality companies when intrinsic value has been discounted allowing investors with limited funds to take advantage of stock volatility.

Charlie Munger, the right hand man of Warren Buffett, when asked what the secret of running Berkshire Hathaway Inc. was replied, “Warren likes to say, just tell us the bad news, the good news can wait. So people trust us in that (decision making process), and that helps prevent mistakes from escalating into disasters. When you’re not managing for quarterly earnings and you’re managing only for the long pull, you don’t give a damn what the next quarter’s earnings look like.” And this has proven to be advice that all investors can learn from.

Lessons from Yes Bank and Ola Electric:

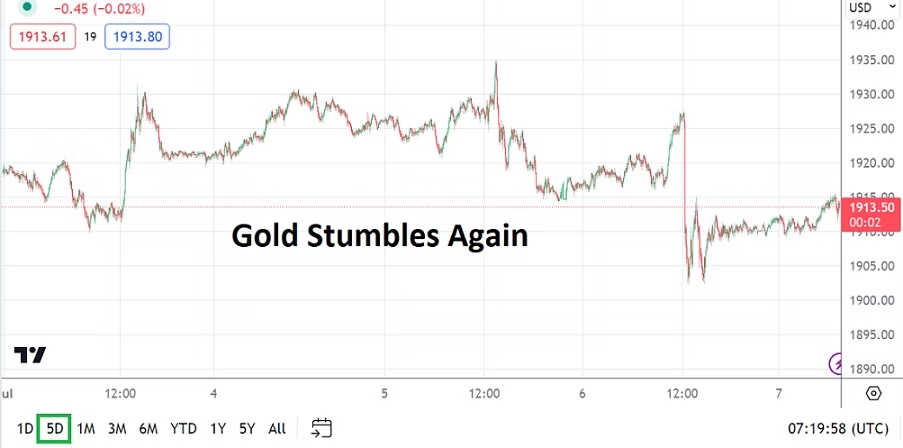

Many speculative investors rely on technical charts using support and resistance patterns for trading decisions. This frequent buying and selling enriches brokers but rarely investors. Technical trading entices because it often is easier to look at a chart and feel that by glancing at past results you are able to predict the future, but this frequently proves to be incorrect. Fundamentals should always be a large part of investment decisions.

Another example unfortunately is Ola Electric Mobility Ltd which highlights a similar trap. Ola’s 2024 IPO raised 75 billion Indian Rupees ($900 million USD) at a value of 76 INR per share. It was hailed as a ‘BYD of India’, and despite high valuation warnings, investors pushed share value towards 160 INR. Predictably as cash burn mounted and with no operating profitability, Ola Electrical Mobility value soon fell below the IPO price and speculators who dreamed big soon began to feel like they had lost. The Yes Bank and Ola Electric Mobility cases demonstrate the dangers of investing outside one’s circle of competence.

Valuations and Investor Behavior:

From October 2022 to October 2024, Indian markets moved significantly higher, stretching valuations beyond earnings. Even after U.S. Liberation Day tariffs triggered a pullback in India, investors continued pouring money into mutual funds through SIPs (Systematic Investment Plans), ignoring glaring fundamental problems. This raises concerns and creates doubts about whether SIP passive investing is wise without understanding individual businesses.

Investment becomes more intelligent when it is done with a business like approach. As Warren Buffett said, “the stock market is a device for transferring money from the impatient to the patient.” But patience should not mean overpaying for growth stories. Predicting future earnings is difficult, and paying lofty prices for stocks in the EV, battery, and micro-processing chip sectors based only on expectations can be dangerous.

When competition or innovation shifts, stock prices collapse as Ola Electric Mobility has shown. True investing is businesslike. It requires understanding, discipline, and buying below intrinsic values. Chasing hype, speculation, and every new IPO can lead to erosion of capital. Smaller investors can do better and they should desire to study fundamentals in order to make good decisions.