AMT Top Ten Miscellaneous Remarks for the 14th of July 2024

10. Words of the Day: Political rhetoric is using platitudes and subterfuge camouflaging verbal nonsense, masking a vacuum of non-results and causing fatigue of populist promises.

9. Harris Prediction: After the NATO press conference in which Biden was more lucid but still made mistakes, it is beginning to feel like Kamala Harris is being given room to audition for the Presidency by the Democratic machine. If her polling numbers show improvement over the next couple of weeks, look for Harris to replace Biden at the DNC in Chicago, if her polling numbers are not good enough in the eyes of the elite power brokers, it is possible Biden may be asked to give up his delegates, allowing for an open convention.

8: Zombie Inflation: Data results via the U.S CPI caused a reaction in the broad markets, and volatility in Forex. While the broad monthly Consumer Price Index number on Thursday was minus -0.1%, the PPI numbers on Friday came in higher than expected causing some to feel that inflation remains a plague. However, if the Producer Price Index was interpreted as being higher because rising prices are coming via more expensive employee costs (which might see an end to the cycle sooner rather than later if jobs data continues to weaken) this is why there might not have been a violent Forex reversal on Friday. And Consumer Sentiment numbers from the University of Michigan came in below expectations again, and inflation expectations via the consumer survey showed some erosion.

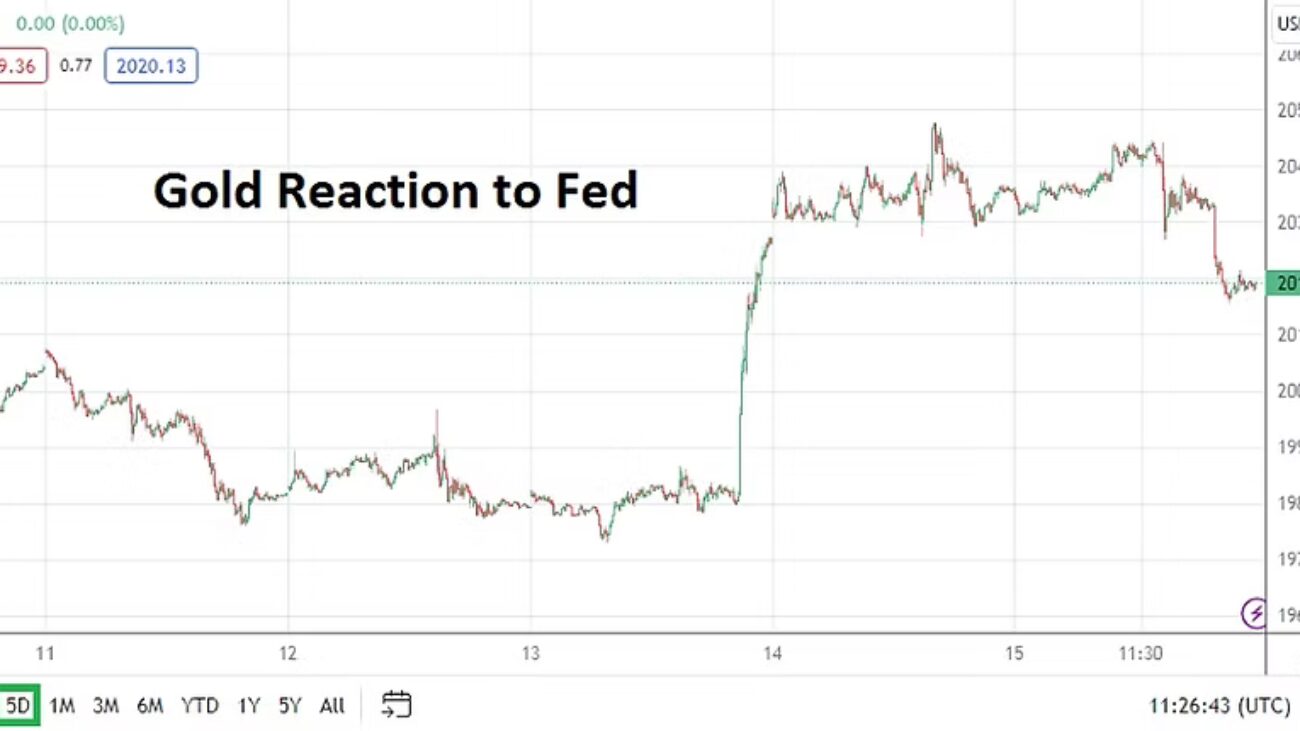

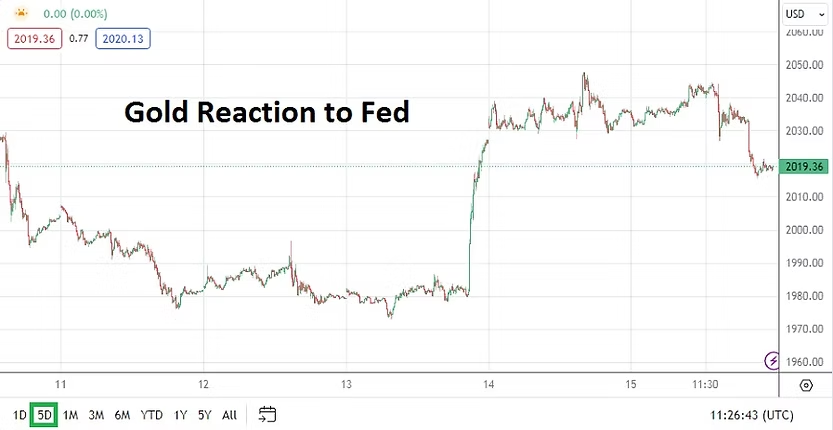

7. Federal Fund Rates: Financial institutions have clearly begun to factor in the belief an interest rate cut will occur in September. The Fed which has been cautious consistently the past seven months may now have enough ammunition to consider becoming more dovish. A September interest rate cut has certainly been factored into Forex and Treasury yields, and there is a growing tide of sentiment which believes the weaker GDP numbers combined with the potential of less inflation could spark additional Federal Funds Rate cuts this calendar year. Outlook fueled by optimism regarding a more dovish Fed could be a factor in the markets the remainder of July.

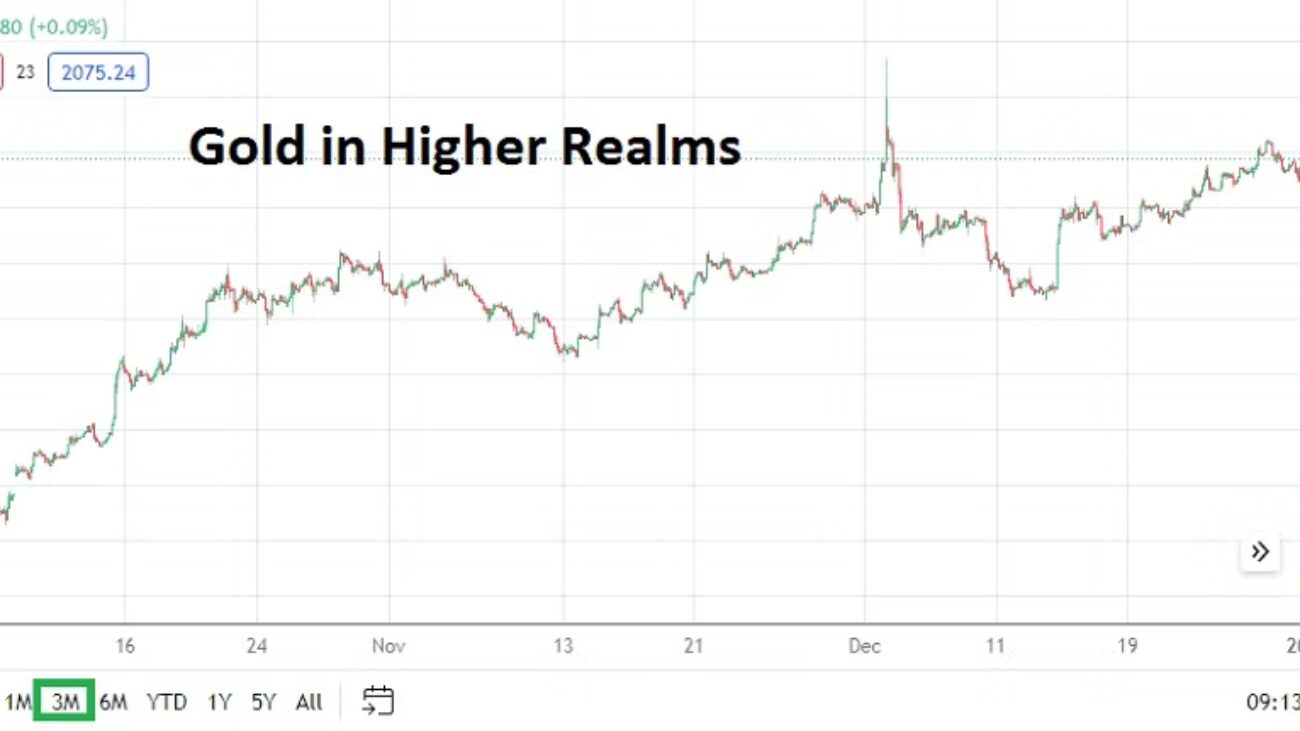

6. Gold and Silver: Commodity prices are soaring as speculators pursue bullish trends. Gold finished this week above 2,410.00 USD. Silver is traversing above 30.00 USD per ounce for the first time since 2011 and 2012. These two metals are not always correlated, and day traders should remember Silver remains a rather easily mined commodity which sometimes influences downwards pressure because supply can be increased. Having said that, Gold and Silver have had solid bullish trends since February of this year.

5. Thaw: Bitcoin is near 60,000 as of this writing. The crypto winter has seemingly ended and many folks are standing in the sunlight and proclaiming long-term projections of Bitcoin as it maintains a higher price range. It should be remembered the most significant percentage of trading volumes within cryptos reside heavily within the top tier, and the ‘assets’ ranked lower remain in wagering cesspools. Cryptocurrency remains speculatively dangerous, and largely a place to move illicit cash with the perception the money can be kept ‘dark’.

4. USD/JPY: The Bank of Japan won last week’s game of fire. The U.S Consumer Price Index numbers dealt a blow to the blind fury of speculative buying in the USD/JPY, and there is also a belief among many that the BoJ added onto the selling momentum of the currency pair too with a well timed intervention. The currency pair which was near the 161.640 juncture suddenly dived to nearly 157.420. The USD/JPY has gone into this weekend near the 157.900 ratio. The USD/JPY saga is not finished yet, and froth via bullish endeavors remains dangerous. Day traders here have been warned.

3. China: Friday’s Trade Balance numbers were good, compared to the rather weak CPI results seen on the 10th of July which were negative. China’s Communist Central Committee begins a Plenary Session tomorrow until the 18th. Will they speak in platitudes? The USD/CNY has certainly seen a ‘soft’ devaluation since February of this year, but the currency pair did go into the weekend near the 7.2500 mark which is off the high of 7.2765 seen this past Thursday. China still must improve consumer sentiment domestically and this remains a difficult struggle as ramifications from the implosion in China housing values mires the landscape. GDP numbers will come from the nation on Monday.

2. Behavioral Sentiment: Equities and indices, Forex, and commodities are all experiencing risk appetite permutations. While it might be tempting for retail traders to bet on lower reversals of trends, sometimes its much easier to simply ride optimistic waves. Certainly there will be days when financial assets struggle, but the apex heights of the Dow Jones 30, S&P 500, Nasdaq 100 should be treated with respect. Treasury yields are at mid-term depths and appear ready to traverse lower.

1. Trump: The attempted assassination of Donald Trump on Saturday in Pennsylvania will galvanize his supporters and likely push many people towards voting for him November. The amount of vitriol Trump has endured from his political opponents including the highest echelons of the Democrats and many in the media needs to be contemplated and quieted. Opposition to political ideology is fine, but the use of hyperbolic musings has led the U.S to a dangerous place. It would be wise for pragmatic adults to rejoin political discourse. Traders should watch the financial markets early this week to see if the U.S political front causes a reaction.